Conditions For Income Tax Rebate On Home Loan Verkko 5 helmik 2023 nbsp 0183 32 Home Loan Tax Benefit Income Tax Benefit on House Loan know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and

Verkko 18 jouluk 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C Who is eligible to claim tax deductions on home loans Verkko 11 tammik 2023 nbsp 0183 32 On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at length how these

Conditions For Income Tax Rebate On Home Loan

Conditions For Income Tax Rebate On Home Loan

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

https://feeds.abplive.com/onecms/images/uploaded-images/2022/04/02/f76f68da854ba91279b6eb80f97615cb_original.jpg?impolicy=abp_cdn&imwidth=1200&imheight=628

Verkko 31 May 2022 Home Loan One of the primary benefits of home loans is that you get to enjoy substantial tax rebates which significantly reduce your tax outgo If you already have a home loan you can claim home loan tax benefits under various sections of the Income Tax Act including Section 24 b 80C 80EE and 80EEA Verkko under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan amount repayment you may claim tax benefit on stamp duty and registration payment as well but only once

Verkko 9 syysk 2022 nbsp 0183 32 Section 80EEA Under Section 80EEA a first time home buyer in India can claim an additional tax deduction of up to Rs 1 50 lakh annually over and above the limit provided under Section 24 on payment of home loan interest Section 80EEA Conditions Available for First time buyers Verkko Principal repayment of home loans can net annual tax deductions of up to Rs 1 5 lakh under Section 80C of the ITA On the interest payments for a home loan you can claim tax deductions of up to Rs 2 lakh as per Section 24 of the Income Tax Act

