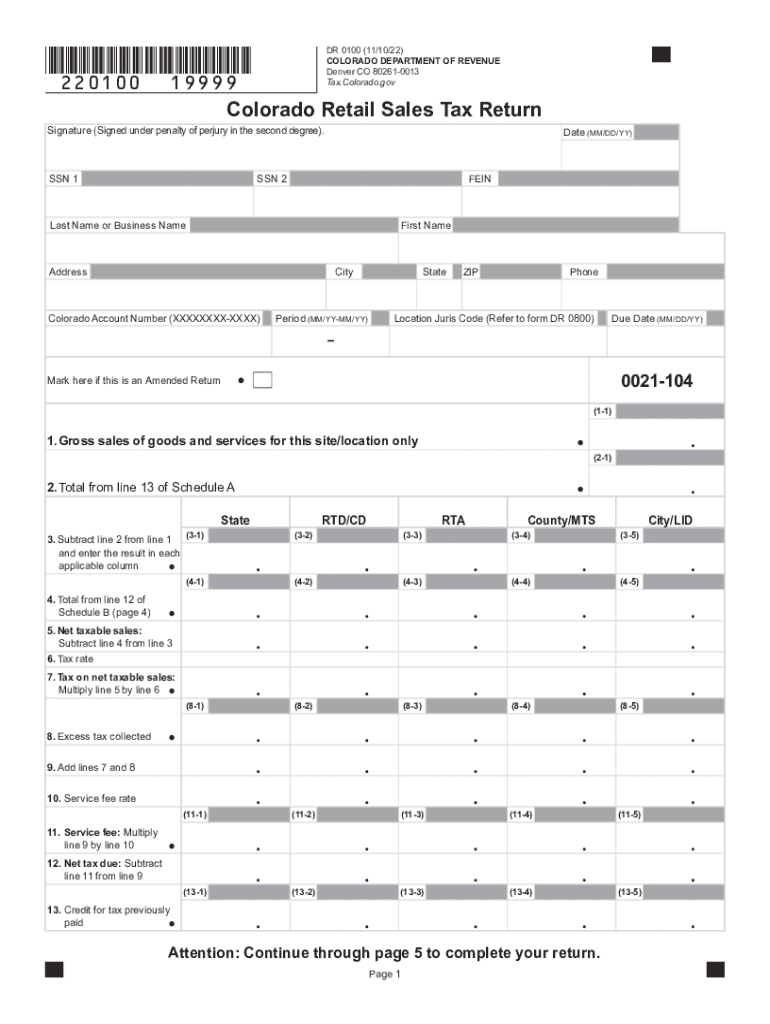

Colorado Retail Sales Tax Return 2022 Retail Sales Tax CR 0100 Sales Tax and Withholding Account Application Instructional Video DR 0100 Retail Sales Tax Return Supplemental Instructions

The Sales Reports summarize data from Colorado State Sales Tax Returns Form DR 0100 broken down by industry county and city In these reports you ll find information on the number of retailers number of returns gross sales Annual returns are due January 20 Under 600 per month Sales tax returns may be filed quarterly 600 or more per month sales tax returns must be filed monthly Monthly returns

Colorado Retail Sales Tax Return 2022

Colorado Retail Sales Tax Return 2022

https://www.cpapracticeadvisor.com/wp-content/uploads/sites/2/2022/07/25115/sales_tax_1_.58de58fc9ed9f.png

