Claiming Tax Credits For Child You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents

You can only claim Child Tax Credit for children you re responsible for What you ll get The amount you could get depends on when your children were born If all your children OVERVIEW The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements 1 age 2 relationship 3 support 4 dependent status 5 citizenship 6 length of residency and 7 family income You and or your child must pass all seven to claim this tax credit

Claiming Tax Credits For Child

Claiming Tax Credits For Child

https://imageio.forbes.com/specials-images/imageserve/6382a9dd088a90f846f35930/0x0.jpg?format=jpg&crop=3207,3207,x0,y0,safe&width=1200

Claiming The Child Tax Credit Abroad Expat Tax

https://expattaxcpas.com/wp-content/uploads/2017/11/child-tax-credit.jpg

Tax Credits MJA Associates

https://mja-associates.com/wp-content/uploads/2023/12/AdobeStock_124656824.jpg

Yes you may claim the child tax credit CTC additional child tax credit ACTC or credit for other dependents ODC as well as the child and dependent care credit on your return if you qualify for those credits If you are eligible for the Child Tax Credit but did not receive advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return during the 2022 tax filing season

For 2024 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married filing jointly or 200 000 or below all The child tax credit credit for other dependents and the additional child tax credit are entered on Form 1040 The intake and interview sheet along with the Volunteer Resource Guide Tab G Nonrefundable Credits are critical tools needed to determine eligibility for the credit

Download Claiming Tax Credits For Child

More picture related to Claiming Tax Credits For Child

Why Families Claiming Child Tax Credits Face Delayed Tax Refunds This

https://www.the-sun.com/wp-content/uploads/sites/6/2022/01/KB_COMP_child-tax-credit-jan-13.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

Are You Claiming The Correct Tax Credits ITAS Accounting

https://itasaccounting.ie/wp-content/uploads/2019/07/38482863171_ff0e852f8e_c.jpg

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

If you can claim someone as a dependent deductions like the earned income tax credit EITC and child tax credit will lower your tax bill Learn which you can claim If they were born before April 6 2017 you can get child tax credits for each person you re responsible for until they re 16 or until they re 20 if they stay in full time education or approved training

Child tax credit is a means tested benefit that can top up your income if you are responsible for at least one child or young person You don t have to be working to claim You can only claim child tax credit if you already receive working tax credit have claimed child tax credit in the past year If you have two or more children or dependents you may be able to get a credit of up to 35 of 6 000 of qualifying expenses or 2 100 The credit is nonrefundable and so once your tax bill

State Income Tax Credits For Child Or Dependent Care Expenses Wolters

https://assets.contenthub.wolterskluwer.com/api/public/content/d4ca91087ac84d8fa74e048f6b617f46?v=7c187506

