Commission Rebates Tax Web For the period 2021 2027 lump sum corrections will reduce the annual GNI based contribution of Denmark the Netherlands Austria Sweden and Germany The gross

Web 3 juin 2019 nbsp 0183 32 A common question many brokers and buyers have is whether such rebates are taxable income that must be reported to the IRS on Form 1099 MISC The answer is Web If the buyers purchase a house for 1 million the agent receives 25 000 HST commission from the vendors and then pays 20 or 5 000 to her clients To

Commission Rebates Tax

Commission Rebates Tax

https://mexus.com.hk/wp-content/uploads/2023/07/253.Profits-Tax-–-Payment-Of-Commissions-Rebates-And-Discounts-To-Be-Assessed-By-An-Agent-1024x576.jpg

What Real Estate Agents Think Of Commission Rebates Getting Real

https://blog.lucidrealty.com/wp-content/uploads/2025/06/real-estate-commission-rebate-ad.jpg

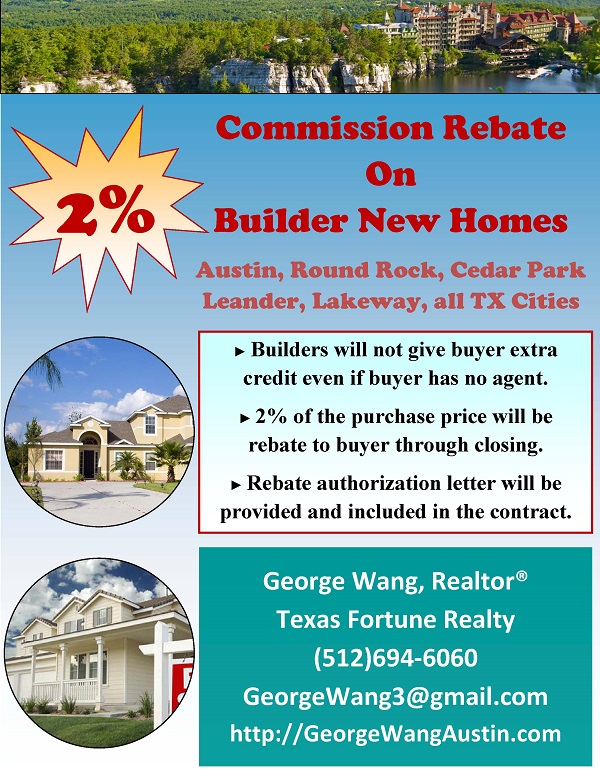

Buyer Commission Rebate Texas Fortune Realty

http://texasfortunerealty.com/wp-content/uploads/2017/07/flyer-buyer-tfr.jpg

Web 16 avr 2014 nbsp 0183 32 The guidance follows HMRC s decision in March 2013 that rebates are an annual payment and therefore subject to income tax HMRC started collecting tax on Web 19 juil 2019 nbsp 0183 32 How is trail commission treated for tax purposes HMRC considers that payments of trail commission to the investor are taxable on the investor The payments

Web 12 avr 2021 nbsp 0183 32 The commission rebate or discount expense is incurred in relation to a capital transaction In the above cases the payer will be regarded as the payee s agent Web 25 mars 2013 nbsp 0183 32 who should have deducted or declared this tax prior to 6 April 2013 What was happening before then Historically the vast majority of rebate arrangements have

Download Commission Rebates Tax

More picture related to Commission Rebates Tax

2 Commission Rebate For Builder Homes Austin Top Commission Rebate

https://georgewangaustin.com/wp-content/ata-images/flyer-buyer600.jpg

55 Commission Rebate Promotion

https://api.insurediy.com.sg/storage/Promo/55-main-banner.png

Profits Tax disclosure Of Commissions Rebates And Discount Expenses

https://mexus.com.hk/wp-content/uploads/2023/07/263.Profits-Tax-Disclosure-Of-Commissions-Rebates-And-Discount-Expenses.jpg

Web Commission rebates are a legitimate marketing tool and a way for registrants to differentiate themselves in the marketplace However registrants have a duty to ensure Web any benefit received by the person for the referral in the form of a referral fee commission rebate or gift fsco ca fsco ca tout avantage dont b 233 n 233 ficierait la

Web 13 ao 251 t 2019 nbsp 0183 32 Commission Rebates Your Way To Purchase a Home for 98 Cents on the Dollar Last updated on June 23rd 2021 at 05 33 pm That s it You have decided to Web 29 mars 2018 nbsp 0183 32 Fee rebates made to members of a partnership or limited liability partnership are an application of its profits and taxable as such with no

Commissions Rebates Setup ISATECH Online Docs

https://docs.isatech.eu/en-us/apps/REB/img/reb-setup-8.en-us.png

Real Estate Commission Rebate Calculator

https://www.mortgagecalculator.biz/img/rebate.jpg

https://commission.europa.eu/.../2021-2027/revenue/rebates_en

Web For the period 2021 2027 lump sum corrections will reduce the annual GNI based contribution of Denmark the Netherlands Austria Sweden and Germany The gross

https://ttlc.intuit.com/community/taxes/discussion/is-a-commission...

Web 3 juin 2019 nbsp 0183 32 A common question many brokers and buyers have is whether such rebates are taxable income that must be reported to the IRS on Form 1099 MISC The answer is

Getting A Realtor Commission Rebate In NY Hauseit New York

Commissions Rebates Setup ISATECH Online Docs

Are NYC Buyer Broker Commission Rebates Taxable FAQ On IRS Tax And

.jpg)

Commission Rebate GrabMerchant

2 Commission Rebate For Our Star Delivery Partners

Why Are Buyer Agent Commission Rebates So Rare Buyers Agent Online

Why Are Buyer Agent Commission Rebates So Rare Buyers Agent Online

Builder Homes Texas Fortune Realty

Getting A Buyer Agent Commission Rebate Explained Hauseit NYC

Commission Rebate

Commission Rebates Tax - Web 16 avr 2014 nbsp 0183 32 The guidance follows HMRC s decision in March 2013 that rebates are an annual payment and therefore subject to income tax HMRC started collecting tax on