Clean Energy Tax Credits Of the 4 billion tax credits 1 5 billion supports projects in historic energy communities These projects will create good paying jobs lower energy costs and support the climate supply chain and energy security goals of the Biden Harris Administration s Investing in America agenda

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the total sum owed to

Clean Energy Tax Credits

Clean Energy Tax Credits

https://www.myfreetaxes.org/wp-content/uploads/2022/01/iStock-Tax-Credit-word-scaled.jpg

The Climate Benefits From Clean Energy Tax Credits Are About Four Times

https://epic.uchicago.edu/wp-content/uploads/2022/02/iStock-1060945826-scaled.jpg

Homeowner Clean Energy Tax Credits

https://www.anbsystems.com/wp-content/uploads/2023/06/Homeowner-Clean-Energy-Tax-Credits-1.jpg

The Inflation Reduction Act allows tax exempt and governmental entities to receive elective payments for 12 clean energy tax credits including the major Investment and Production Tax 45 and 48 credits as well as tax credits for electric vehicles and charging stations Spurred in large part by the tax credits over 215 billion in private sector clean energy manufacturing investments have been announced under the Biden Harris Administration The investments are widely distributed across over 740 sites in 46 states and Puerto Rico and have the potential to create over 210 000 jobs

In Budget 2023 the government announced a refundable Clean Electricity ITC that would be available to taxable and tax exempt entities investing in clean energy equipment Budget 2024 elaborates on the design and implementation details for the Clean Electricity ITC Use these steps for claiming a residential clean energy tax credits Step 1 Check eligibility Make sure the property on which you are installing the energy property is eligible Located in the United States A new or existing home Make sure you are installing qualified energy property Solar electric panels

