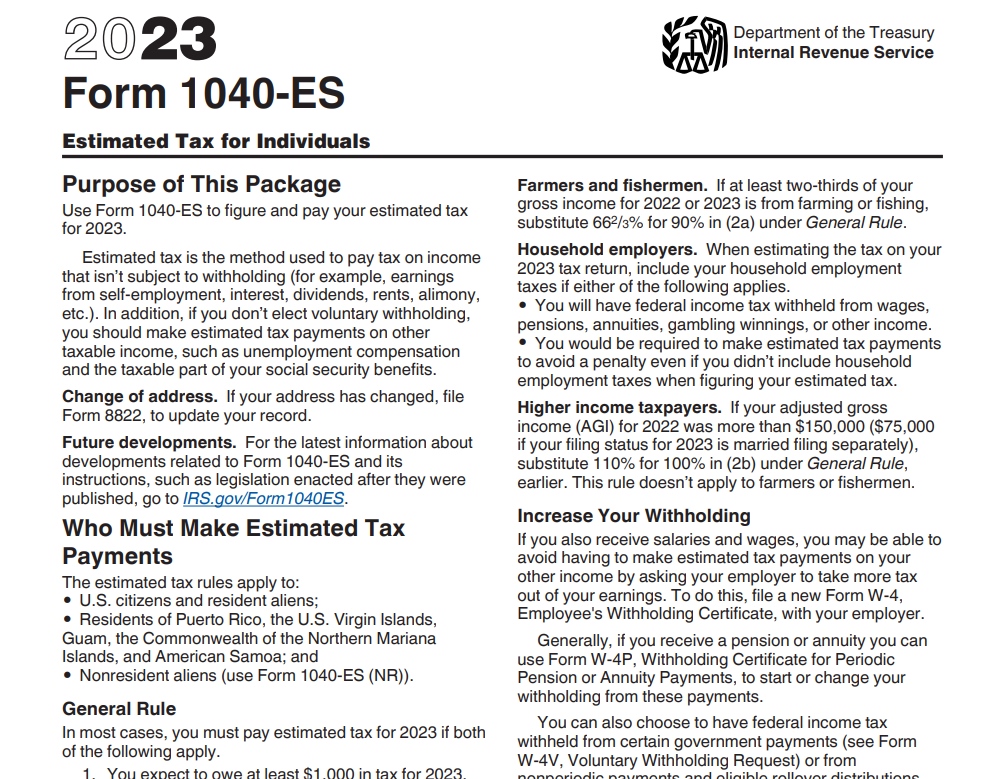

Claiming Tax Rebate For Previous Years Web If you re employed and making a tax rebate claim under PAYE you can claim back overpaid tax for the last four tax years This used to be six tax years but was

Web 12 nov 2022 nbsp 0183 32 Self Assessment How to claim back pension tax relief of previous years Posted 10 months ago by bas Hi I m new to self assessment and currently fill out my Web 3 mars 2016 nbsp 0183 32 You can claim tax relief by phone if you ve already claimed the same expense type in a previous year and your total expenses are less than either 163 1 000

Claiming Tax Rebate For Previous Years

Claiming Tax Rebate For Previous Years

https://i.pinimg.com/originals/6a/dc/d7/6adcd798adfe62171470a359853679ad.jpg

Track Your Recovery Rebate With This Worksheet Style Worksheets

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

How To Check Your Tax Rebate Eligibility Tax Rebate Check 2023 Tax

https://www.tax-rebate.net/wp-content/uploads/2023/04/Tax-Rebate-Check-2023.jpg

Web 15 ao 251 t 2014 nbsp 0183 32 Details If you ve paid too much tax and want to claim back the over payment use form R38 You can also use this form to authorise a representative to get Web 6 avr 2023 nbsp 0183 32 How do I claim tax back Updated on 6 April 2023 Tax basics These pages tell you how to claim back overpaid tax from HM Revenue amp Customs HMRC and what the time limits are for making

Web 13 juil 2023 nbsp 0183 32 If you ve left employment and received your last pay before 5 April the previous tax year use form 38 to claim a refund Claim online Web 30 juil 2023 nbsp 0183 32 The last date to claim the refund for the 2019 Tax Return is July 17 2023 After this date the unclaimed refunds will be transferred to the U S Treasury For the

