Company Car Fuel Tax Rebate Web 30 d 233 c 2019 nbsp 0183 32 The car fuel benefit charge is calculated by multiplying 2 figures a fixed sum of 163 24 600 for 2021 to 2022 163 24 500 for 2020 to 2021

Web 21 juil 2020 nbsp 0183 32 Reimburse employees for company car business travel If the mileage rate you pay is no higher than the advisory fuel rates for the engine size and fuel type of the Web The company car fuel benefit charge means that you will pay more income tax because HMRC classifies the free fuel for personal journeys as a benefit in kind The fuel

Company Car Fuel Tax Rebate

Company Car Fuel Tax Rebate

https://data.formsbank.com/pdf_docs_html/172/1728/172849/page_1_thumb_big.png

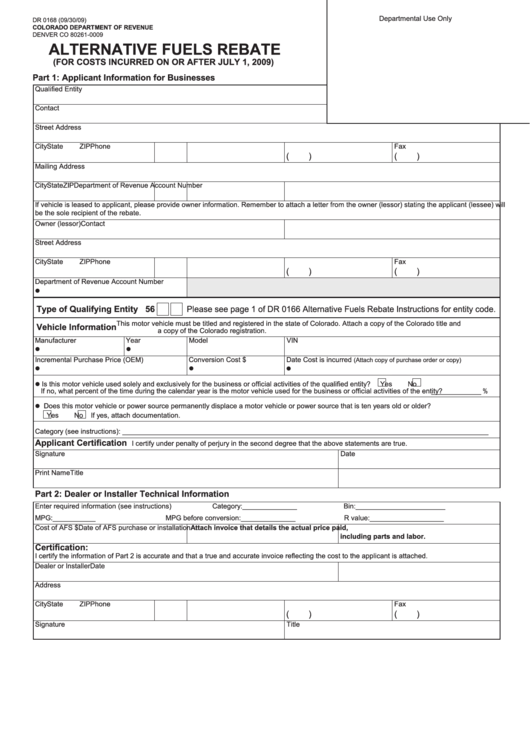

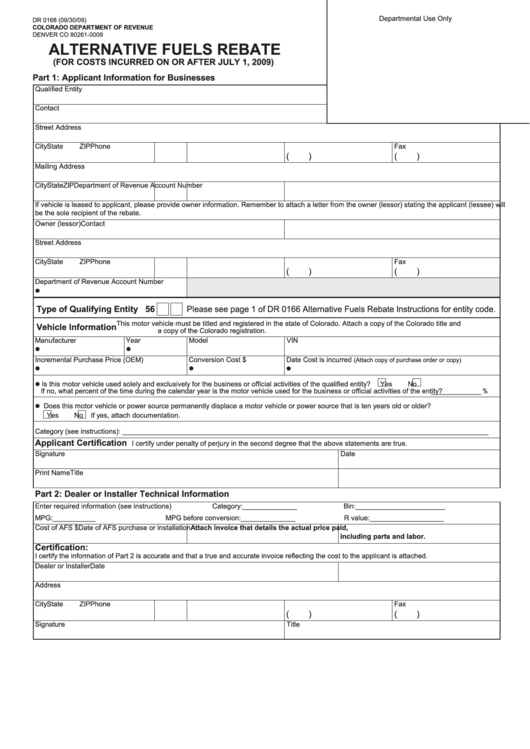

Piedmont Natural Gas Rebates Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/14/944/14944825/large.png

