Claim Tax Rebate 2024 Claim an Income Tax refund by post or nominate someone else to receive the refund on your behalf using form R38

If you do not complete a Self Assessment tax return use form R40 to claim for a repayment of tax on your savings and investments The UK tax year ends on 5 April 2024 the HMRC processed the tax rebate after 6 April 2024 for the 23 24 tax year The taxpayers get the overpaid tax back with tax rebates refunds The article covers everything you wish to know about the UK tax rebate for 2024

Claim Tax Rebate 2024

Claim Tax Rebate 2024

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

Here s How To Get A Refund For Missouri s Gas Tax Increase Howell County News

https://www.howellcountynews.com/sites/default/files/field/image/afront-gas rebate.jpg

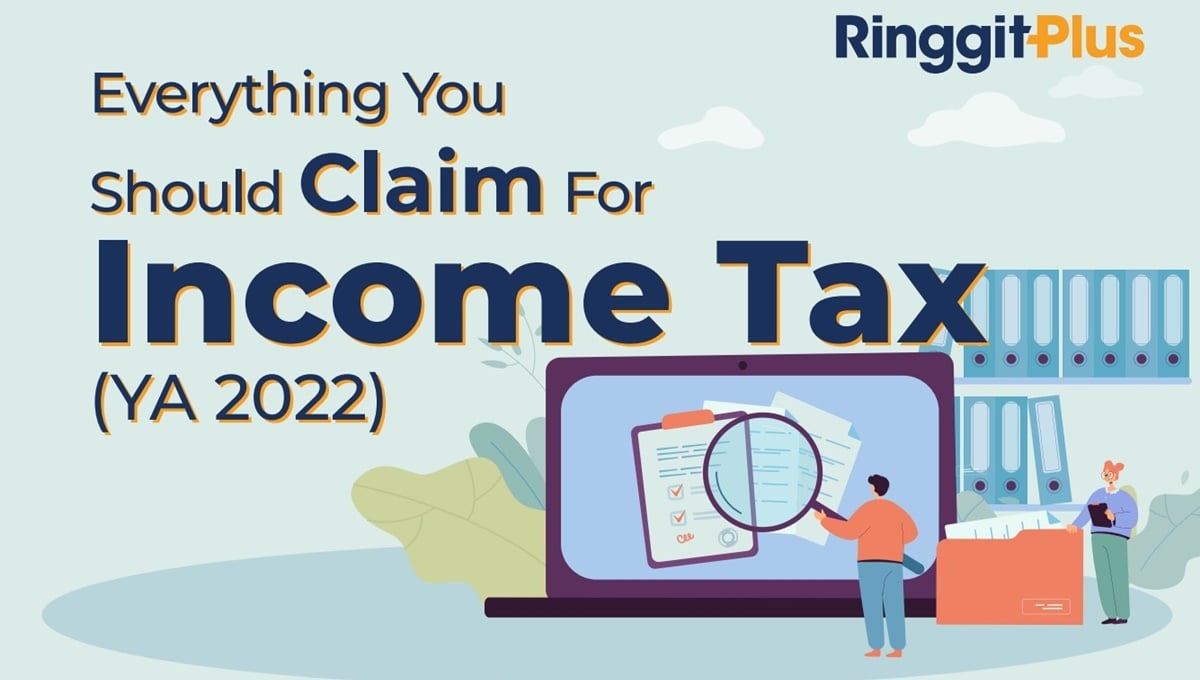

Everything You Should Claim As Income Tax Relief Malaysia 2023 YA 2022

https://ringgitplus.com/en/blog/wp-content/uploads/2023/03/everything-you-should-claim-as-tax-relief-2023_ya2022_1.jpg

In this guide you ll learn how to claim the full amount of stimulus payments you re owed using the Recovery Rebate Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695 Beginning Jan 1 2023 the credit equals 30 of certain qualified

