Consumer Rebate Tax Laws Web Thus rebates that have not qualified as exclusions have been disallowed altogether when the IRS held them to be not ordinary and necessary or when the payment fit one of the

Web 1 d 233 c 2022 nbsp 0183 32 Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2022 December 1 2022 09 19 AM OVERVIEW Tax rebates encourage taxpayers to make certain types of Web 1 mai 2023 nbsp 0183 32 It helps that many of the benefits will be around for a decade or more though not all of them are available just yet Federal tax credits took effect on Jan 1 but

Consumer Rebate Tax Laws

Consumer Rebate Tax Laws

https://pic2.zhimg.com/v2-f5740fabc4f2324bebfe753bd8e44195_b.jpg

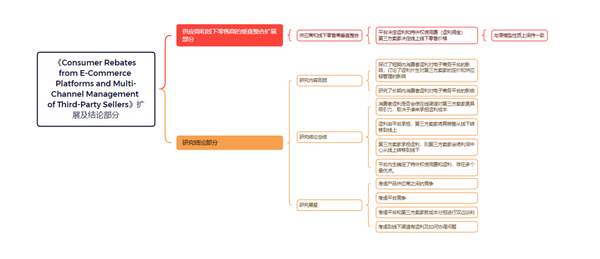

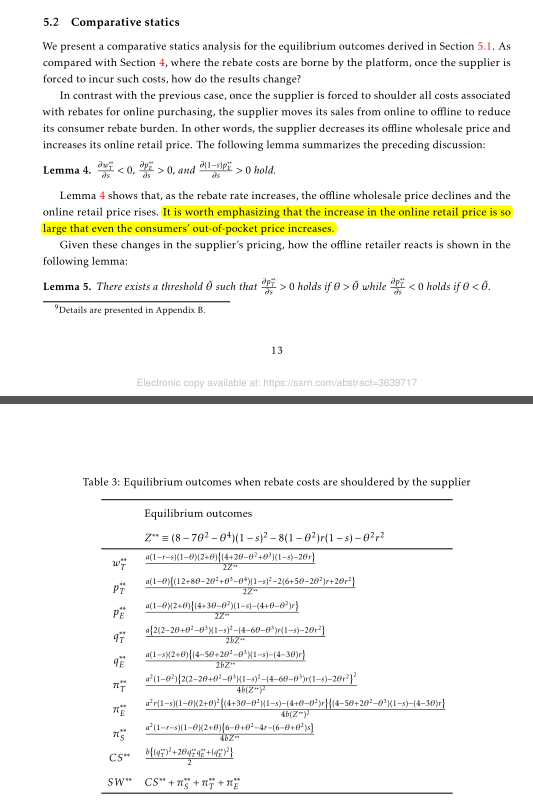

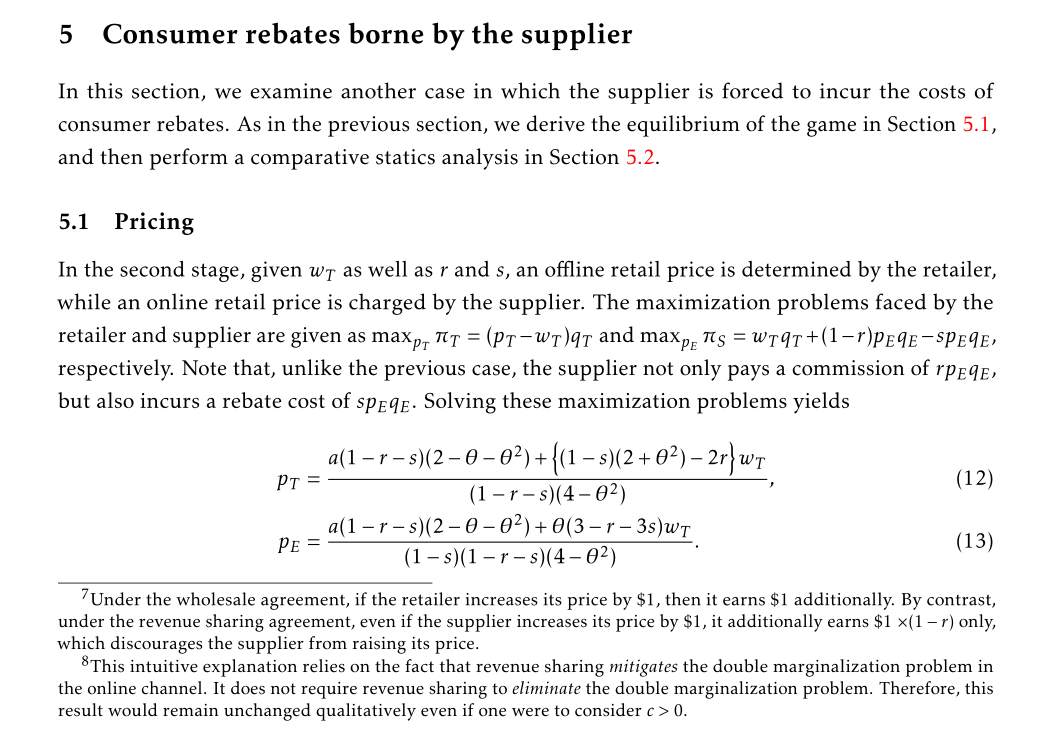

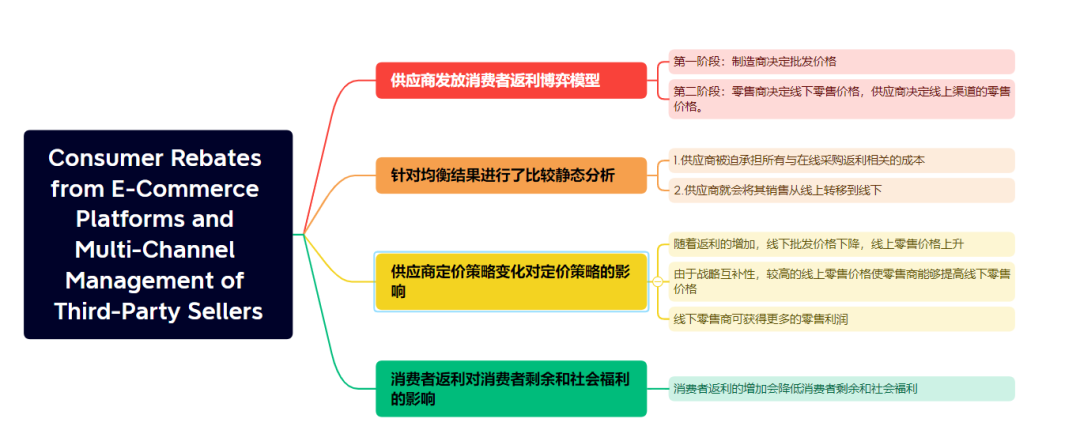

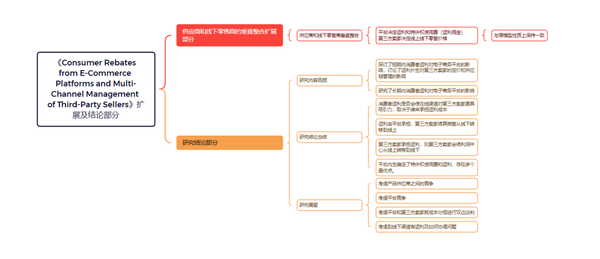

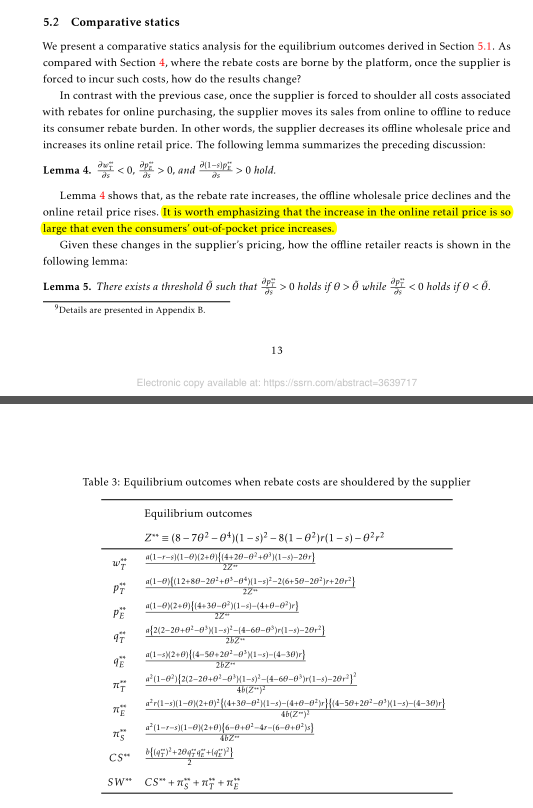

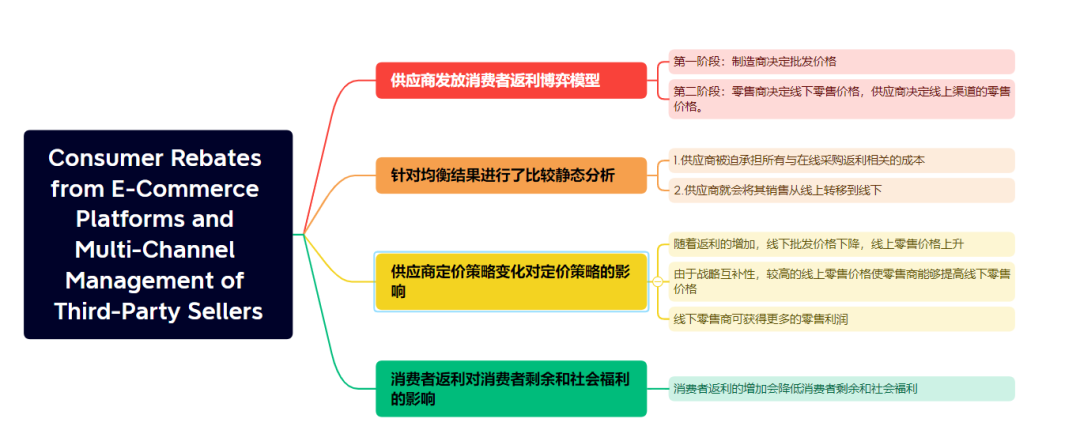

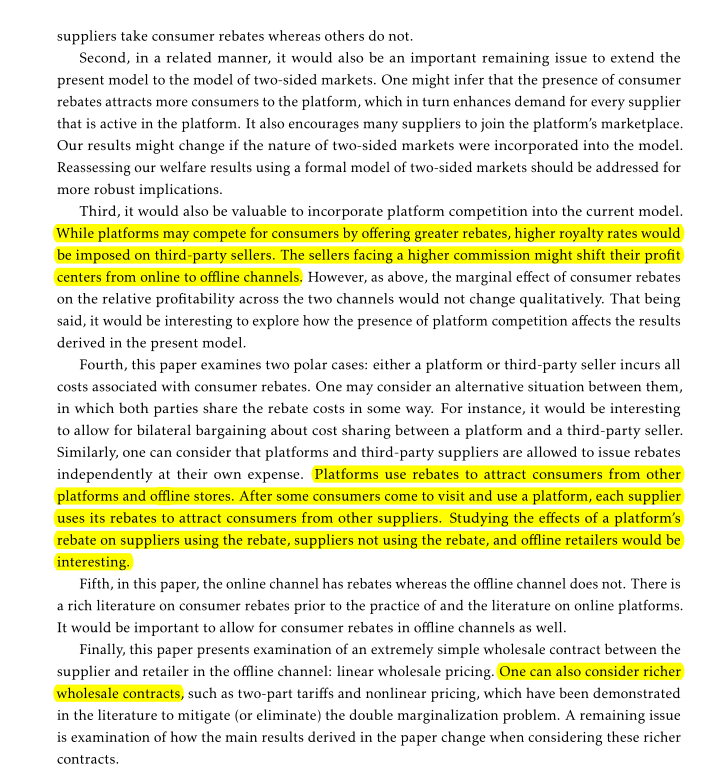

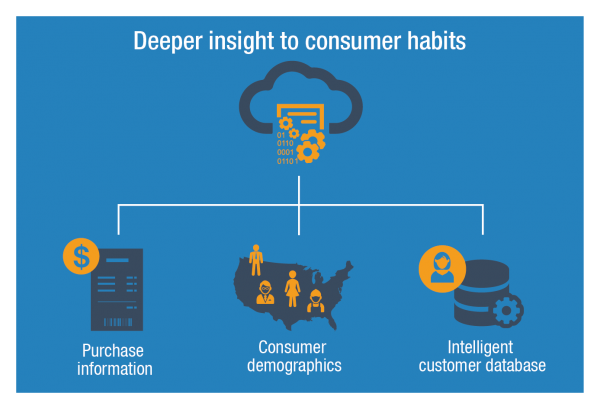

Consumer Rebates From E Commerce Platforms

https://pic3.zhimg.com/v2-42c27a3a9b8d8d341fb108e229dbb972_b.jpg

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

Web 2 mai 2016 nbsp 0183 32 If they don t have time to answer you during tax season they re for real Let s talk about the question There is a kernel of truth in this What the poster is talking about Web 1 Best answer There seems to be a myth circulating that there is some sort of new quot rebate quot on any retail purchases made There is no such rebate program At the end of the year

Web 13 ao 251 t 2022 nbsp 0183 32 In all consumers may qualify for up to 10 000 or more in tax breaks and rebates depending on the scope of their purchases The legislation is a win for Web into law on June 7 2001 Under the bill tax payers were entitled to a rebate in tax year 2001 up to 300 for single individuals and up to 600 in the case of a married couple

