Construction Industry Tax Rebate Web 20 juil 2017 nbsp 0183 32 You can claim a repayment of your Construction Industry Scheme deductions if you re a limited company subcontractor or an agent of a limited company

Web 4 janv 2022 nbsp 0183 32 The personal allowance for 2020 21 was 163 12 500 and this alone is worth 163 2 500 in tax relief for a basic rate taxpayer This means CIS workers normally overpay Web Construction worker Quickly calculate how big your CIS tax rebate is and what expenses you can claim Sometimes you can claim expenses even

Construction Industry Tax Rebate

Construction Industry Tax Rebate

https://static.wixstatic.com/media/cebb6d_19e191dff4f545af92a300d98c9526bd~mv2.png/v1/fill/w_980,h_619,al_c,q_90,usm_0.66_1.00_0.01,enc_auto/cebb6d_19e191dff4f545af92a300d98c9526bd~mv2.png

5 Essential Features Of Construction Rebate Management Software Enable

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/63f89906c7b20c2fca24794c_Construction.jpg

Types Of Rebates To Help Construction Companies Buildertrend

https://buildertrend.com/wp-content/uploads/2023/04/3-Rebates-waiting-for-you_full-graphic-1024x2701.png

Web Construction industry tax returns A self assessment tax return has to be completed by all CIS sub contractors and some PAYE workers If you work under PAYE only and you Web Those subcontracted in construction under CIS are often due annual Tax rebates This is mainly because too much Tax has been deducted from the sub contractors payments

Web START YOUR CIS TAX REBATE NOW ONLY 163 60 VAT 163 119 VAT GET STARTED Join over 7 900 happy customers and file your tax return with tax2u Are you Web 29 sept 2020 nbsp 0183 32 Construction Industry Scheme CIS tax rebate is available to CIS subcontractors who have overpaid income tax on their Self Assessment tax return

Download Construction Industry Tax Rebate

More picture related to Construction Industry Tax Rebate

CIS Tax Rebates Verulams

https://verulams.co.uk/wp-content/uploads/2022/01/construction-engineers-discussion-with-architects-at-construction-site-1024x540.jpg

