Claiming Mileage Tax Return Self Employed What is the Self Employed Mileage Allowance The answer to this depends upon whether you use simplified expenses or not If so then the rates are also 45p for the first 10 000 miles and 25p for any over

Self employed workers and business owners are eligible for the largest tax deductible mileage rate Mileage can be deducted for January 15 2024 Contents Claiming Business Mileage Allowance Claiming Business Mileage Employees Claiming Business Mileage Self Employed Business Mileage Calculation Calculating Mileage

Claiming Mileage Tax Return Self Employed

Claiming Mileage Tax Return Self Employed

https://goselfemployed.co/wp-content/uploads/2018/01/self-employed-mileage-allowance.jpg

Mileage Log For Taxes Requirements And Process Explained MileIQ

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110c7808a1a34e392da06a0_610f13719242da6fd79cc8b1_MileIQ-vs-paper-mileage-log-1.jpeg

How The Self Employed Claim Mileage On Their Taxes

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111cabad516a1f1ceea16e1_60d8c67933840b4f5f836616_claim-mileage-deduction-canada.jpeg

How do I claim mileage on my UK tax return If you re self employed or an established business owner and use your personal vehicle for business purposes HMRC offers two If you are self employed and use your car in that business see Interest earlier under Standard Mileage Rate Taxes paid on your car If you are an employee you can deduct personal property taxes paid on your car if

