Company Tax Rebate Singapore Web 28 f 233 vr 2023 nbsp 0183 32 Corporate Tax Relief Partial Tax Exemption PTE For All Companies In Singapore All companies in Singapore enjoy a

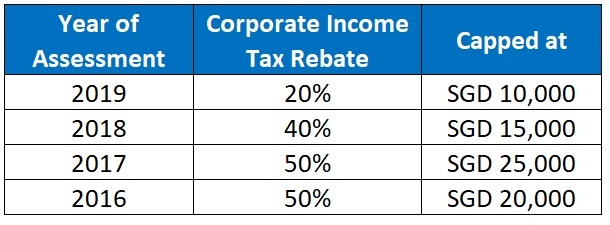

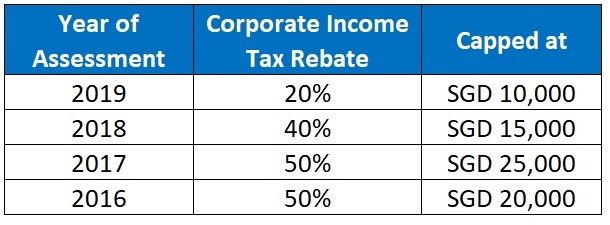

Web 18 f 233 vr 2020 nbsp 0183 32 All Singapore companies are eligible for corporate income tax rebate regardless of profit levels or paid up capital amount The following table lists the Web Help My Business through COVID 19 Corporate Income Tax Rebate for YA2020 No application is required Companies will be granted a 25 Corporate Income Tax Rebate

Company Tax Rebate Singapore

Company Tax Rebate Singapore

https://www.accountingsolutionssingapore.com/wp-content/uploads/CIT-2018.jpg

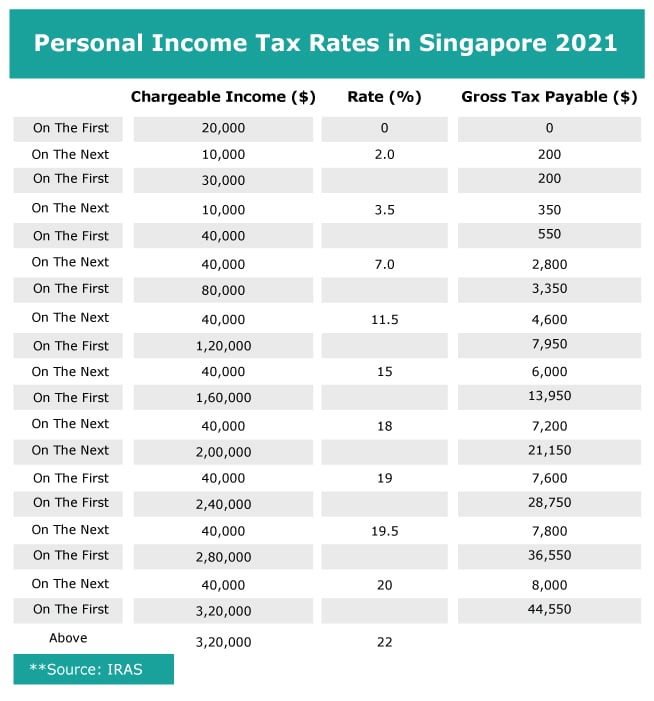

All You Need To Know About Taxation In Singapore Taxofindia

https://www.singaporecompanyincorporation.sg/wp-content/uploads/effective-corporate-tax-rate-full-exemption.jpg

Singapore Corporate Tax Rebate Ya 2022 Rebate2022

https://www.rebate2022.com/wp-content/uploads/2023/05/singapore-corporate-tax-rate-singapore-taxation-guide-2021.jpg

Web Note After 15 corporate tax rebate Max 40 000 The SME sector contributes more than 50 percent of economic output and 70 percent of employment in the country and need all the help they can get to grow Web 15 mars 2020 nbsp 0183 32 Corporate Income Tax Rebate Crowe Singapore home Blog Corporate Income Tax Rebate Singapore Budget 2020 15 03 2020 To help businesses cushion

