Company Car Tax Rebate Web 11 avr 2023 nbsp 0183 32 To find out how much of a reduction in company car tax you re eligible for use the company car tax calculator on HM Revenue amp Customs website

Web 3 sept 2021 nbsp 0183 32 Company cars aren t completely free however Depending on the type of car and how you use it you will likely have to make some payments on any company car as a benefit in kind tax In this guide we ll explain how benefit in kind tax works and Web 21 oct 2022 nbsp 0183 32 There are two thresholds for the commercial tax credit Vehicles that weigh less than 14 000 pounds qualify for up to 7 500 those that weigh more than that qualify for up to 40 000 The

Company Car Tax Rebate

Company Car Tax Rebate

https://www.carrebate.net/wp-content/uploads/2022/08/mceleney-chevrolet-buick-gmc-toyota-hurry-these-new-car-savings-won-t.jpg

Electric Car Tax Rebate California ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/californias-ev-rebate-changes-a-good-model-for-the-federal-ev-tax.png

Electric Car Rebates Washington State 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/ma-tax-rebates-electric-cars-2022-carrebate-2.jpg?w=358&h=537&ssl=1

Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed once in a Web 7 janv 2023 nbsp 0183 32 If you run a business you may be interested in the commercial tax credit for EVs which provides up to 7 500 for a light vehicle and up to 40 000 for a larger vehicle like a delivery truck If

Web 22 mars 2022 nbsp 0183 32 The relevant BIK percentage is applied to the list price of the car which must include the cost of the battery even when this is leased separately by the business The employer will have a Class 1A NIC charge on the BIK currently at the rate of 13 8 Web Benefits of Tesla for Business Company Car Tax Benefit in Kind From 6th April 2022 both new and existing Tesla cars are eligible for a 2 percent BiK rate for the 2022 23 tax year The BiK rate will be held at 2 percent for 2023 24 amp 2024 25 The average petrol or

Download Company Car Tax Rebate

More picture related to Company Car Tax Rebate

Tax Rebates On New Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/electric-car-tax-credits-and-rebates-charged-future-1.jpeg

Tax Rebate Lease Electric Car 2022 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/does-a-leased-electric-car-qualify-for-tax-credit-car-retro-2.jpg

