Clean Vehicle Rebate Tesla 2024 BREAKING Tesla is now officially offering the new 7 500 Fed EV point of sale POS rebate in the US enabling an estimated 250 million Americans up from 75M in 2023 To get a 7 500 discount

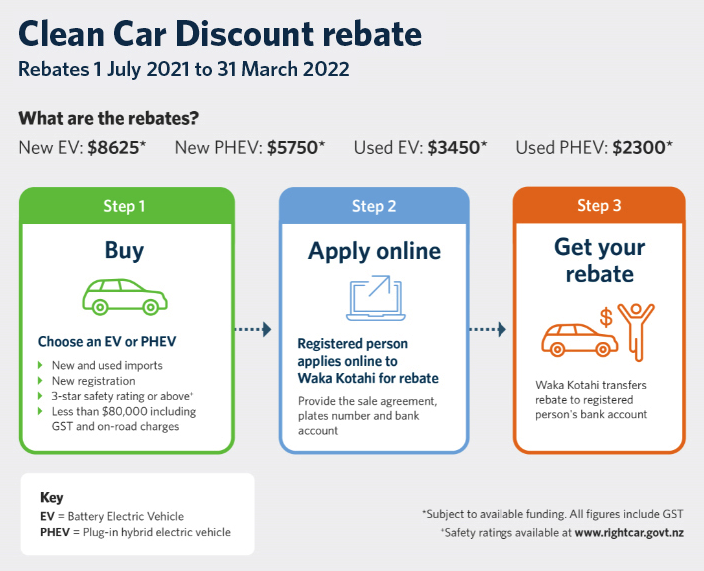

A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models qualify For EV customers everything changes on January 1 2024 The Treasury Department has now issued new rules that will turn the federal EV tax credit into what is basically a point of sale rebate

Clean Vehicle Rebate Tesla 2024

Clean Vehicle Rebate Tesla 2024

https://media.assets.ansira.net/websites/content/nissan-dublin-ca/4cb5e0ab2f774f578996e55abaeb50d1_1600x2094.jpg

Clean Vehicle Rebate Project CVRP Enjoy OC

https://enjoyorangecounty.com/wp-content/uploads/2022/10/cvrp-clean-vehicle-rebate-project-1024x1024.jpg

B C Reduces Clean energy Vehicle Rebate Amounts Kamloops This Week

https://www.vmcdn.ca/f/files/glaciermedia/import/lmp-all/1447716-Daniel-Hartt-15-was-impressed-with-the-Tesla-and-agrees-it-should-be-his-1st-car-when-he-gets-his-license-in-a-couple-of-months-5896-copy.jpg;w=1200;h=800;mode=crop

You claim the credit using Form 8936 Qualified Plug in Electric Drive Motor Vehicle Credit and submit it with your individual tax return Beginning in 2024 buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit amount as a down payment or a reduction of the manufacturer s suggested retail price New vehicles eligible for the 7 500 tax credit on or after Jan 1 2024 2022 2023 Chevrolet Bolt EUV with an MSRP limit of 55 000 2022 2023 Chevrolet Bolt EV with an MSRP limit of 55 000 2022 2024 Chrysler Pacifica PHEV with an MSRP limit of 80 000 2022 2024 Ford F 150 Lightning Extended Range Battery with an MSRP limit of 80 000