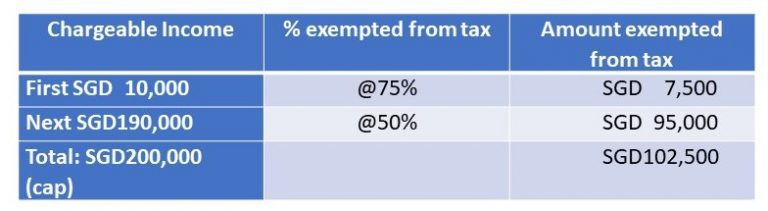

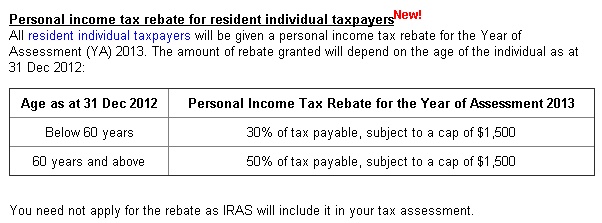

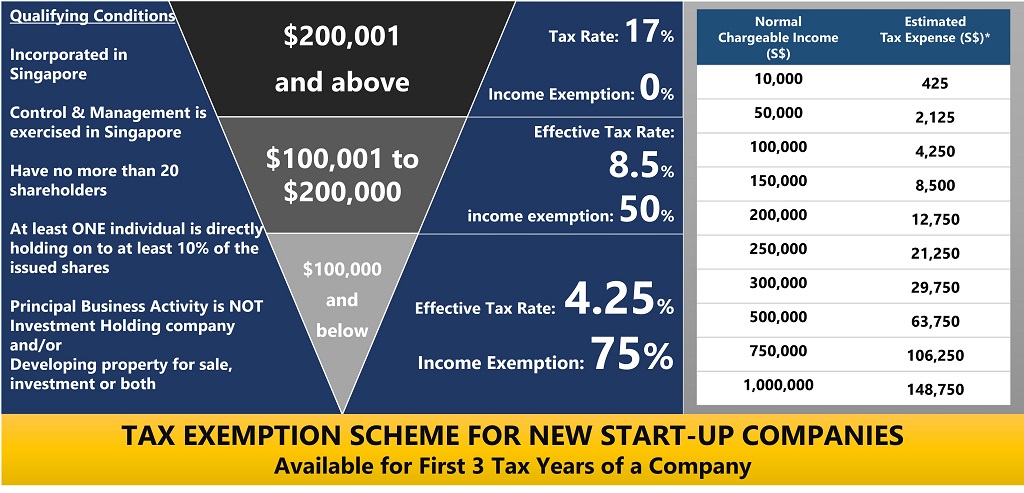

Web 18 f 233 vr 2020 nbsp 0183 32 If a company s chargeable income is SGD250 000 for YA2020 the total income exempted from tax would be SGD125 000 SGD75 000 SGD 50 000 and final chargeable income would be Web February 2 2022 What s in the article Corporate Income Tax Exemption Schemes Corporate Income Tax CIT Rebate for YAs 2013 to 2020 There s no denying that

Download Company Tax Rebate Singapore

More picture related to Company Tax Rebate Singapore

Understanding Corporate Tax In Singapore ContactOne

https://i2.wp.com/www.contactone.com.sg/wp-content/uploads/2017/11/Illustration-Tax-Exemption-Scheme-Partial.png?resize=1024%2C494&ssl=1

Why Invest In India Through A Singapore Company Rikvin Pte Ltd

https://www.rikvin.com/wp-content/uploads/singapore-corporate-tax-rate-infographic.jpg