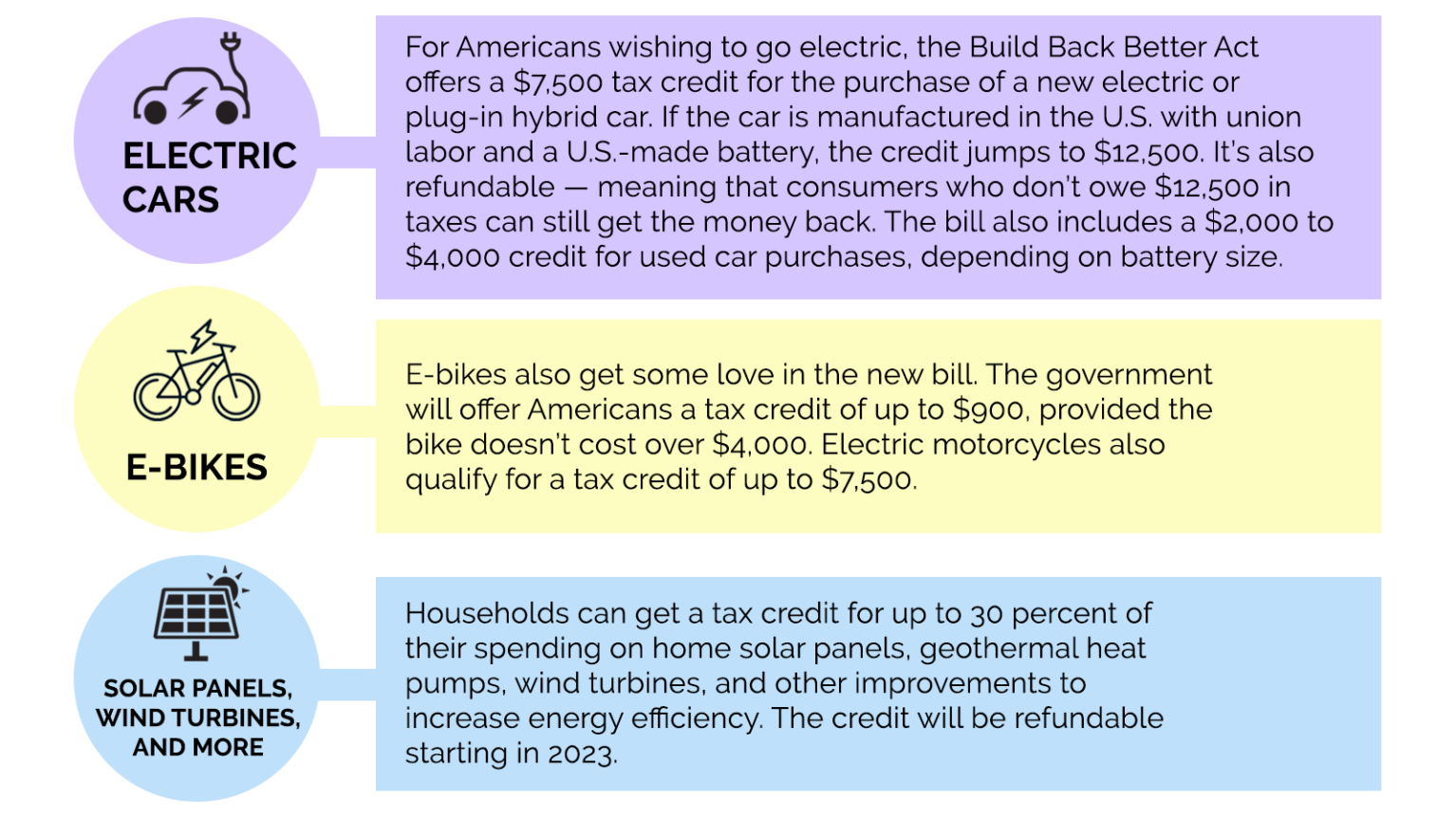

Green Incentives Usually Help The Rich Here s How The Build Back

https://grist.org/wp-content/uploads/2021/12/tax-credits-chart.png?w=1536

https://www.irs.gov › ... › individuals › child-tax-credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents

https://www.gov.uk › child-tax-credit › new-claim

You can only claim Child Tax Credit for children you re responsible for What you ll get The amount you could get depends on when your children were born If all your children

We Must Protect Tax Credits For Working Families

State Income Tax Credits For Child Or Dependent Care Expenses Wolters

Tax Credits For Paid Sick And Paid Family And Medical Leave Questions

Claiming Advance Child Tax Care Credits For Tax Year 2021 Haugen Law

TAX CREDITS FOR FAMILIES US Taxes TV

Money Matters Tax Credits For Families

Money Matters Tax Credits For Families

The Big Push To Restore R D Tax Credits FI Group USA

Child Tax Credit Changes Coming Soon Update From The IRS

Tax Credits Save You More Than Deductions Here Are The Best Ones

Claiming Tax Credits For Child - Manage an existing benefit payment or claim Financial help if you have children Child Tax Credits if you re responsible for one child or more how much you get eligibility claim tax