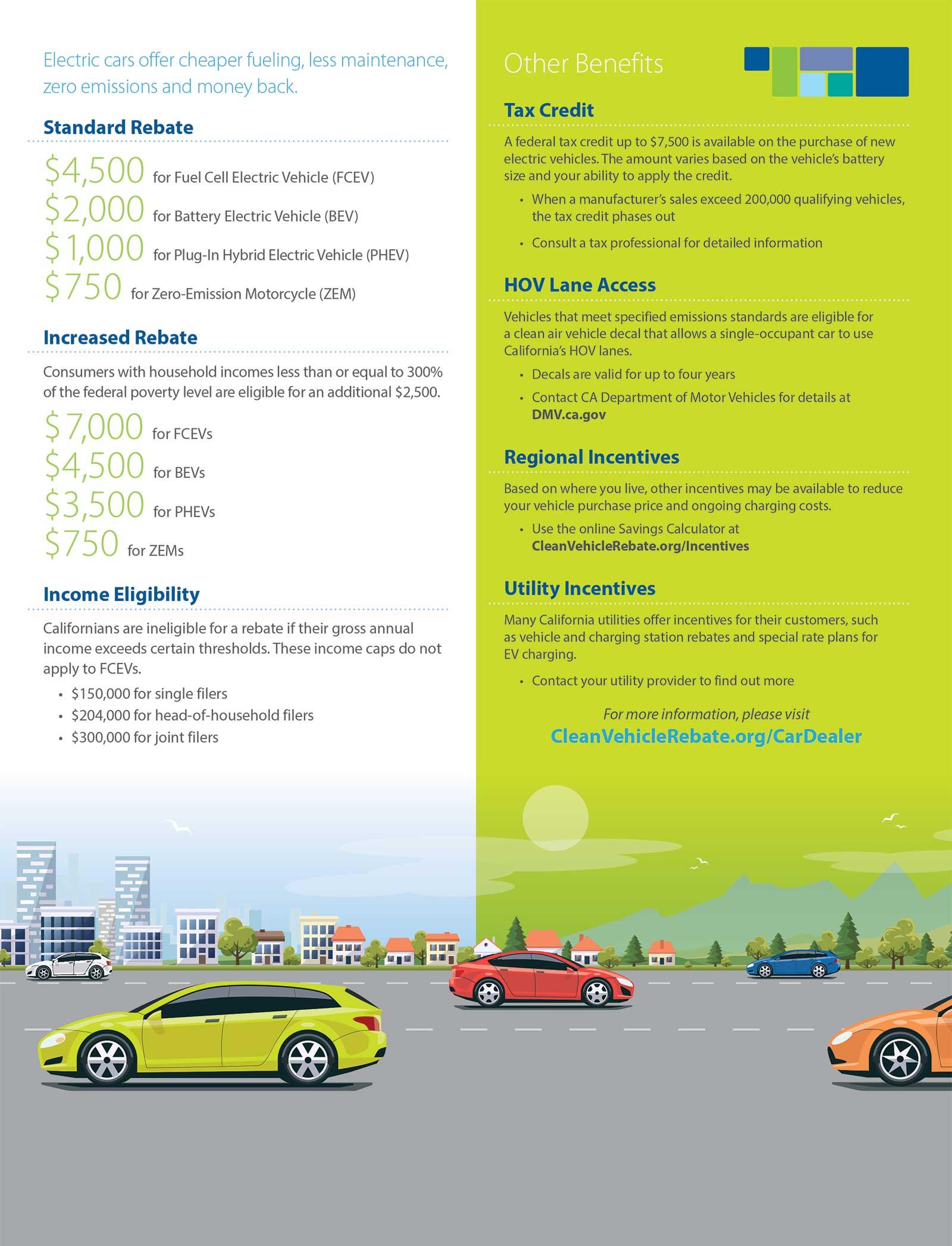

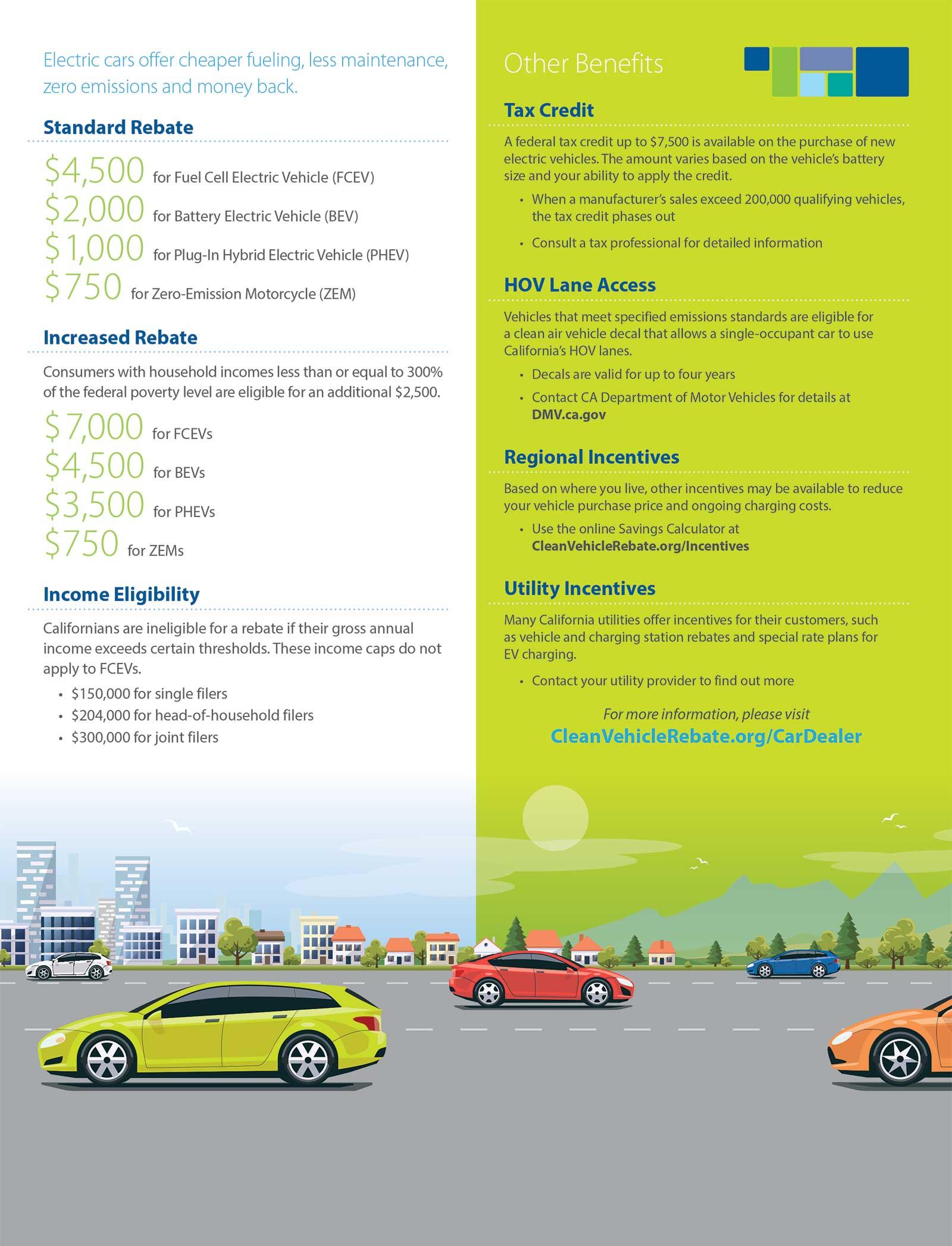

Eligible Vehicles Effective November 8 2023 CVRP is closed to new applications Applications submitted on or after September 6 2023 were placed on a standby list For more information view the standby list FAQ If you missed out on CVRP several EV incentives are still available Used Clean Vehicle Credit Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used clean vehicle tax credit also referred to as a previously owned clean vehicle credit The credit equals 30 of the sale price up to a

Download Clean Vehicle Rebate Tesla 2024

More picture related to Clean Vehicle Rebate Tesla 2024

Grants For Farmers California Climate Investments

https://images.squarespace-cdn.com/content/v1/55a6b117e4b002796fd89798/1586389249733-HIY3QSTI4OOC2105FEY9/cleanvehilerebate.png

Clean Vehicle Rebate Project Jumpstarts Zero Emission Vehicle Adoption California Climate

https://images.squarespace-cdn.com/content/v1/55a6b117e4b002796fd89798/1554308796748-UKXMWL627YMFRTTL60M1/21_HSP_Photo_1.jpg

CVRP Overview Clean Vehicle Rebate Project

https://cleanvehiclerebate.org/sites/default/files/column-images/cvrp-info.jpg

Frequently Asked Questions about income and price limitations for the new Clean Vehicle Credit Updated FAQs were released to the public in Fact Sheet 2023 29PDF Dec 26 2023 certain variants of the 2022 and 2023 Tesla Model Y certain variants of the 2022 and 2023 Volkswagen ID 4 and the 2022 and 2023 Ford Escape Plug In Hybrid Consumers that purchase a qualifying electric vehicle can continue to claim the electric vehicle tax credit on their annual tax filing Starting in 2024 the Inflation Reduction Act establishes a mechanism that will allow car buyers to transfer the credit to dealers at the point of sale so that it can directly reduce the purchase price