Ev Car Tax Rebate Calculator 2022 Carrebate

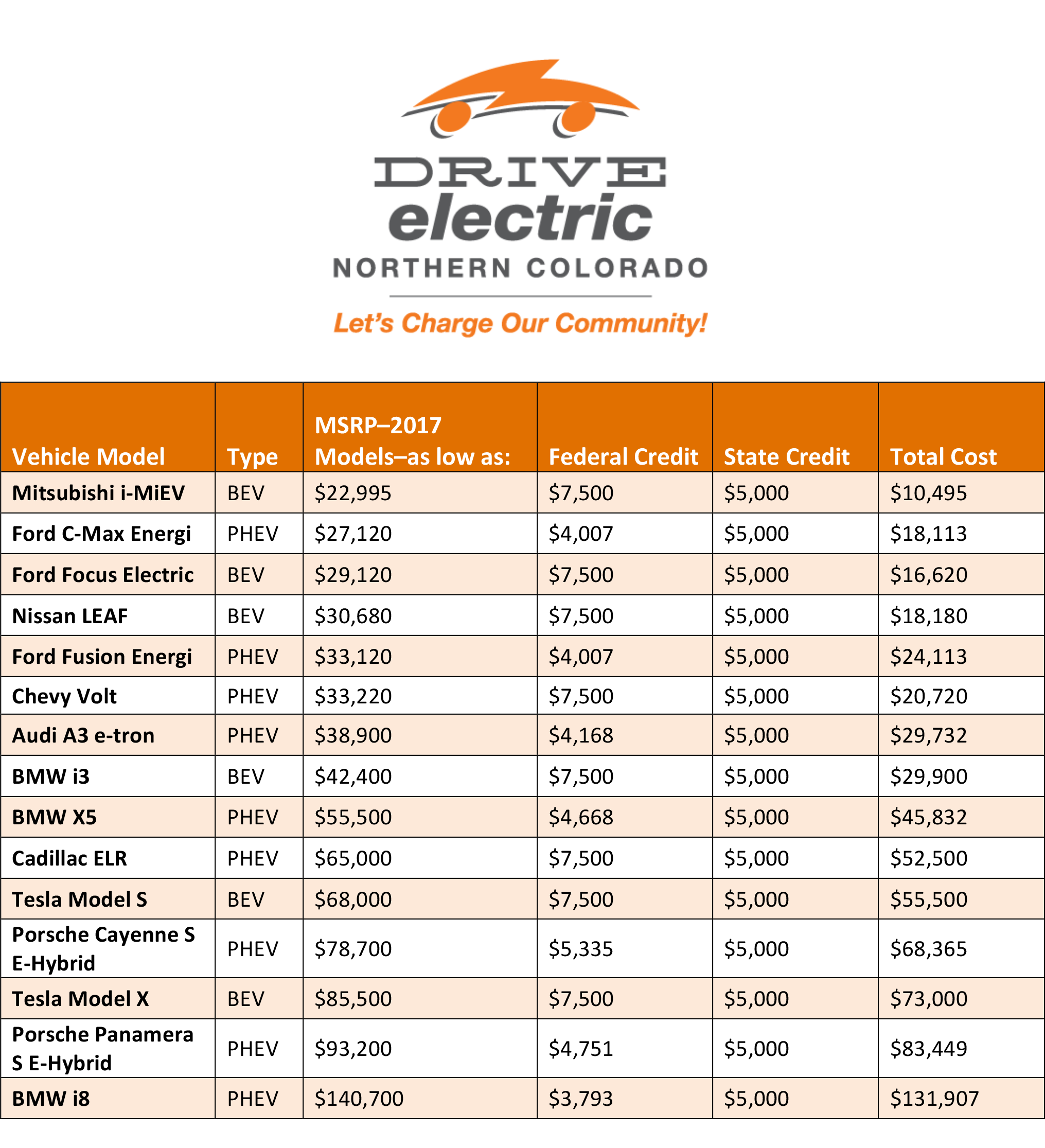

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

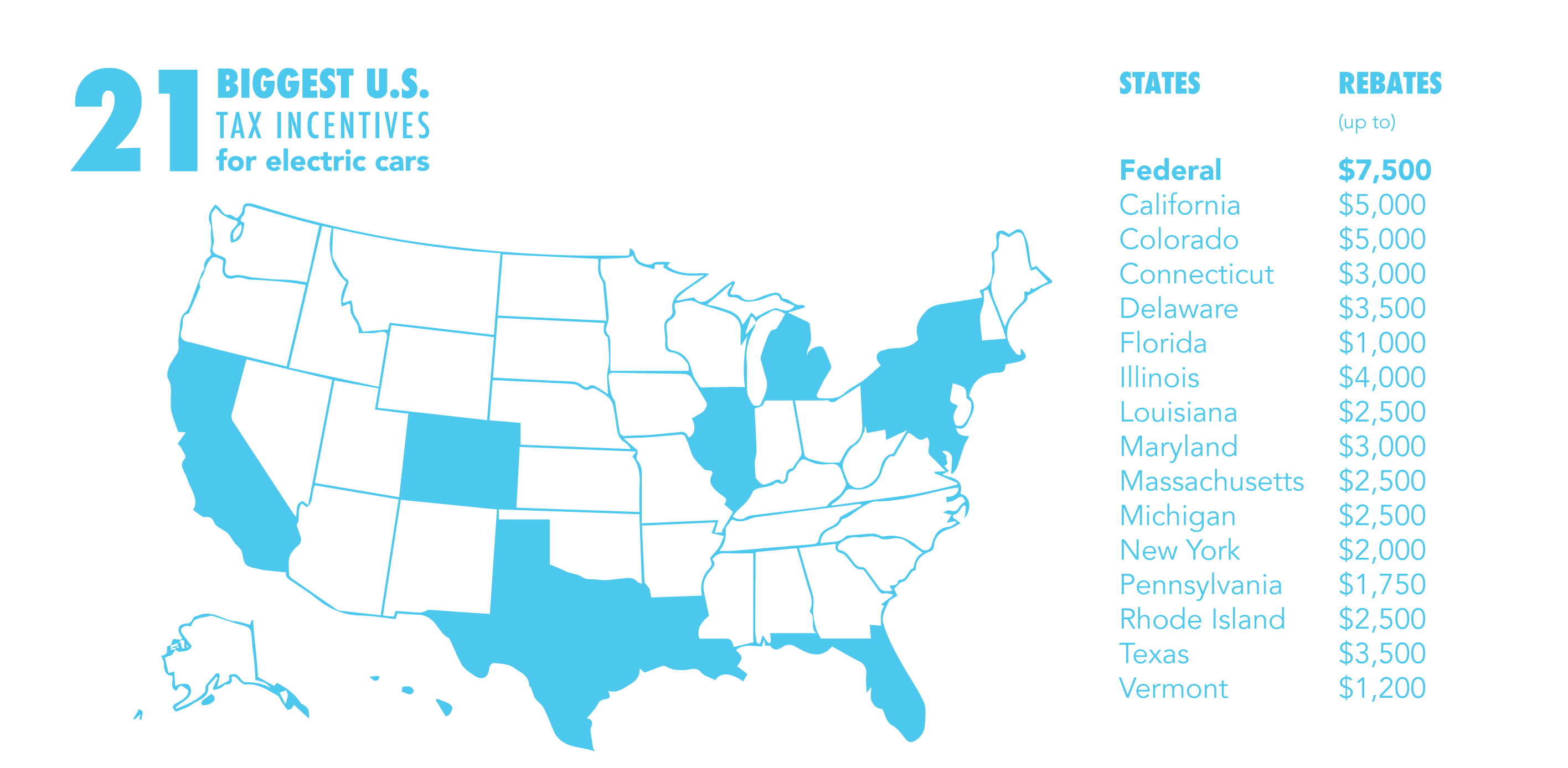

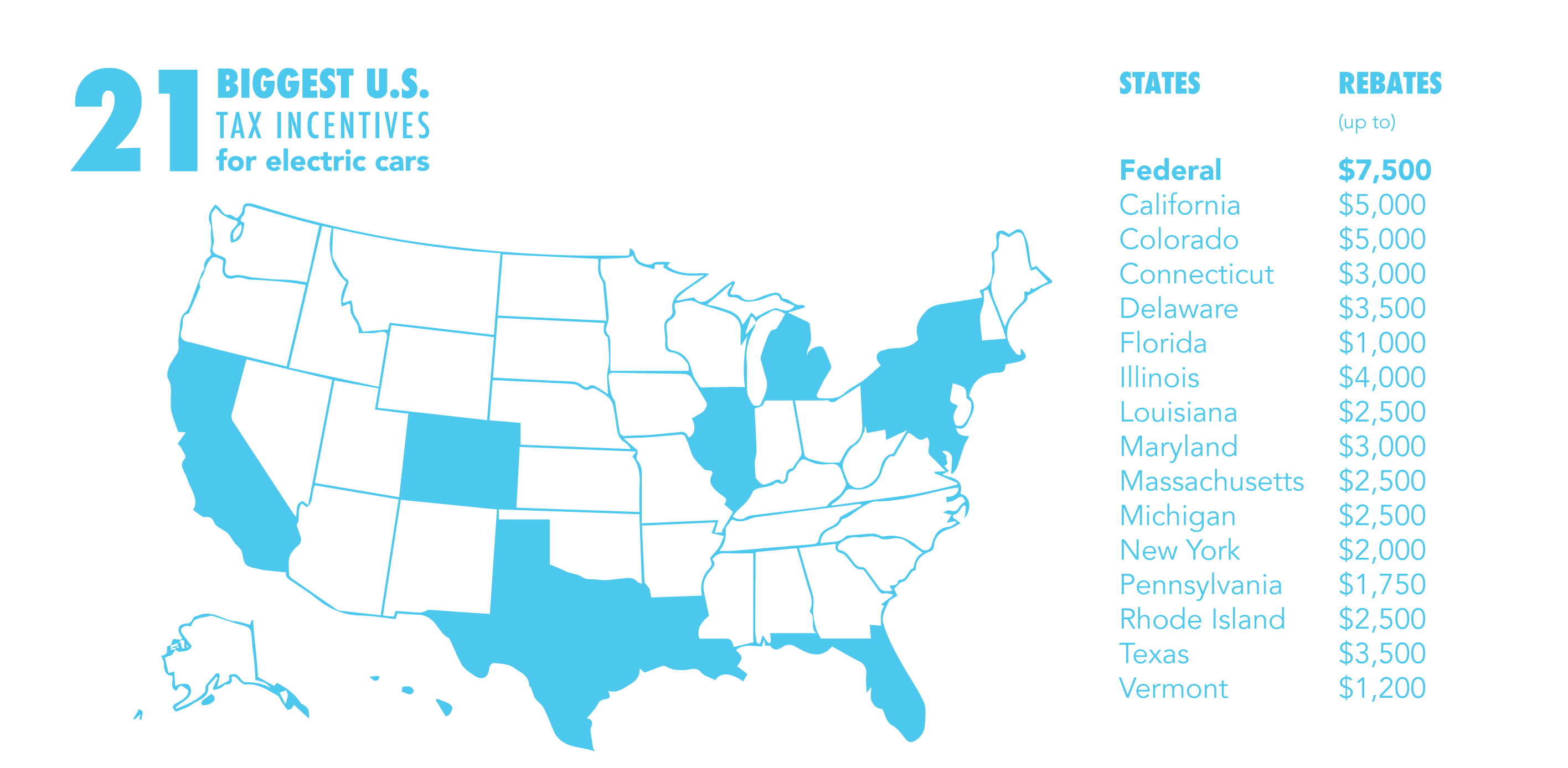

Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only qualifies for the leasing company Web Il y a 21 heures nbsp 0183 32 Lower income buyers could get up to 12 000 California is eliminating its popular electric car rebate program which often runs out of money and has long waiting lists to focus on

