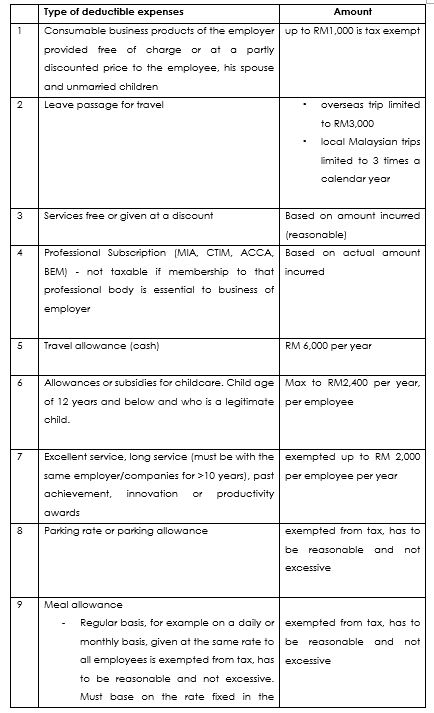

Company Tax Deductible Expenses Malaysia 2022 PwC 2021 2022 Malaysian Tax Booklet 1 INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for

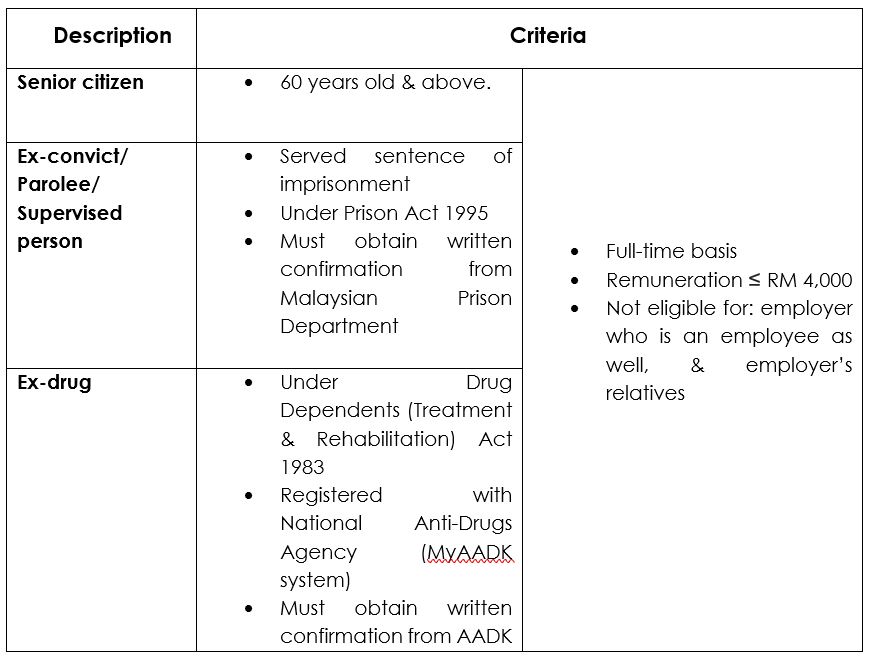

Applications must be received by 31 December 2022 The government has proposed an extension of this incentive but details have not been released yet Income tax rates Resident companies are taxed at the rate of 24 while those with paid up capital of RM2 5 million or less and gross business income of not more than RM50

