Clothing Tax Deduction Calculator Verkko 28 syysk 2023 nbsp 0183 32 If you donate clothing and other items to a non profit organization like Goodwill or St Vincent De Paul you may be eligible to receive a tax deduction for your donation Keep a list of everything you give to charity and do research to calculate the fair market value of the things you donate

Verkko The maximum deduction is EUR 3 500 normally EUR 2 250 The deduction is 60 of the work related expenses specified on an invoice and 30 of the wages that the household has paid to a worker The threshold share is EUR 100 per tax year The temporary change is in force in 2022 2023 Verkko 13 jouluk 2023 nbsp 0183 32 Deductions when you buy repair or launder occupation specific or protective clothing or distinctive uniforms Last updated 13 December 2023 Print or Download For a summary of this content in poster

Clothing Tax Deduction Calculator

Clothing Tax Deduction Calculator

https://i.pinimg.com/originals/80/a7/71/80a771ab9f2ef0ac717c9a3e35380ffa.jpg

Example Tax Deduction System For A Single Gluten free GF Item And

https://www.researchgate.net/profile/Julio-Bai/publication/274087526/figure/tbl1/AS:391861509345282@1470438472540/Example-tax-deduction-system-for-a-single-gluten-free-GF-item-and-calculations-for-tax.png

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

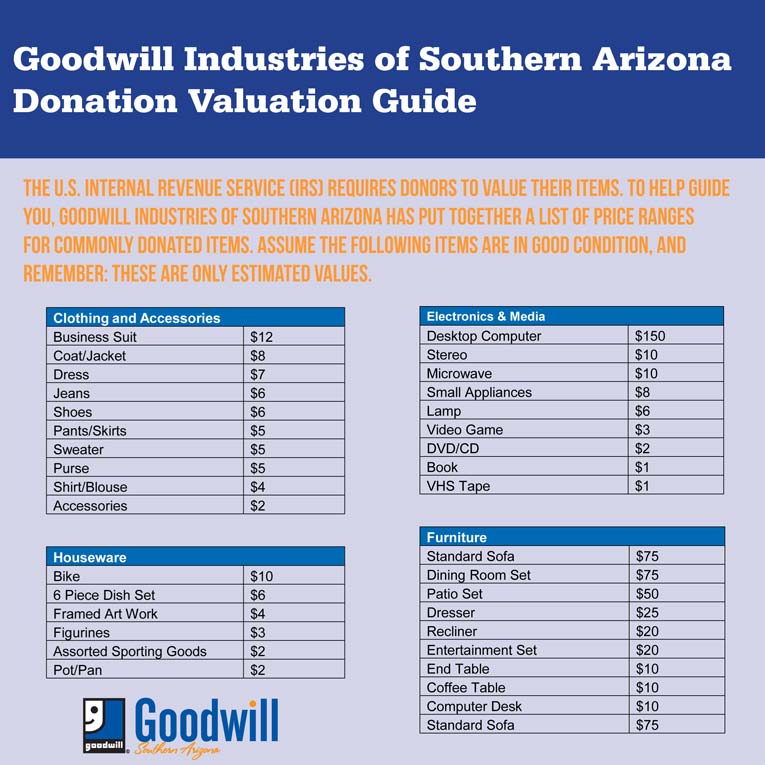

Verkko 19 jouluk 2022 nbsp 0183 32 You may be able to claim the below tax deductions for some common clothing items you donated These values are according to The Salvation Army and Goodwill You can also use the Goodwill Fair Market Value calculator Verkko 28 huhtik 2023 nbsp 0183 32 From this it follows that the deduction rights also concern interest expenses of a loan taken for the purpose to receive dividends the interest can be deducted although income in the form of dividends is partially tax exempt under the provisions in 167 33a to 167 33d of the Act on income tax or although the relevant tax

Verkko 19 lokak 2023 nbsp 0183 32 Updated for Tax Year 2023 October 19 2023 8 39 AM OVERVIEW Learn how to estimate the value of clothing for IRS tax deductions as charitable donations The value of clothing donations to charity are based on published lists of retail values or current thrift store prices Verkko 4 jouluk 2023 nbsp 0183 32 Use calculator to estimate whether you need a change in your withholding tax percentage rate Go to Tax percentage calculator This very simple calculator can only give you an unofficial estimate a guideline to get you started

