Claim Tax Back For Working From Home Through Covid If you worked from home during the 2020 21 and 2021 22 tax years but failed to apply for the rebate you can still do so because claims can be backdated In the article we explain How does WFH tax relief work When is

Employees who have either returned to working in an office since early April or are preparing for their return can still claim the working from home tax relief and benefit from the full year s Millions of workers were able to claim tax relief on expenses they incurred from working from home during the Covid 19 pandemic but the rules have changed since then Some people will still be eligible to make a claim for

Claim Tax Back For Working From Home Through Covid

Claim Tax Back For Working From Home Through Covid

https://miro.medium.com/max/6910/1*VCL3qnX22bVa2rxxHaijsg.jpeg

Can You Claim Tax Deductions For Working From Home

https://biz-com.co.za/wp-content/uploads/2021/08/Bizcom-Blog-Images-2-1.png

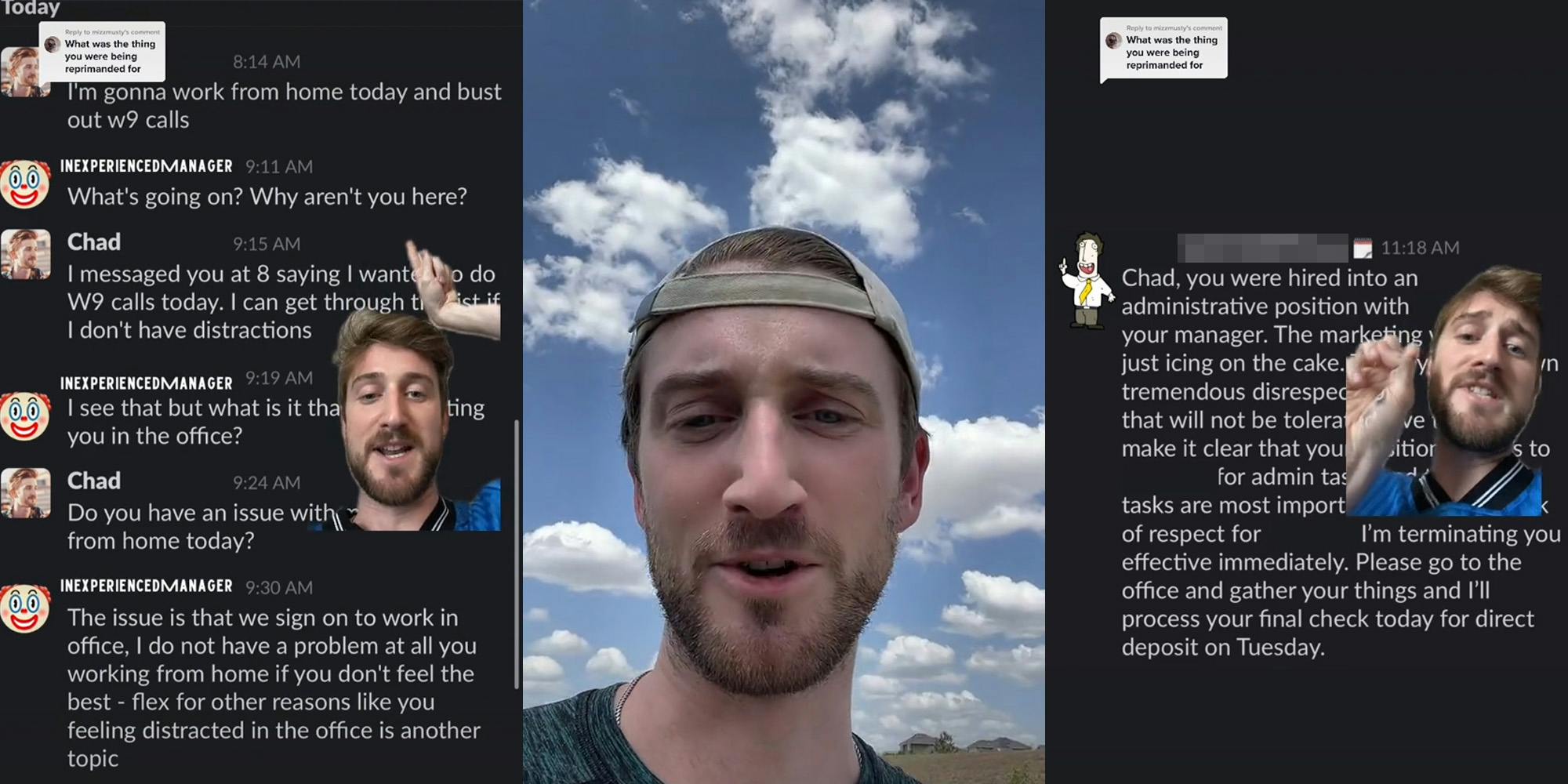

Man Fired For Working From Home Because It s More Productive

https://uploads.dailydot.com/2022/08/wfh-tiktok.jpg?auto=compress&fm=pjpg

Brits who ve worked from home for even one day due to Covid restrictions can claim back 125 or more in tax The work from home guidance has been reinstated from today December 13 for People who worked from home during the pandemic could be eligible for tax relief of up to 125 a year even if they only did so for one day Employees returning to the office can still

As a person who has been required to work from home during the COVID 19 pandemic you are likely to be eligible to claim back tax paid on your earnings to offset the extra energy expenditure associated with working at home If you ve been working from home during the pandemic you could be entitled to tax relief here s how to claim and the deadline

Download Claim Tax Back For Working From Home Through Covid

More picture related to Claim Tax Back For Working From Home Through Covid

Hecht Group Does Pennymac Pay Property Taxes

https://img.hechtgroup.com/1663215364372.jpg

3 Ways To Claim Tax Back When You Work In Construction Irish Tax Rebates

http://blog.irishtaxrebates.ie/wp-content/uploads/2016/11/Blog-Work-in-Construction-3-Ways-You-May-Be-Entitled-To-Tax-Back.jpg

Working From Home Allowance Calculator Employed Individuals