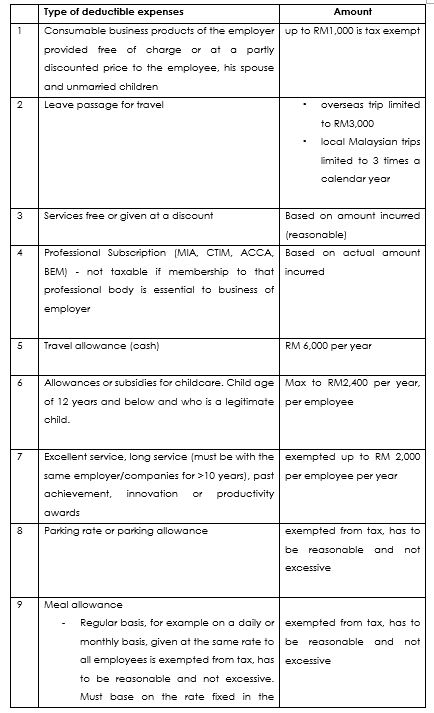

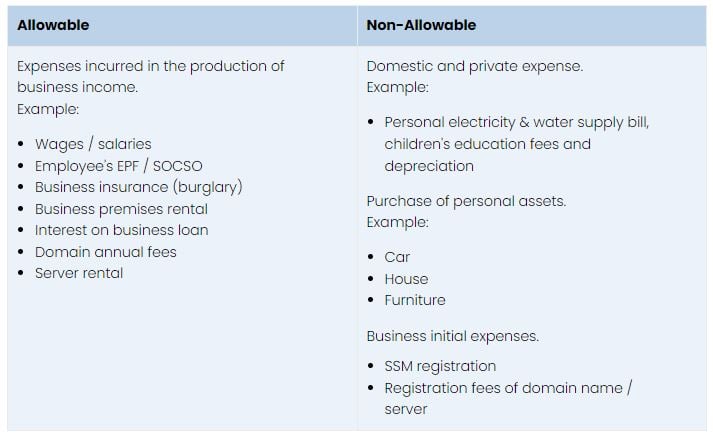

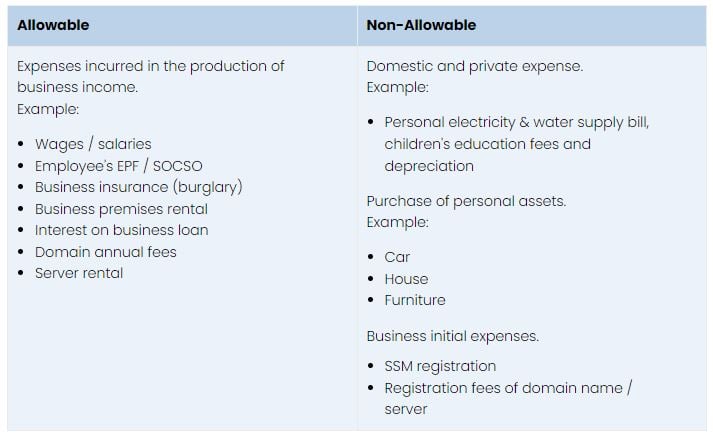

Company Tax Deductible Expenses Malaysia 2022

Company Tax Deductible Expenses Malaysia 2022

https://cdn.shopify.com/s/files/1/0070/7032/files/non-deductible-expenses.png?format=jpg&quality=90&v=1666892015

13 Tax Deductible Expenses Business Owners Need To Know About CPA

https://gurianco.com/wp-content/uploads/2018/11/tax-deductions.png

How To Calculate Mileage Claim In Malaysia Tracey Ellison

https://chengco.com.my/wp/wp-content/uploads/2021/08/Point-14.jpg

Corporate Taxes on corporate income Last reviewed 06 December 2023 For both resident and non resident companies corporate income tax CIT is imposed Restriction on Deductibility of Interest Guidelines 2022 Revised Guidelines on Tax Deduction of Secretarial and Tax Filing Fees Updated FAQ in relation to Withholding

Any balance of unabsorbed adjusted business losses is to be disregarded from the year of assessment 2031 11 Special Provision Effective year of assessment 2019 the time Extending the tax deduction for manufacturing and manufacturing related service companies on rental expenses incurred on premises used as employees