Download Clothing Tax Deduction Calculator

More picture related to Clothing Tax Deduction Calculator

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

10 Clothing Donation Tax Deduction Worksheet Worksheets Decoomo

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/01/tax-deduction-spreadsheet-in-clothing-donation-tax-deduction-worksheet-2018-goodwill-sample.jpg

Premium AI Image Tax Deduction Planning Concept Businessman Calculating

https://img.freepik.com/premium-photo/tax-deduction-planning-concept-businessman-calculating_993599-4654.jpg?w=2000

Verkko 17 jouluk 2021 nbsp 0183 32 the maximum deduction is 3 500 normally 2 250 the deduction is 60 of the work related expenses specified on an invoice normally 40 and 30 of the wages that the household has paid to a worker normally 15 the credit threshold is 100 a year as before This temporary change is in force in 2022 2023 Verkko The IRS requires an item to be in good condition or better to take a deduction Our donation value guide displays prices ranging from good to like new To determine the fair market value of an item not on this list below use this calculator or 30 of

Verkko 27 maalisk 2023 nbsp 0183 32 Giving away belongings you no longer want or need can bring happiness to others who could use them An added bonus You get a tax break for your charitable gifts if you donate to a qualifying Verkko How to use ItsDeductible 1 Track your donations year round and watch your estimated tax savings add up 2 We ll provide the fair market value for over 1700 items 3 Easily import your donations into TurboTax at tax time Start ItsDeductible Add donations to your taxes with just a few clicks With all of your donations in one place you

Understand About Clothing Tax Deduction Sherif Associates

https://www.sherif-associates.com/wp-content/uploads/millennials-dropping-off-clothes-donation-outbox-getty_573x300.jpg

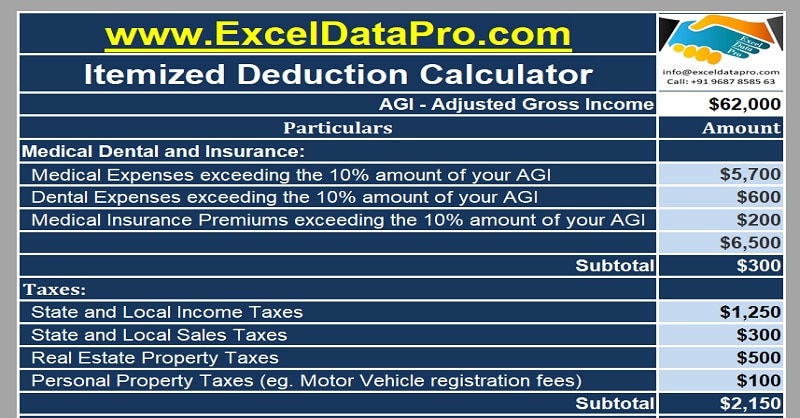

Download Itemized Deductions Calculator Excel Template ExcelDataPro

https://exceldatapro.com/wp-content/uploads/2017/12/Itemized-Deduction-Calculator.jpg

https://www.wikihow.com/Calculate-Clothing-Donations-for-Taxes

Verkko 28 syysk 2023 nbsp 0183 32 If you donate clothing and other items to a non profit organization like Goodwill or St Vincent De Paul you may be eligible to receive a tax deduction for your donation Keep a list of everything you give to charity and do research to calculate the fair market value of the things you donate

https://taxsummaries.pwc.com/finland/individual/deductions

Verkko The maximum deduction is EUR 3 500 normally EUR 2 250 The deduction is 60 of the work related expenses specified on an invoice and 30 of the wages that the household has paid to a worker The threshold share is EUR 100 per tax year The temporary change is in force in 2022 2023