A new federal tax credit of 4 000 for used EVs priced below 25k Subject to other requirements like lower annual income see below Revised credit applies to battery electric vehicles with an In Tesla Rivian and the Ford F 150 Lighting Out almost everything else A year ago nearly every new electric vehicle and plug in hybrid on the market qualified for a tax credit of up to

Clean Vehicle Rebate Project California Climate Investments

https://images.squarespace-cdn.com/content/v1/55a6b117e4b002796fd89798/1489220493821-H77TBAVJHN4OG7Z3CCE0/CVRP_NDEW+San+Mateo_Rosie.jpg

Clean Vehicle Rebate Program Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/01/NZ-Clean-Car-Rebate-2022.png

https://cleantechnica.com/2024/01/16/now-you-can-claim-your-tesla-ev-federal-tax-rebate-online/

BREAKING Tesla is now officially offering the new 7 500 Fed EV point of sale POS rebate in the US enabling an estimated 250 million Americans up from 75M in 2023 To get a 7 500 discount

https://www.npr.org/2023/12/28/1219158071/ev-electric-vehicles-tax-credit-car-shopping-tesla-ford-vw-gm

A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models qualify

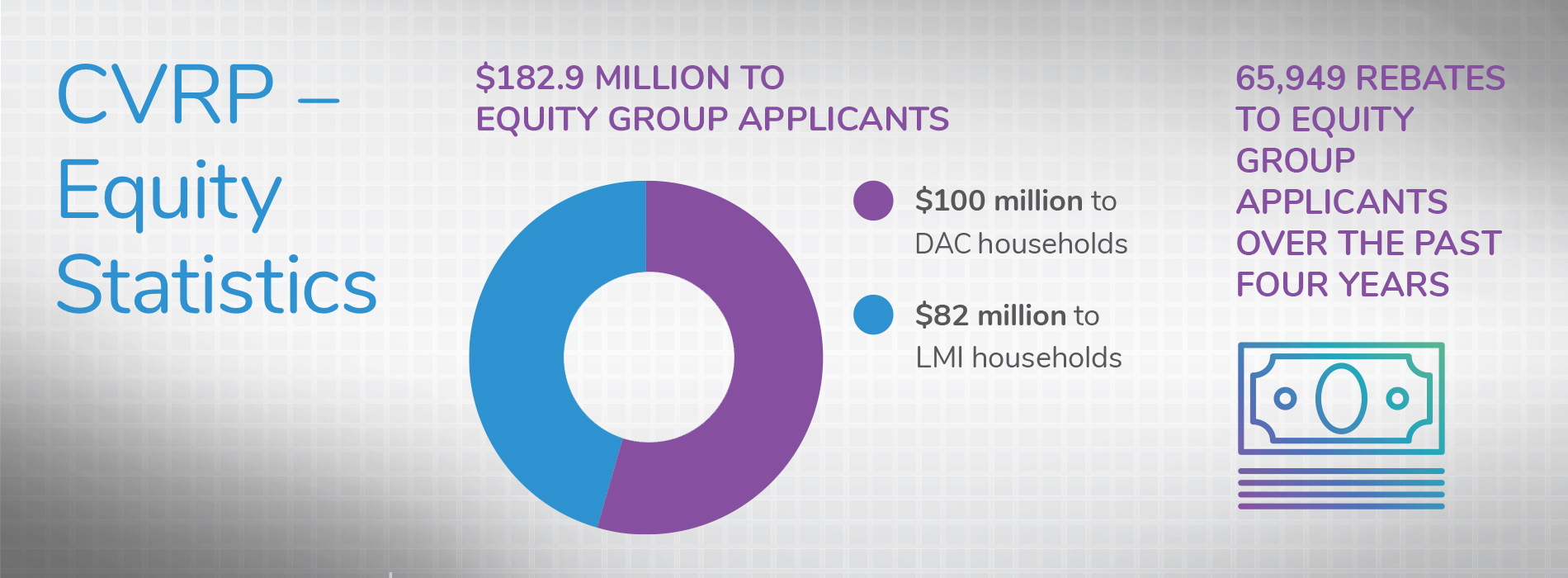

California Directs More Clean Vehicle Rebates To Lower Income Families Center For Sustainable