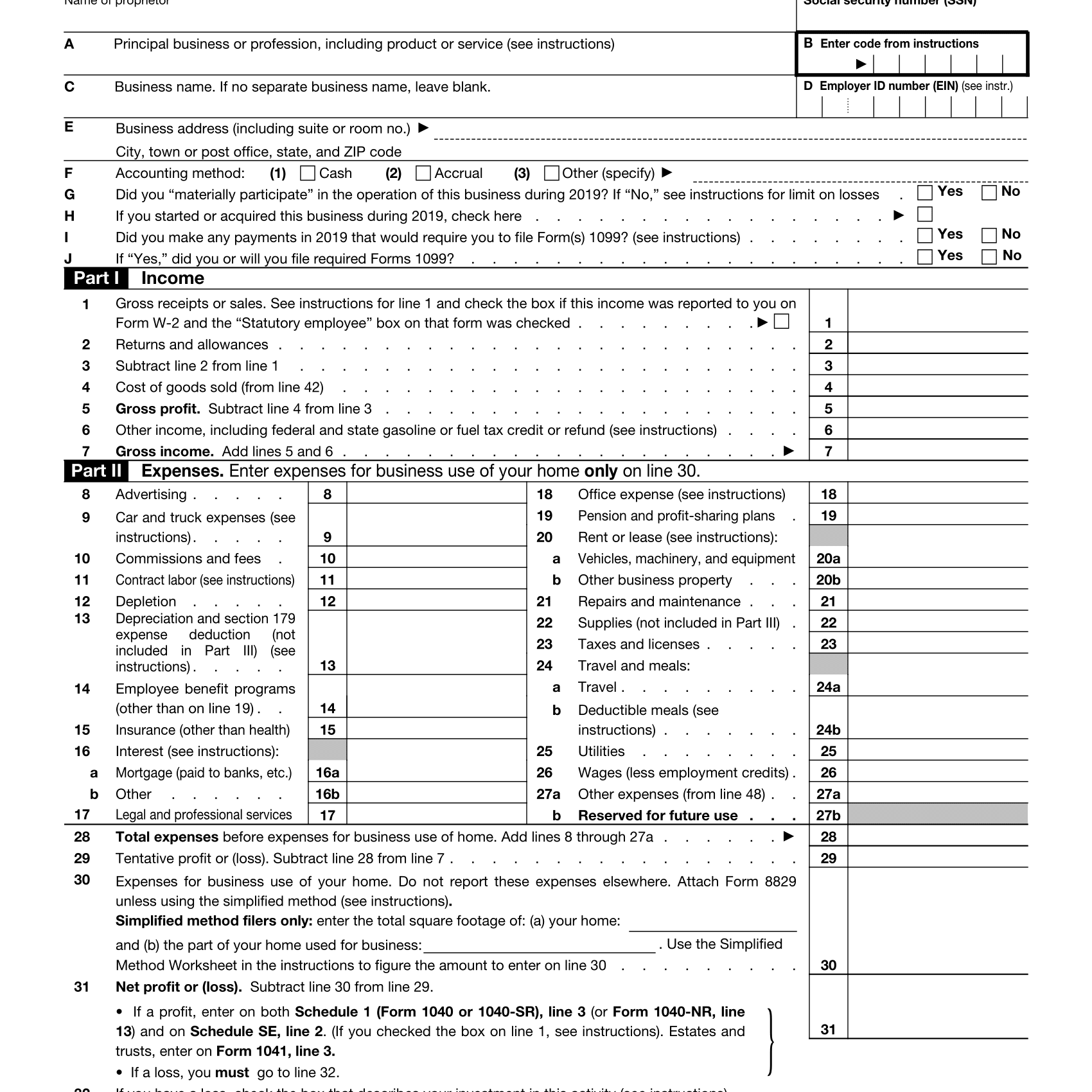

January 15 2024 5 min read Self employed Mileage Deductions Rules In this article Methods for calculating your self employed mileage deductions Tips for If you re self employed you can claim a mileage allowance of 45p per business mile travelled in a car or van for the first 10 000 miles and 25p per business mile thereafter

Download Claiming Mileage Tax Return Self Employed

More picture related to Claiming Mileage Tax Return Self Employed

Income Tax Rates For The Self Employed 2020 2021 TurboTax Canada Tips

https://turbotax.intuit.ca/tips/images/self-employed-taxes-canada.jpg

Free Mileage Log Template For Taxes Track Business Miles

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110cac61f61527fef942bec_60d8292fc2f1e427c014c612_excel-mileage-log-spreadsheet-2018-01-23.png

Tips On Claiming Travel Mileage When You re Self Employed GOFAR

https://www.gofar.co/wp-content/uploads/2020/03/gofar-claiming-travel-mileage.jpg

If you re self employed you can claim a mileage allowance of 45p per business mile travelled in a car or van for the first 10 000 miles 25p per business mile for each mile in excess of 10 000 miles 24p a If you re self employed you can claim a mileage allowance of 45p per business mile travelled in a car or van for the first 10 000 miles and 25p per business mile thereafter 24p a mile if you use your motorbike for

