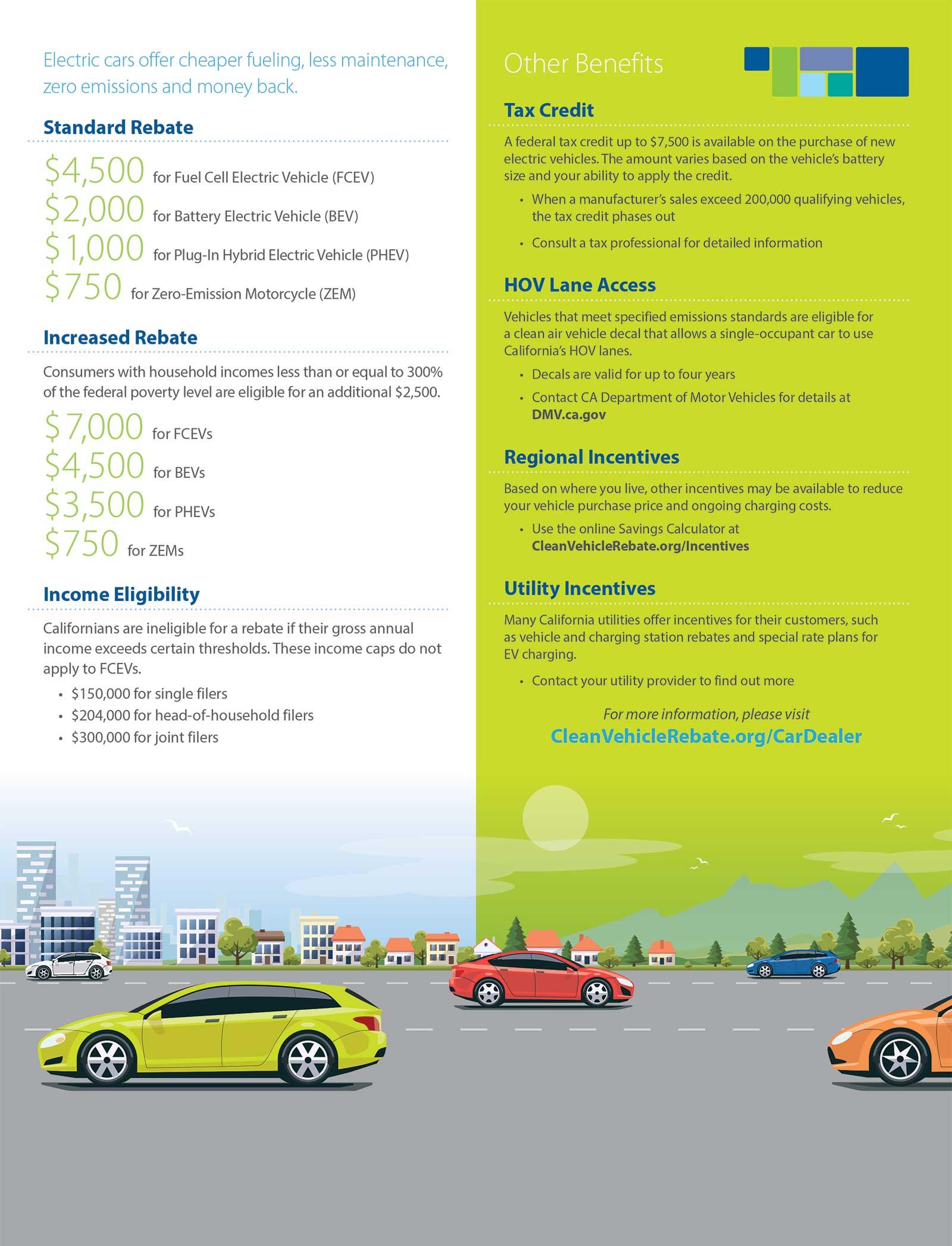

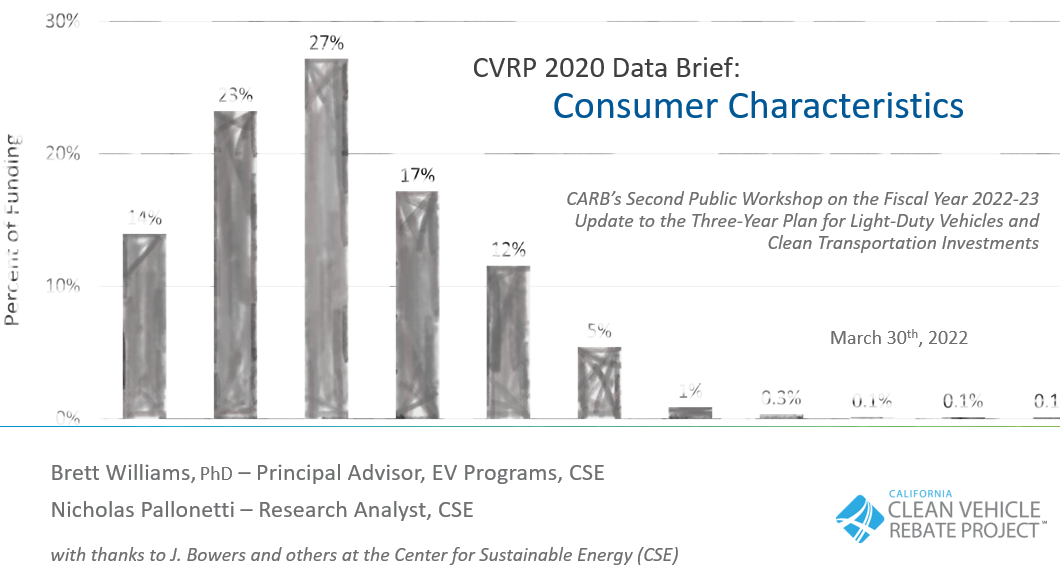

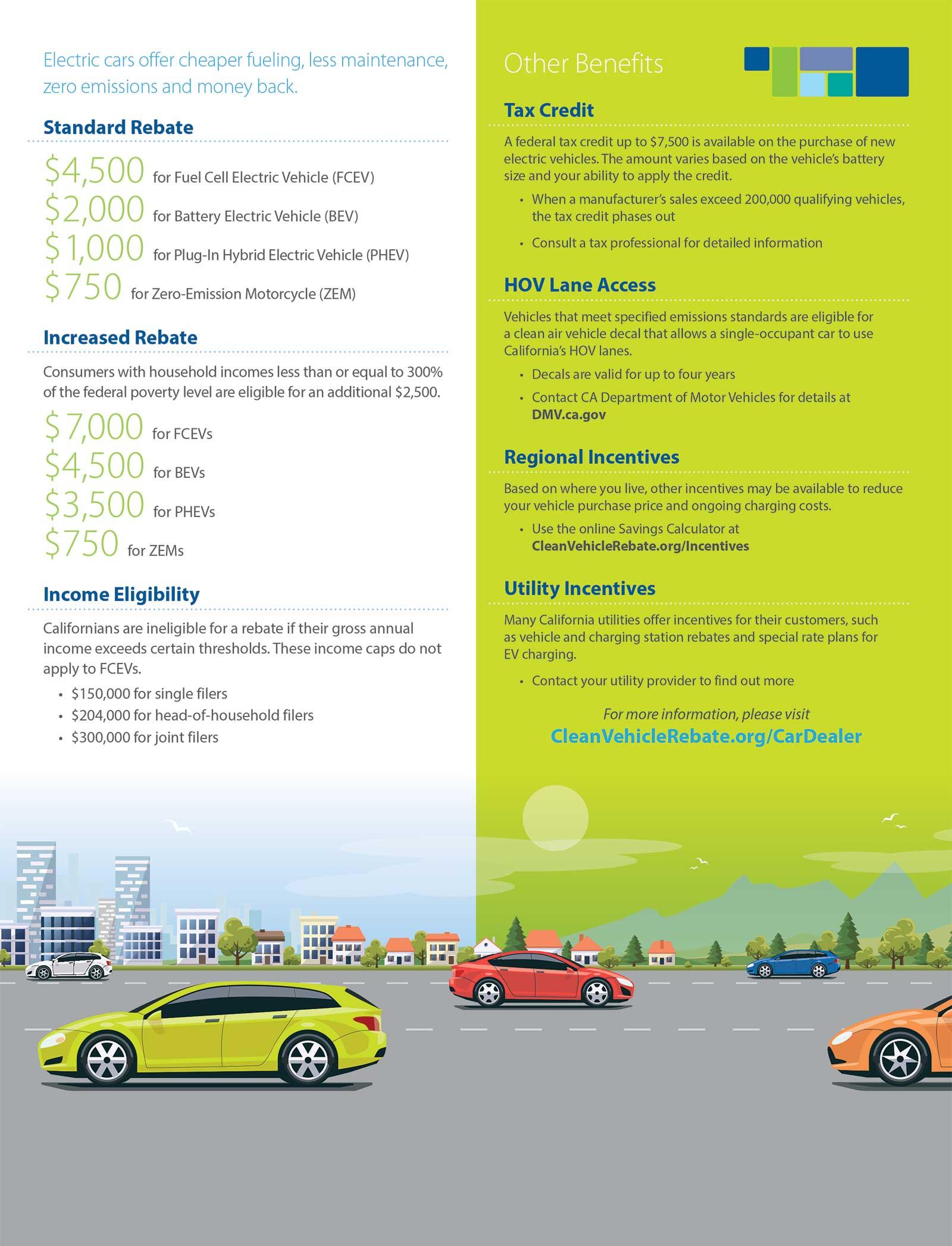

Clean Vehicle Rebate 2024 If you missed out on CVRP several EV incentives are still available Updated preliminary EV market forecasts and CVRP funding demand projections covering years 2022 2024 The slides include estimates of three year rebate and rebate funding demand for five different scenarios The five scenarios include various combinations of the following

Taxpayers can now claim tax credits for new and used clean vehicles they buy during the tax year and starting Jan 1 2024 can transfer that credit to the dealership This means that the taxpayer who is buying the vehicle can exchange their credit for a financial benefit such as reduced final cost The financial benefit is equal to the amount For eligible clean vehicles placed in service on or after January 1 2024 you must submit all reports through IRS Energy Credits Online within 3 calendar days of the date of sale You must also provide the buyer with a copy of the accepted seller report submitted to IRS Energy Credits Online within 3 calendar days of the date of submission

Clean Vehicle Rebate 2024