Download Conditions For Income Tax Rebate On Home Loan

More picture related to Conditions For Income Tax Rebate On Home Loan

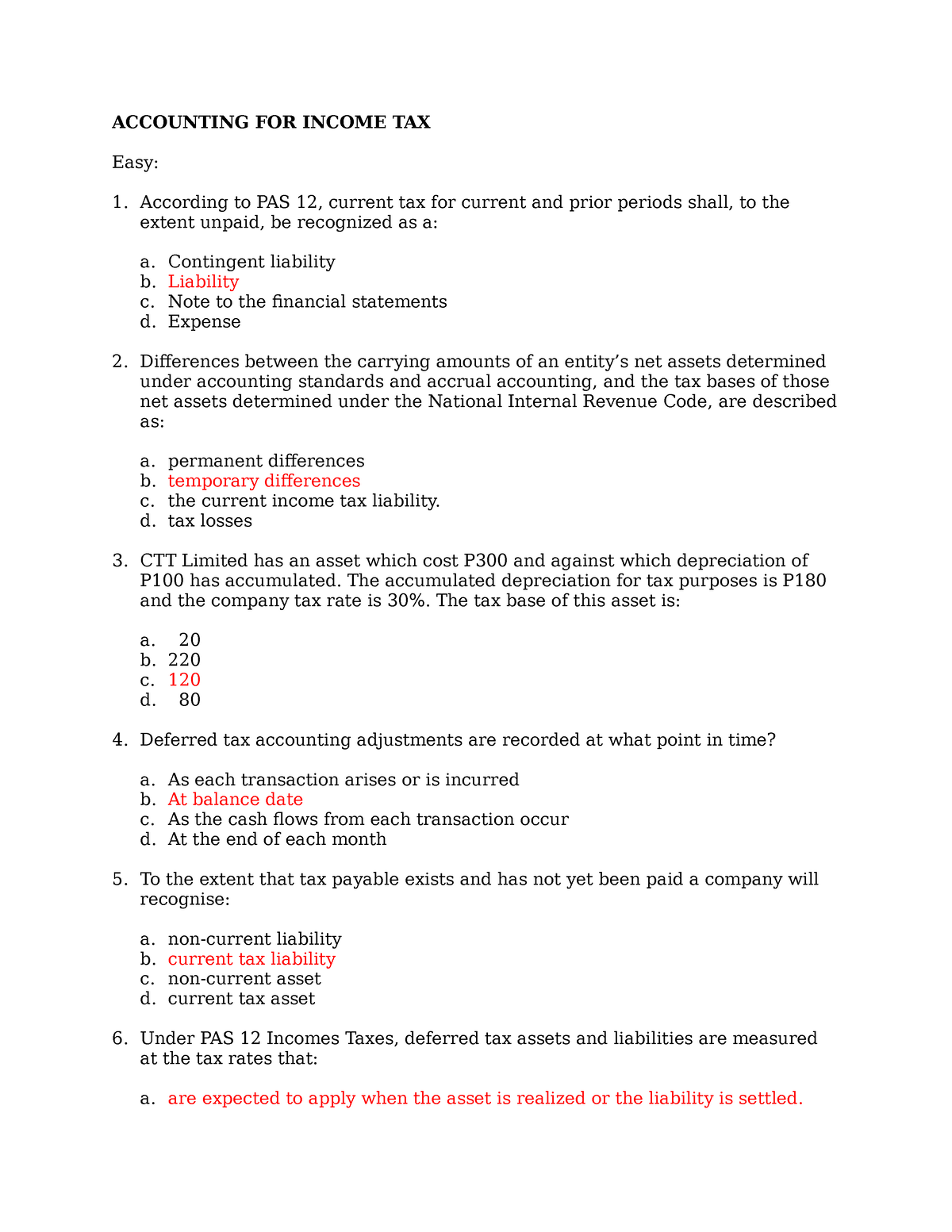

Accounting For Income Tax ACCOUNTING FOR INCOME TAX Easy According

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4dd23997c9a66529179438e4942faf81/thumb_1200_1553.png

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

What Are The Tax Benefits On Home Loans

https://cloudfrontgharpediabucket.gharpedia.com/uploads/2020/05/Tax-Benefits-on-Home-Loan-01-0905020005.jpg

Verkko Under Section 24 of the Income Tax Act an individual can claim a tax deduction of the interest payment on the housing loan up to a maximum amount of Rs 2 00 000 You can claim this deduction if you complete the building of the house within 5 years otherwise you can claim only Rs 30 000 Verkko Section 24 b offers income tax rebate on home loan but only on the interest part of the loan It is also applicable if you have taken a loan for home construction or renovation The deduction is applicable on the prepayment

Verkko 20 lokak 2023 nbsp 0183 32 As per Section 80C of the Income Tax Act You can claim a deduction of up to Rs 1 5 lakh on the amount paid as the repayment of the home loan principal This may include stamp duty and registration fees but can be claimed once in the same year in which they incurred Verkko You must be a co owner in the property To be able to claim tax benefits for a home loan you must be an owner in the property Many a time a loan is taken jointly but the borrower is not an owner as per the property documents In such a case you may not be able to claim tax benefits

How To File For Income Tax Online Auto Calculate For You

https://lh3.googleusercontent.com/taZHiZDjNseZXMc7QJuXIE4X0Xc5Iyz2sb-Nzb9r5FqvASiduSKxixNQuc-t-z7qSmXRrOVDaSfE3zaYZqQ2CNMK-VrJO89nyuLHMcq9M0PaRtrbiwy-eFewxGv541_DcISKjAng