Download Clean Energy Tax Credits

More picture related to Clean Energy Tax Credits

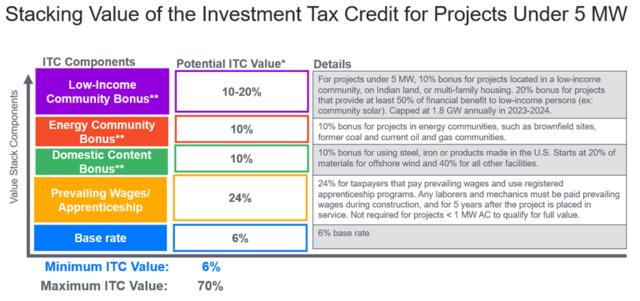

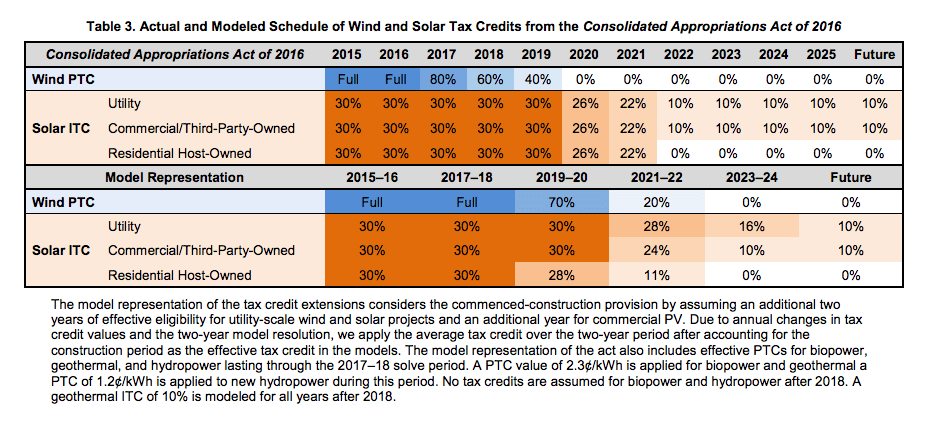

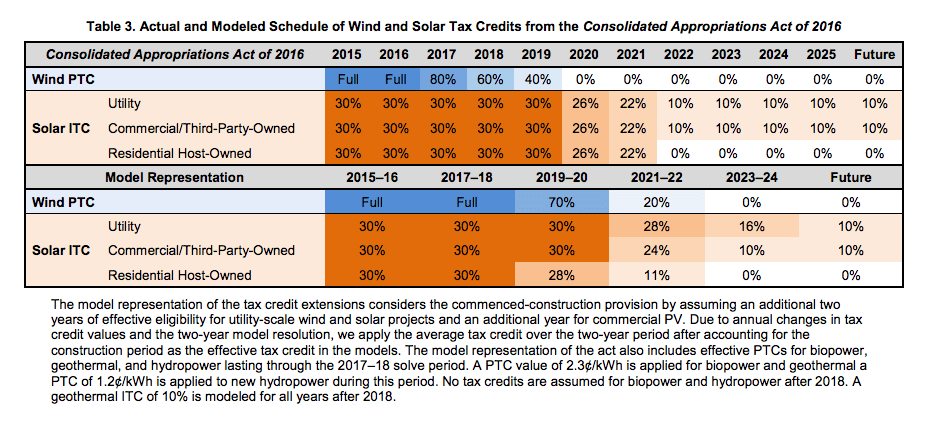

IRA Tax Provisions Prove Promising For The Renewables Sector Edison

https://uploads.edisonenergy.com/2022/08/25153840/Picture1-2-640x301.png

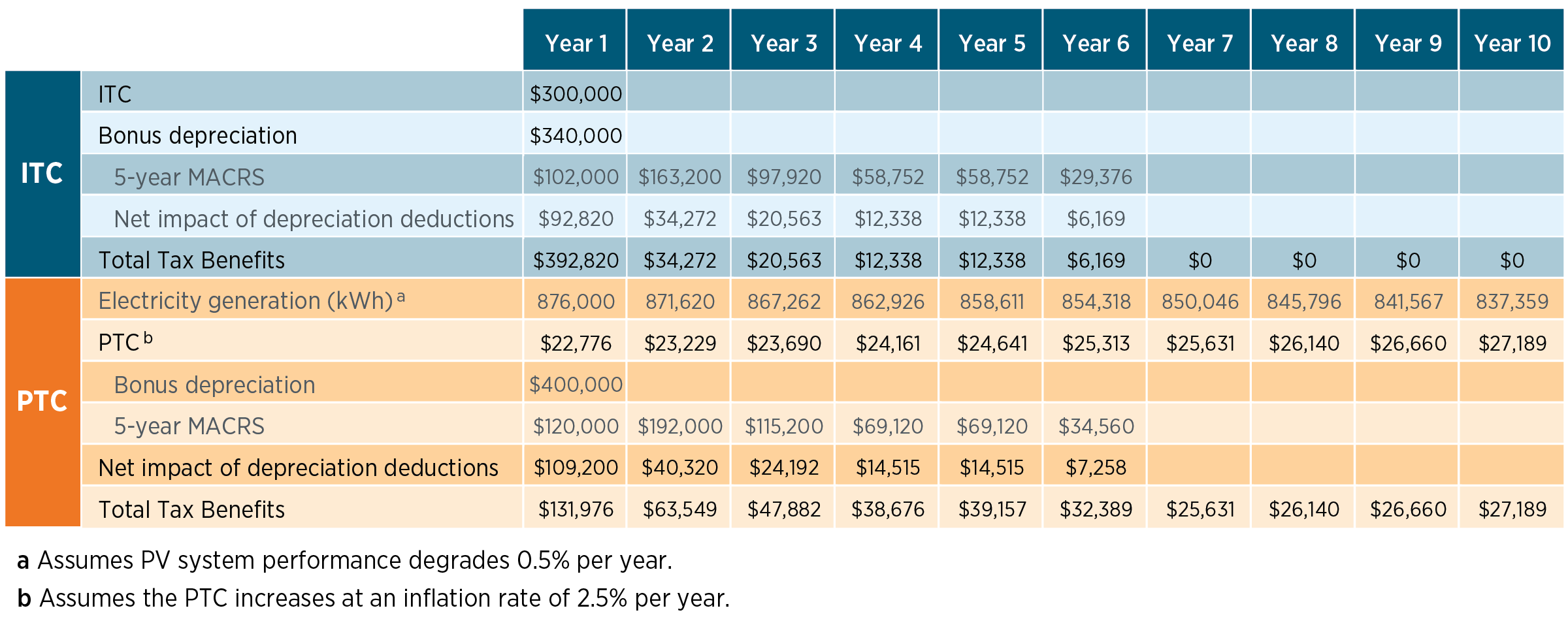

Commercial Solar Tax Benefits In California TENCO SOLAR

https://tencosolar.net/wp-content/uploads/2023/02/ITC-PTC-Chart.png

New Clean Energy Tax Credits Eco Tax Inc

https://eco-tax.com/wp-content/uploads/2022/09/10.5-1024x576.png

90 per cent say all outstanding clean economy business investment tax credits should be fast tracked e g for clean technologies projects clean energy carbon capture etc The Inflation Reduction Act IRA included a major forthcoming refresh for one of the biggest policy drivers of the nation s clean energy transition to date tax credits subsidizing the deployment of clean electricity resources These incentives aren t just historically important Across multiple analyses they ve been repeatedly identified as one of if

[desc-10] [desc-11]

Clean Energy Tax Credits Can t Do The Work Of A Carbon Tax Tax Policy

https://www.taxpolicycenter.org/sites/default/files/styles/manual_crop_1500w/public/blog/ap20216281060047.jpg?itok=qlSfx47g&c=44233d1d0daee765e903d0c9bbaa68f8

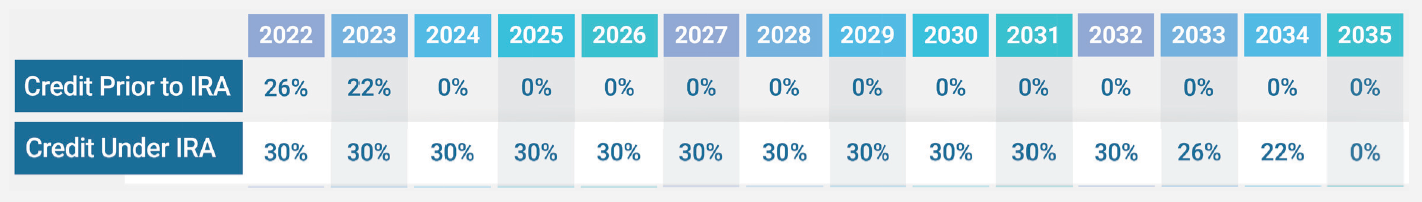

