Colorado Income Tax Exemption HB 1312 increases this exemption from 7 700 to 50 000 for tax years beginning on January 1 2021 and January 1 2022 For tax years beginning on January 1 2023 Verkko

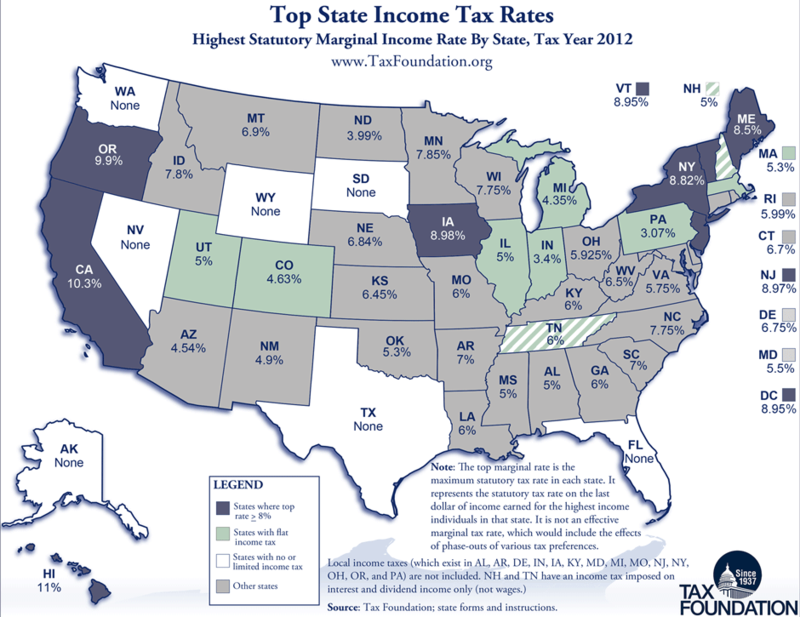

31 toukok 2023 nbsp 0183 32 For the 2023 tax year taxpayers under age 55 can exclude up to 15 000 of income from a military retirement plan Railroad Retirement benefits are exempt from state tax in Colorado Verkko To calculate the Colorado income tax a flat tax rate of 4 63 percent is applied to federal taxable income after adjusting for state additions and subtractions the largest Verkko