Download Consumer Rebate Tax Laws

More picture related to Consumer Rebate Tax Laws

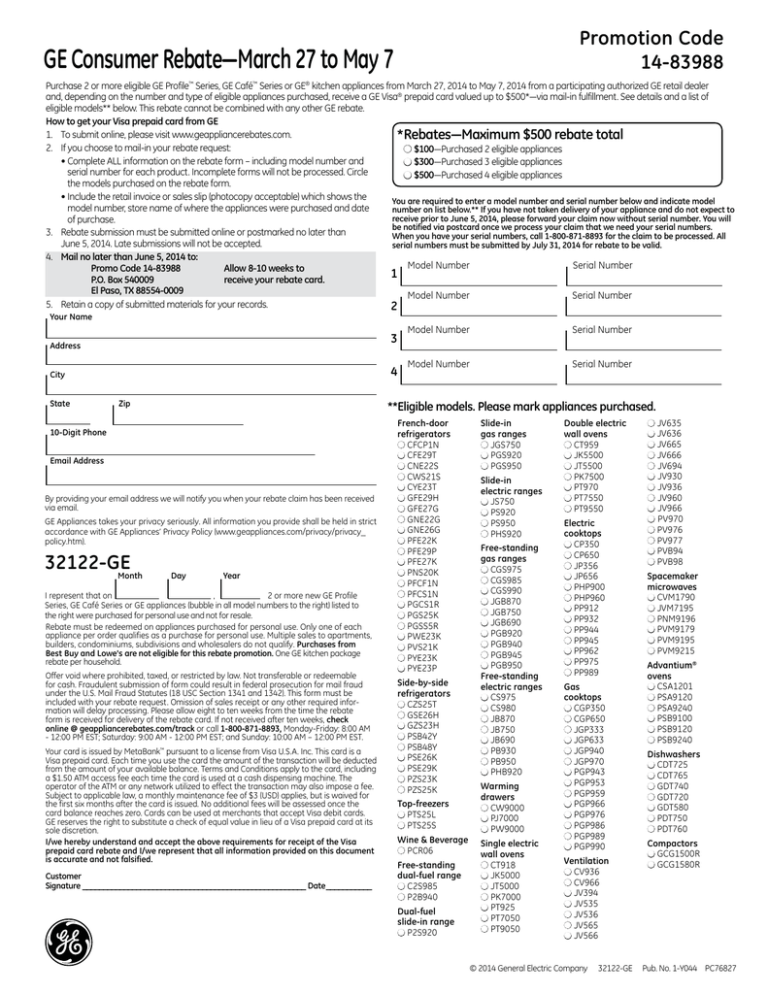

GE Consumer Rebate March 27 To May 7

https://s2.studylib.net/store/data/018255398_1-da43573a94f5bb60b746d404df2554b5-768x994.png

Consumer Rebates From E Commerce Platforms

https://pic3.zhimg.com/v2-12da75ab6467ce1c7b00b98096c339c6_r.jpg

42 4 Billion Consumer Rebate Program Snopes

https://www.snopes.com/tachyon/2016/09/rebate.jpg

Web 20 juil 2023 nbsp 0183 32 What the EV tax credit covers The law renewed the 7 500 Clean Vehicle Credit for new electric vehicles which was set to expire at the end of 2022 It also added a 30 percent tax credit capped Web This plastic tax is an own resource to the 2021 2027 EU budget In fact it is not a tax but a contribution from the Member States to the EU based on the amount of non recycled

Web tax law considers rebates as ordinary discounts where the retailer or manufacturer reduces the price of an item to reward their customers Therefore such rebates are not taxable Web This article incorporates tax evasion and sales tax rebates to consumers into Ramsey s optimal taxation problem Consumers may act as tax enforcers by request ing sales

Consumer Rebates From E Commerce Platforms

https://pic2.zhimg.com/v2-2ac8249e75c22fece02958444b1063a9_r.jpg

Consumer Rebates From E Commerce Platforms

https://pic1.zhimg.com/v2-7f56f429c7a89f2af54c6579665325e4_720w.jpg?source=172ae18b

https://www.journalofaccountancy.com/issues/2008/oct/tax_treatment_of...

Web Thus rebates that have not qualified as exclusions have been disallowed altogether when the IRS held them to be not ordinary and necessary or when the payment fit one of the

https://turbotax.intuit.com/tax-tips/tax-relief/w…

Web 1 d 233 c 2022 nbsp 0183 32 Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2022 December 1 2022 09 19 AM OVERVIEW Tax rebates encourage taxpayers to make certain types of

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Consumer Rebates From E Commerce Platforms

Consumer Rebates From Platforms

Consumer Rebates Can

Consumer Rebates From E Commerce Platforms

Consumer Rebates From Platforms

Consumer Rebates From Platforms

Consumer Rebates From E Commerce Platforms

Consumer Rebates From E Commerce Platforms

Whitepaper A New Era For Consumer Rebates

Consumer Rebate Tax Laws - Web 14 janv 2022 nbsp 0183 32 The consumer rights group has identified 208 firms with quot tax reclaim quot quot tax refund quot quot tax claim quot and quot tax rebate quot in their names It found the term quot tax rebate quot gets