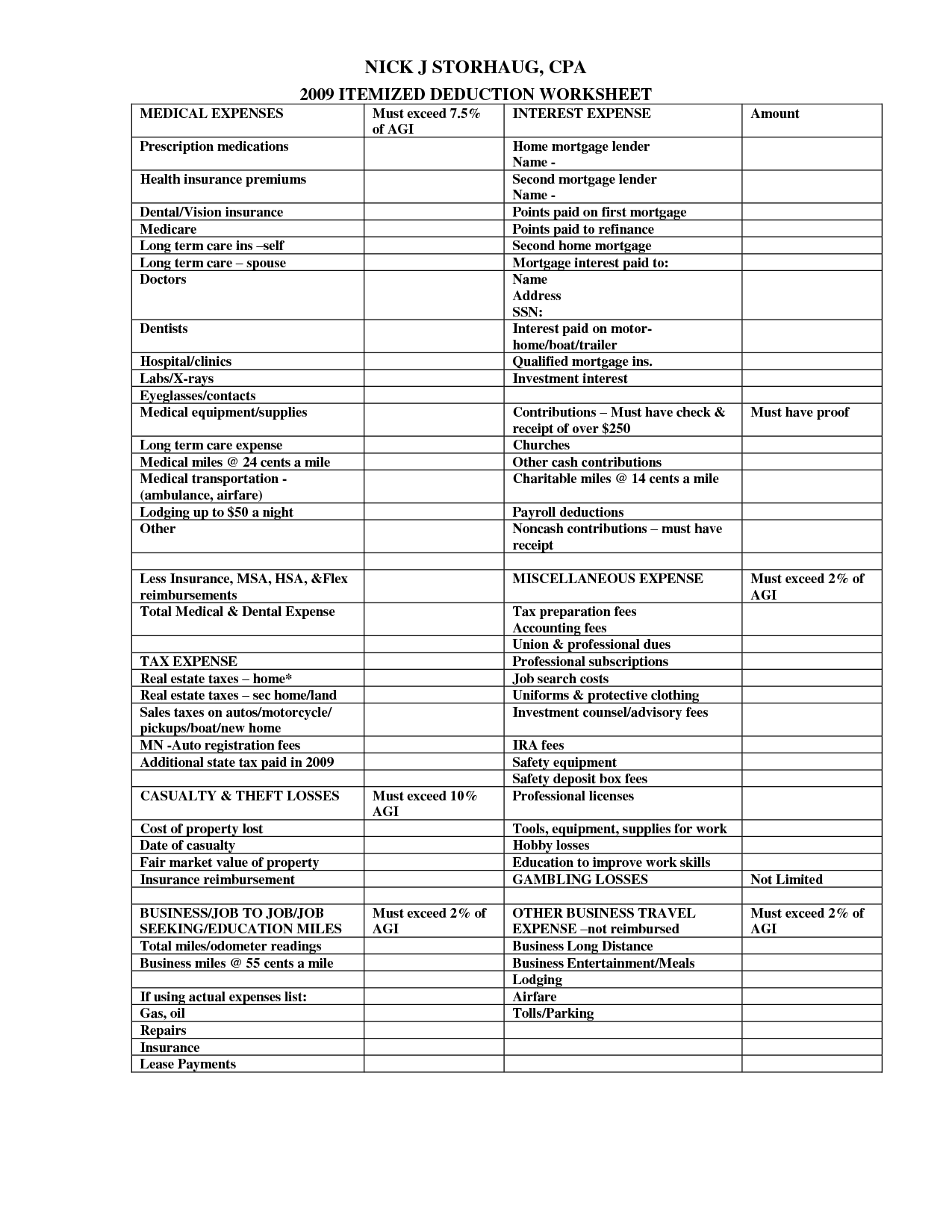

Printable Itemized Deductions Worksheet

Understand About Clothing Tax Deduction Sherif Associates

16 Insurance Comparison Worksheet Worksheeto

On Table Is Tax Deduction Form And Calculator Stock Photo Alamy

BHT Partners What You Think You Know About Work Clothing Tax

Tax Reduction Company Inc

Tax Reduction Company Inc

Irs Donation Values Spreadsheet Printable Spreadshee Irs Donation Value

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

Goodwill Donation Estimate The Value Of Your Donation

Clothing Tax Deduction Calculator - Verkko 22 kes 228 k 2022 nbsp 0183 32 Clothing is one of the more contested tax deductions and it tends to get rejected a lot But this doesn t mean you should avoid deducting work related clothing expenses on your tax return altogether Here s an overview of the clothing purchases that can and can t be deducted as a business expense