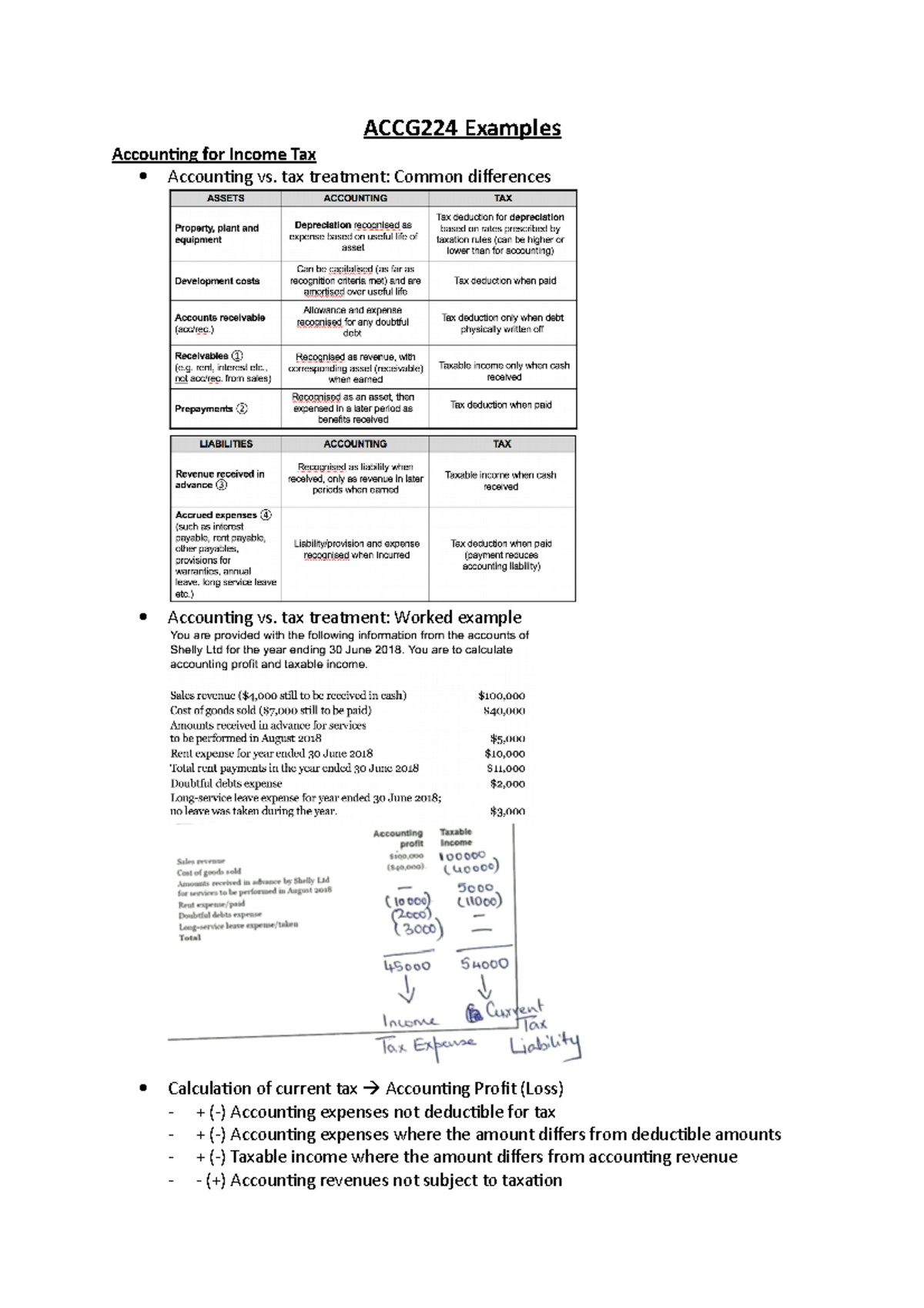

ACCG224 Examples ACCG224 Examples Accounting For Income Tax

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/66dc85bf9bb71a4ba85cc3dea53ca628/thumb_1200_1698.png

https://cleartax.in/s/home-loan-tax-benefit

Verkko 5 helmik 2023 nbsp 0183 32 Home Loan Tax Benefit Income Tax Benefit on House Loan know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and

https://cleartax.in/s/home-loan-tax-benefits

Verkko 18 jouluk 2023 nbsp 0183 32 how much tax benefit on home loan The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5 lakh under Section 80C Who is eligible to claim tax deductions on home loans

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

How To File For Income Tax Online Auto Calculate For You

ITR Filing Income Tax Exemptions And Deductions That Home Loan

Income Tax Chandigarh Sports Quota Recruitment HaryanaAlert In

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Benefits On Home Loan Loanfasttrack

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

InkPoint Media Breaking Down The New Income Tax Structure

Request Letter For Tax Certificate For Income Tax SemiOffice Com

Conditions For Income Tax Rebate On Home Loan - Verkko 20 helmik 2020 nbsp 0183 32 Each co applicant can claim a maximum tax rebate of up to Rs 1 50 lakh for principal repayment Section 80C and Rs 2 lakh for interest payment Section 24 The very first condition is the house property has to be bought by the individuals jointly and this should be in their joint names