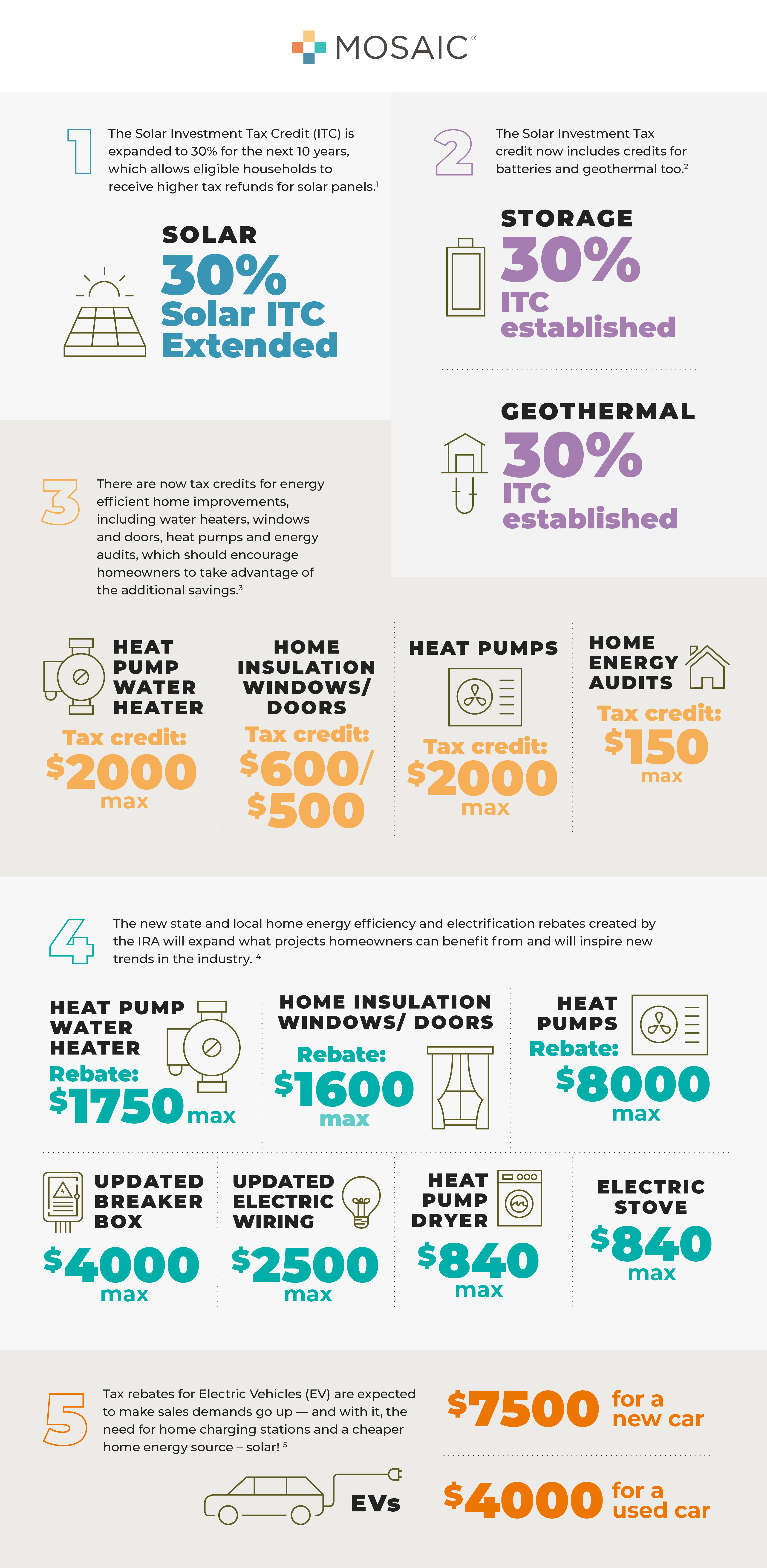

Clean Energy Rebates 2024 For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes How It Works The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

Clean Energy Rebates 2024

Clean Energy Rebates 2024

https://www.electricrate.com/wp-content/uploads/2023/01/nj-rebates-for-energy-efficient-appliances.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

NJ Clean Energy Rebates For Heaters And Air Conditioners 2020 Broadley s Plumbing Heating

https://broadleys.net/wp-content/uploads/ductless.jpg

A professional home energy assessment which is often offered for free by local utilities or state energy programs helps homeowners figure out how much energy they use where their homes are inefficient and how to maximize savings and improve comfort When will clean energy rebates be available to consumers Each state is responsible for distributing rebates and deciding which technologies qualify To do so some states need to build energy offices from scratch 2023 The Department of Energy released guidance on the rebates program Aug 16 2024 States must tell the DOE that they

