Claim Tax Rebate For Laundry Web If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 163 100s of tax for up to five years of expenses

Web If you claim a deduction for laundering washing and drying you must keep details of how you work out your claim If your laundry expenses washing drying and ironing but not Web 5 oct 2022 nbsp 0183 32 The uniform tax return is a tax relief you can claim if you re responsible for washing repairing and replacing your work uniform without any reimbursement from

Claim Tax Rebate For Laundry

Claim Tax Rebate For Laundry

https://taxrebates.co.uk/wp-content/uploads/uniform_laundry-1024x536.png

Complete Guide To Uniform Tax Rebates Money Back Helpdesk

https://moneybackhelpdesk.co.uk/images/articles/Uniform-Tax-Rebate/_articleCard/Tax-Rebate-for-Washing-Uniform.jpg

Claim A Tax Rebate For Your Uniform Rmt

https://www.rmt.org.uk/public/news/large_2uniform.jpeg

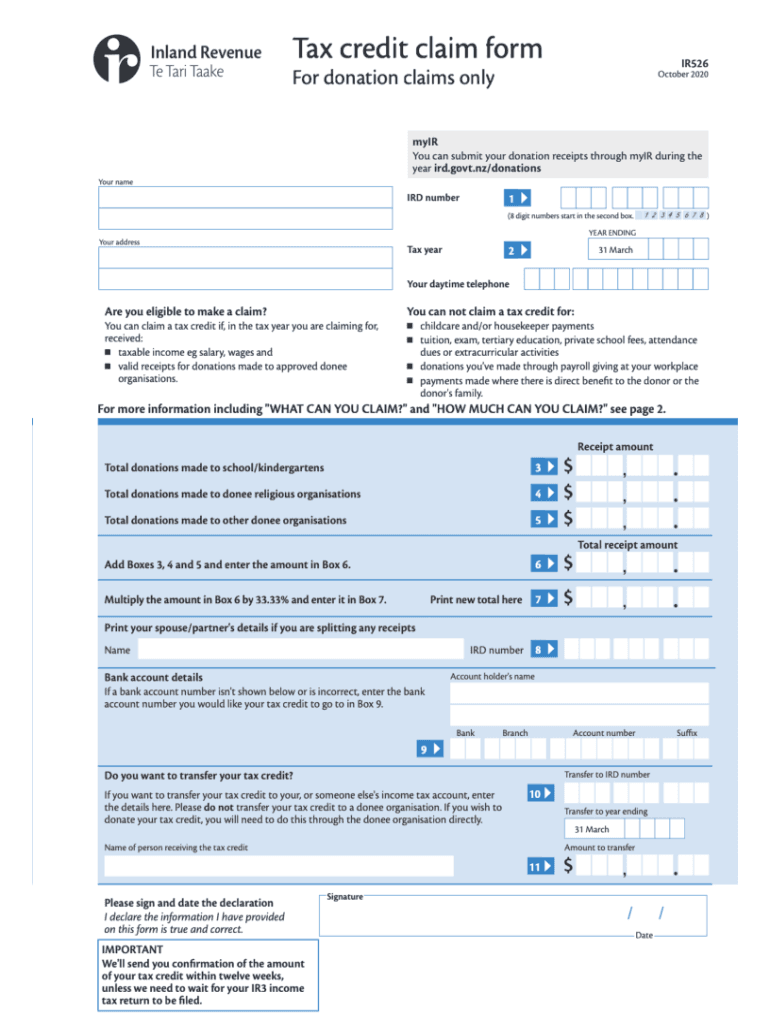

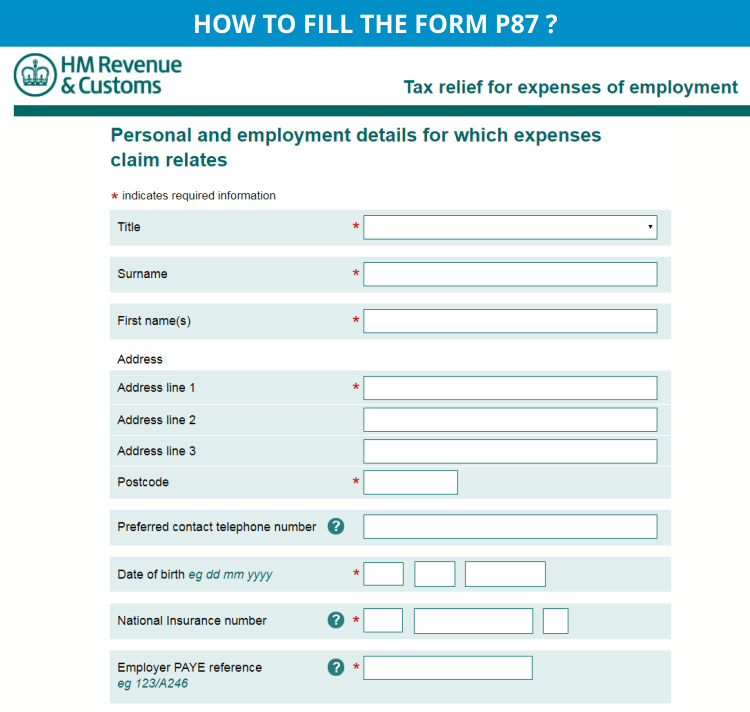