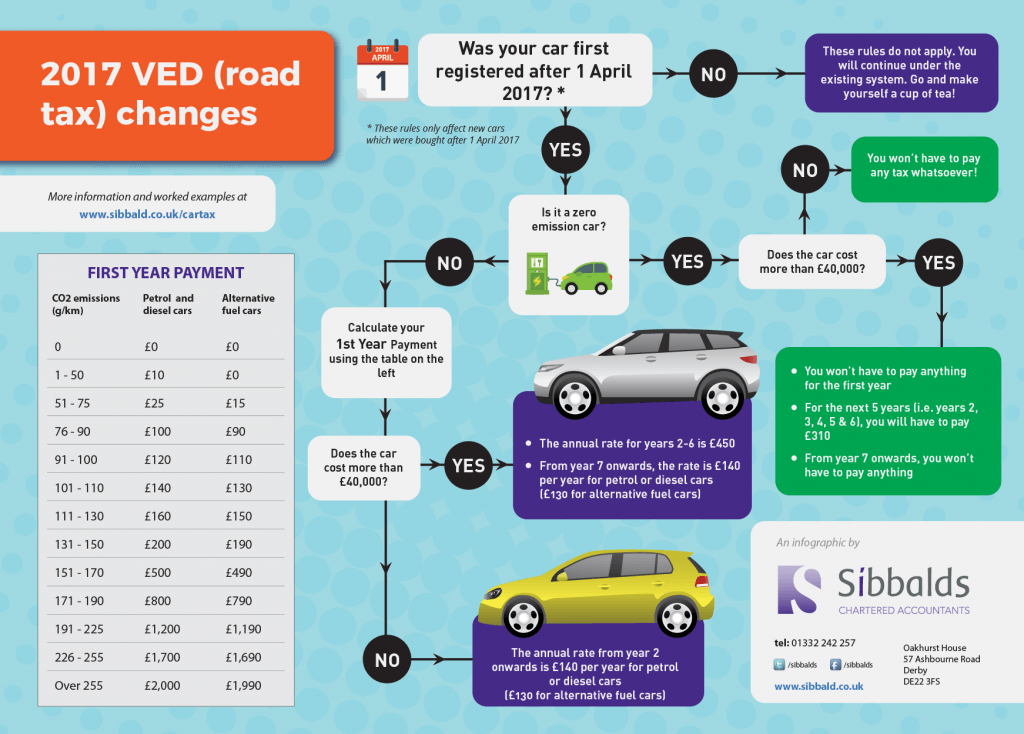

Web 10 ao 251 t 2023 nbsp 0183 32 What is a car tax Rebate A car tax Rebate also known as a road tax refund is money you get back on any excise duty you ve already paid on your vehicle Is the DVLA reimbursing taxes Yes if you have the proper documents You can get some of Web You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel If your employer

Tax Rebates Electric Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/21-biggest-us-tax-incentives-for-electric-cars.png

Government Tax Rebates For Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/are-the-tax-rebates-for-electric-and-hybrid-cars-worth-it-lionsgate-7.png?w=567&h=378&ssl=1

https://www.carbuyer.co.uk/tips-and-advice/115642/company-car-tax...

Web 11 avr 2023 nbsp 0183 32 To find out how much of a reduction in company car tax you re eligible for use the company car tax calculator on HM Revenue amp Customs website

https://www.moneyexpert.com/.../benefit-in-kind-company-car-tax-expla…

Web 3 sept 2021 nbsp 0183 32 Company cars aren t completely free however Depending on the type of car and how you use it you will likely have to make some payments on any company car as a benefit in kind tax In this guide we ll explain how benefit in kind tax works and

Tax On Company Cars Calculator CALCULATORSA

Tax Rebates Electric Cars 2023 Carrebate

What Is The Tax Rebate For Electric Cars 2023 Carrebate

Ev Car Tax Rebate Calculator 2022 Carrebate

2017 VED Road Tax UK Car Tax Calculator Sibbalds Chartered

Tax Rebate RM20 000 X 3 Years On Investment Holding Company Apr 20

Tax Rebate RM20 000 X 3 Years On Investment Holding Company Apr 20

Nys Charges Tax On Car Rebates 2023 Carrebate

Tax Rebates For Electric Car 2023 Carrebate

Government Rebate For Buying A Hybrid Car 2022 Carrebate

Company Car Tax Rebate - Web The company car tax on electric cars is currently at a rate of 2 The rate is also known as the benefit in kind BIK rate and is used to work out how much tax is payable on an electric company car The government is keeping the BIK rate for electric cars considerably