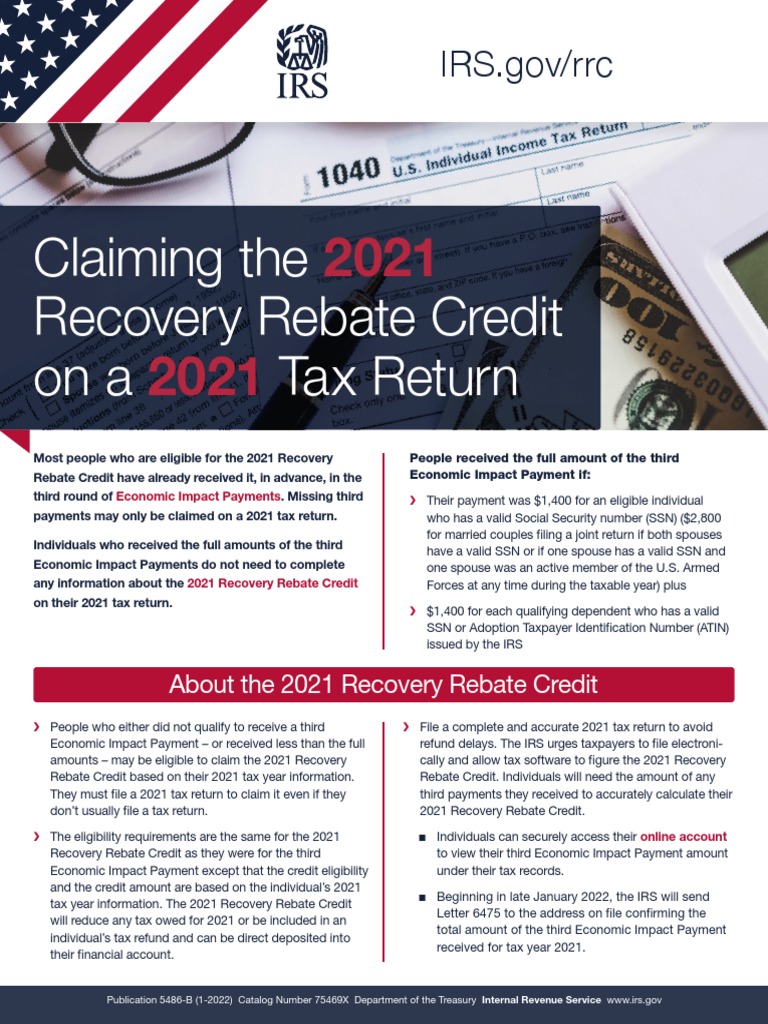

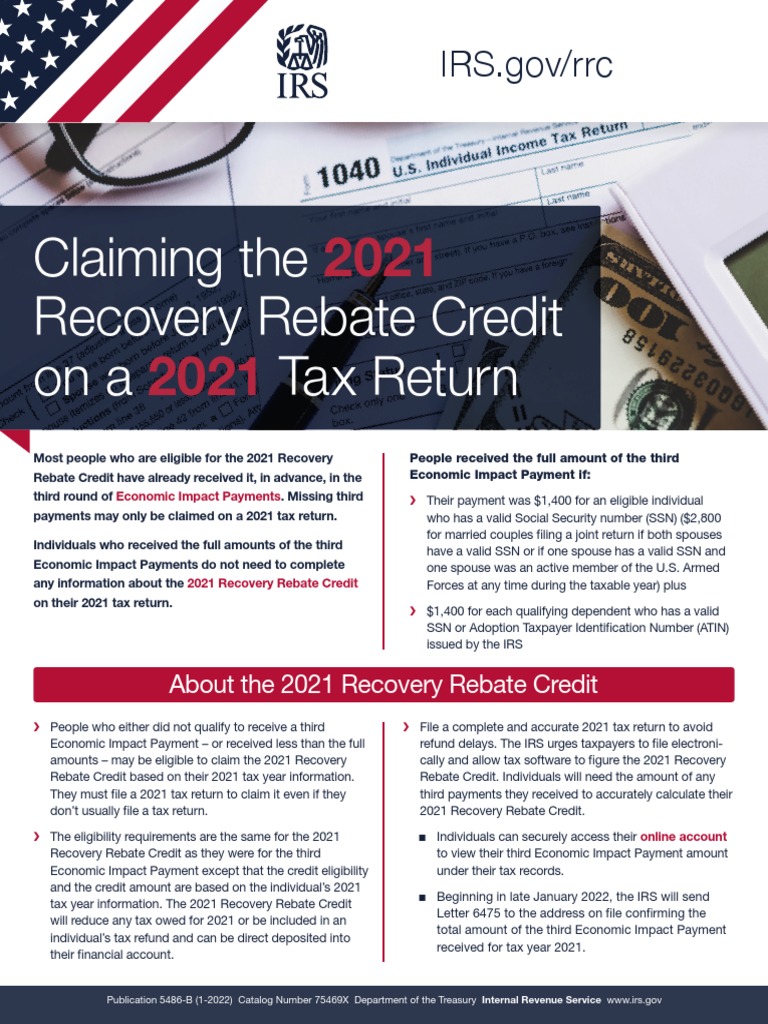

Claiming Recovery Rebate Web 8 f 233 vr 2021 nbsp 0183 32 Check your Recovery Rebate Credit eligibility February 8 2021 Most people who are eligible for the Recovery Rebate Credit already received it in advance as two

