Co Op Tax Credit In Ontario this is known as the Co operative Education Tax Credit CETC which provides Ontario businesses incentive to hire post secondary students enrolled in a co operative education program How does the tax credit work

The government of Ontario offers a tax credit for businesses hiring students enrolled in any recognized post secondary co operative education program These tax credits help Ontario s college and university students to gain valuable work experience and enhance their future employment opportunities The Co op tax credit is a refundable tax credit that creates a reciprocal relationship in which the student and employer can both benefit greatly The government seeks to connect companies with ambitious and diligent students from across Ontario through the Co op Tax Credit

Co Op Tax Credit

Co Op Tax Credit

https://cdn.erealtymedia.com/onekey/property/3502278/3502278_1_thumb.webp?v=385402417

Employer Funding Resources Engineering Career Centre

https://engineeringcareers.utoronto.ca/files/bb-plugin/cache/Co-op-Tax-Credit-1-square-faa681c757274407fe020e73c7b7e7eb-60b107ffe903f.jpg

Co op Tax Credit BDO Canada

https://www.bdo.ca/getattachment/2e7bf7aa-7543-49ca-a7ad-3dbe03fd5f12/LandingBanner_679x220_YoungPeople_CasualMeeting_ThinkstockPhotos-494374653.jpg.aspx

Ontario Co operative Education Tax Credit Other credits and incentives Available across Canada Scientific Research and Experimental Development Tax Credit When you hire a student enrolled in a co operative education program there are a number of tax credits that you can take advantage of Ontario co operative education tax credit You can claim this credit if you are a corporation that provided a qualifying work placement at a permanent establishment in Ontario for a student enrolled in a qualifying post secondary co operative education program

Use this form to claim an Ontario co operative education tax credit Ways to get the form Download and fill out with Acrobat Reader You must download and Ontario Co op Education Tax Credit In order to help Ontario s university and college students gain work experience and enhance their future employment opportunities the Ontario government provides a refundable tax credit for businesses hiring students enrolled in a recognized post secondary co operative education program

Download Co Op Tax Credit

More picture related to Co Op Tax Credit

Bill Would Give Co ops Tax Credits To Fund Retirement Plans

https://www.electric.coop/wp-content/uploads/2020/08/GettyImages-CapitolinSummer-1024x683.jpg

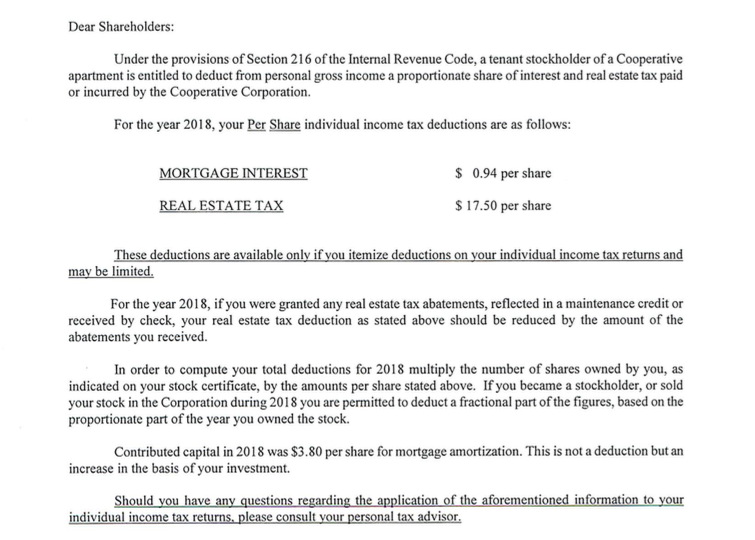

Co op Tax Deduction Letter Hauseit Tax Deductions Deduction

https://i.pinimg.com/originals/5b/d2/65/5bd265f90ba4400c8a69111524c70a90.jpg

What Is The Typical NYC Co op Flip Tax Nyc Co op Flipping

https://i.pinimg.com/originals/17/83/6f/17836f4a413c6ba302a004904ad0f516.jpg

Provided as a tax credit businesses may claim up to 25 30 of a student s wage to a maximum 3 000 per 10 week to 4 month co op placement As opposed to other government wage subsidy programs the Ontario CETC is an option that provides businesses with the ability to claim funding year round Description The Co operative Education Tax Credit is a refundable tax credit available to employers who hire students enrolled in a co operative education program at an Ontario university or college Most work placements are for a minimum employment period of 10 weeks up to a maximum of four months Comments on Funding

The Co operative Education Tax Credit is a refundable tax credit for Ontario based co op employers who hire students enrolled in a co operative education program at an Ontario university or college Corporations can claim 25 of eligible expenditures 30 for small businesses for up to a maximum credit of 3 000 per co op term Cooperative Education Tax Credit The Cooperative Education Tax Credit CETC is an Ontario tax credit that is available to employers of students from many co op and internship programs The credit can total as much

What Is The Co op Flip Tax In NYC ELIKA New York

https://www.elikarealestate.com/blog/wp-content/uploads/2018/03/flip-tax-1600x1067-2.jpeg

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

https://www.ggfl.ca/co-operative-education-tax-credits-cetc

In Ontario this is known as the Co operative Education Tax Credit CETC which provides Ontario businesses incentive to hire post secondary students enrolled in a co operative education program How does the tax credit work

https://www.fanshawec.ca/sites/default/files/...

The government of Ontario offers a tax credit for businesses hiring students enrolled in any recognized post secondary co operative education program These tax credits help Ontario s college and university students to gain valuable work experience and enhance their future employment opportunities

Co op Credit Union Vendi Advertising

What Is The Co op Flip Tax In NYC ELIKA New York

Sample Co op Apartment Tax Deduction Letter For NYC Hauseit

Kathryn Leistner kathrynleistner Twitter

Tax Accounting Services Lee s Tax Service

Tax Accounting Services Lee s Tax Service

Credit Co operative Society Registration Procedure And Benefits

Scotiabank Changemakers Fund Co Op Program Ted Rogers School Of

Tax Reduction Company Inc

Co Op Tax Credit - Ontario Co operative Education Tax Credit Other credits and incentives Available across Canada Scientific Research and Experimental Development Tax Credit When you hire a student enrolled in a co operative education program there are a number of tax credits that you can take advantage of