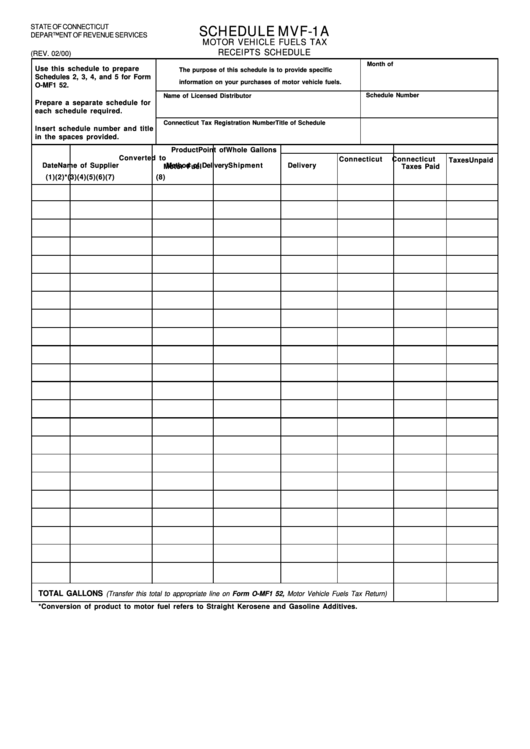

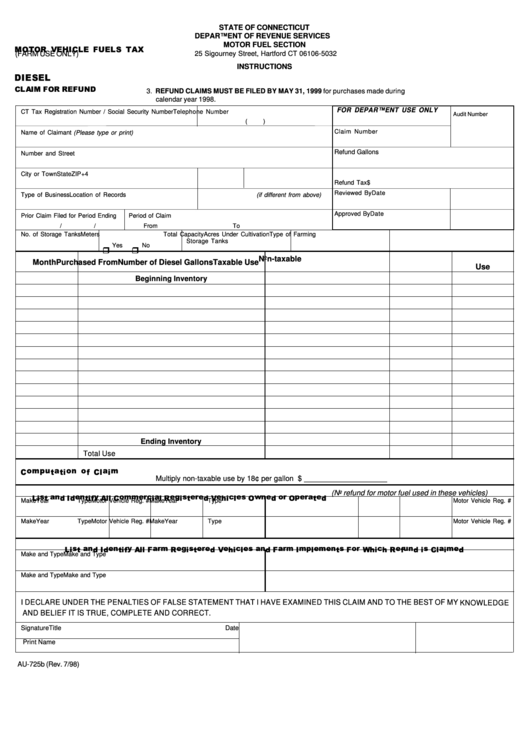

Motor Vehicle Fuels Tax Form Receipts Schedule Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/224/2249/224944/page_1_thumb_big.png

Web 24 mai 2023 nbsp 0183 32 Details For retailers selling unleaded petrol and diesel as road fuel and eligible to claim relief you can either use the online service fill in the print and post form Web Company car tax Private fuel expense Tax on employer provided private fuel Contributions required by your employer To illustrate how expensive a company car can

Web Calculate tax on employees company cars Expenses and benefits for employers Running payroll Web 45p per mile for the first 10 000 miles you travel for work in a year After that the rate drops to 25p These are called Approved Mileage Allowance Payments AMAP If your

Download Company Car Fuel Tax Rebate

More picture related to Company Car Fuel Tax Rebate

This Is An Attachment Of 2023 LG Rebates Printable Rebate Form From

https://www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-iowa-energy-rebates-printable-rebate-form-from-bayer-rebates-2023-post.png