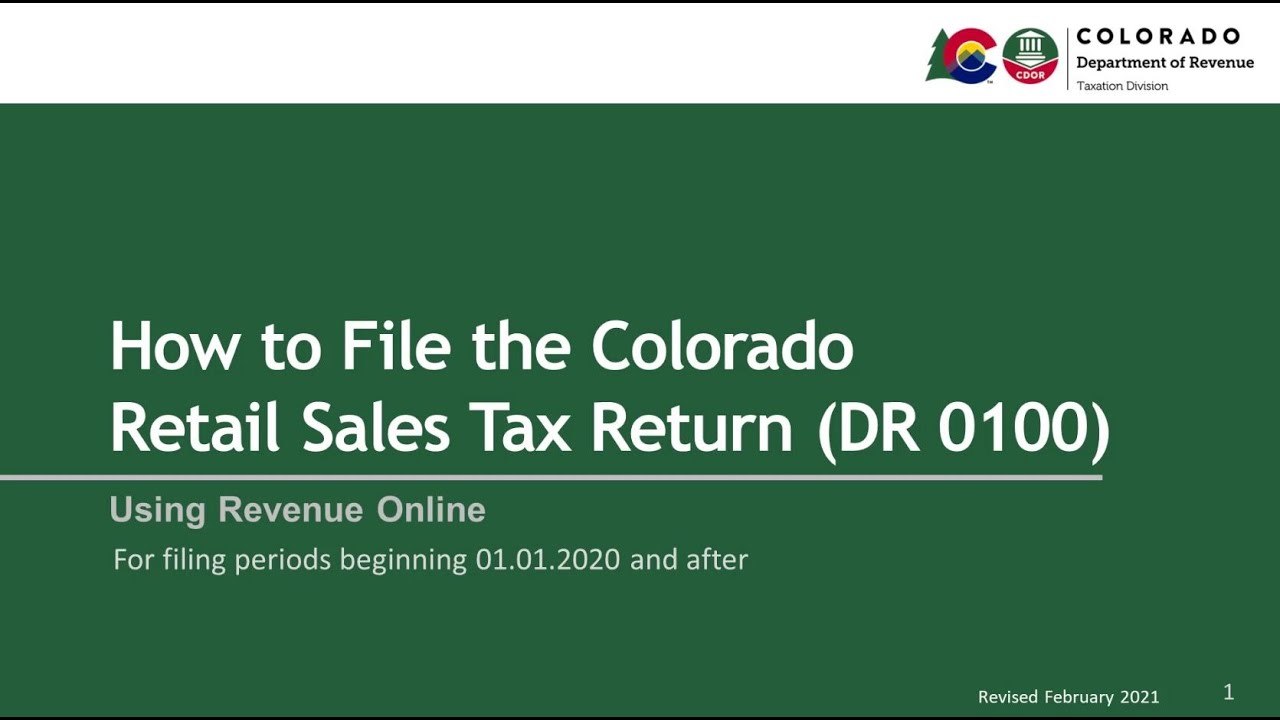

How To File The Colorado Retail Sales Tax Return DR 0100 Using

https://i.ytimg.com/vi/X7Eg6K4v4Dc/maxresdefault.jpg