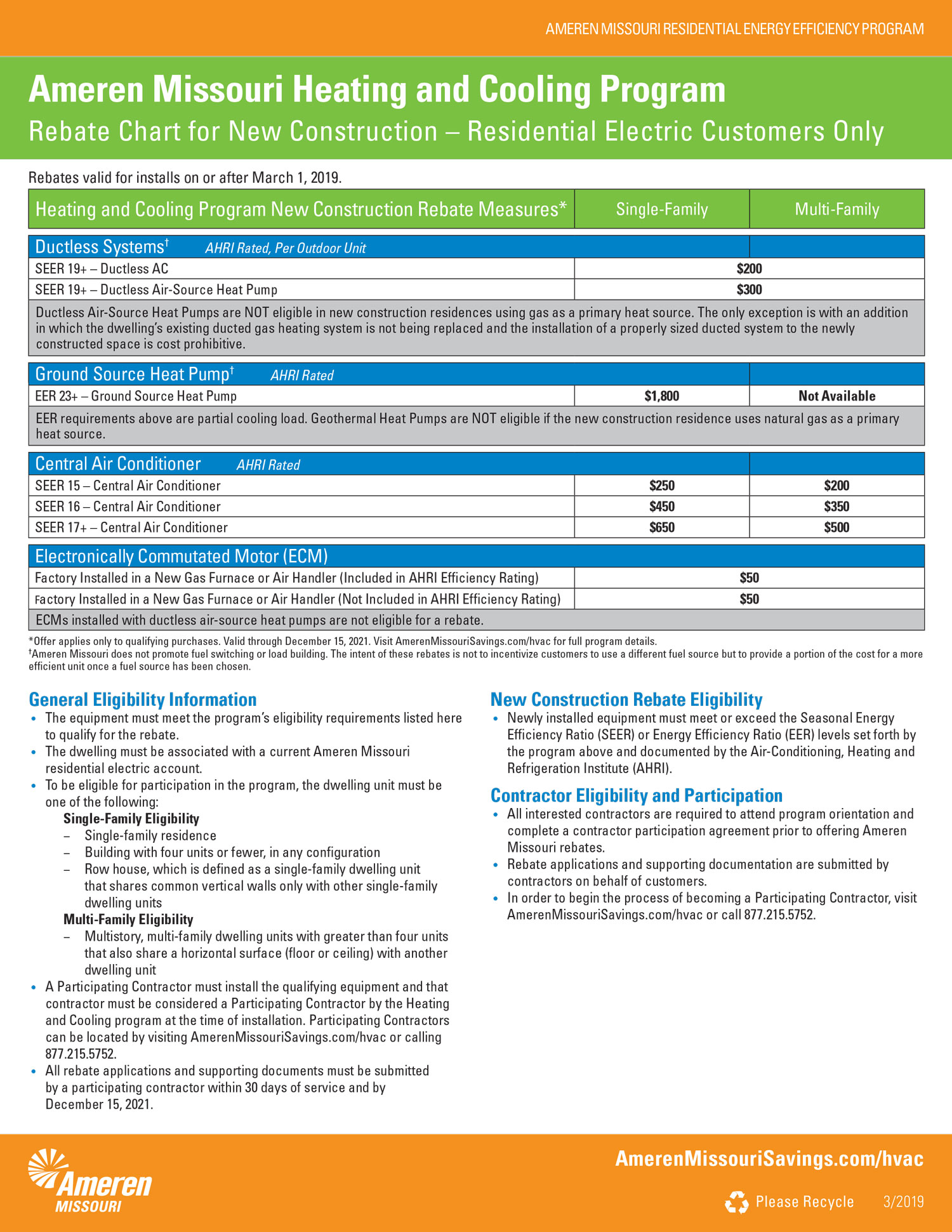

Rebates HOME By SMCI

https://homebysmci.com/wp-content/uploads/page/13/ameren-rebate-construction.jpg

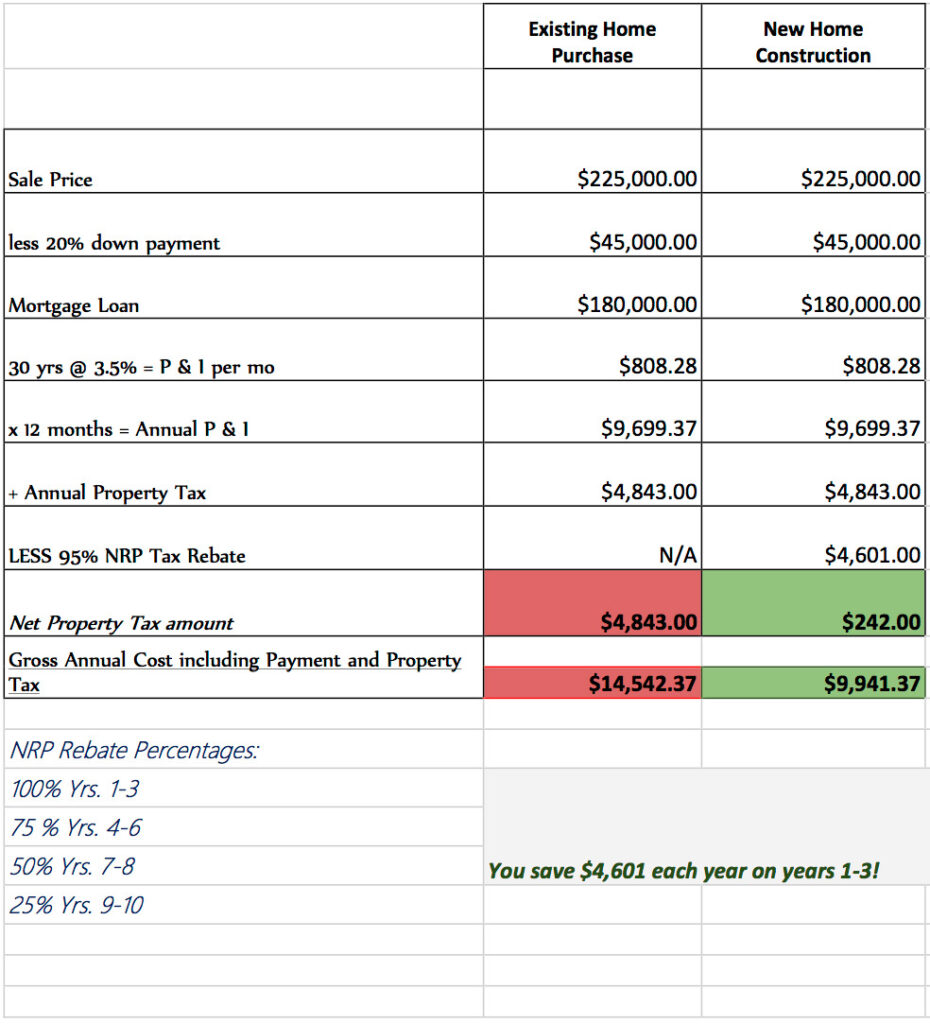

New Construction Advantage Realty

https://www.foradvantage.com/wp-content/uploads/2021/06/Existing-Home-Purchase-1-930x1024.jpg

Web Construction workers using the Construction Industry Scheme CIS can claim tax refunds for travel and other expenses Our clients at Rebate My Tax receive an average Web PAYE construction tax refunds who can claim When you re working a Pay As You Earn PAYE job and travel to temporary worksites you re probably owed some money back

Web Average annual rebate values of 163 2 300 Do CIS Tax the right way Using the Construction Industry Scheme CIS you could claim tax rebates for overpaid tax each year Web Taxfile will help you claim a tax refund rebate for overpayment of tax you have already paid through the Construction Industry Scheme CIS You can claim from 6 April for

A Simple Guide To Construction Industry Scheme Tax Rebates VW

https://www.vwtaxation.com/wp-content/uploads/2019/03/guide-to-Construction-Industry-Scheme-Tax-Rebates.jpg

Types Of Rebates To Help Construction Companies Buildertrend

https://buildertrend.com/wp-content/uploads/2022/10/3-Rebates-waiting-for-you-1.png

https://www.gov.uk/guidance/claim-a-refund-of-construction-industry...

Web 20 juil 2017 nbsp 0183 32 You can claim a repayment of your Construction Industry Scheme deductions if you re a limited company subcontractor or an agent of a limited company

https://www.litrg.org.uk/latest-news/news/220104-construction-industry...

Web 4 janv 2022 nbsp 0183 32 The personal allowance for 2020 21 was 163 12 500 and this alone is worth 163 2 500 in tax relief for a basic rate taxpayer This means CIS workers normally overpay

CIS Construction Industry Scheme Rebate My Tax Ltd

A Simple Guide To Construction Industry Scheme Tax Rebates VW

Construction Paye Tax Rebate Online

Top 5 Reasons The Construction Industry Needs Supplier Rebate

How To Maximise A CIS Rebates EXPLAINED Construction Industry Scheme

Customer Rebates For Construction Industry Enable

Customer Rebates For Construction Industry Enable

Customer Rebates For Construction Industry Enable

Construction Industry Scheme CIS ABG LLP London

A Guide To Super Deduction Tax For The Construction Industry Spector

Construction Industry Tax Rebate - Web Construction Industry Scheme Atthe end of the tax year once we have received the company s P35annual return any excess CIS deductions that cannot be set offmay be