Overview Of Singapore Corporate Taxation System JSE Office

https://jseoffices.com/wp-content/uploads/2018/06/no-11-768x211.jpg

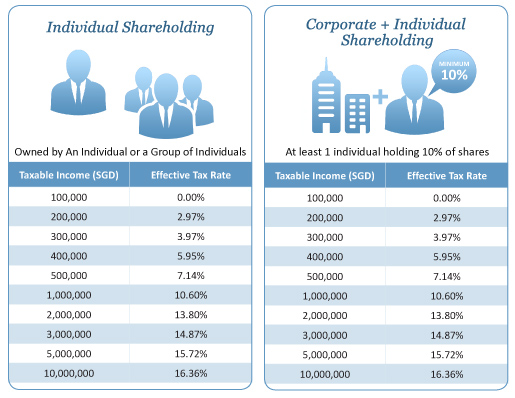

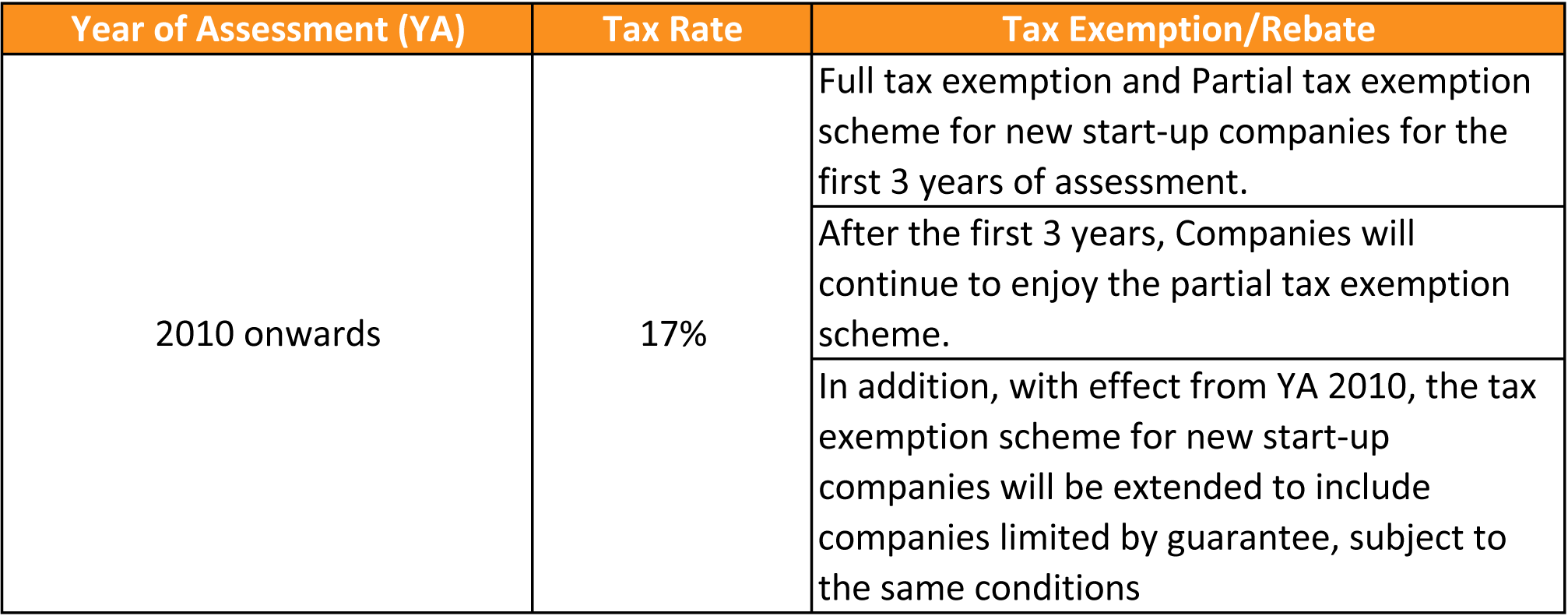

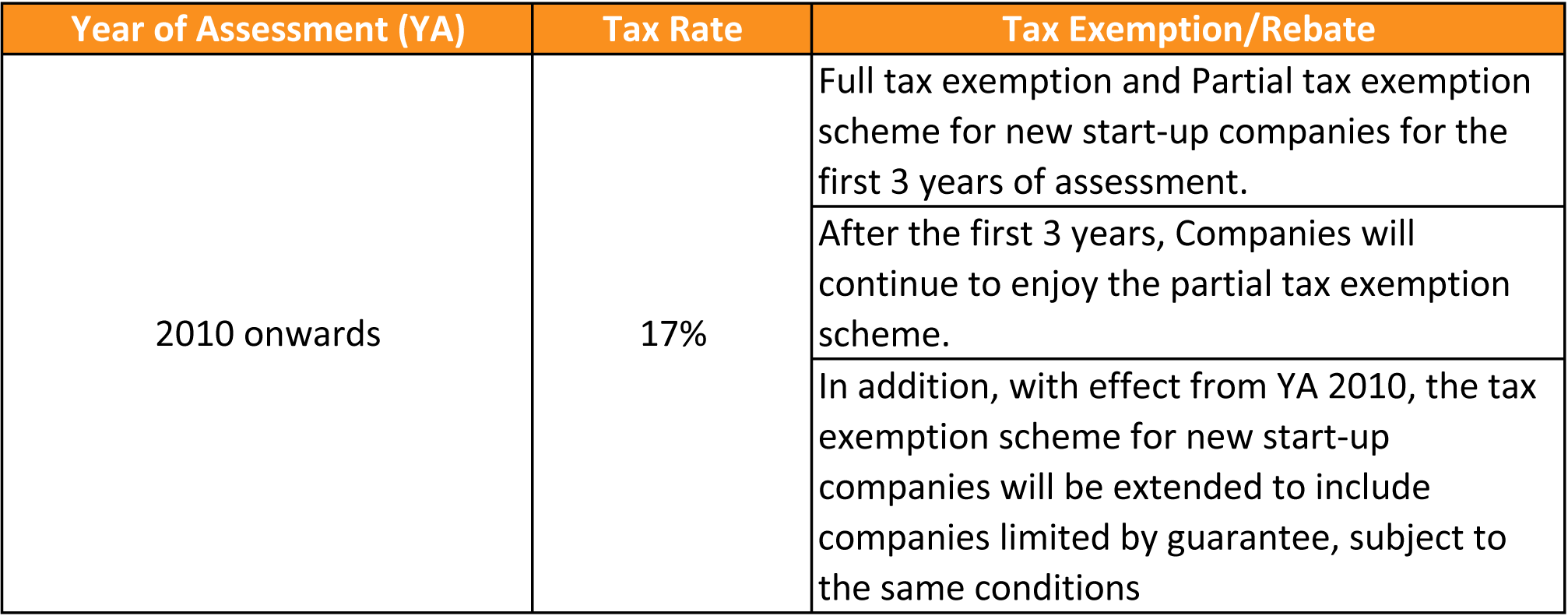

Web 10 janv 2022 nbsp 0183 32 Since 2010 the headline corporate tax rate in Singapore is a flat 17 on the company s chargeable income To keep Singapore competitive the government Web 14 mars 2023 nbsp 0183 32 The corporate income tax rebate is designed to assist businesses that are liable to pay taxes However small and medium sized enterprises SMEs who are the primary beneficiaries of the rebate

Web 4 mai 2023 nbsp 0183 32 Tax on corporate income is imposed at a flat rate of 17 A partial tax exemption and a three year start up tax exemption for qualifying start up companies are Web 16 f 233 vr 2021 nbsp 0183 32 Tax highlights of Budget 2021 for companies 09 March 2021 Share Singapore s Deputy Prime Minister and Minister for Finance Mr Heng Swee Keat

Corporate Tax In Singapore Company Incorporation In Singapore

http://www.paulhypepage.com/wp-content/uploads/2012/06/Corporate-Tax-Table-1.png

2020 Singapore Corporate Tax Update Singapore Taxation