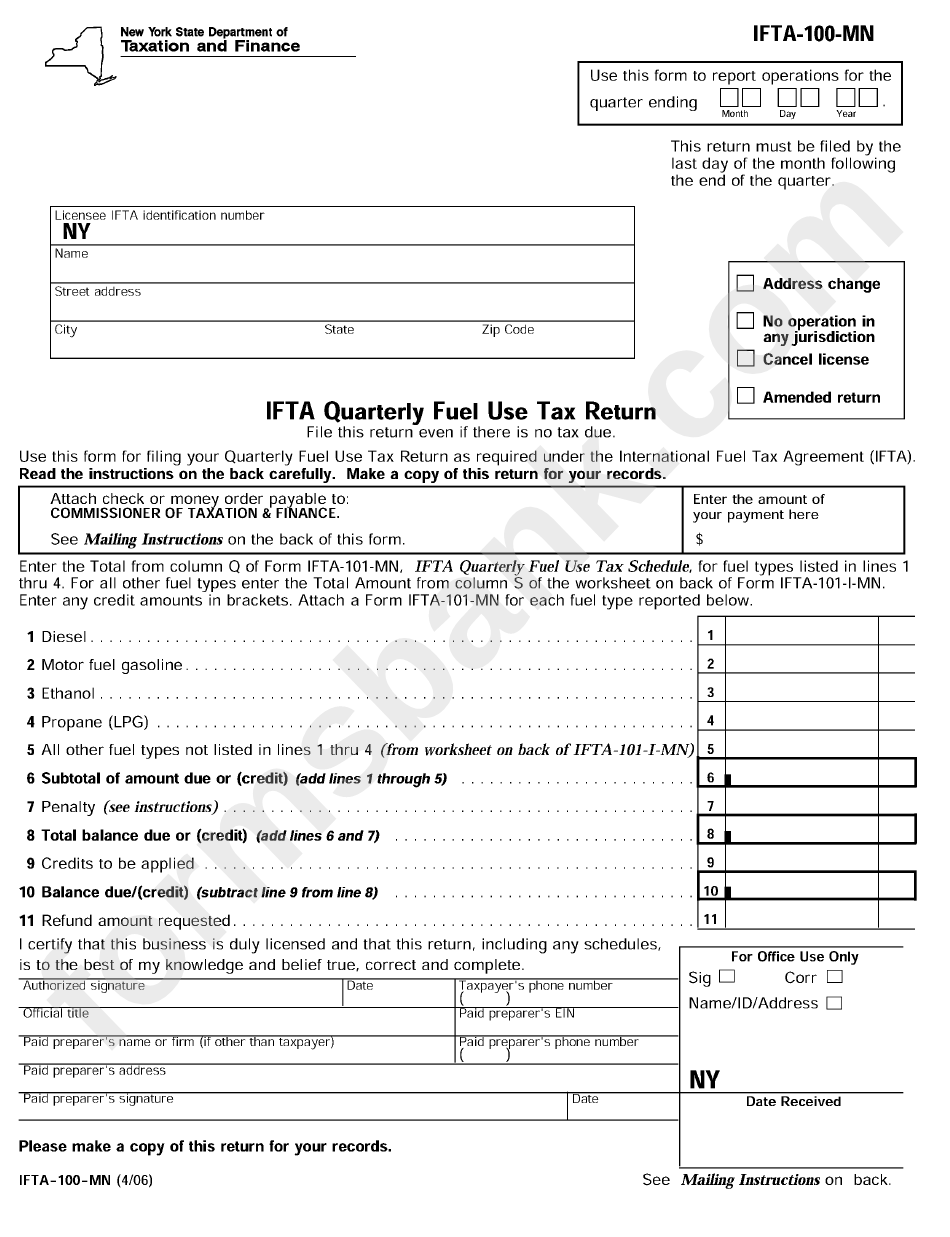

Form Ifta 100 Mn Ifta Quarterly Fuel Use Tax Return Printable Pdf

https://data.formsbank.com/pdf_docs_html/229/2297/229768/page_1_bg.png

Texas Dyed Diesel Bonded User Fuels Tax Report Fill Out And Sign

https://www.signnow.com/preview/100/289/100289841/large.png

Web We at DSR Tax Refunds hope that this guide has answered your questions about the taxation of your company car but if you think you are due a tax refund give our team of Web The rate is set at 8p per mile from the 1 December 2022 If you are claiming a mileage tax rebate for using your own electric car for work you should use the standard AMAP rates

Web 1 avr 2022 nbsp 0183 32 Rather than cut fuel taxes the French government has instead opted for a rebate on the price of petrol and diesel which comes into force on Friday April 1st Web 1 juin 2022 nbsp 0183 32 The tables outline how to work out the percentage benefit for both petrol powered cars and hybrid powered cars The figures for the 2022 23 tax year will be