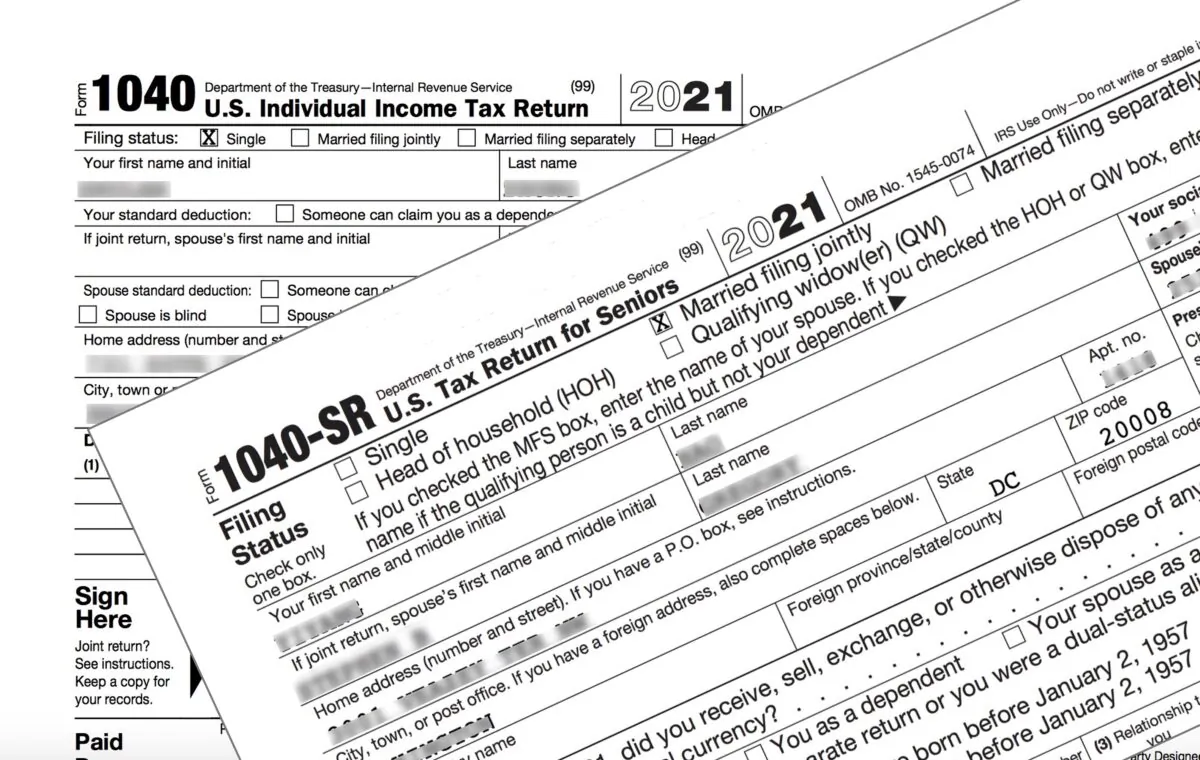

Self Employment Tax Return Form 2022 Employment Form

https://www.employementform.com/wp-content/uploads/2022/08/self-employment-tax-return-form-2022.jpg

