Claim Spouse S Unused Tax Allowance Marriage Allowance lets you transfer 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

Marriage Allowance lets you transfer 1 260 of your Personal Allowance to your husband wife or civil partner This reduces their tax by up to 252 in the tax year 6 April to 5 Ask HMRC to transfer any unused Married Couple s Allowance or Blind Person s Allowance to your spouse or civil partner using form 575 T From HM Revenue Customs

Claim Spouse S Unused Tax Allowance

Claim Spouse S Unused Tax Allowance

https://www.ianswertoyou.com/wp-content/uploads/2020/01/image-331-scaled.jpg

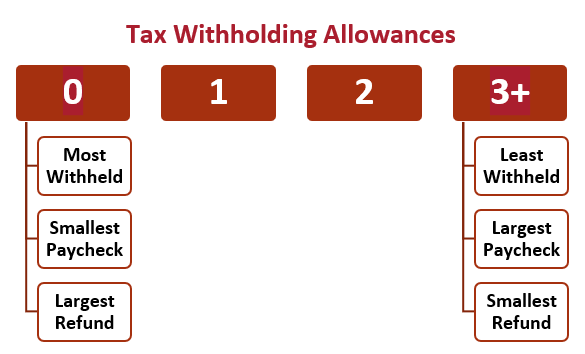

A Guide To Withholding Tax From Your Income Autumn Financial Advisors

https://images.squarespace-cdn.com/content/v1/59c5b5f82994ca741bd1f87d/1548704221766-GGKD05BUAU1PWWTRGQXS/How+many+tax+allowances+should+I+claim_Autumn+Financial+Advisors+LLC_Fee+Only.PNG

How Can We Use My Husband s Tax Allowance

https://s3-eu-west-1.amazonaws.com/ic-ez-prod/ez/images/9/2/1/1/3691129-8-eng-GB/iStock-1029343092.jpeg

The marriage tax allowance means you may be eligible to claim a 1 250 tax rebate but an estimated 2 4 million married and civil partnered couples are missing out If you and your spouse or partner meet the proper criteria you can claim back all the taxes you would have paid There is however a four year limit on how far you can go back To claim back your tax give the HMRC

Marriage tax allowance is a tax break that enables a married person or someone in a civil partnership to claim a proportion of their spouse s personal allowance In this article we explain how marriage tax You can claim Married Couple s Allowance in your Self Assessment tax return If you don t complete a Self Assessment tax return contact HMRC Opens in a new window

Download Claim Spouse S Unused Tax Allowance

More picture related to Claim Spouse S Unused Tax Allowance

Which Sounds Marriage Tax Allowance Copycat Website Warning Which News

https://media.product.which.co.uk/prod/images/original/gm-7ce5457b-5466-4324-a86c-7df159cfd35f-tax-allowance-copycat-websiteinline-2.jpeg

Claiming My Wife s Unused Tax Allowance UK PLA

https://pearllemonaccountants.com/wp-content/uploads/2022/07/Claiming-My-Wifes-Unused-Tax-Allowance-860x450.jpg

Unused Tax Allowances Diggy Insurance

https://diggyinsurance.com/wp-content/uploads/bfi_thumb/methode2Fsundaytimes2Fprod2Fweb2Fbin2F2de585b6-1b7f-11e7-90b3-67de1d6b4791-37v9ba46s8jtjzjhn9jjt6.jpg

Find out whether you re eligible to claim marriage allowance the tax break which could allow married couples to earn an extra 252 in 2024 25 plus other tax breaks available for married couples and civil partners A spouse or civil partner who is liable to income tax at the basic rate dividend ordinary rate or the starting rate for savings will be able to claim the transferred personal allowance

One member of the couple must have taxable income of less than the 12 570 tax free personal allowance In addition Neither you nor your partner must pay tax at higher Marriage tax allowance offers a couple that is married or in a civil partnership the opportunity to claim tax relief if one spouse earns less than the standard personal allowance Here s everything you need to know

Marriage Tax Allowance How To Combine Your Tax free Allowance YouTube

https://i.ytimg.com/vi/cnAZlPCJlmQ/maxresdefault.jpg

Claiming My Wife s Unused Tax Allowance UK PLA

https://pearllemonaccountants.com/wp-content/uploads/2022/07/word-image-14654-2.png

https://www.gov.uk/apply-marriage-allowance

Marriage Allowance lets you transfer 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

https://www.gov.uk/marriage-allowance

Marriage Allowance lets you transfer 1 260 of your Personal Allowance to your husband wife or civil partner This reduces their tax by up to 252 in the tax year 6 April to 5

Claiming My Wife s Unused Tax Allowance UK PLA

Marriage Tax Allowance How To Combine Your Tax free Allowance YouTube

Locking In A Deceased Spouse s Unused Federal Estate Tax Exemption

Employee s Withholding Allowance Certificate Form 2022 2023

Carry Forward Unused Pension Tax Allowance Anthony James Brice LP

A Blue And White Brochure With The Words Are You Making The Most Of

A Blue And White Brochure With The Words Are You Making The Most Of

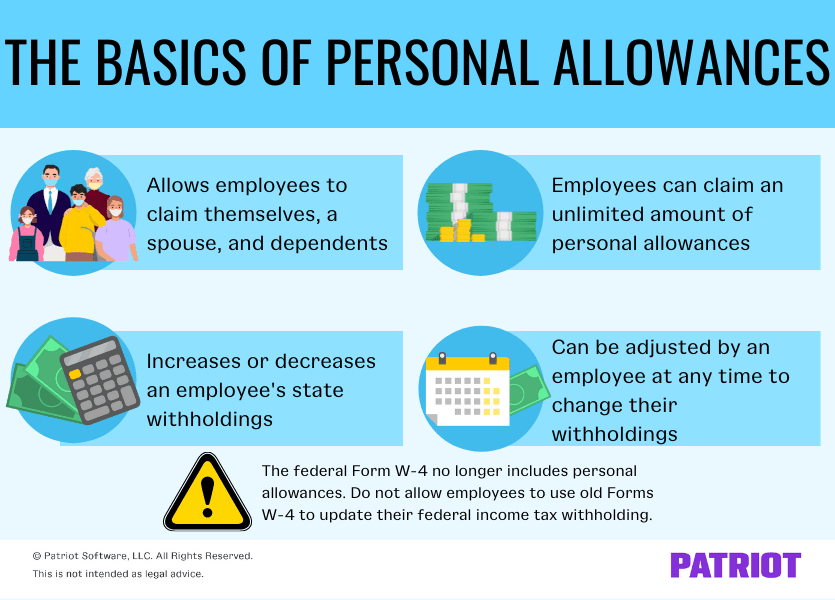

Personal Allowances What To Know About W 4 Allowances

Can I Use My Wifes Tax Free Allowance Tax Walls

Locking In A Deceased Spouse s Unused Federal Estate Tax Exemption

Claim Spouse S Unused Tax Allowance - If you do not complete a tax return you can claim married couple s allowance by contacting HMRC and giving them details about your marriage or civil partnership