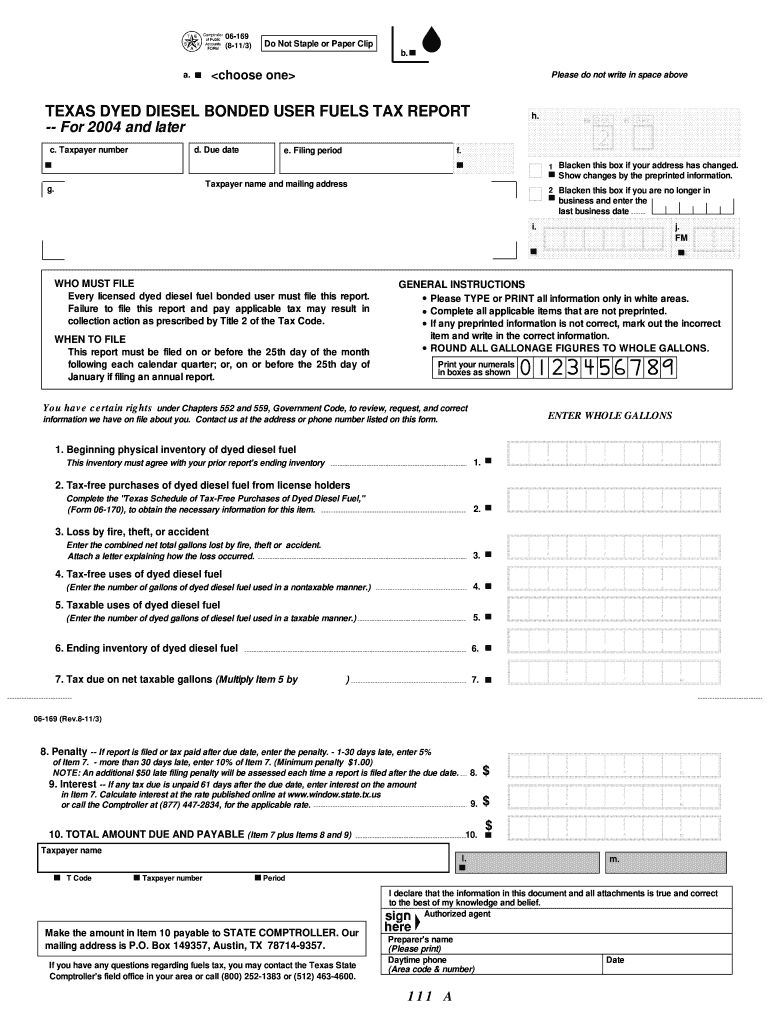

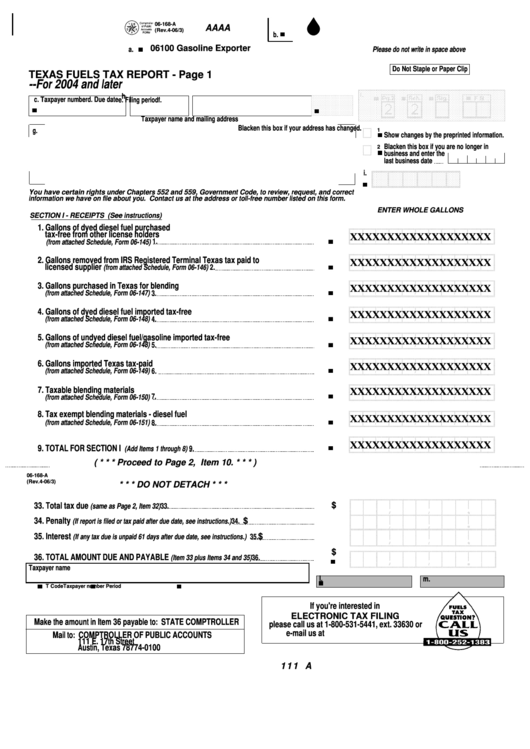

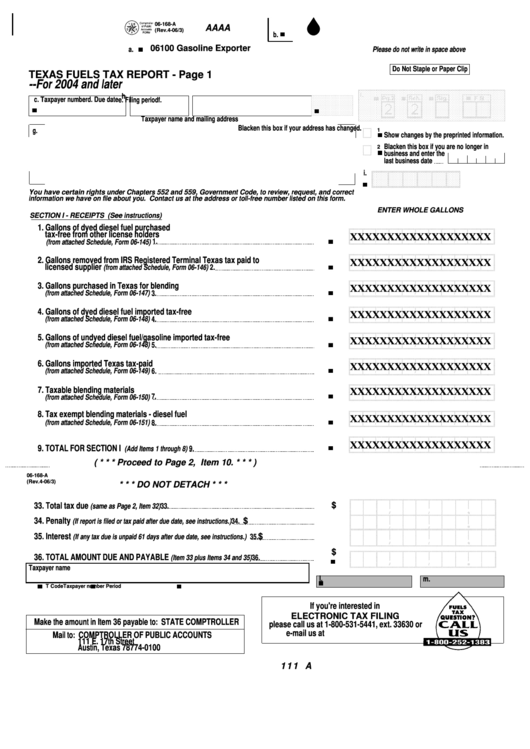

Fillable Form 06 168 Texas Fuels Tax Report 2004 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/230/2301/230116/page_1_thumb_big.png