Renewable You for 2024 Clean Energy Upgrades for Your New Year s Resolutions As the confetti from New Year s Eve celebrations settles it is only fitting that we prepare our 2024 New Year s Resolutions In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30 percent income tax credit for clean energy equipment such as rooftop solar wind energy geothermal heat pumps and battery storage through 2032 stepping down to 22 percent for 2033 a

Download Clean Energy Rebates 2024

More picture related to Clean Energy Rebates 2024

Canadian Clean Energy Rebates Incentives The Sundamentals Project

https://sundamentals.ca/wp-content/uploads/2022/02/Rebates-1.png

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

Biden s Top Clean Energy Adviser On How The UAW Strike Affects EV Goals

https://d.newsweek.com/en/full/2286403/podesta-clean-energy-biden-white-house-climate.jpg

The Inflation Reduction Act of 2022 has a bunch of incentives aimed at helping you make your home more energy efficient This year and next a few more incentives will roll out Kara Saul Rinaldi 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit Resources Inflation Reduction Act of 2022 Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022

Jan 11 2024 Cindy Camp is one of many Americans facing rising utility costs Ms Camp who lives in Baltimore with three family members said her gas and electric bills kept going up and up California Energy Commission Programs and Topics All Programs Inflation Reduction Act Residential Energy Rebate Programs in California Inflation Reduction Act Residential Energy Rebate Programs in California The federal Inflation Reduction Act will provide funding for whole house energy efficiency