Colorado Income Tax Exemption

Colorado Income Tax Exemption

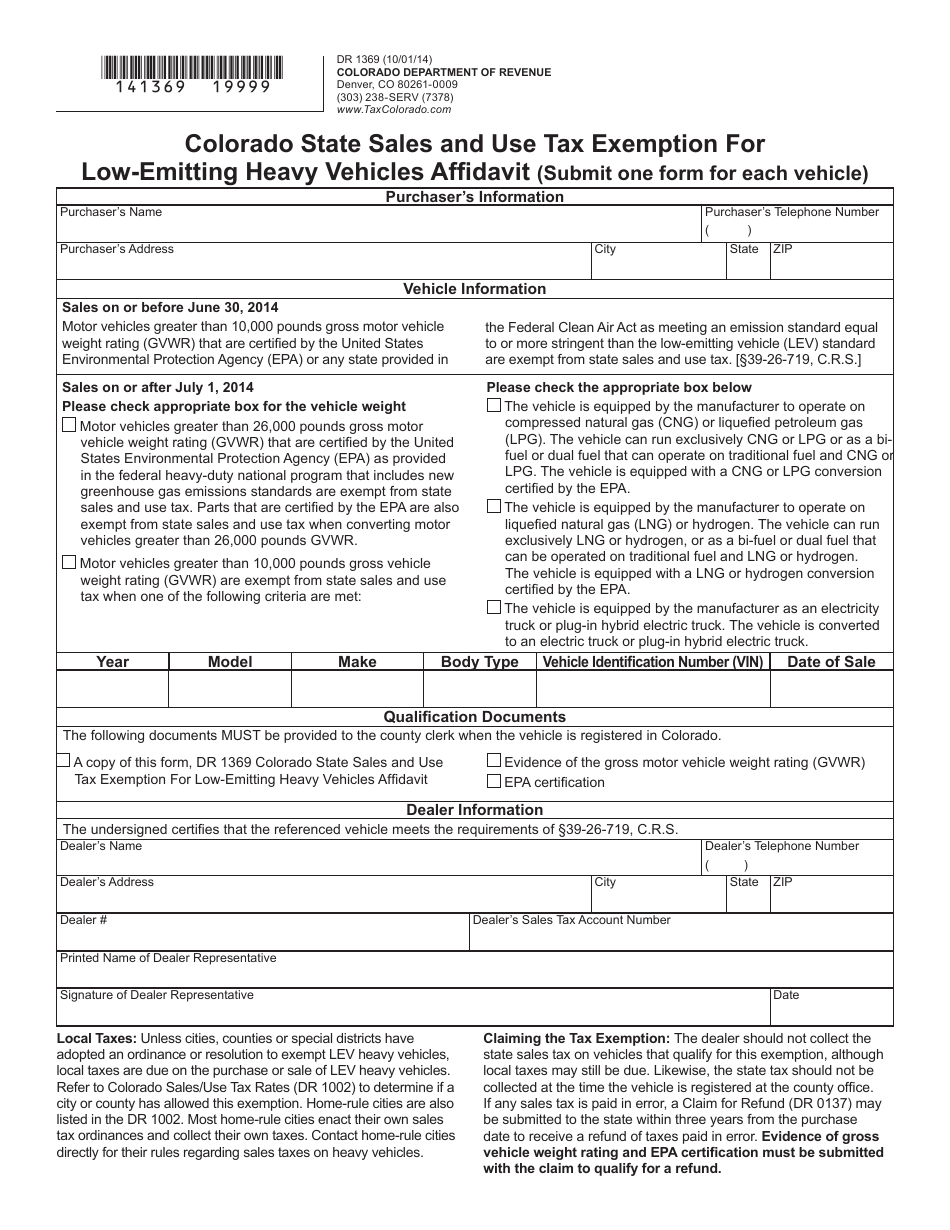

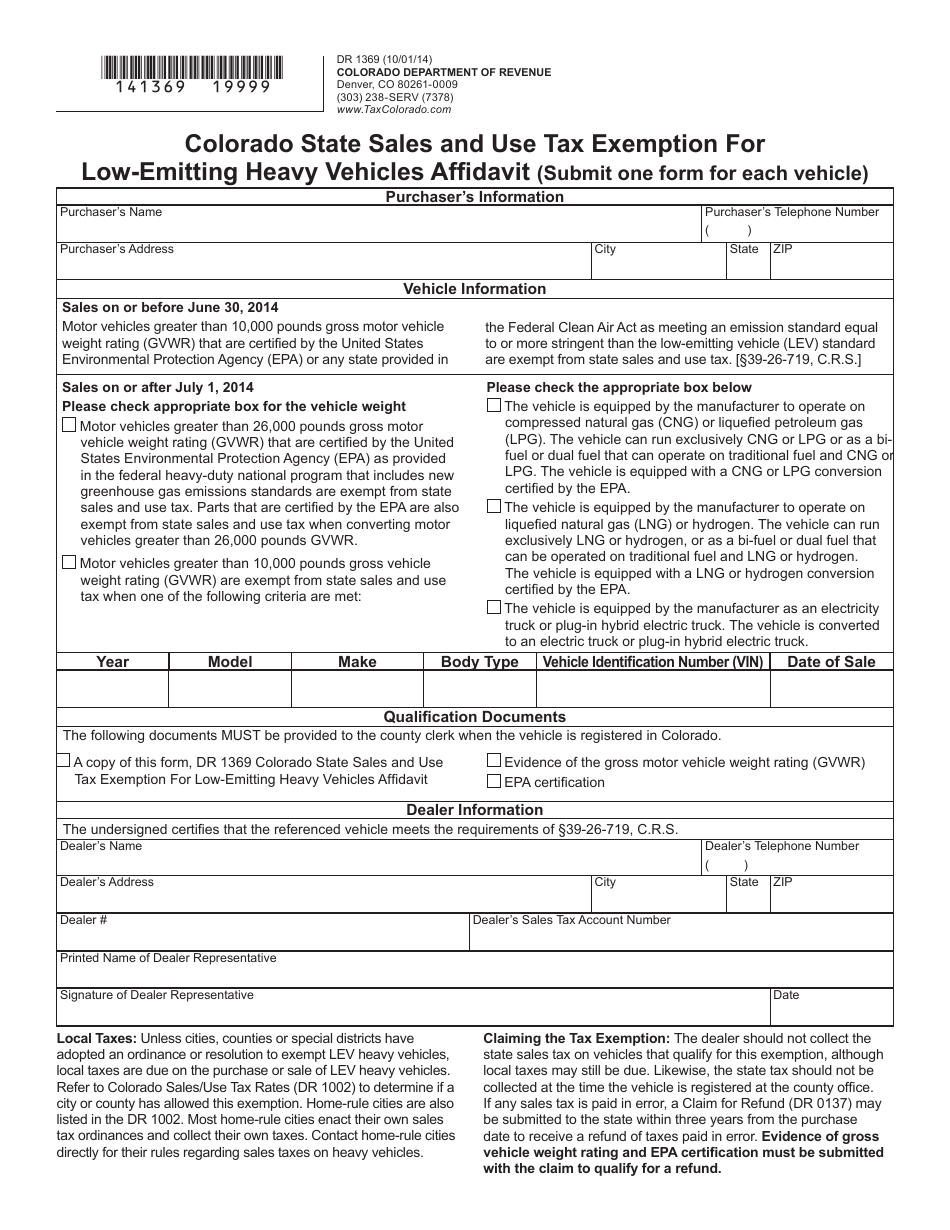

https://data.templateroller.com/pdf_docs_html/1728/17283/1728383/form-dr-1369-colorado-state-sales-and-use-tax-exemption-low-emitting-heavy-vehicles-affidavit-colorado_print_big.png

2017 PAFPI Certificate of TAX Exemption Certificate Of

https://www.certificateof.com/wp-content/uploads/2018/06/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Colorado s tax system also includes many sales tax exemptions income tax credits and other tax expenditures valued at close to 6 5 billion annually 3 Many more Verkko Be 100 exempt Line 3 Social Security Benefits You may be able to subtract some or all of the social CO Income Tax Withheld from W 2s and 1099s you must submit the Verkko

The Colorado income tax has one tax bracket with a maximum marginal income tax of 4 40 as of 2023 Detailed Colorado state income tax rates and brackets are Verkko 1 tammik 2023 nbsp 0183 32 Find out how much you ll pay in Colorado state income taxes given your annual income Customize using your filing status deductions exemptions and Verkko

Download Colorado Income Tax Exemption

More picture related to Colorado Income Tax Exemption

Revocation Of Federal Tax Exemption Grant Management Nonprofit Fund

https://mygrantmanagement.com/wp-content/uploads/2019/07/tax_exemption_1563850735.png

Some Pay For Teachers Raise Under Amendment 73

https://mediaassets.thedenverchannel.com/photo/2018/10/22/INCOME_1540258046123_101108934_ver1.0_900_675.png

Colorado Sales And Use Tax Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-dr1369-download-fillable-pdf-or-fill-online-colorado-state-sales.png

24 huhtik 2023 nbsp 0183 32 For tax year 2022 taxes filed in 2023 Colorado s state income tax rate is 4 4 Previously Colorado taxed income at a fixed rate of 4 55 but the Verkko The senior property tax exemption is a form of property tax relief available to seniors who own and occupy their home in Colorado The exemption is equal to 50 of the Verkko

In 2023 the Colorado state income tax rates will remain the same as in 2022 with the following brackets and rates 4 55 on the first 15 800 of taxable income 4 95 on Verkko 27 syysk 2023 nbsp 0183 32 2 9 Food and prescription drugs are exempt but the local tax rate could be as high as 8 3 Total Colorado sales tax ranges from 2 9 to 11 2 and Verkko

