Claiming Child Care Rebate Tax Return Web Eligibility Your eligibility depends on if you re working employed self employed or both your income and your partner s income if you have one your child s age and

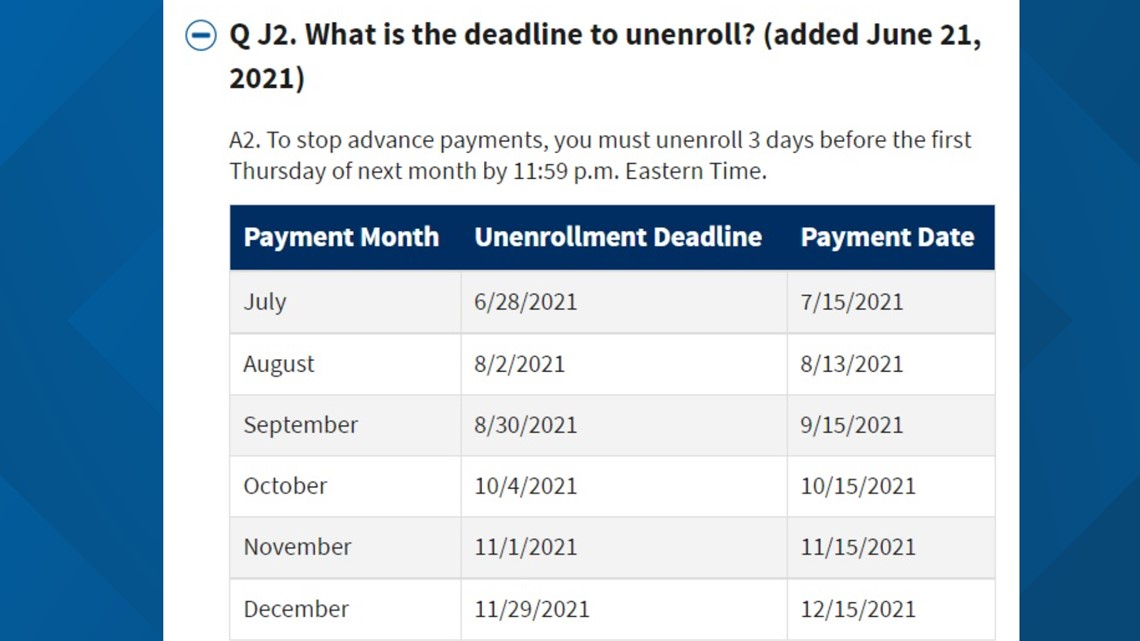

Web 2 mars 2022 nbsp 0183 32 For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more Depending on their income taxpayers could Web Confirming income for the 2022 23 financial year If you got CCS for 2022 23 you have until 30 June 2024 to confirm your family s income If you don t confirm your income your

Claiming Child Care Rebate Tax Return

Claiming Child Care Rebate Tax Return

https://www.carrebate.net/wp-content/uploads/2022/08/t778-fill-19e-pdf-clear-data-child-care-expenses-fill-out-and-sign.png

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

2022 Recovery Rebate Credit Phase Out Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/what-happens-if-i-make-a-mistake-when-claiming-my-remaining-child-tax-8.png?fit=735%2C955&ssl=1