Clean Vehicle Rebate 2024

https://media.assets.ansira.net/websites/content/nissan-dublin-ca/4cb5e0ab2f774f578996e55abaeb50d1_1600x2094.jpg

Clean Vehicle Rebate Project CVRP Enjoy OC

https://enjoyorangecounty.com/wp-content/uploads/2022/10/cvrp-clean-vehicle-rebate-project-1024x1024.jpg

California EV Rebate Program Clean Vehicle Rebate Program

https://www.ny-engineers.com/hs-fs/hubfs/clean vehicle rebate.jpg?width=1875&name=clean vehicle rebate.jpg

You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return Beginning in 2024 buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit amount as a down payment or a reduction of the manufacturer s suggested retail price A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models qualify

The last rebate amount change was made in June 2021 Under the Inflation Reduction Act you may be eligible for a clean vehicle Federal tax credit up to 7 500 for the purchase of your vehicle if you meet certain income limitations Please visit the IRS website for more information Make and Model All Electric Range miles The Clean Vehicle Tax Credit up to 7 500 for electric vehicles can now be used at the point of sale like an instant rebate Effective this year the changes may help steer more potential

Download Clean Vehicle Rebate 2024

More picture related to Clean Vehicle Rebate 2024

Clean Vehicle Rebate Project Jumpstarts Zero Emission Vehicle Adoption California Climate

https://images.squarespace-cdn.com/content/v1/55a6b117e4b002796fd89798/1554308796748-UKXMWL627YMFRTTL60M1/21_HSP_Photo_1.jpg

Clean Vehicle Rebate Project California Climate Investments

https://images.squarespace-cdn.com/content/v1/55a6b117e4b002796fd89798/1489220493821-H77TBAVJHN4OG7Z3CCE0/CVRP_NDEW+San+Mateo_Rosie.jpg

Grants For Farmers California Climate Investments

https://images.squarespace-cdn.com/content/v1/55a6b117e4b002796fd89798/1586389249733-HIY3QSTI4OOC2105FEY9/cleanvehilerebate.png

The new regs published October 6 2023 bring happy news for EV buyers Under the Inflation Reduction Act consumers can choose to transfer their new clean vehicle credit of up to 7 500 and Starting January 1 2024 the clean vehicle tax credits can be accessed as point of sale rebates at participating dealerships This is great for two reasons You no longer have to wait until tax time to take advantage of the tax credit When point of sale the tax credit is no longer based on your personal tax liability