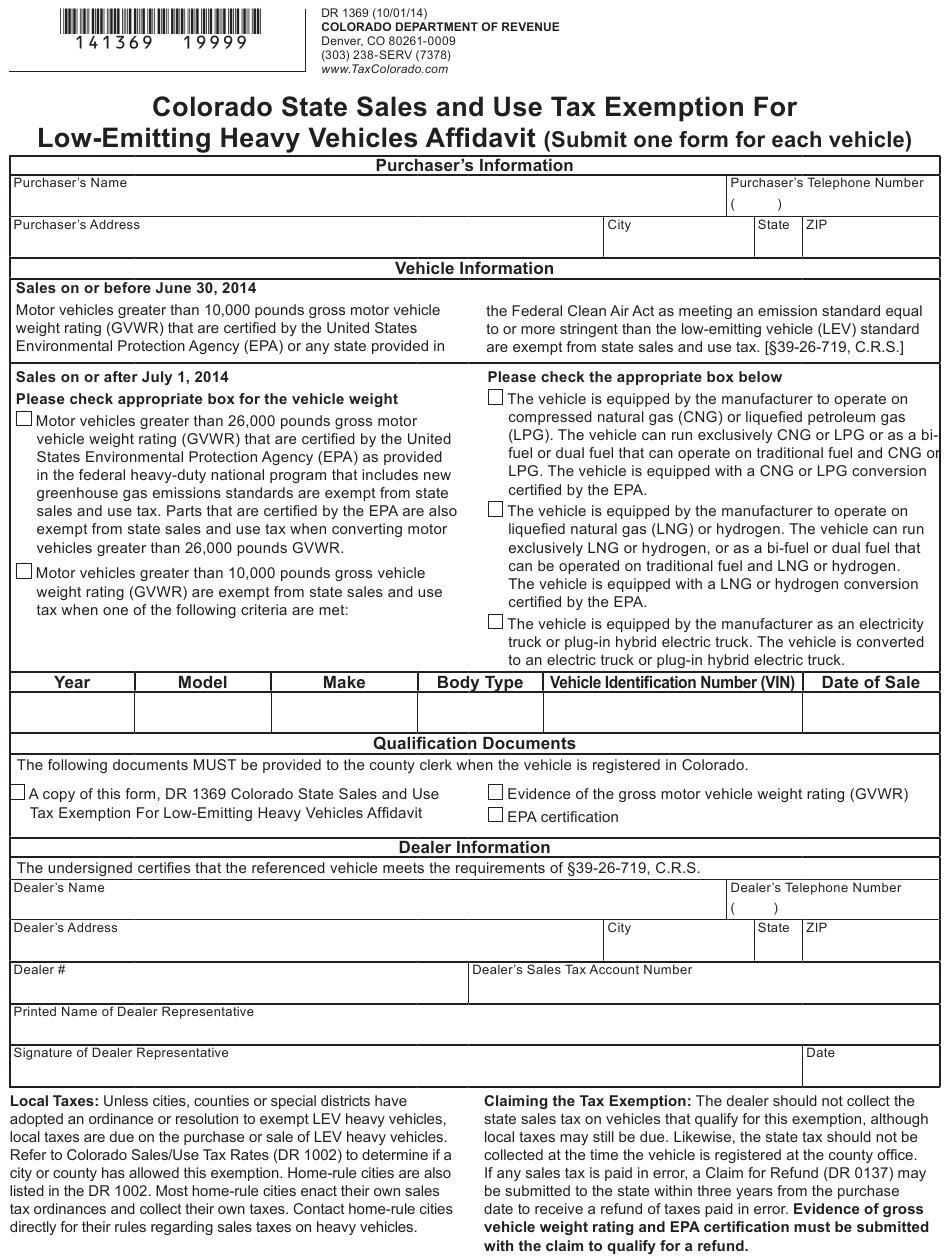

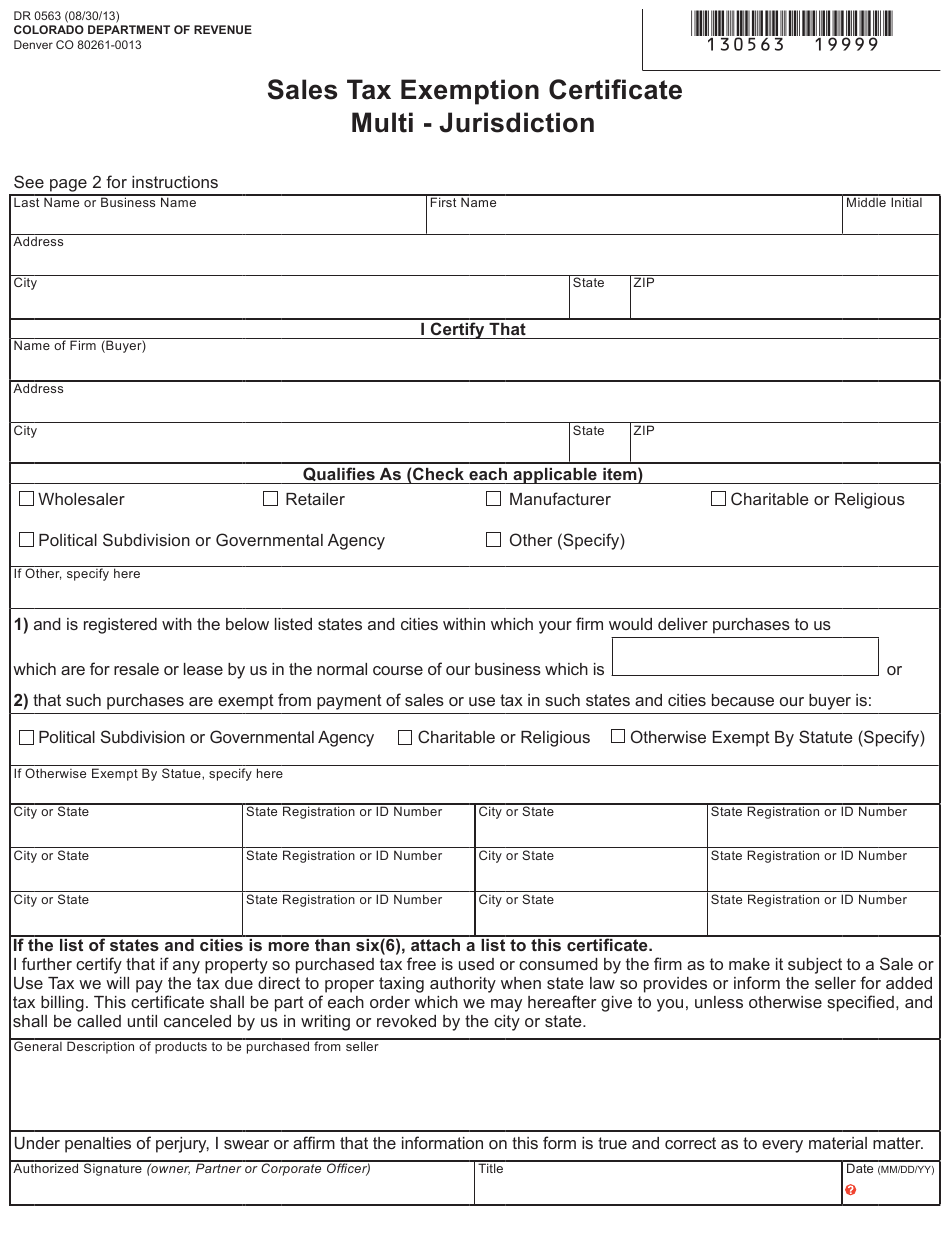

How To Get A Sales Tax Exemption Certificate In Colorado ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-dr0563-download-fillable-pdf-or-fill-online-sales-tax-exemption-3.png