Solar Installation Air Conditioning And Battery Storage Oahu

https://alternateenergyhawaii.com/ugc/aei/ITC-Schedule-IRA.png

https://www.energy.gov/articles/biden-harris...

Of the 4 billion tax credits 1 5 billion supports projects in historic energy communities These projects will create good paying jobs lower energy costs and support the climate supply chain and energy security goals of the Biden Harris Administration s Investing in America agenda

https://www.irs.gov/credits-deductions/residential...

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

Clean Energy Tax Credits How Do They Work Tidwell Group

Clean Energy Tax Credits Can t Do The Work Of A Carbon Tax Tax Policy

Final Rule To Expand clean Energy Tax Credits Issued By Treasury

Clean Energy Tax Credits Are An Essential Part Of Budget Reconciliation

Monetizing IRA clean Energy Tax Credits Crowe LLP

Federal Tax Credit ITC For Solar Energy Gets Extended

Federal Tax Credit ITC For Solar Energy Gets Extended

Energy Secretary Says Time Is Right For clean Energy Tax Credits

Renewable Energy Tax Credits Iowa Utilities Board

Clean Energy Tax Credits Are An Essential Part Of Budget Reconciliation

Clean Energy Tax Credits - In Budget 2023 the government announced a refundable Clean Electricity ITC that would be available to taxable and tax exempt entities investing in clean energy equipment Budget 2024 elaborates on the design and implementation details for the Clean Electricity ITC