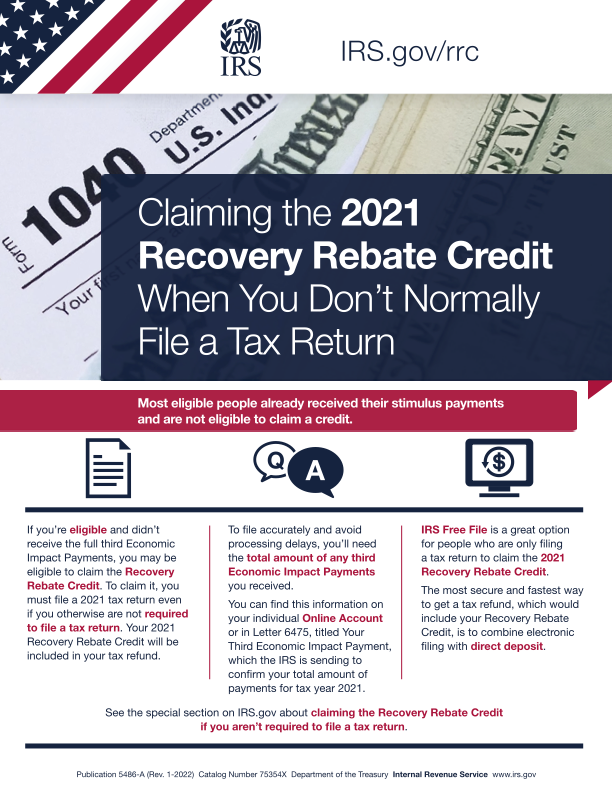

Web 13 janv 2022 nbsp 0183 32 You ll claim the 2021 Recovery Rebate Credit when you file your 2021 tax return If your income is 73 000 or less you can file your federal tax return Web 20 d 233 c 2022 nbsp 0183 32 Most eligible people already received their stimulus payments and won t be eligible to claim a Recovery Rebate Credit People who are missing a stimulus payment

Claiming Recovery Rebate

Claiming Recovery Rebate

https://imgv2-1-f.scribdassets.com/img/document/572963332/original/10dcefeb3b/1681400610?v=1

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/child-tax-credit-worksheet-claiming-the-recovery-rebate-credit.jpg?resize=791%2C1024&ssl=1

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Web 13 janv 2022 nbsp 0183 32 To calculate and claim the 2021 Recovery Rebate Credit you ll need to know the amounts of any third Economic Impact Payments you received This includes Web 24 janv 2023 nbsp 0183 32 Claiming Recovery Rebate Credit 2023 Taxpayers can receive a tax rebate through the Recovery Rebate program This lets them receive a tax refund for

Web 22 f 233 vr 2023 nbsp 0183 32 February 22 2023 by tamble How To Claim Recovery Rebate Credit On 2023 Taxes A Recovery Rebate is an opportunity for taxpayers to receive a tax refund Web 5 avr 2023 nbsp 0183 32 Claiming Recovery Rebate The Recovery Rebate is an opportunity for taxpayers to get an income tax refund without having to alter their tax return This

Download Claiming Recovery Rebate

More picture related to Claiming Recovery Rebate

Claim 2022 Recovery Rebate Credit Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2022/11/claiming-the-2021-recovery-rebate-credit-when-you-don-t-normally-file-a-2.png

Recovery Credit Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Web 11 d 233 c 2022 nbsp 0183 32 The Recovery Rebate is available for federal income tax returns up to 2021 A qualified tax dependent can receive up 1 400 married couples with two children or Web File a complete and accurate 2021 tax return to avoid People who either did not qualify to receive a third Economic Impact Payment or received less than the full amounts may

Web 2 d 233 c 2022 nbsp 0183 32 Claim The Recovery Rebate Credit December 2 2022 by tamble Claim The Recovery Rebate Credit The Recovery Rebate offers taxpayers the chance to get an Web 19 f 233 vr 2021 nbsp 0183 32 1 Best answer If you did not receive your first and or second stimulus payment or if the amount received is not correct you can claim it on your 2020 tax return

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

https://www.irs.gov/newsroom/check-your-recovery-rebate-credit-eligibi…

Web 8 f 233 vr 2021 nbsp 0183 32 Check your Recovery Rebate Credit eligibility February 8 2021 Most people who are eligible for the Recovery Rebate Credit already received it in advance as two

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 You ll claim the 2021 Recovery Rebate Credit when you file your 2021 tax return If your income is 73 000 or less you can file your federal tax return

Recovery Rebate Credit Calculator EireneIgnacy

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Worksheet Example Studying Worksheets

2022 Recovery Rebate Credit Phase Out Recovery Rebate

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

IRS CP 12R Recovery Rebate Credit Overpayment

IRS CP 12R Recovery Rebate Credit Overpayment

1040 Recovery Rebate Credit Drake20

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Claiming Recovery Rebate - Web 5 avr 2023 nbsp 0183 32 Claiming Recovery Rebate The Recovery Rebate is an opportunity for taxpayers to get an income tax refund without having to alter their tax return This