Clean Vehicle Rebate Project California Climate Investments

Clean Vehicle Rebate Project Center For Sustainable Energy

Apply For California Clean Vehicle Rebate CVRP TESLA Time Is Running Out YouTube

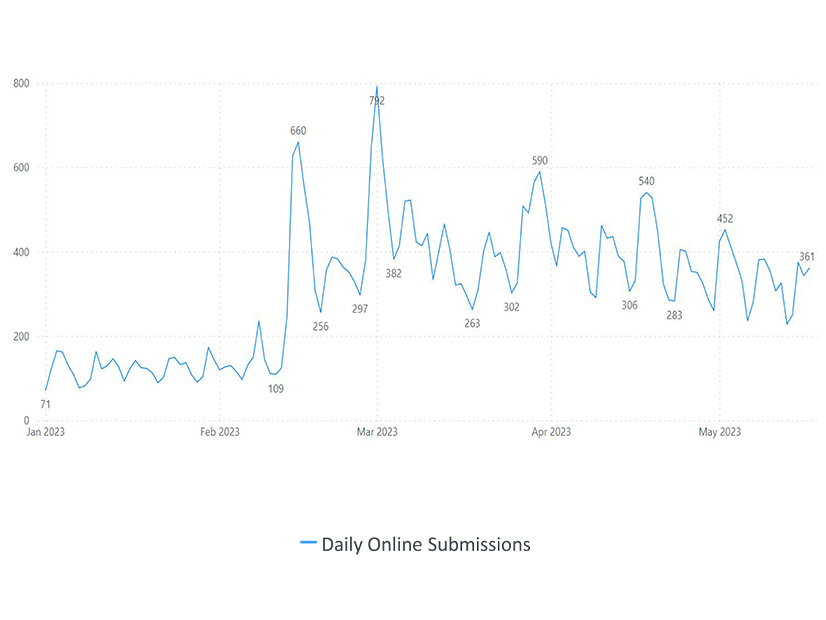

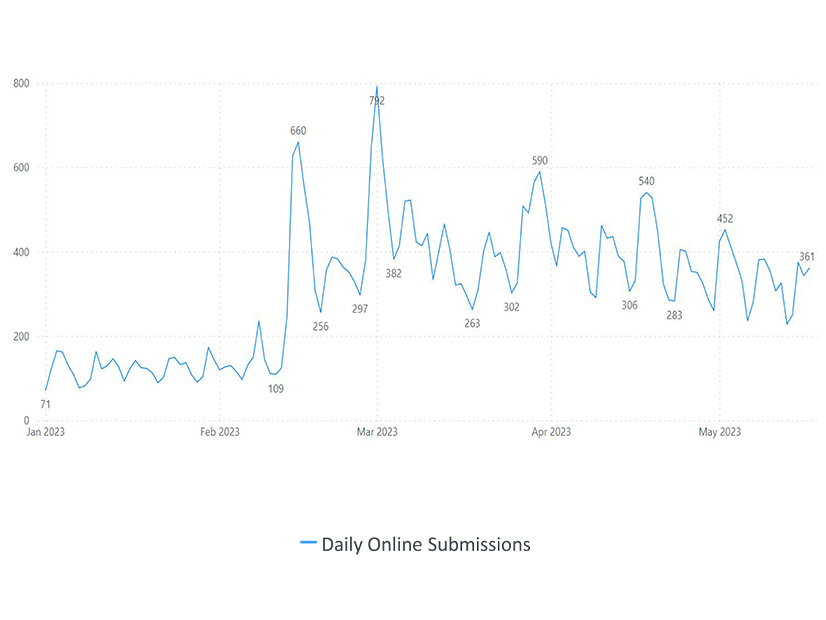

Program Reports Clean Vehicle Rebate Project

California EV Rebate Program Expected To Run Empty Ahead Of Plan RTO Insider

California EV Rebate Program Expected To Run Empty Ahead Of Plan RTO Insider

How Do The Used And Commercial Clean Vehicle Tax Credits Work Blink Charging

How To Apply For The Clean Vehicle Rebate Project Tesla EV YouTube

Does My Tesla Qualify For California CLean Vehicle Rebate Project CRRP YouTube

Clean Vehicle Rebate Tesla 2024 - 2023 2024 Tesla Model Y Performance 2023 2024 Tesla Model Y Rear Wheel Drive Additionally the following vehicles qualify for a 3 750 tax credit 2022 2024 Ford Escape Plug In Hybrid 2022 2024