5 April 2024 marks the end of the 2023 2024 tax year which means you can now apply for your UK tax refund With the average UK tax rebate being 963 it is definitely worth your while Keep reading to find out if you are entitled to a UK tax refund and how you can go about collecting the money you may be owed Any tax rebate due will automatcially be calculated and issued following the end of this 23 24 tax year after the 6th of April 2024 If you would like us to confirm if you have overpaid tax

Download Claim Tax Rebate 2024

More picture related to Claim Tax Rebate 2024

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/04/Michigan-Tax-Rebate-2023-768x675.png

Tax Refund Gambaran

https://g.foolcdn.com/editorial/images/230742/getty-tax-refund.jpg

P55 Tax Rebate Form By State PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

Tax Rebate Under Section 87A Find out Who can claim Income Tax Rebate u s 87A for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 Know how to claim section 87A rebate in ClearTax Software How to claim a tax rebate Last updated 27 June 2024 Changing jobs or taking a break from work can mean that you get charged the wrong amount of income tax In this guide we teach you what a tax rebate is how much you might be owed and how to claim that money back What is a tax rebate

If you didn t get a first and second Economic Impact Payment or got less than the full amounts you may be eligible to claim the 2020 Recovery Rebate Credit by filing a 2020 tax return if you have not filed yet or by amending your 2020 tax return if it s already been processed If you re entitled to receive the CCR you can expect to receive your payments on the 15th of April July October and January When the 15th falls on a Saturday Sunday or a federal statutory holiday the payment will be made on the last business day before the 15th

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

Property Tax Rebate Pennsylvania LatestRebate

https://www.latestrebate.com/wp-content/uploads/2023/02/form-pa-1000-property-tax-or-rent-rebate-claim-benefits-older-2.png

https://www.gov.uk › government › publications

Claim an Income Tax refund by post or nominate someone else to receive the refund on your behalf using form R38

https://www.gov.uk › guidance › claim-a-refund-of...

If you do not complete a Self Assessment tax return use form R40 to claim for a repayment of tax on your savings and investments

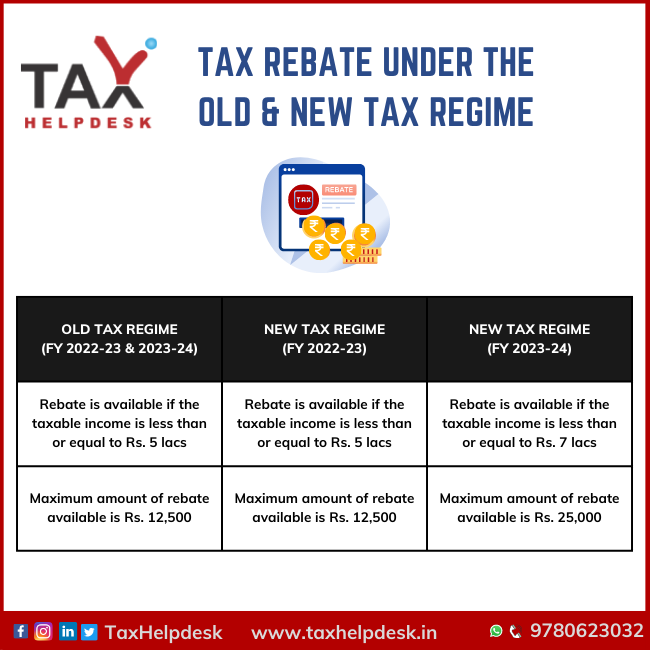

Tax Rebate Under The Old New Tax Regime

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

How To Claim Tax Rebate Under Income Tax Goyal Mangal Company

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

Tax Rebate Calculator Claim Your Tax Refund QuickRebates

Virginia Tax Rebate 2024

Virginia Tax Rebate 2024

Income Tax Rebate Under Section 87A

Minnesota Fillable Tax Forms Printable Forms Free Online

Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia

Claim Tax Rebate 2024 - 5 April 2024 marks the end of the 2023 2024 tax year which means you can now apply for your UK tax refund With the average UK tax rebate being 963 it is definitely worth your while Keep reading to find out if you are entitled to a UK tax refund and how you can go about collecting the money you may be owed