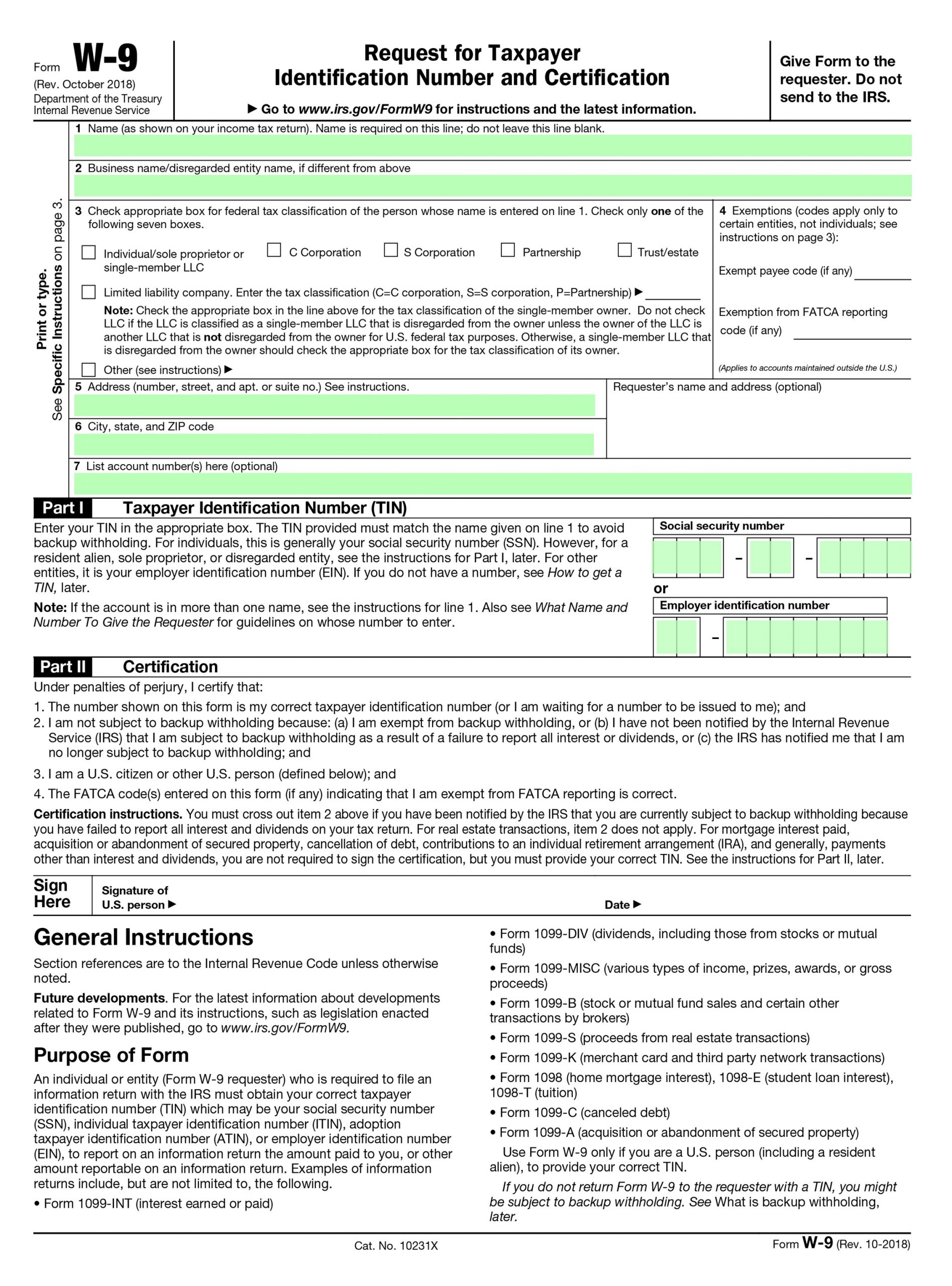

How to File a Zero Sales Tax Return Filing Extensions for Natural Disasters Revenue Online Spreadsheet Filings Part 1 Retail Sales Colorado imposes sales tax on retail sales of tangible personal property prepared food and drink and certain services as well as the furnishing of rooms and