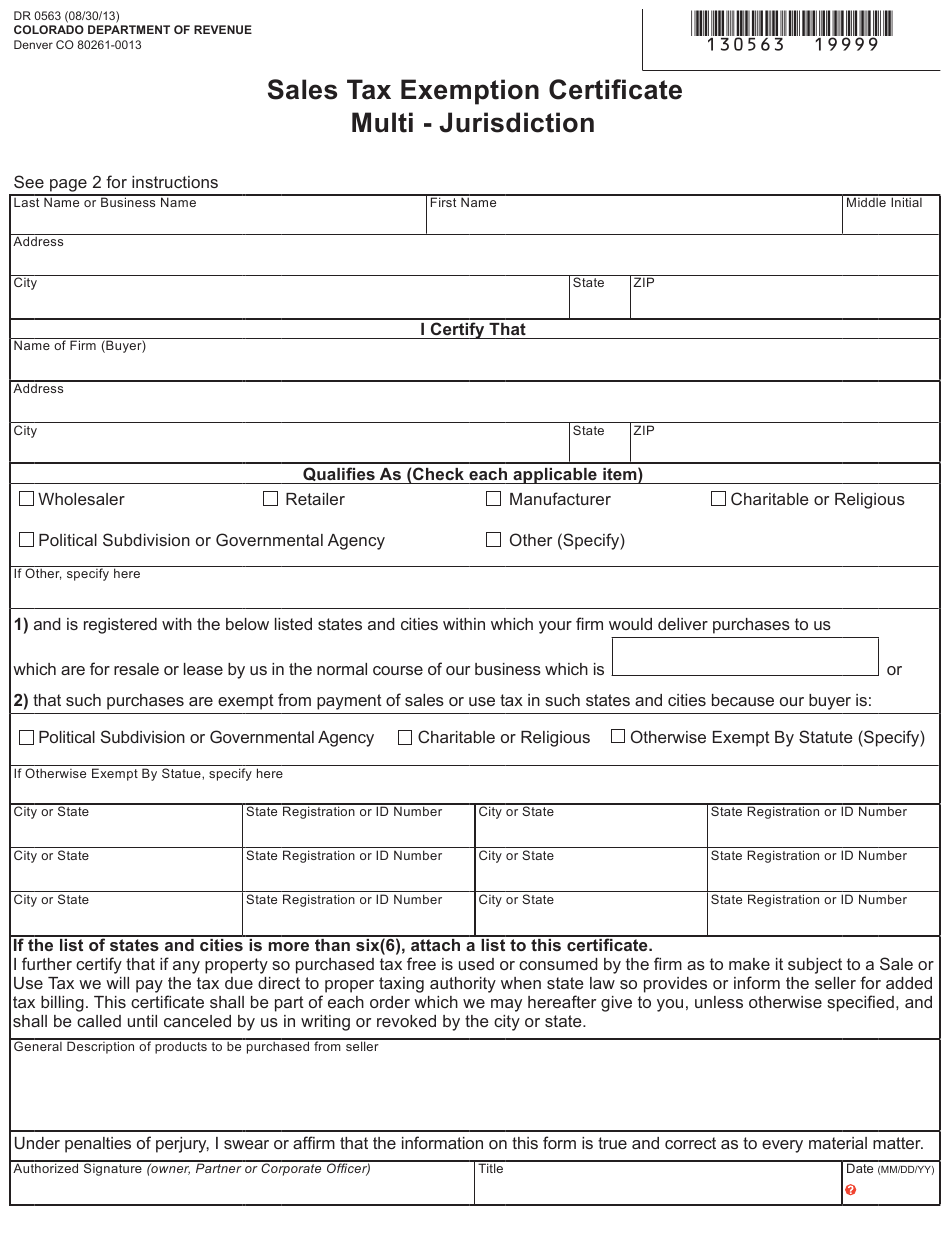

Wash Park Prophet Colorado s Top Income Tax Rate Is Low

http://2.bp.blogspot.com/-3z-gq9tRnLc/T1geZJrXLQI/AAAAAAAAAPc/yymg490X3K0/s1600/taxmap.png

https://www2.deloitte.com/content/dam/Deloitte/us/Docume…

HB 1312 increases this exemption from 7 700 to 50 000 for tax years beginning on January 1 2021 and January 1 2022 For tax years beginning on January 1 2023 Verkko

https://www.kiplinger.com/state-by-state-guid…

31 toukok 2023 nbsp 0183 32 For the 2023 tax year taxpayers under age 55 can exclude up to 15 000 of income from a military retirement plan Railroad Retirement benefits are exempt from state tax in Colorado Verkko