Download Company Tax Deductible Expenses Malaysia 2022

More picture related to Company Tax Deductible Expenses Malaysia 2022

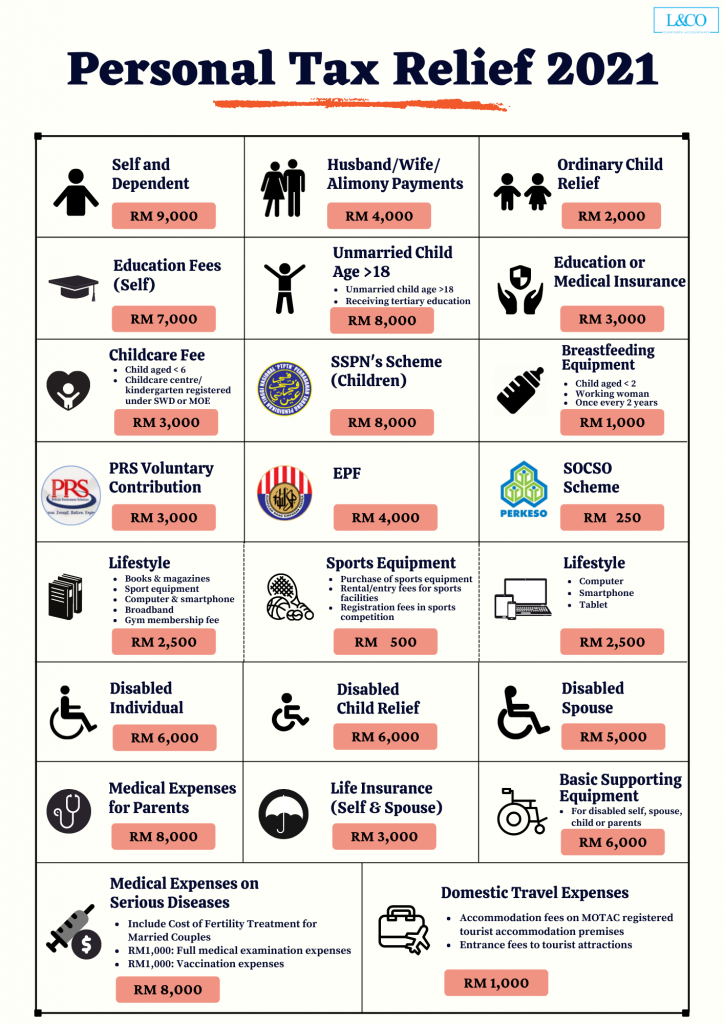

Malaysia Income Tax Here Are The Tax Reliefs To Claim For YA 2022

https://storage.googleapis.com/buro-malaysia-storage/www.buro247.my/2023/03/e94fe23e-tax-relief-infographic-02.jpg

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

Have Fun Without Worries It s Tax Deductible

https://www.yycadvisors.com/images/entertainmenttaxcompressed.jpg

Tax Rate of Company Tax Payment Update Company Information Appeal Corporate Tax Cooporative Tax Non Resident Company Company Resident Status Certificate Malaysia adopts a territorial system of income taxation A company or corporate whether resident or not is assessable on income ACCRUED IN OR DERIVED FROM

On 17 August 2022 Lembaga Hasil Dalam Negeri Malaysia LHDNM issued a revised Guideline on deductible expenses related to secretarial as well as tax 2022 Income tax relief of up to RM 3 000 is provided for deferred annuity premium payment in the Private Retirement Scheme PRS Relief period will be extended for 4 years to be

Car Allowance Taxable In Malaysia JorgefvSullivan

https://chengco.com.my/wp/wp-content/uploads/2021/08/POINT14.jpg

Is Ang Pow Taxable In Malaysia Pippa MacLeod

https://chengco.com.my/wp/wp-content/uploads/2021/08/Point-10.jpg

https://www.pwc.com/my/en/assets/publications/2021/...

PwC 2021 2022 Malaysian Tax Booklet 1 INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for

https://taxsummaries.pwc.com/malaysia/corporate/...

Applications must be received by 31 December 2022 The government has proposed an extension of this incentive but details have not been released yet

KTP Company PLT Audit Tax Accountancy In Johor Bahru

Car Allowance Taxable In Malaysia JorgefvSullivan

KTP Company PLT Audit Tax Accountancy In Johor Bahru

Investment Expenses What s Tax Deductible Charles Schwab

Personal Tax Relief 2021 L Co Accountants

Are Quotes Copyrighted In India

Are Quotes Copyrighted In India

Have Fun Without Worries It s Tax Deductible

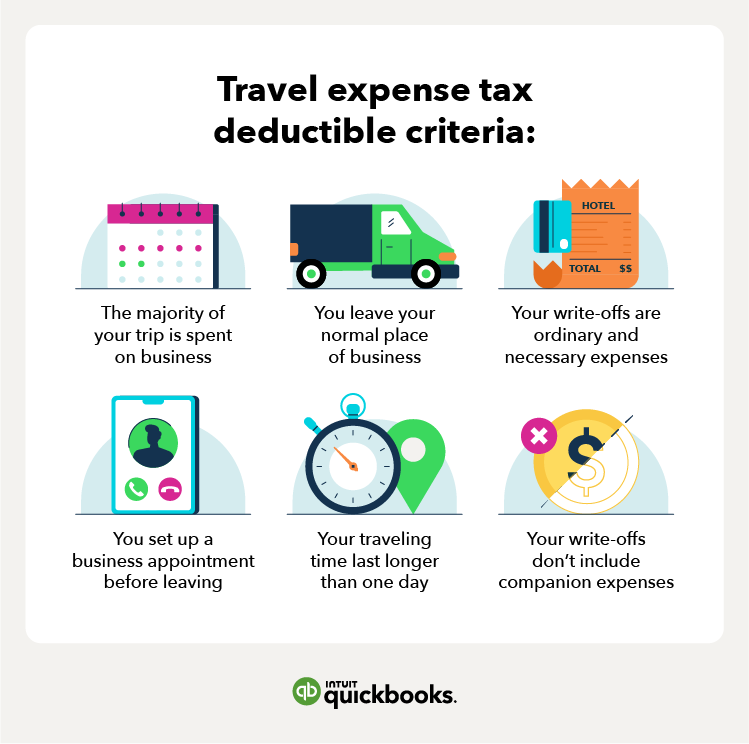

10 Ultimate Tips Starting A Blog Writing Off Travel Expenses 2023

How To Claim Tax Deductions For Donations And Gifts

Company Tax Deductible Expenses Malaysia 2022 - Corporate Taxes on corporate income Last reviewed 06 December 2023 For both resident and non resident companies corporate income tax CIT is imposed