Download Claiming Tax Rebate For Previous Years

More picture related to Claiming Tax Rebate For Previous Years

RULES FOR CLAIMING TAX REBATE UNDER SECTION 87A YouTube

https://i.ytimg.com/vi/QNSG7Xp0XPI/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYfyAvKBMwDw==&rs=AOn4CLAbbWOTQIMM8jFjEGXyWnsJEU8q6g

Income Tax Rebate On Electric Car 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/claiming-the-7-500-electric-vehicle-tax-credit-a-step-by-step-guide-3.png

Tax Rebate RM20 000 X 3 Years On Investment Holding Company Apr 20

https://cdn1.npcdn.net/image/1618905210e3b8bb075144f9faf8856b273237113c.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1600&new_height=1600&w=-62170009200

Web 11 f 233 vr 2022 nbsp 0183 32 For any tax refunds for previous years you ll need to contact HMRC This should be unlikely if you ve been filling out your self assessment tax returns correctly Web 24 juil 2023 nbsp 0183 32 The IRS allows taxpayers up to three years to file their returns and collect their due refunds without facing any late filing penalties However you must act quickly

Web 22 d 233 c 2022 nbsp 0183 32 You may want to file a prior year tax return to claim tax credits that you may have missed out on like the Earned Income Tax Credit EITC the Child Tax Credit Web 18 mai 2023 nbsp 0183 32 Where an employee meets the criteria to claim tax relief for working from home and makes a claim for previous years HMRC will issue a tax refund This is