Web What form do I need for a Laundry tax rebate claim To make your claim for uniform allowance you need to complete a form P87 through an online or postal process with Web 28 mars 2023 nbsp 0183 32 2 min read Last updated 28 Mar 2023 How much can I claim for laundry expenses self employed one of our most commonly asked questions The answer

Web 3 mars 2016 nbsp 0183 32 If you are claiming flat rate expenses for work clothing and tools you do not need to keep records or receipts make annual claims Claiming more than the flat rate Web 13 mai 2022 nbsp 0183 32 In the event your employer covers all your work related expenses or provides a laundry service for uniforms then you can t claim this tax rebate What

Download Claim Tax Rebate For Laundry

More picture related to Claim Tax Rebate For Laundry

Inland Revenue Uniform Rebate

http://www.calculatemytax.net/wp-content/uploads/2017/07/tax-4.jpg

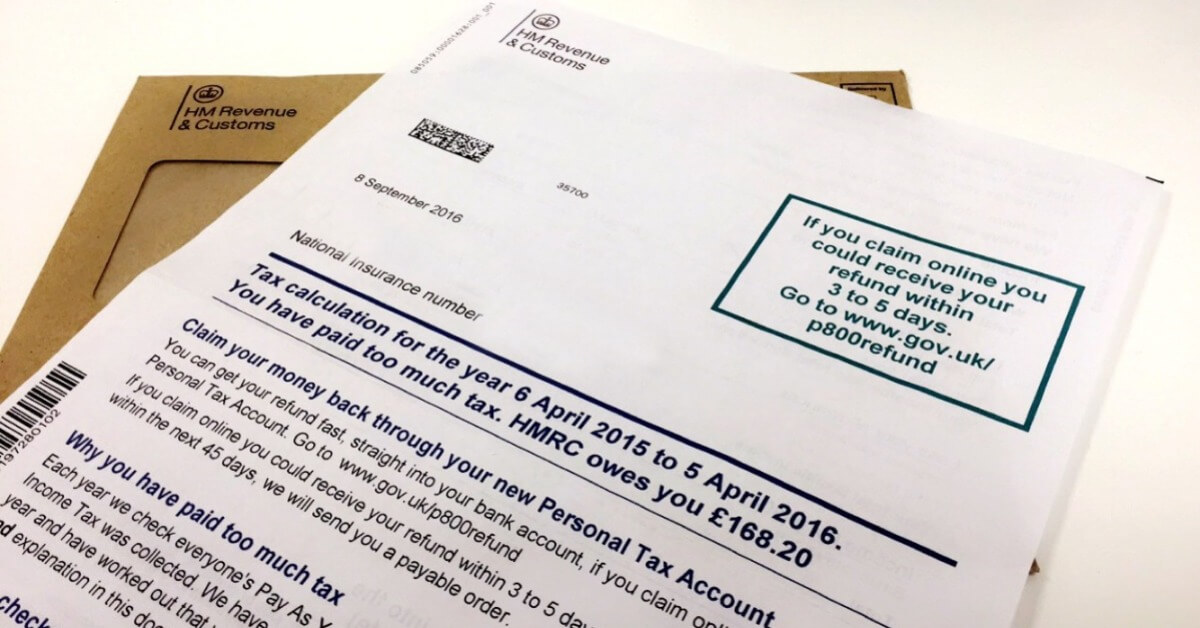

How To Claim and Increase Your P800 Refund Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/P800_Calculation.jpeg