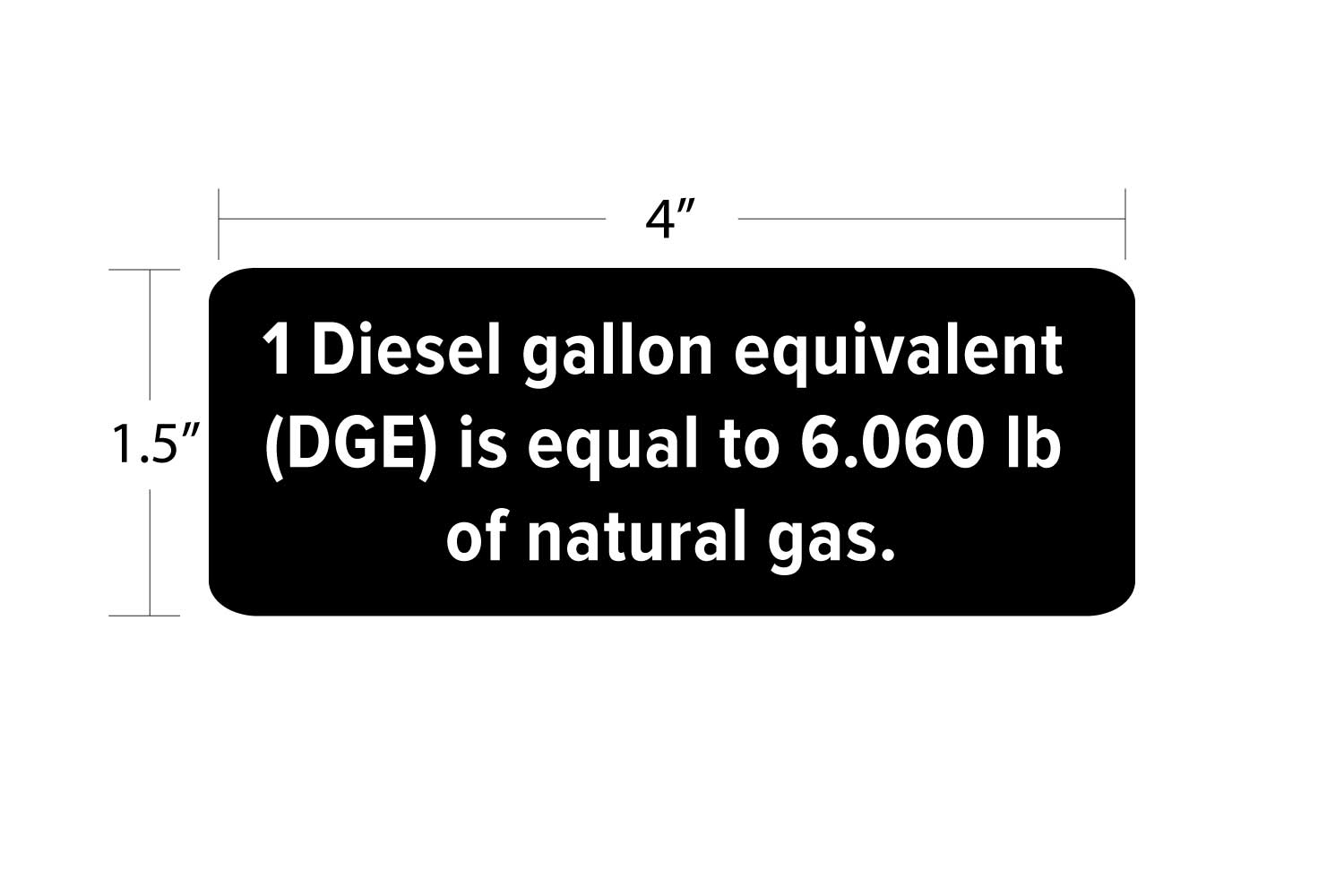

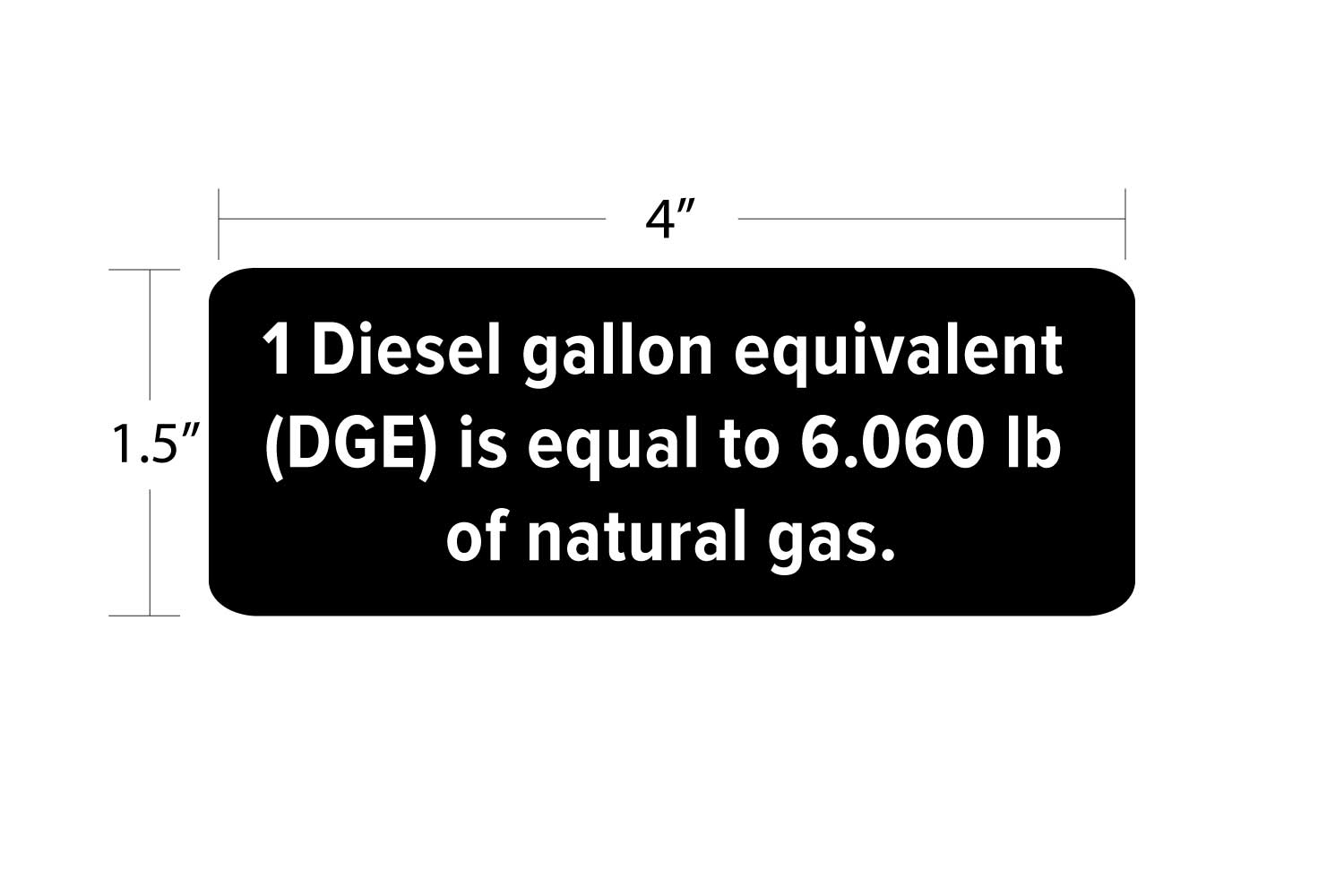

Clean Energy N DGE Description Kraus CNG Warehouse

https://zoomnsupply.com/wp-content/uploads/2022/04/Clean-Energy-N-DGE-Gasoline-Equation.jpg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