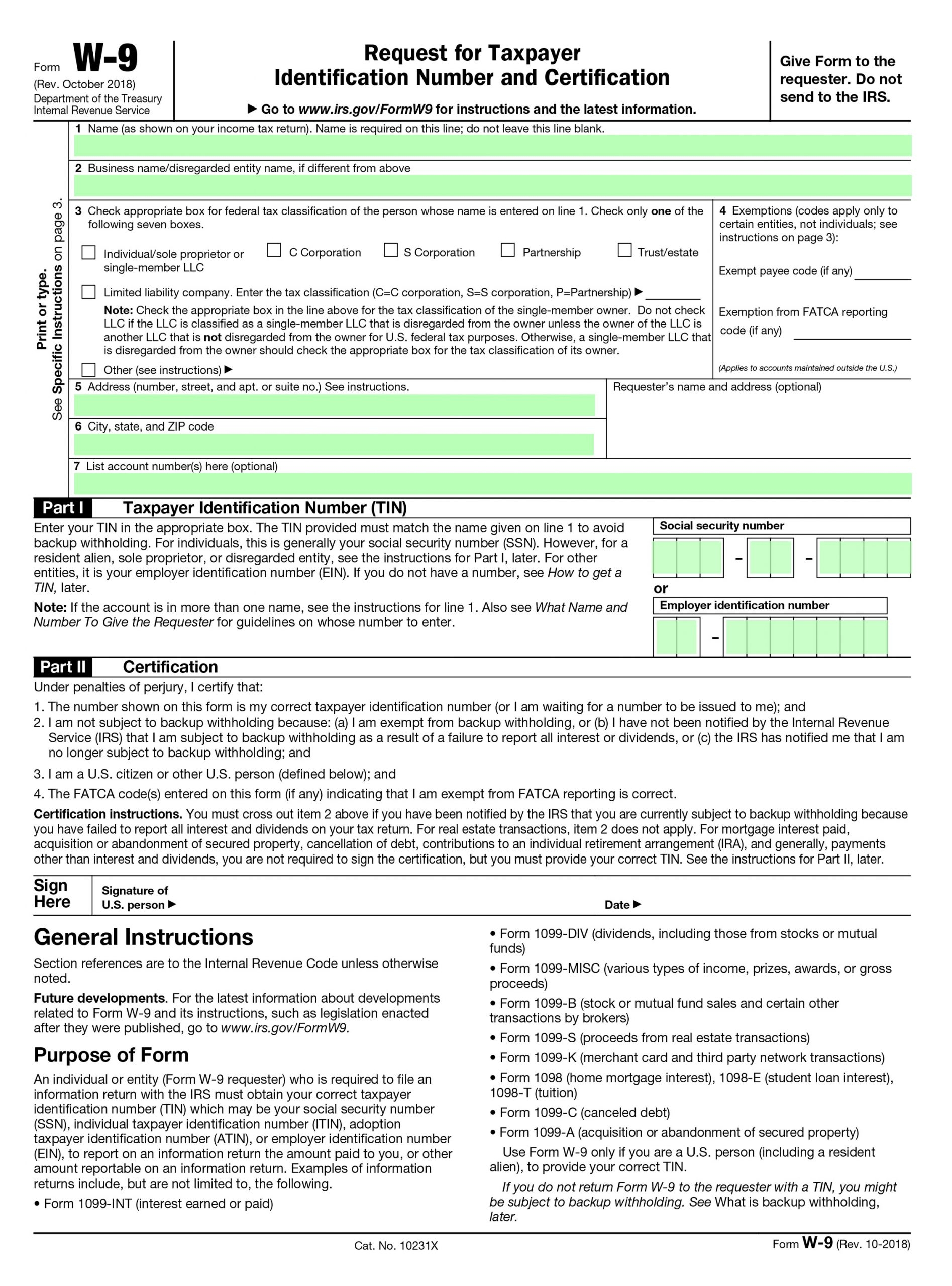

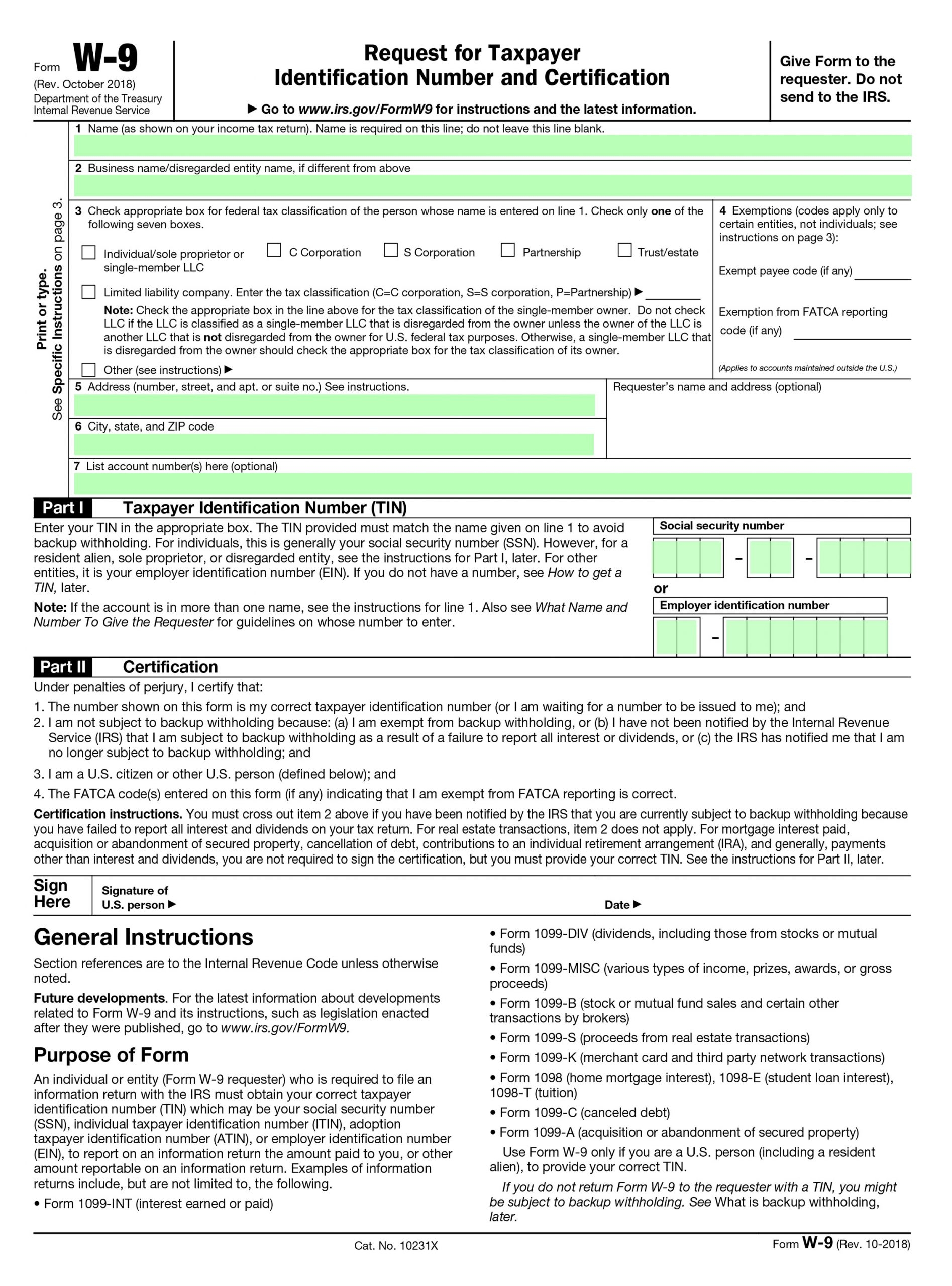

The IRS allows self employed individuals to claim mileage as a part of their business expenses This can include travel from your home to your place of work You must complete form P87 online or use the self assessment system to claim mileage from HMRC Here s What We ll Cover What Costs Does Business

2022 Self Employed Tax Form Employment Form

https://www.employementform.com/wp-content/uploads/2022/10/2022-self-employed-tax-form.jpg

Business Spreadsheet Tools Custom Software Development Working Data

https://www.workingdata.co.uk/wp-content/uploads/2013/08/simple-excel-mileage-claim-tool-04.png

https://www.gosimpletax.com/blog/car-al…

What is the Self Employed Mileage Allowance The answer to this depends upon whether you use simplified expenses or not If so then the rates are also 45p for the first 10 000 miles and 25p for any over

https://money.usnews.com/money/pers…

Self employed workers and business owners are eligible for the largest tax deductible mileage rate Mileage can be deducted for