Up to 2 000 rebate for purchased or leased eligible vehicle Used Electric Vehicle 30 of the sale price up to 4 000 for eligible buyers of qualified previously owned clean vehicles Home Electric Vehicle Charger 30 of cost up to 1 000 For EVs placed in service January 1 to April 17 2023 the tax credit is calculated from a base Clean Vehicle Tax Credits We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Looking to claim a credit for a new clean vehicle you already bought This page covers rules before and after changes under the Inflation Reduction Act of 2022

CVRP Overview Clean Vehicle Rebate Project

https://cleanvehiclerebate.org/sites/default/files/column-images/cvrp-info.jpg

Program Reports Clean Vehicle Rebate Project

https://cleanvehiclerebate.org/sites/default/files/styles/thumbnail_250/public/thumbnail.png?itok=uP59C3Rd

https://cleanvehiclerebate.org/en/content/preliminary-2022%E2%80%932024-cvrp-projections

If you missed out on CVRP several EV incentives are still available Updated preliminary EV market forecasts and CVRP funding demand projections covering years 2022 2024 The slides include estimates of three year rebate and rebate funding demand for five different scenarios The five scenarios include various combinations of the following

https://www.irs.gov/newsroom/clean-vehicle-credits-can-help-car-buyers-pay-less-at-the-dealership

Taxpayers can now claim tax credits for new and used clean vehicles they buy during the tax year and starting Jan 1 2024 can transfer that credit to the dealership This means that the taxpayer who is buying the vehicle can exchange their credit for a financial benefit such as reduced final cost The financial benefit is equal to the amount