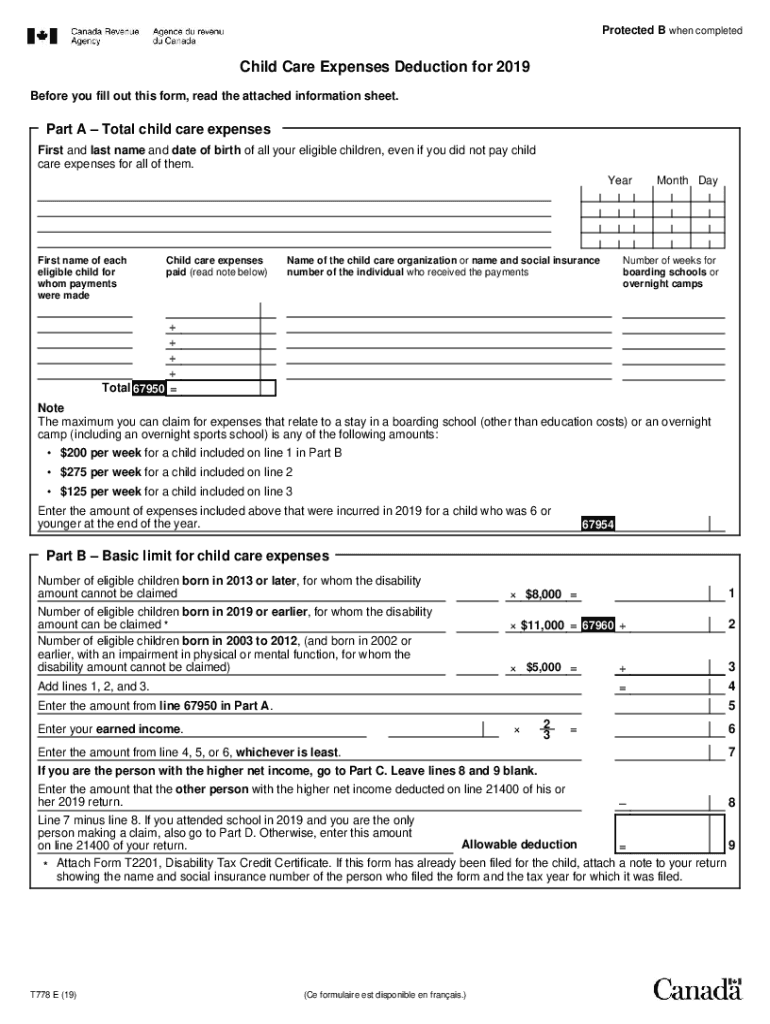

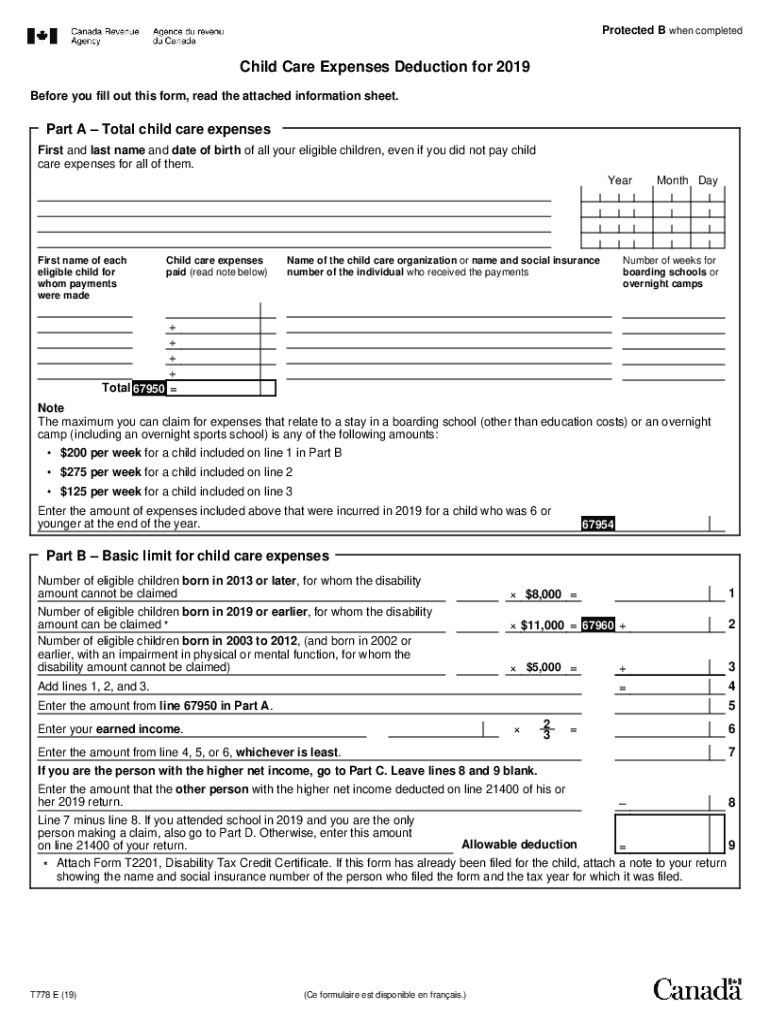

Web Use this tool to find out what you need to do to get a tax refund rebate if you ve paid too much Income Tax Web Note Line 21400 was line 214 before tax year 2019 The following information will help you determine the child care expenses deduction you can claim

Web Balancing Child Care Subsidy What you need to do to balance your Child Care Subsidy CCS payments depends on your circumstances on this page If you lodge a tax Web Find a list of all deductions credits and expenses you may be able to claim on your return Date modified 2023 01 24

Download Claiming Child Care Rebate Tax Return

More picture related to Claiming Child Care Rebate Tax Return

Child Care Rebate Tax Brackets 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

New Child Care Rebate Calculator 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/if-only-singaporeans-stopped-to-think-higher-subsidies-for-child.jpg

FREE 11 Child Care Application Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Child-Care-Rebate-Application-Form.jpg?width=320

Web 28 sept 2020 nbsp 0183 32 Childcare expenses can be claimed for the purposes of earning a living or going to school this will in turn reduce your income therefore the amount of taxes you Web 13 janv 2022 nbsp 0183 32 Here s what you need to know Published Thu Jan 13 20229 44 AM EST Updated Tue Feb 8 20224 05 PM EST Sarah O Brien sarahtgobrien Key Points For

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web You can claim child care expenses that were incurred for services provided in 2022 These include payments made to any of the following individuals or institutions caregivers

New Child Care Rebate 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2023/05/child-care-tax-rebate-canada-2023-carrebate.jpg

5 Best Photos Of Child Care Provider Tax Form Daycare Provider Tax Db

https://www.latestrebate.com/wp-content/uploads/2023/02/5-best-photos-of-child-care-provider-tax-form-daycare-provider-tax-db-1243x2048.jpg

https://www.gov.uk/tax-free-childcare

Web Eligibility Your eligibility depends on if you re working employed self employed or both your income and your partner s income if you have one your child s age and

https://www.irs.gov/.../understanding-the-child-and-dependent-care-credit

Web 2 mars 2022 nbsp 0183 32 For tax year 2021 the maximum eligible expense for this credit is 8 000 for one child and 16 000 for two or more Depending on their income taxpayers could

Summer Day Camp Costs Even In Coronavirus Time Still Eligible For A

New Child Care Rebate 2022 2023 Carrebate

How Does The Advanced Child Tax Credit Work Leia Aqui Do You Have To

Child Care Expenses Tax Credit Colorado Free Download

Child Care Benefit Claim Form Notes Australia Free Download

Recovery Rebate Credit Married Filing Separately Recovery Rebate

Recovery Rebate Credit Married Filing Separately Recovery Rebate

Childcare Tax Rebate Google Docs

Child Care Rebate Income Tax Return 2022 Carrebate

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Claiming Child Care Rebate Tax Return - Web 24 f 233 vr 2022 nbsp 0183 32 For your 2021 tax return the cap on the expenses eligible for the credit is 8 000 for one child up from 3 000 or 16 000 up from 6 000 for two or more