2020 2023 Form NZ IR 526Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/568/283/568283124/large.png

Web diary records of your laundry costs if the amount of your laundry expenses claim is greater than 150 and your total claim for work related expenses exceeds 300 the Web If you pay the 20 basic rate of tax and claim tax relief on 163 6 a week you would get 163 1 20 per week in tax relief 20 of 163 6 You ll usually get tax relief through a change to your

Web Your uniform tax rebate depends on the work you do and the tax band you re in As a basic rule HMRC estimates that it costs most people 163 60 per year to maintain their work Web 20 mars 2023 nbsp 0183 32 Step 4 Claiming the deduction Include your clothing costs with your other quot miscellaneous itemized deductions quot on the Schedule A attachment to your tax return

Claiming Tax Back When Working From Home Tax Rebates

https://www.taxrebates.co.uk/wp-content/uploads/wfh.jpeg

Here s How To Claim Montana Tax Rebates Of Up To 2 500

https://www.valuewalk.com/wp-content/uploads/2023/04/Tax-Rebates-from-Minnesota-1536x768.jpeg

https://www.moneysavingexpert.com/reclaim/…

Web If you wear a uniform at work and have to wash repair or replace it yourself you may be able to reclaim 163 100s of tax for up to five years of expenses

https://www.ato.gov.au/.../Clothing-laundry-and-dry-cleaning-expenses

Web If you claim a deduction for laundering washing and drying you must keep details of how you work out your claim If your laundry expenses washing drying and ironing but not