https://www.spondoo.co.uk/wp-content/uploads/2022/02/Working-from-Home-Allowance-Calculator-–-employed-individuals.png

To claim your tax relief rebate for working from home you can apply directly via GOV UK for free here Once your application has been approved the online portal will adjust your tax code for the 2021 22 tax year If you re eligible to claim tax back for working from home just head to the government s microsite If you haven t already you ll need to create a Government Gateway user ID and password To do this you need your

Employees have just weeks left to apply for a 125 tax rebate if they have been told to work from home in the past year It s part of relaxed tax measures introduced at the Apply for working from home tax relief online at Gov uk or by calling HMRC Anyone required to work from home even for one day could also apply for tax relief for the

Claim Tax Back For Working From Home Applied Accountancy Ltd

https://www.appliedaccountancy.co.uk/wp-content/uploads/2020/03/img_4364.jpg

Consumer Column What Can I Claim Tax Back For When WFH

https://evoke.ie/wp-content/uploads/2022/05/shutterstock_editorial_5884605a.jpg

https://www.thetimes.com › money-mentor …

If you worked from home during the 2020 21 and 2021 22 tax years but failed to apply for the rebate you can still do so because claims can be backdated In the article we explain How does WFH tax relief work When is

https://www.gov.uk › government › news

Employees who have either returned to working in an office since early April or are preparing for their return can still claim the working from home tax relief and benefit from the full year s

3 Ways To Claim Tax Back WikiHow

Claim Tax Back For Working From Home Applied Accountancy Ltd

How To Claim Tax Back Taxfiler

17 Solutions For Working From Home And Parenting Parenting Matters

What s The Deal With Working From Home Allworths

Find Out How To Claim Tax Back From Covid 19 Tests

Find Out How To Claim Tax Back From Covid 19 Tests

Tax Difference Between LLC And S Corp LLC Vs S Corporation

Tax Return 6 Ways To Get The Most Money Back From Your Tax Return NT

How To Claim Tax Back Ireland Tax Returns Submitted In 3 Easy Steps

Claim Tax Back For Working From Home Through Covid - As a person who has been required to work from home during the COVID 19 pandemic you are likely to be eligible to claim back tax paid on your earnings to offset the extra energy expenditure associated with working at home