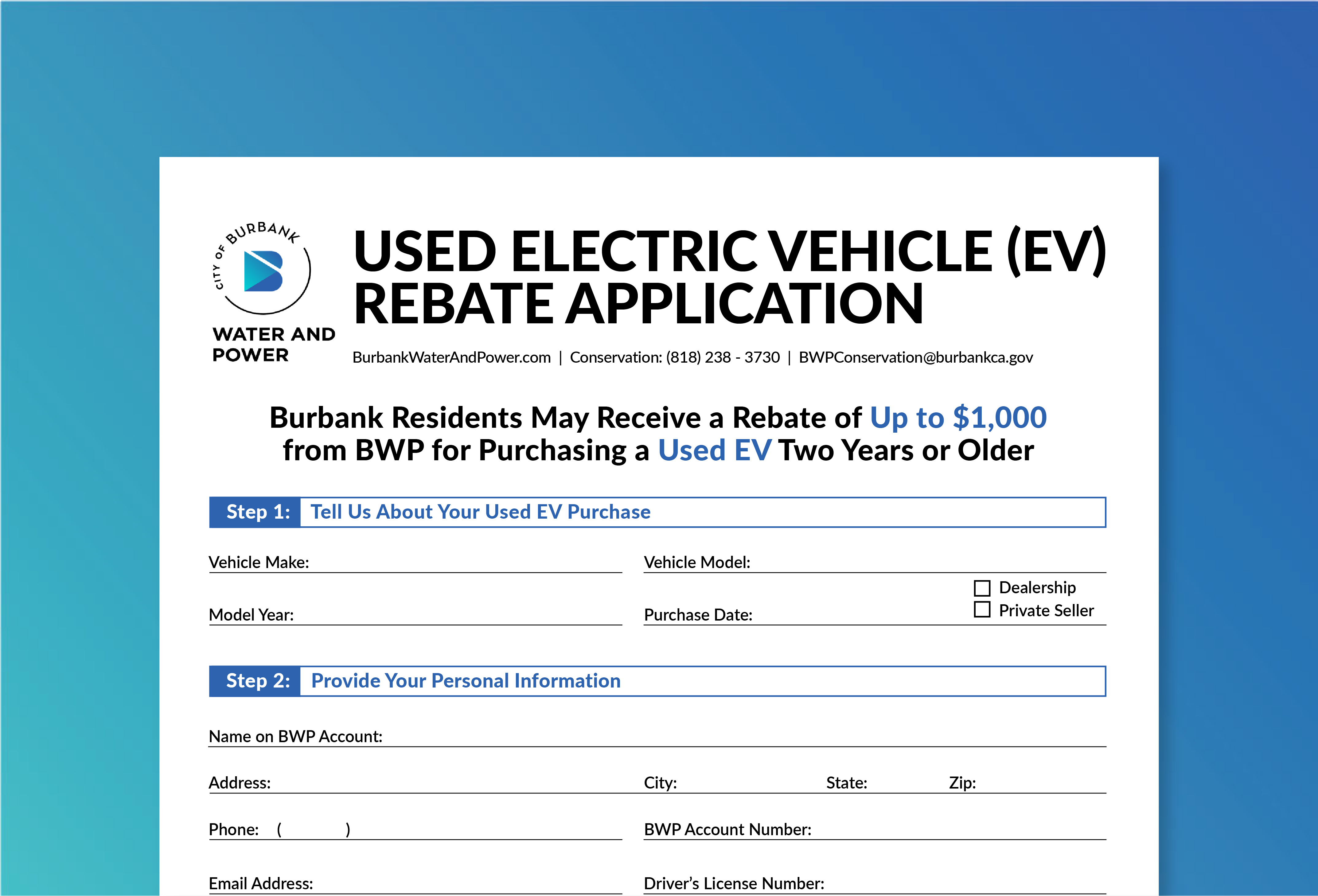

Clean Vehicle Rebate Program Printable Rebate Form

CVRP Overview Clean Vehicle Rebate Project

Used Electric Vehicle Rebate

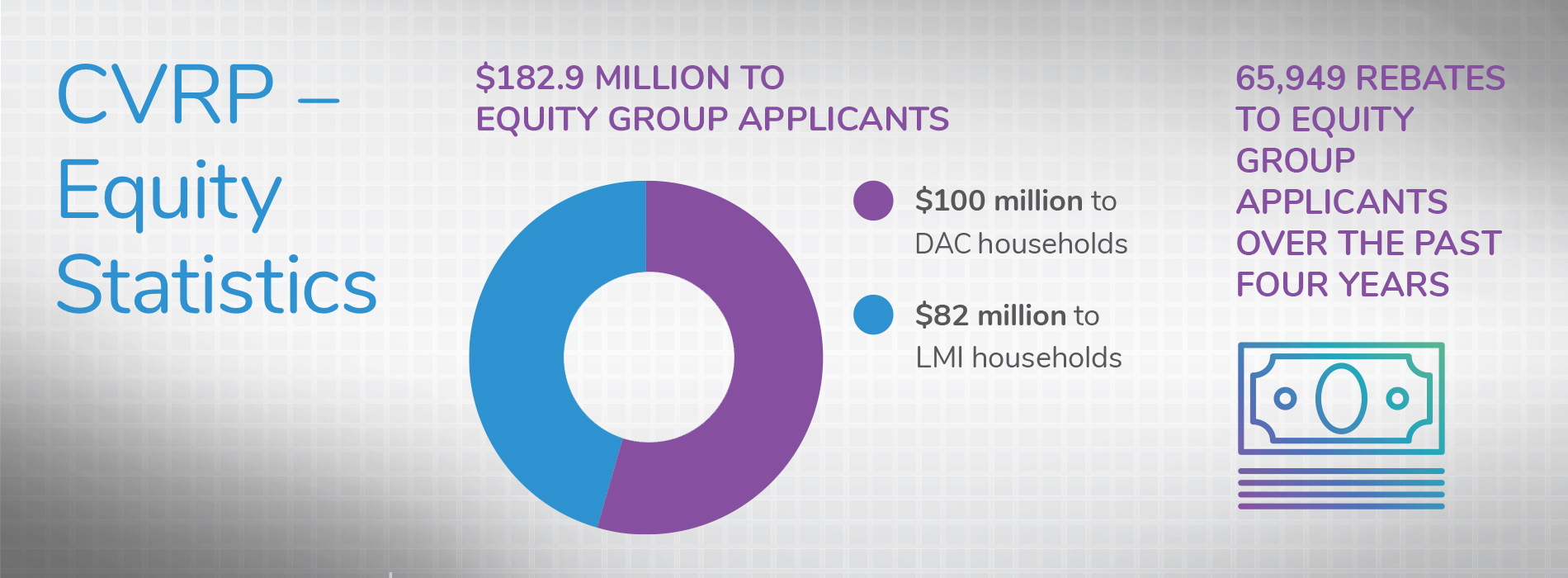

California Directs More Clean Vehicle Rebates To Lower Income Families Center For Sustainable

Clean Vehicle Rebate Login

Clean Vehicle Rebate Project Center For Sustainable Energy

Clean Vehicle Rebate Project Center For Sustainable Energy

California EV Rebate Program Clean Vehicle Rebate Program

Oregon Clean Vehicle Rebate Program Oregon CVRP

Resource Guide Clean Vehicle Rebate Project

Clean Vehicle Rebate 2024 - A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models qualify