Download Form P87 For Claiming Uniform Tax Rebate DNS Accountants

Claiming Tax Back When Working From Home Tax Rebates

Can I Claim Tax Back For Work Uniform

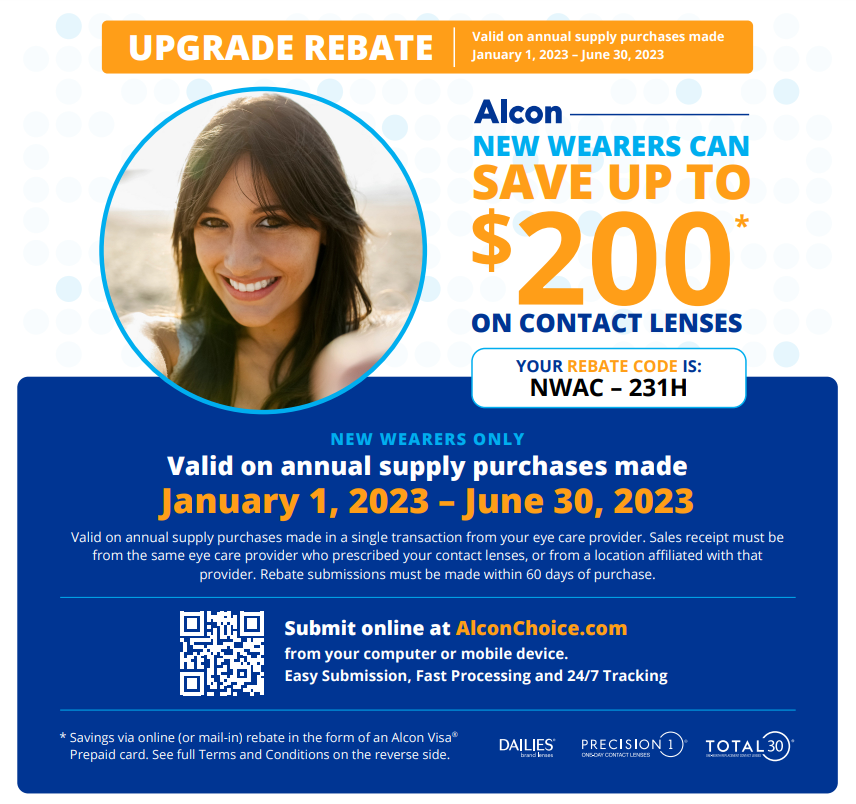

2023 Alcon Choice Rebate Printable Rebate Form

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

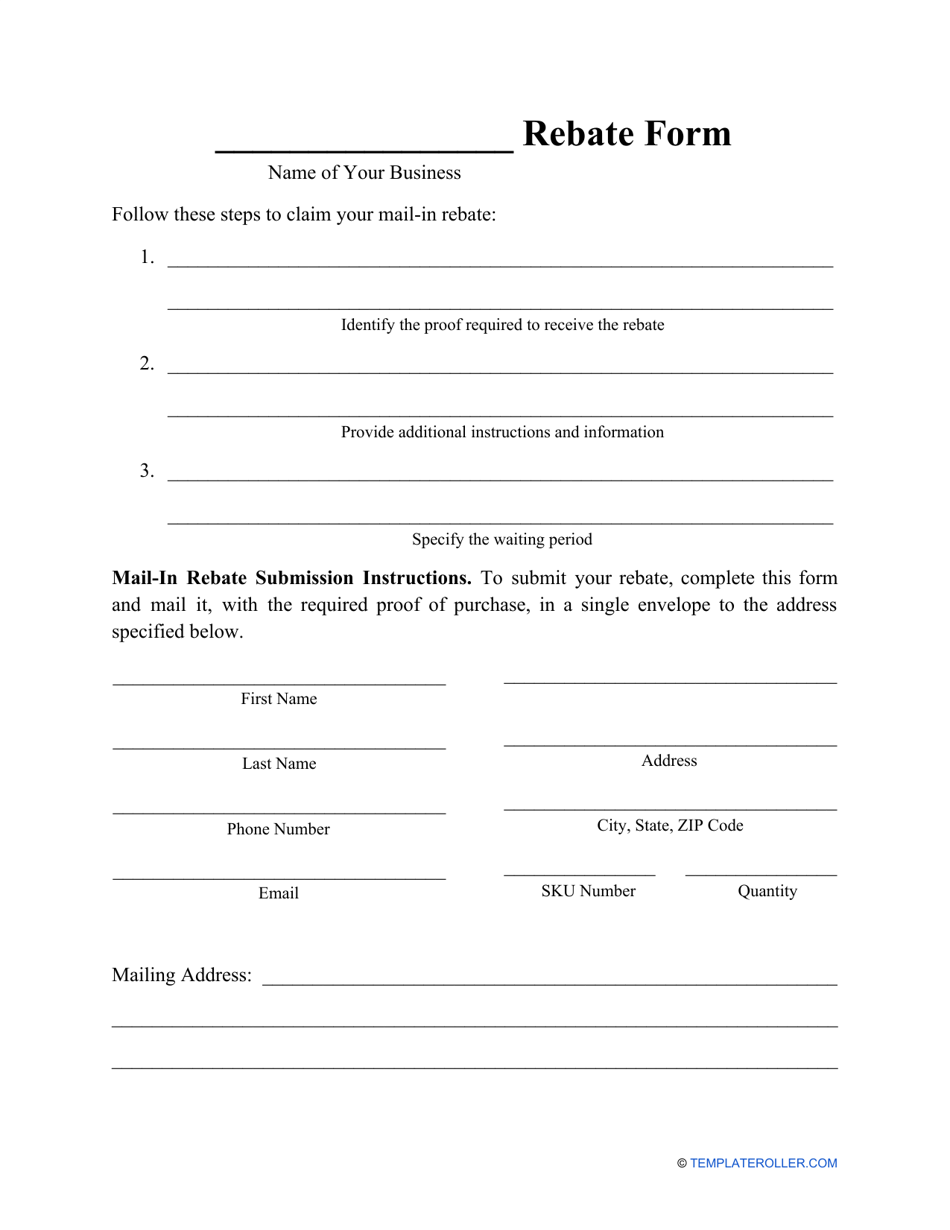

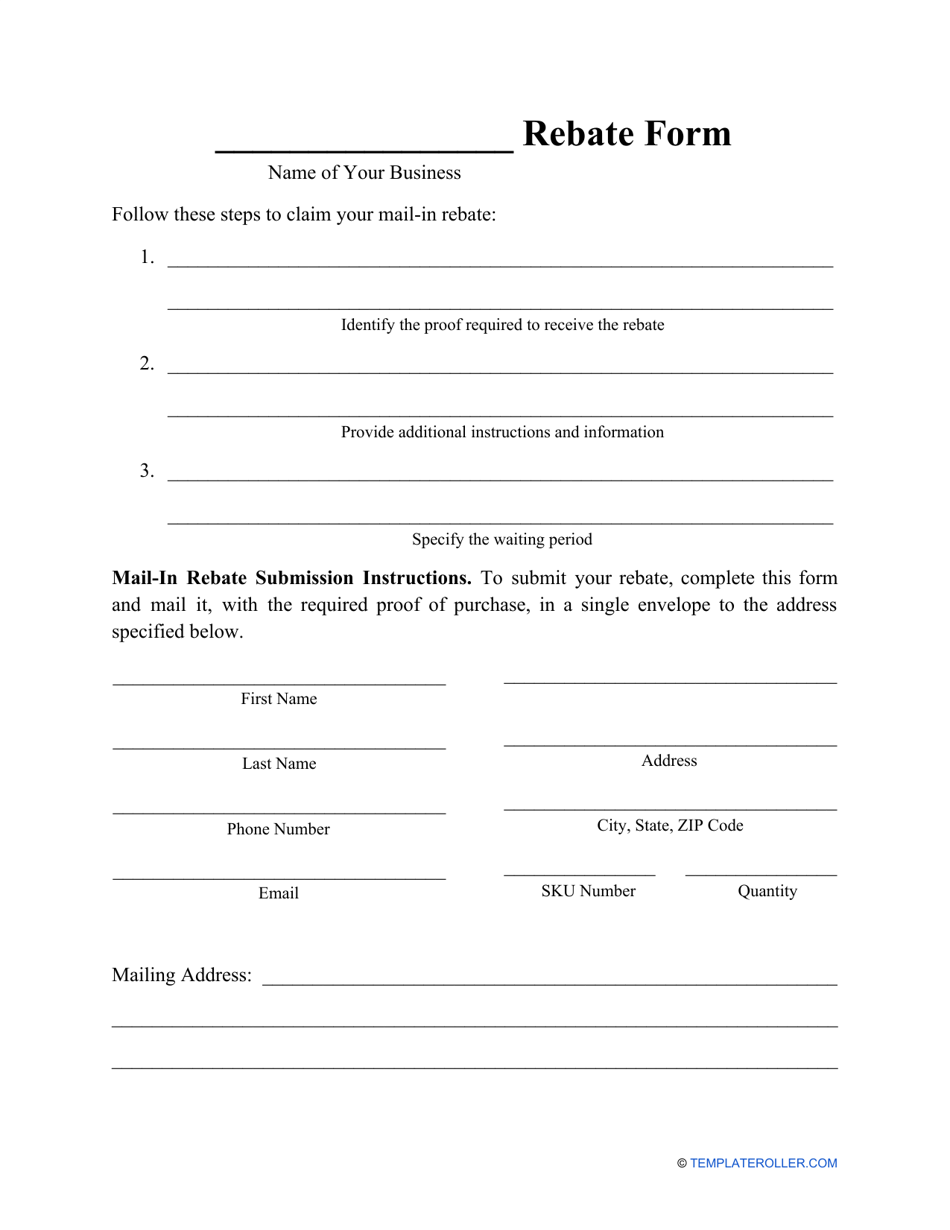

Supplier Rebate Agreement Template

Supplier Rebate Agreement Template

How Do You Claim Uniform Tax Rebate To HMRC Classified Ad Tax

How To Claim and Increase Your P800 Refund Tax Rebates

How To Calculate Tax Rebate On Home Loan Grizzbye

Claim Tax Rebate For Laundry - Web 4 mai 2021 nbsp 0183 32 The regular flat rate uniform maintenance cost allowance is 163 60 You ll get back the amount of tax you would have paid on the 163 60 if you applied for a uniform tax