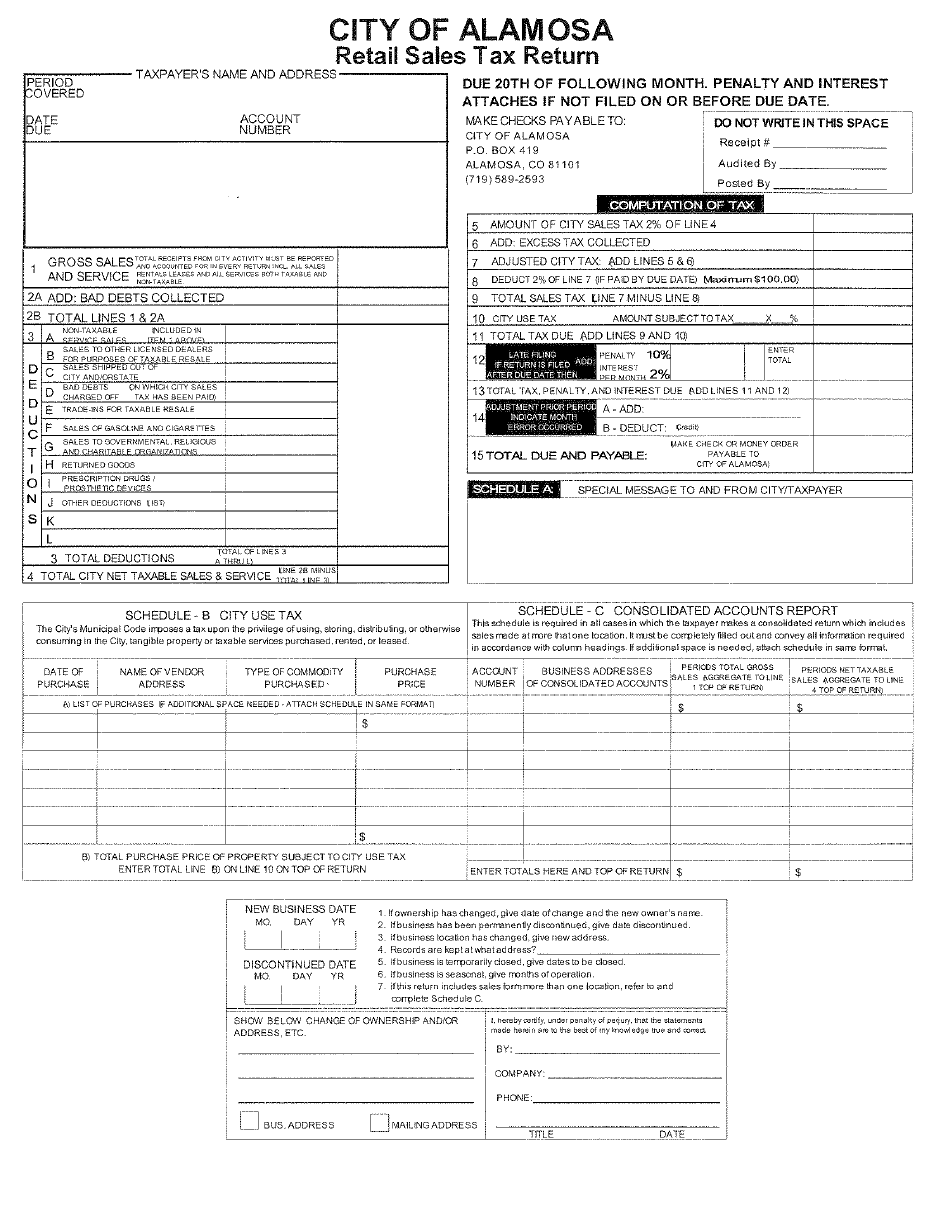

Retailers with active retailer s use tax accounts must file a return for each filing period even if the retailer made no sales in Colorado during the period and no tax is due Typically returns must Colorado 1 Gross Sales 2 Deductions from Schedule A 3 Exemptions from Schedule B 4 Net taxable sales Subtract lines 2 and 3 from line 1 4 Sales tax rate 2 90 5 Tax on net taxable

Download Colorado Retail Sales Tax Return 2022

More picture related to Colorado Retail Sales Tax Return 2022

Sales Tax Permit Registrations Get Into Compliance Quickly

https://www.salestaxsystem.com/wp-content/uploads/2021/06/reg.jpg

Colorado Retail Sales Tax Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/100/433/100433314/large.png

Where Can I See The Sales Tax Amount Printify

https://help.printify.com/hc/article_attachments/10904441371665

Some cities in Colorado are in process signing up with the SUTS program Cities that have not yet signed up will be shown with a red exclamation mark beside their sales tax rate Those cities Form DR 0100 Colorado Retail Sales Tax Return With Deductions Exemptions Schedules is required for any retail establishment