https://www.paulhypepage.my/wp-content/uploads/2020/05/Infographic-Tax-Corporate-Relief-Singapore-New-Startup.jpg

https://dollarsandsense.sg/business/complete …

Web 28 f 233 vr 2023 nbsp 0183 32 Corporate Tax Relief Partial Tax Exemption PTE For All Companies In Singapore All companies in Singapore enjoy a

https://pwco.com.sg/guides/corporate-tax-rebate

Web 18 f 233 vr 2020 nbsp 0183 32 All Singapore companies are eligible for corporate income tax rebate regardless of profit levels or paid up capital amount The following table lists the

Bulicenas Singapore Tax Rebates

Corporate Tax In Singapore Company Incorporation In Singapore

WorkSmart Asia Singapore Announces SME friendly Budget 2016

Understanding Corporate Tax In Singapore ContactOne

A Guide To Taxes And Tax Relief R singaporefi

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Understanding Singapore Taxes In 5 Minutes

Singapore Budget 2019 GST Vouchers More CHAS Subsidies Income Tax

Singapore Personal Tax Taxation Guide

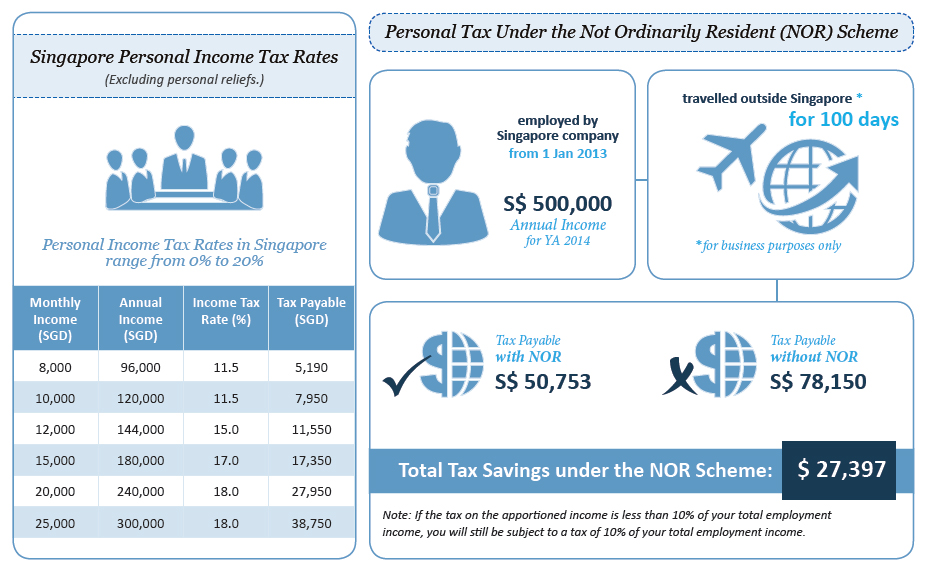

Company Tax Rebate Singapore - Web The rate for corporate income tax in Singapore is 17 and the tax legislation is relatively straightforward There are also added incentives in the form of a partial exemption from