Claim Tax Back Ireland Dental Expenses Relief for your health expenses is granted by way of a tax refund To benefit you must have paid tax in the relevant year If you have private health insurance you can claim tax relief on the portion of those qualifying expenses not covered by your insurer

You can claim income tax back on some types of healthcare expenses Tax relief for most expenses is at the standard rate of tax Relief on nursing home expenses is available at your highest rate of income tax You can claim tax relief on medical expenses you pay for yourself or for any other person If you ve undergone dental treatment in the last four years you can claim tax back on the procedure This guide covers which treatments qualify for dental tax relief the amount available for relief and how to apply for tax back on dental expenses

Claim Tax Back Ireland Dental Expenses

Claim Tax Back Ireland Dental Expenses

https://www.mytaxrebate.ie/wp-content/uploads/2020/09/Medical-Expenses-Blog-Image-e1602500412593.png

How To Claim For Tax Saving On Home Loan Payments In ITR By Sikha

https://image.isu.pub/220927133100-1b8703482174ad97c1c03877a3b01982/jpg/page_1.jpg

Statement Of Liability Explained How To Check If You Are Owed Tax

https://i.ytimg.com/vi/TAKTh8-v6KA/maxresdefault.jpg

You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 This section will explain the types of expenses that qualify As long as you paid for a qualifying expense you re entitled to claim 20 tax back The treatment or care you receive must also be carried out by a registered dental practitioner We can assure you all Smiles Dental practitioners are registered with the Irish Dental Council of Ireland

Non cosmetic dental expenses are tax deductible You could claim tax back on dental treatment in Ireland for the last 4 years Apply now You are entitled to claim tax back on the cost of non routine dental expenses for yourself your family or any other individuals as long as you have paid for them You must have a Med2 form completed by your dentist in order to claim tax relief

Download Claim Tax Back Ireland Dental Expenses

More picture related to Claim Tax Back Ireland Dental Expenses

How To Claim Tax Back In Ireland Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2022/01/Blog-Image-how-do-i-claim-tax-back.jpg

Are Dental Expenses Tax Deductible Maybe

https://www.deltadentalia.com/webres/image/blog/Taxes-iStock.jpg

How To Claim Tax Back For Dental Expenses Irish Tax Rebates

http://blog.irishtaxrebates.ie/wp-content/uploads/2017/12/pexels-photo-305568.jpeg

Claim tax back on dental treatments While routine procedures like teeth scaling and denture maintenance aren t eligible you can claim tax relief on several other treatments including Crowns Veneers Tip replacements Posts Inlays Root canal treatments Periodontal care Orthodontic treatments like braces Bridgework Extractions How much tax relief can you claim back on dental expenses Tax relief on qualifying dental expenses is given at the rate of 20 of the qualifying dental expenses you have incurred up with a limit of 1 000 per adult and 500 per child in a calendar year

In Ireland taxpayers can claim tax relief on specific medical and dental expenses not covered by the State or private health insurance This guide aims to provide a comprehensive understanding of the tax relief available for dental expenses the Med 2 Form and how to maximize the tax savings on dental treatments An individual claiming relief for non routine dental treatment must hold a Med 2 form Dental which is signed and certified by the dental practitioner Contact Irishtaxback ie today to find out more about Dental Expenses tax relief

How To Claim 20 Back On GP Receipt Medical Expenses Tax Relief

https://i.ytimg.com/vi/_IoxUfPxGnc/maxresdefault.jpg

How To Claim Emergency Tax Back Ireland YouTube

https://i.ytimg.com/vi/k7LlpaP0DYY/maxresdefault.jpg

https://www.revenue.ie/en/personal-tax-credits...

