Claiming Tax Relief On Business Mileage Calculator You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel

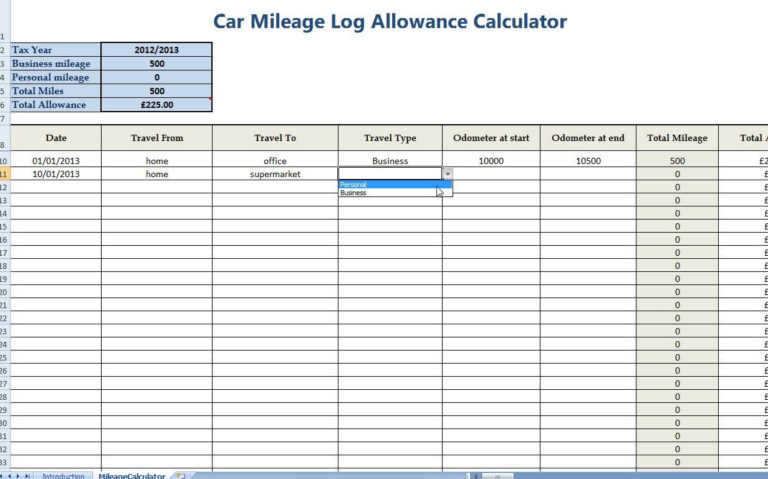

To calculate the approved amount multiply your employee s business travel miles for the year by the rate per mile for their vehicle Use HMRC s MAPs working sheet if you need Quickly calculate how much you can claim per vehicle using our Mileage Tax calculator Cars vans motorcycles or bicycles Give it a go

Claiming Tax Relief On Business Mileage Calculator

Claiming Tax Relief On Business Mileage Calculator

https://comfortkeepers.ie/app/uploads/2022/08/BC_220302_1438_Final-resize.jpg

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Mileage Reimbursement Form Template Awesome Business Mileage Claim Form

https://i.pinimg.com/736x/15/09/12/15091254dbdb305b4b9533b1516baa88.jpg

Mileage claims are calculated by multiplying your work related mileage throughout the tax year with the applicable HMRC mileage rate What mileage rate can I HM Revenue Customs Guidance Travel mileage and fuel rates and allowances Updated 26 March 2024 Approved mileage rates from tax year 2011 to

Use the provided HMRC mileage claim calculator to determine how much you can receive in reimbursement for your business driving To calculate this you will You can claim all or part of your MAR against your tax bill depending on the way your employer reimburses you for business mileage If your employer does not

Download Claiming Tax Relief On Business Mileage Calculator

More picture related to Claiming Tax Relief On Business Mileage Calculator

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Claiming Tax Relief On Work Expenses CB Reid

https://cbreid.co.uk/wp-content/uploads/CBR-Expenses-1536x864.jpg

4 Tips On How To Look For The Ideal Tax Relief Company Cecra

https://www.cecra.org/wp-content/uploads/2020/08/tax-relief-paper-calculator.png

If self employed and using your own vehicle you can claim Mileage Allowance at a flat rate instead of claiming against income from wages salary If you re an employee claim the For business trips you made in your company car you can claim tax relief on the money you spent on fuel and electricity Remember to keep records of the actual cost of the fuel as you ll need to include it

The only tax free way to receive reimbursement for business miles is using the approved mileage allowance AMAPs If your employer pays you against petrol Use our free Business Mileage Calculator to see how much tax relief you can claim for your work travel expenditure

Claiming Tax Relief On Pension Contributions Thompson Taraz Rand

https://www.thompsontarazrand.co.uk/wp-content/uploads/2018/05/2015-12-17-223313-1.jpg

Claiming Tax Relief On Work related Expenses Alden Co

https://www.aldenandco.co.uk/wp-content/uploads/2020/05/c563222d-efcd-4f9c-a58f-f7916c28c078-800x240.jpg

https://www.gov.uk/tax-relief-for-employees/...

You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel

https://www.gov.uk/expenses-and-benefits-business...

To calculate the approved amount multiply your employee s business travel miles for the year by the rate per mile for their vehicle Use HMRC s MAPs working sheet if you need

How To Claim For Expenses And Tax Relief On Your Self Assessment Tax

Claiming Tax Relief On Pension Contributions Thompson Taraz Rand

How Write A Claim Letter Riset

Online Mileage Log Spreadsheet With Free Mileage Log Template For Taxes

Easily Calculate Your Business Mileage Tax Deduction YouTube

Higher And Additional Rate Pension Tax Relief Penfold

Higher And Additional Rate Pension Tax Relief Penfold

HMRC Tax Overview Online Self Document Templates Documents

Business Panel How To Qualify For Mortgage Tax Relief Explained

How To Claim Pension Higher Rate Tax Relief

Claiming Tax Relief On Business Mileage Calculator - If you use your own vehicle for business purposes you may be entitled to claim tax relief on the expenses you incur This section outlines the tax considerations