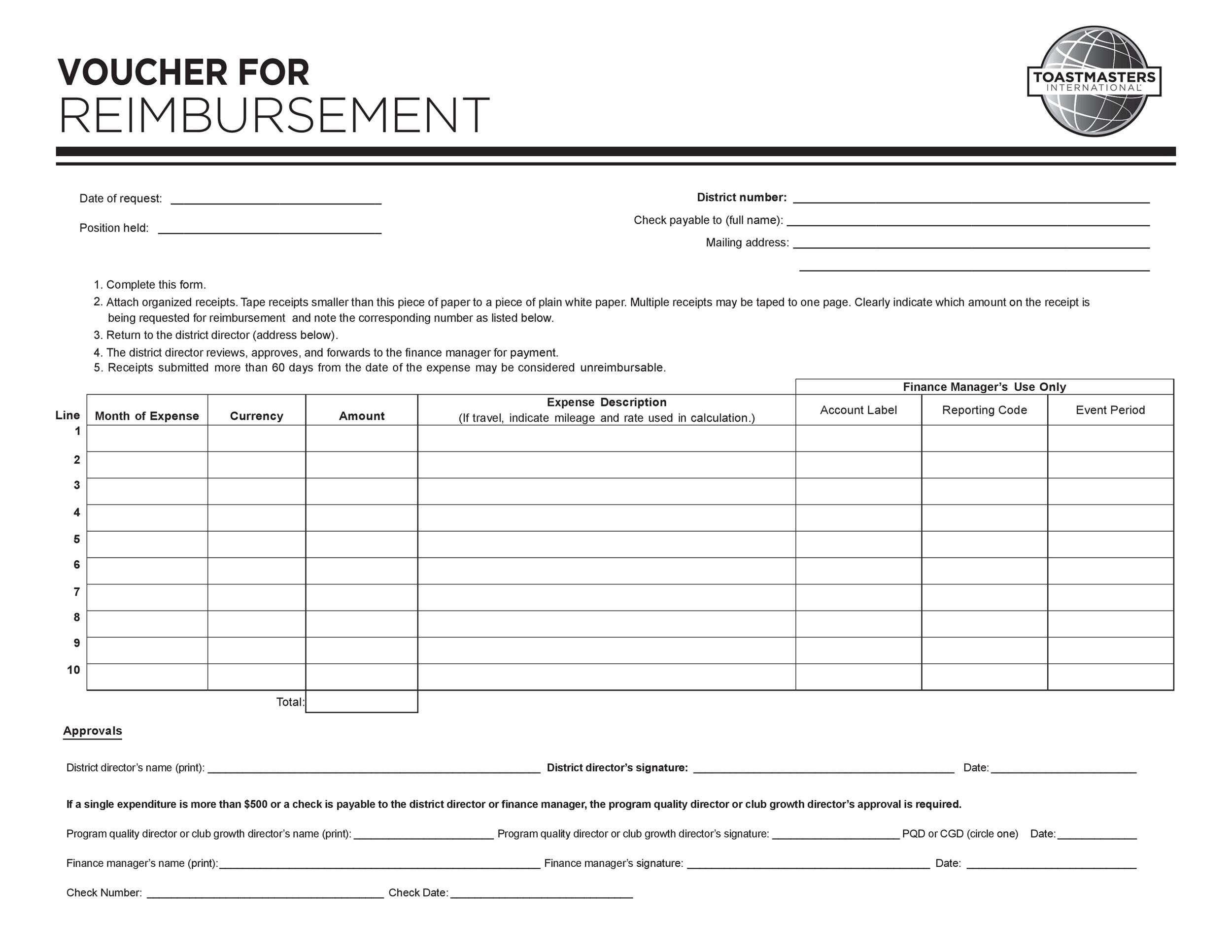

Reimbursement Form Template IRS Mileage Rate 2021

2022 Self Employed Tax Form Employment Form

USA 1040 Self Employed Form Template Income Tax Return Templates Self

Tax Return Self Employed Grant Employment Form

Amazon Flex Take Out Taxes Augustine Register

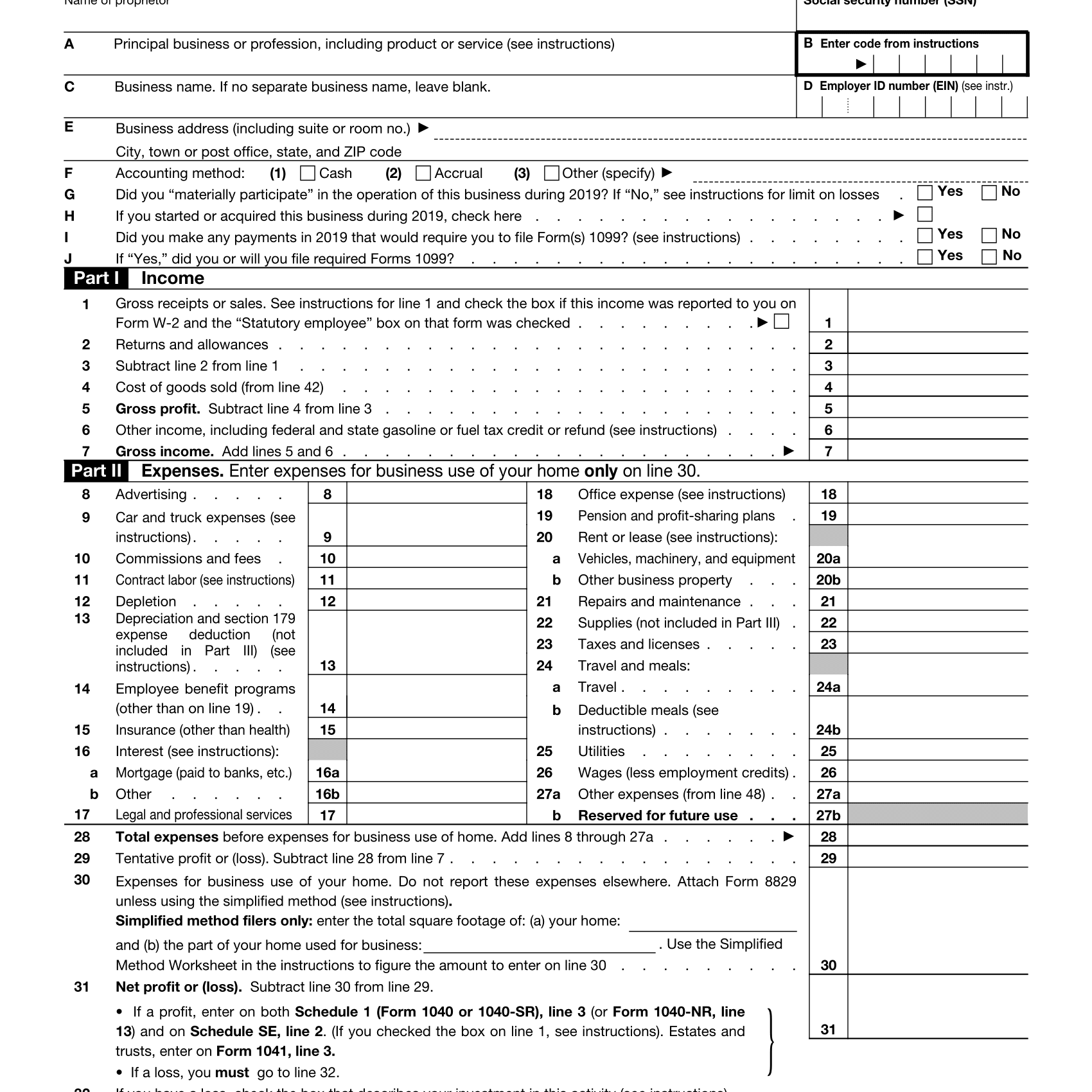

Self Employment Tax Form 2022 Schedule C Employment Form

Self Employment Tax Form 2022 Schedule C Employment Form

25 Printable Irs Mileage Tracking Templates Gofar Self Employed Mileage

Guide To Self Employed Tax Returns Checkatrade

Self Employed Tax Preparation Printables Instant Download Etsy In

Claiming Mileage Tax Return Self Employed - The mileage tax deduction rules generally allow you to claim 0 655 per mile in 2023 if you are self employed You may also be able to claim a tax deduction for mileage in a few