https://www.forbes.com/home-improvement/hvac/heat-pump-tax-credit/

For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

Here s What You Need To Know About Clean Energy Rebates

Clean Energy N DGE Description Kraus CNG Warehouse

Clean Energy Clear Vinyl Canopy Routed Illuminated Logo

Clean Energy N Gasoline Gallon Equivalent Kraus CNG Warehouse

About EVs Savings Rebates Peninsula Clean Energy

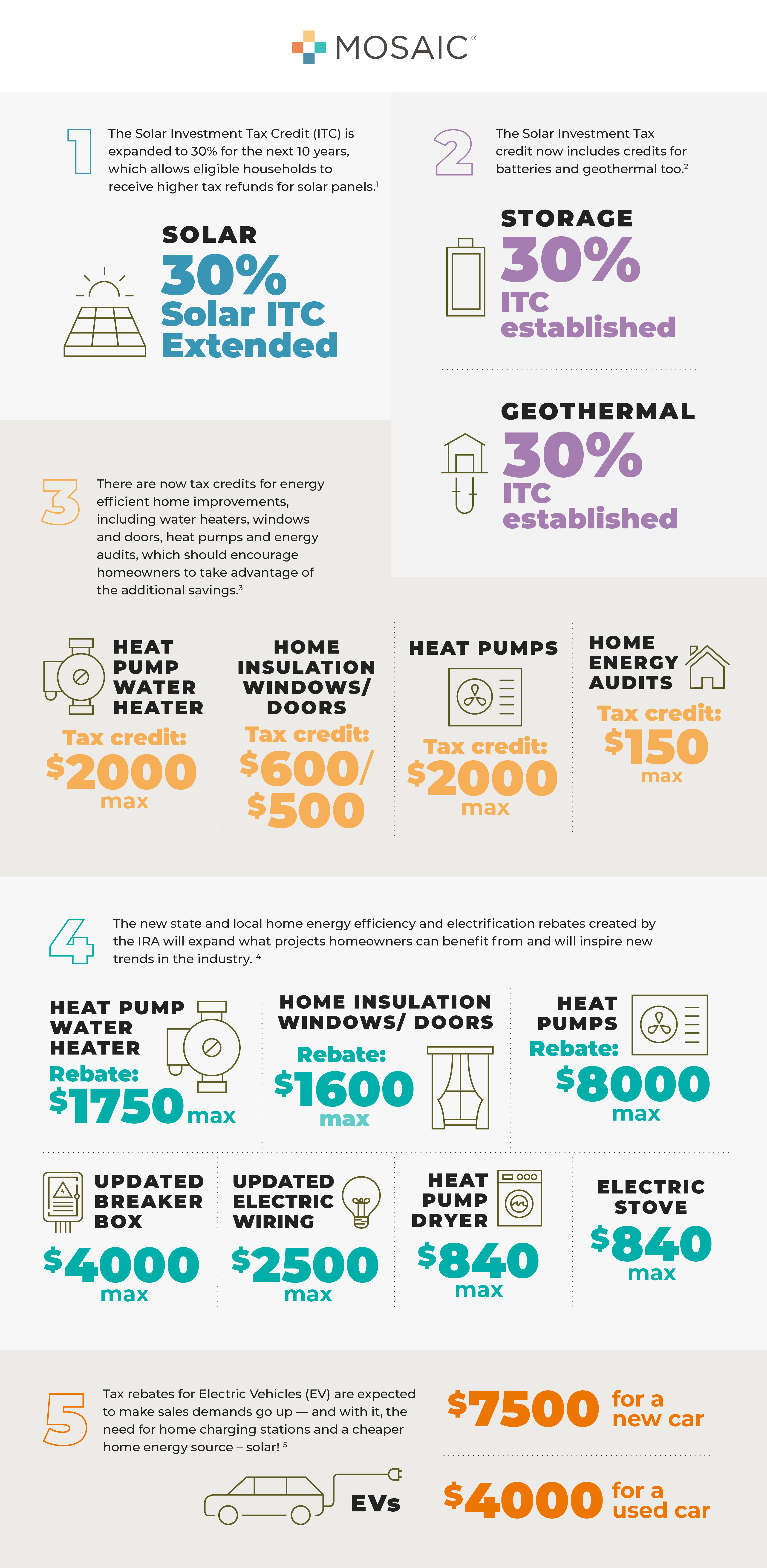

5 Ways The IRA Will Benefit Homeowners and Contractors

5 Ways The IRA Will Benefit Homeowners and Contractors

Inflation Reduction Act Green Credits And Rebates Green Mountain Energy

Power Rebates For Washing Machines PowerRebate

DOE Launches I2X Partnership To Reduce Wait Times For Clean Energy Sources Lower Clean Energy

Clean Energy Rebates 2024 - A professional home energy assessment which is often offered for free by local utilities or state energy programs helps homeowners figure out how much energy they use where their homes are inefficient and how to maximize savings and improve comfort