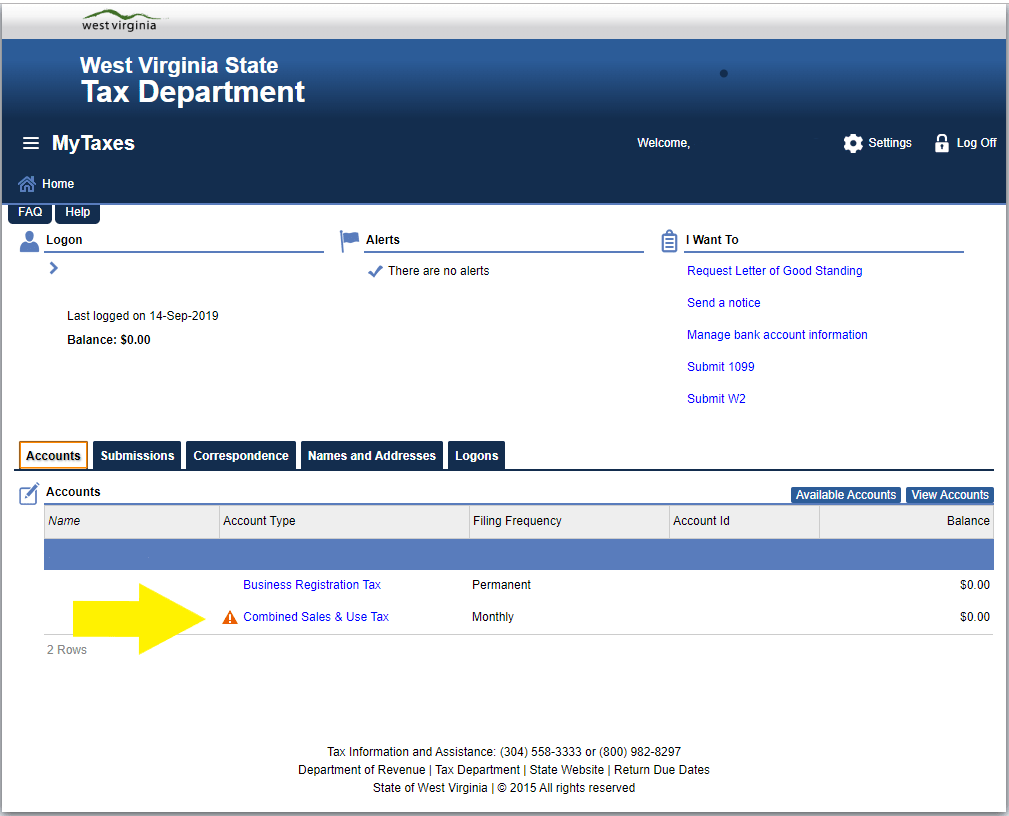

Sales Use Tax System SUTS This portal allow retailers to file retail sales tax returns for state state collected and participating home rule self collecting taxation jurisdictions Colorado requires any business with a sales tax permit to file a sales tax return on its due date even if it doesn t have any sales tax to report or pay If a business fails to file

Sales And Use Tax Return Form

https://s3.studylib.net/store/data/008754085_1-c1b188d592909f51d444a3ad8df36f87.png

How To File Income Tax Return 2022 I Offers Online Income Tax Return

https://i.ytimg.com/vi/S3CONZF9Qig/maxresdefault.jpg

https://tax.colorado.gov › sales-use-tax-forms

Retail Sales Tax CR 0100 Sales Tax and Withholding Account Application Instructional Video DR 0100 Retail Sales Tax Return Supplemental Instructions

https://cdor.colorado.gov › retail-sales-reports

The Sales Reports summarize data from Colorado State Sales Tax Returns Form DR 0100 broken down by industry county and city In these reports you ll find information on the number of retailers number of returns gross sales

How To Calculate Income Tax On Salary In Pakistan In 2022

Sales And Use Tax Return Form

City Of Alamosa Colorado Retail Sales Tax Return Fill Out Sign

Instructions Sales Tax 2022 2024 Form Fill Out And Sign Printable PDF

Dr 0100 Fillable Form Printable Forms Free Online

TaxJar A Stripe Company On LinkedIn TaxJar Sales Tax Compliance For

TaxJar A Stripe Company On LinkedIn TaxJar Sales Tax Compliance For

Imposition Of Withholding Sales Tax In Pakistan Withholding Taxes In

How To File And Pay Sales Tax In West Virginia TaxValet

How To Keep Your Tax Return From Getting Hung Up

Colorado Retail Sales Tax Return 2022 - Retail delivery fee returns are due by the 20th day of the month following the reporting period For most retailers the first return will be due by August 20 2022 Retailers