Relief for your health expenses is granted by way of a tax refund To benefit you must have paid tax in the relevant year If you have private health insurance you can claim tax relief on the portion of those qualifying expenses not covered by your insurer

https://www.citizensinformation.ie/.../taxation-and-medical-expenses

You can claim income tax back on some types of healthcare expenses Tax relief for most expenses is at the standard rate of tax Relief on nursing home expenses is available at your highest rate of income tax You can claim tax relief on medical expenses you pay for yourself or for any other person

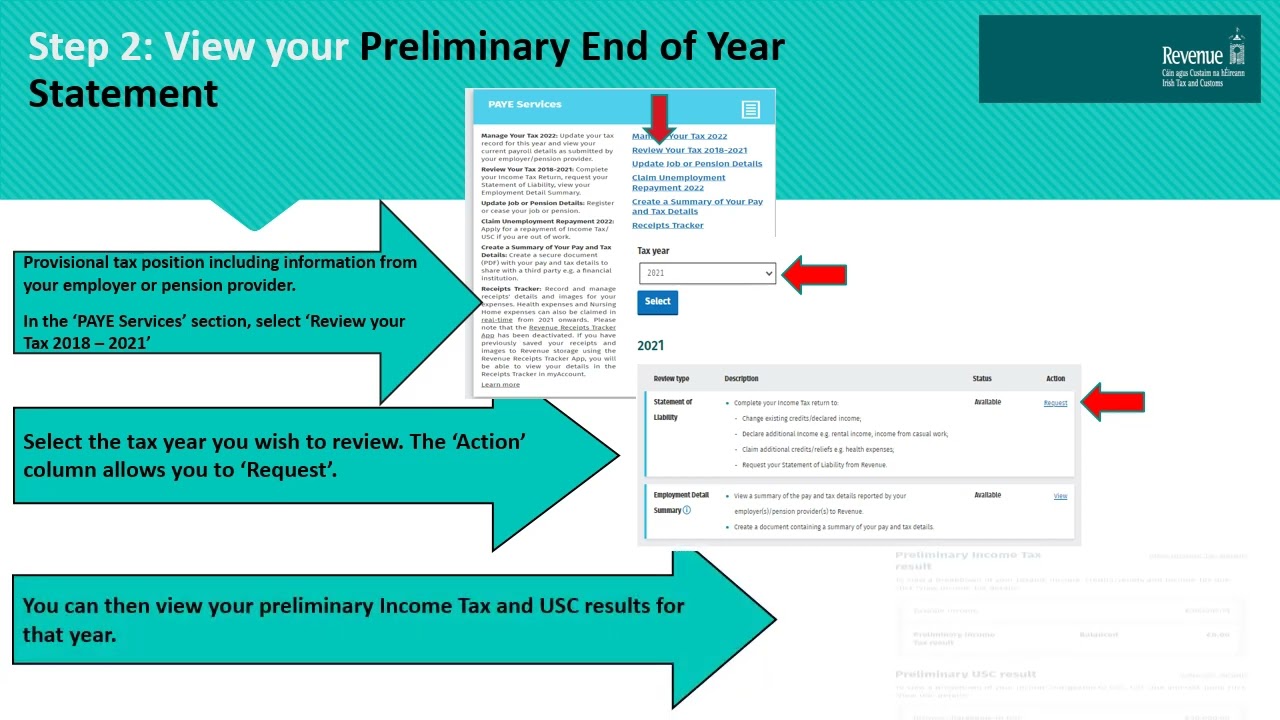

How To Claim Tax Back Online Revenue Refund Your Tax

How To Claim 20 Back On GP Receipt Medical Expenses Tax Relief

2023 Tax Code Changes Dentists Need To Know About Engage Advisors

PAYE End Of Year Review YouTube

How To Get Your Tax Back Income Tax Return 2022 How To Claim Rent

Itemized Deductions Medical Dental Expenses 550 Income Tax 2020 YouTube

Itemized Deductions Medical Dental Expenses 550 Income Tax 2020 YouTube

Flat Rate Expenses Irish Federation Of University Teachers

3 Ways To Claim Tax Back WikiHow

Form MED 2 Dental Expenses Certificate By Dental Practitioner PDF

Claim Tax Back Ireland Dental Expenses - As long as you paid for a qualifying expense you re entitled to claim 20 tax back The treatment or care you receive must also be carried out by a registered dental practitioner We can assure you all Smiles Dental practitioners are registered with the Irish Dental Council of Ireland