What Are Fuel Tax Rebates Explained Vimcar Resources

https://blog-media.vimcar.com/uk-blog/uploads/2021/02/09113745/fuel-tank-on-empty.jpg

https://www.gov.uk/guidance/taxable-fuel-provided-for-company-cars-a…

Web 30 d 233 c 2019 nbsp 0183 32 The car fuel benefit charge is calculated by multiplying 2 figures a fixed sum of 163 24 600 for 2021 to 2022 163 24 500 for 2020 to 2021

https://www.gov.uk/guidance/advisory-fuel-rates

Web 21 juil 2020 nbsp 0183 32 Reimburse employees for company car business travel If the mileage rate you pay is no higher than the advisory fuel rates for the engine size and fuel type of the

Fillable Form Au 725b Motor Vehicle Fuels Tax Farm Use Only

Fillable Form 06 168 Texas Fuels Tax Report 2004 Printable Pdf Download

Vehicle Excise Tax Calculator DeenahZikra

REV 643 Motor Fuels Tax Reimbursement Claim Form In Truck

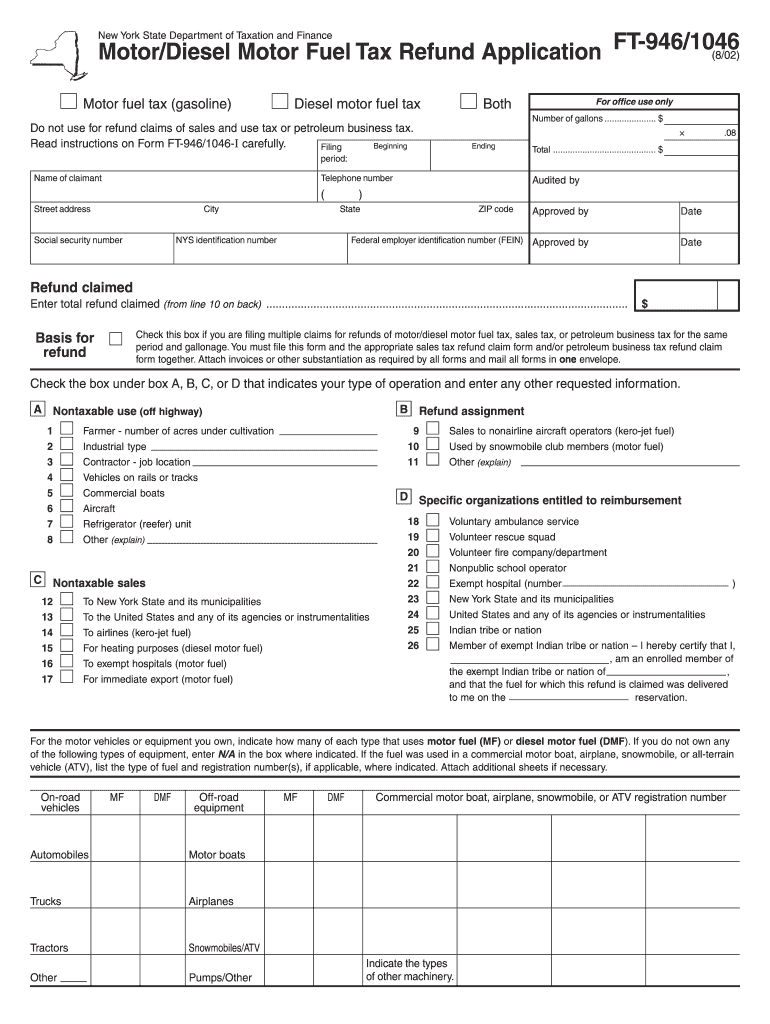

New York Motordiesel Fuel Tax Refund Application Form Fill Out And

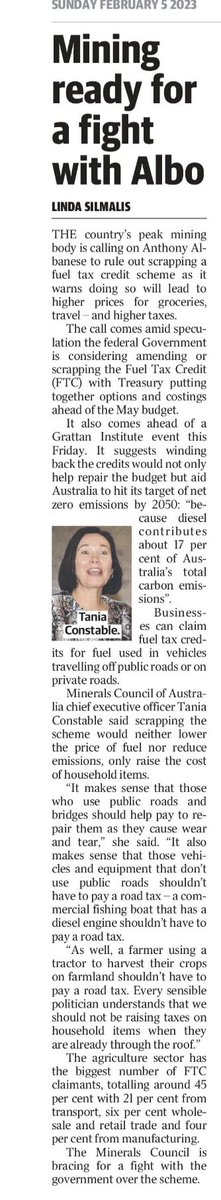

Tom Chesson On Twitter Labor Looking To Scrap The Fuel Tax Credits

Tom Chesson On Twitter Labor Looking To Scrap The Fuel Tax Credits

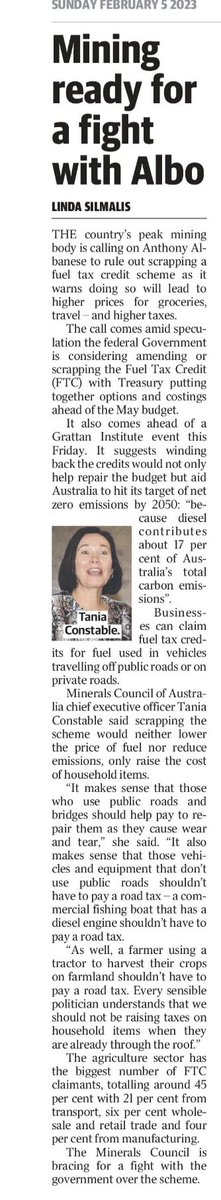

Liquid Fuels And Fuels Tax Report Form Printable Pdf Download

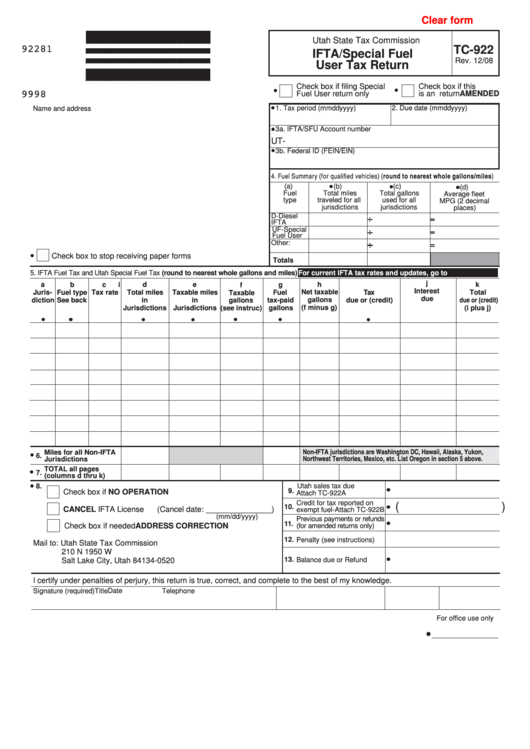

Fillable Ifta special Fuel User Tax Return Printable Pdf Download

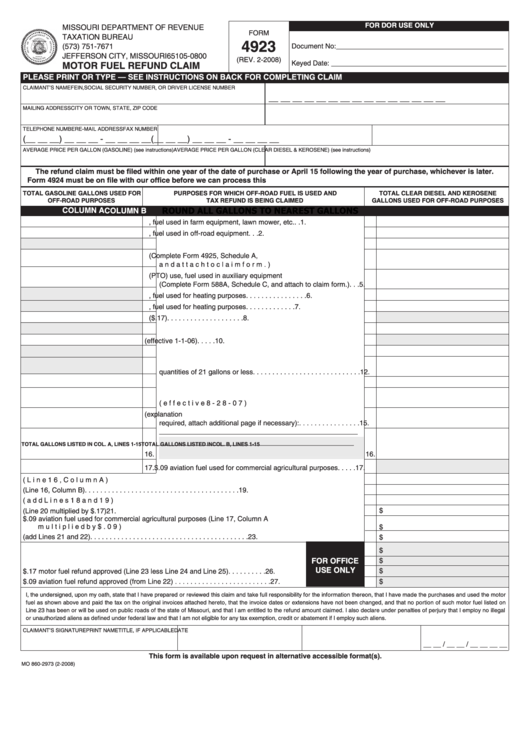

Form 4923 Motor Fuel Refund Claim February 2008 Printable Pdf Download

Company Car Fuel Tax Rebate - Web 11 avr 2023 nbsp 0183 32 In the current 2023 24 tax year all fully electric cars are eligible for a 2 BiK rate and this is set to stay the same until it changes in April 2025 This is a huge subsidy