Income Tax Statistics 2023 Tax Brackets USA UK And More

How To Get A Sales Tax Exemption Certificate In Colorado ExemptForm

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

The Estate Tax The Motley Fool

Extension Of Timelines For Filing Of Income tax Returns And Various

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

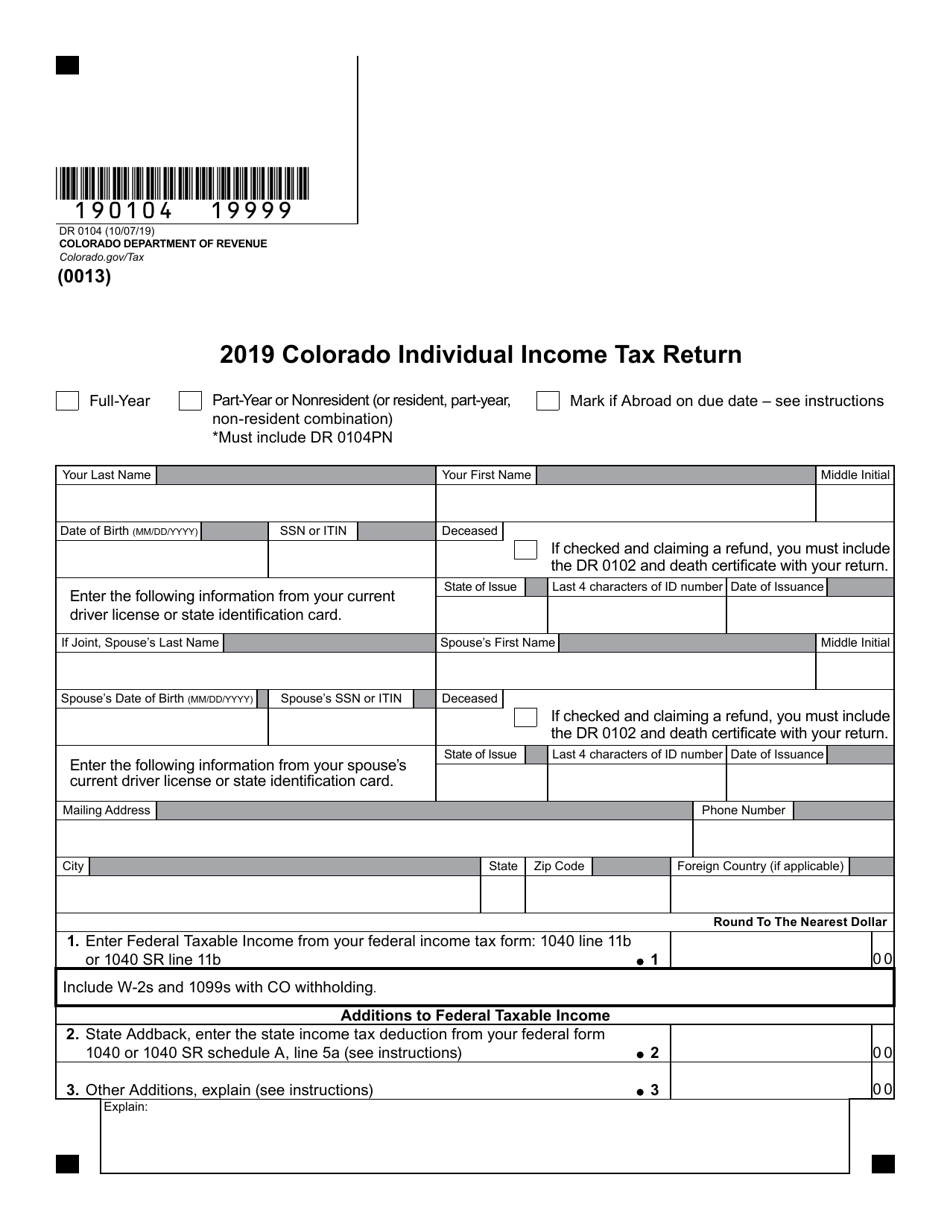

Form DR0104 Download Fillable PDF Or Fill Online Colorado Individual

How To Submit Your Personal Income Tax Return

Writing Religious Exemption Letters

Colorado Income Tax Exemption - The Colorado income tax has one tax bracket with a maximum marginal income tax of 4 40 as of 2023 Detailed Colorado state income tax rates and brackets are Verkko