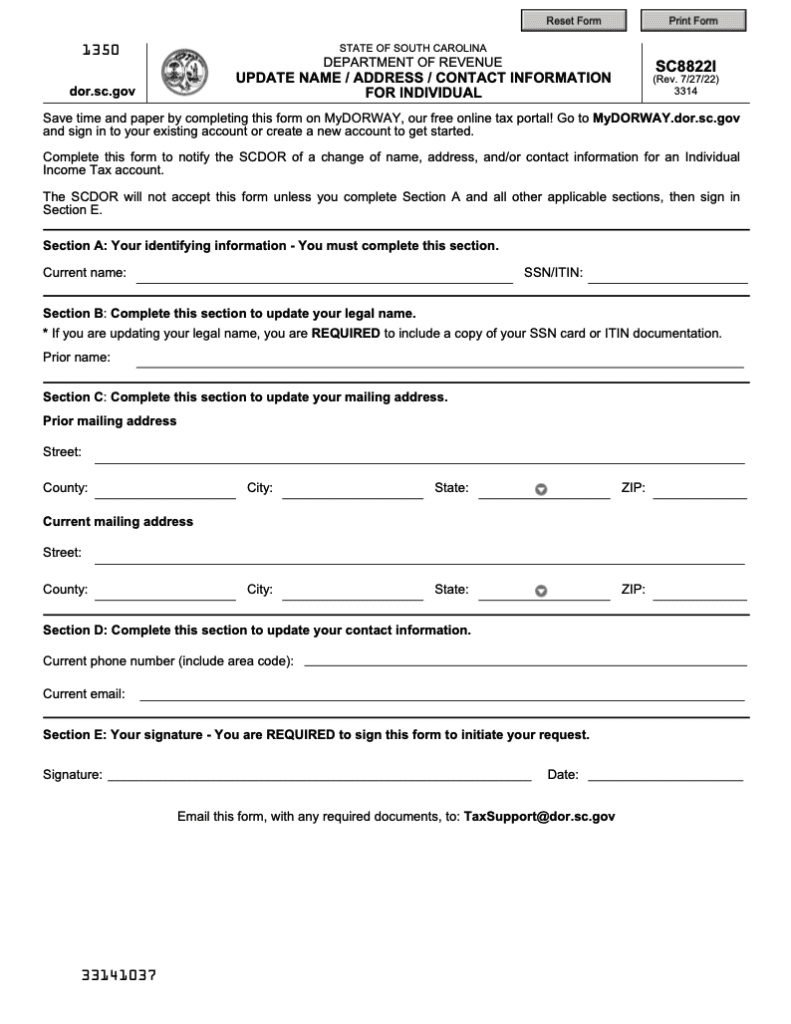

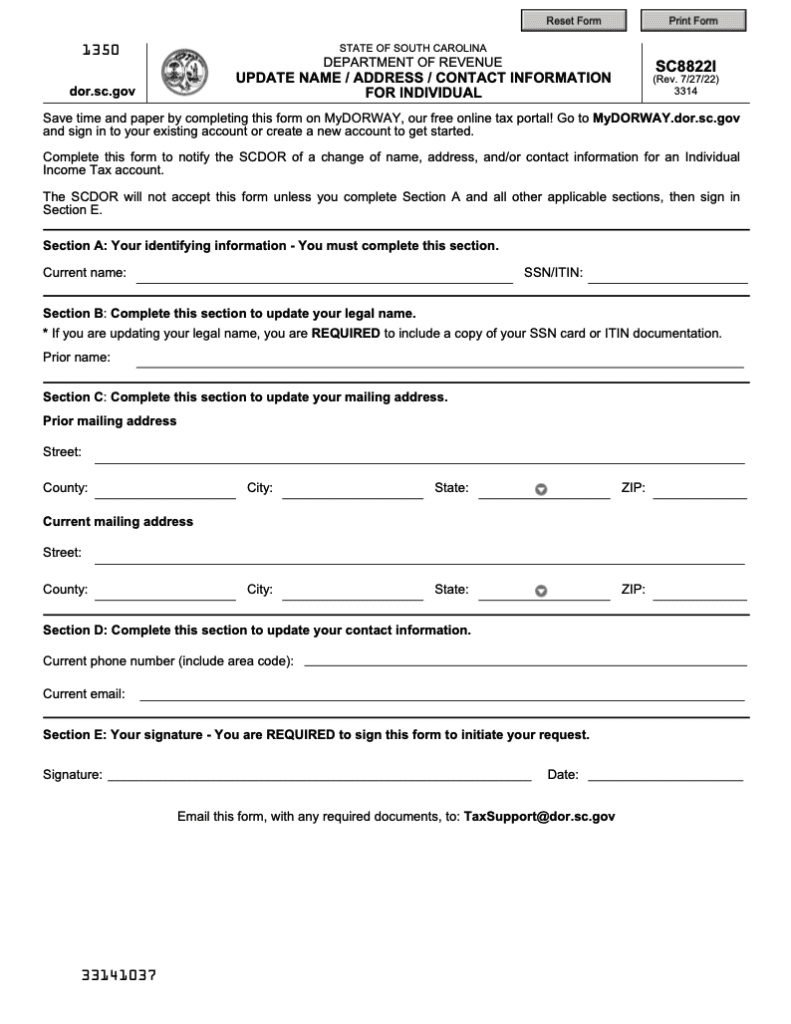

Washington State Tax Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/SC-State-Tax-Rebate-2023-791x1024.png

Tulsa Sales Tax Rebate Form Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/27/773/27773189/large.png

https://www.taxrebateservices.co.uk/tax-faqs/how-far-back-can-i-claim...

Web If you re employed and making a tax rebate claim under PAYE you can claim back overpaid tax for the last four tax years This used to be six tax years but was

https://community.hmrc.gov.uk/customerforums/sa/7714b015-be62-ed11-…

Web 12 nov 2022 nbsp 0183 32 Self Assessment How to claim back pension tax relief of previous years Posted 10 months ago by bas Hi I m new to self assessment and currently fill out my

2007 Tax Rebate Tax Deduction Rebates

Washington State Tax Rebate Printable Rebate Form

Working From Home Tax Rebate Form 2022 Printable Rebate Form

Claiming Tax Back When Working From Home Tax Rebates

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

P55 Tax Rebate Form Business Printable Rebate Form

P55 Tax Rebate Form Business Printable Rebate Form

Happy Chinese New Year

Pin On Tigri

Claiming Tax Offsets And Rebates Westcourt

Claiming Tax Rebate For Previous Years - Web 15 ao 251 t 2014 nbsp 0183 32 Details If you ve paid too much tax and want to claim back the over payment use form R38 You can also use this form to authorise a representative to get