Contribution To Nps Under Section 80ccd 2 Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you can claim a deduction of up to 2 lakh in a financial

Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn about eligibility limits and benefits Section 80CCD 2 of the Income Tax Act provides an excellent opportunity for salaried individuals to save on taxes while securing their

Contribution To Nps Under Section 80ccd 2

Contribution To Nps Under Section 80ccd 2

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Section-80CCD-Deductions-For-NPS-And-APY-Contributions.jpg

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

https://www.alankit.com/blog/blogimage/NPS-80CCD.jpg

A Govt employee can claim a deduction of your employer s contribution towards NPS under Section 80CCD 2 up to a limit of 10 of your salary i e Basic Salary 80CCD 2 relates to the deduction of employer s contribution to New Pension Scheme NPS This contribution is firstly added in salary income and later allowed as

Learn how to claim tax deductions under Section 80CCD for NPS contributions Explore limits for employees self employed and employers plus additional benefits Enter your email Address A salaried person is eligible to claim the following deduction under Section 80CCD 2 a maximum contribution from the Central Government or State Government to NPS of

Download Contribution To Nps Under Section 80ccd 2

More picture related to Contribution To Nps Under Section 80ccd 2

Deduction Under Section 80CCD 2 For Employer s Contribution To

https://img.etimg.com/thumb/msid-97694570,width-640,resizemode-4,imgsize-406338/deduction-under-section-80ccd-2-for-employers-contribution-to-employees-national-pension-system-nps-account.jpg

Should I Invest In NPS Investeek

https://investeek.com/wp-content/uploads/2019/08/bank-notes-cash-cash-box-210599-500x325.jpg

What Is Dcps Nps Yojana Login Pages Info

https://www.basunivesh.com/wp-content/uploads/2018/12/NPS-Tax-Benefits-2019-Sec.80CCD1-80CCD2-and-80CCD1B-1280x720.jpg

Understand the 80CCD 2 eligibility criteria deduction limits and tax limit exemptions under Section 80CCD 2 Section 80CCD 2 allows salaried employees to claim tax deductions on If your employer contributes to your NPS account your employer gets a tax benefit under section 80CCD 2 This tax benefit is limited to 20 of the total income of the employer in the previous

Contributions made by employers to an employee s NPS account are eligible for deductions under Section 80CCD 2 The limit is 10 of the employee s salary basic DA This deduction is 2 Employee s Self Contribution Section 80CCD 1 and 80CCD 1B Deduction Availability In the new tax regime deductions under Section 80CCD 1 up to 1 5 lakh and

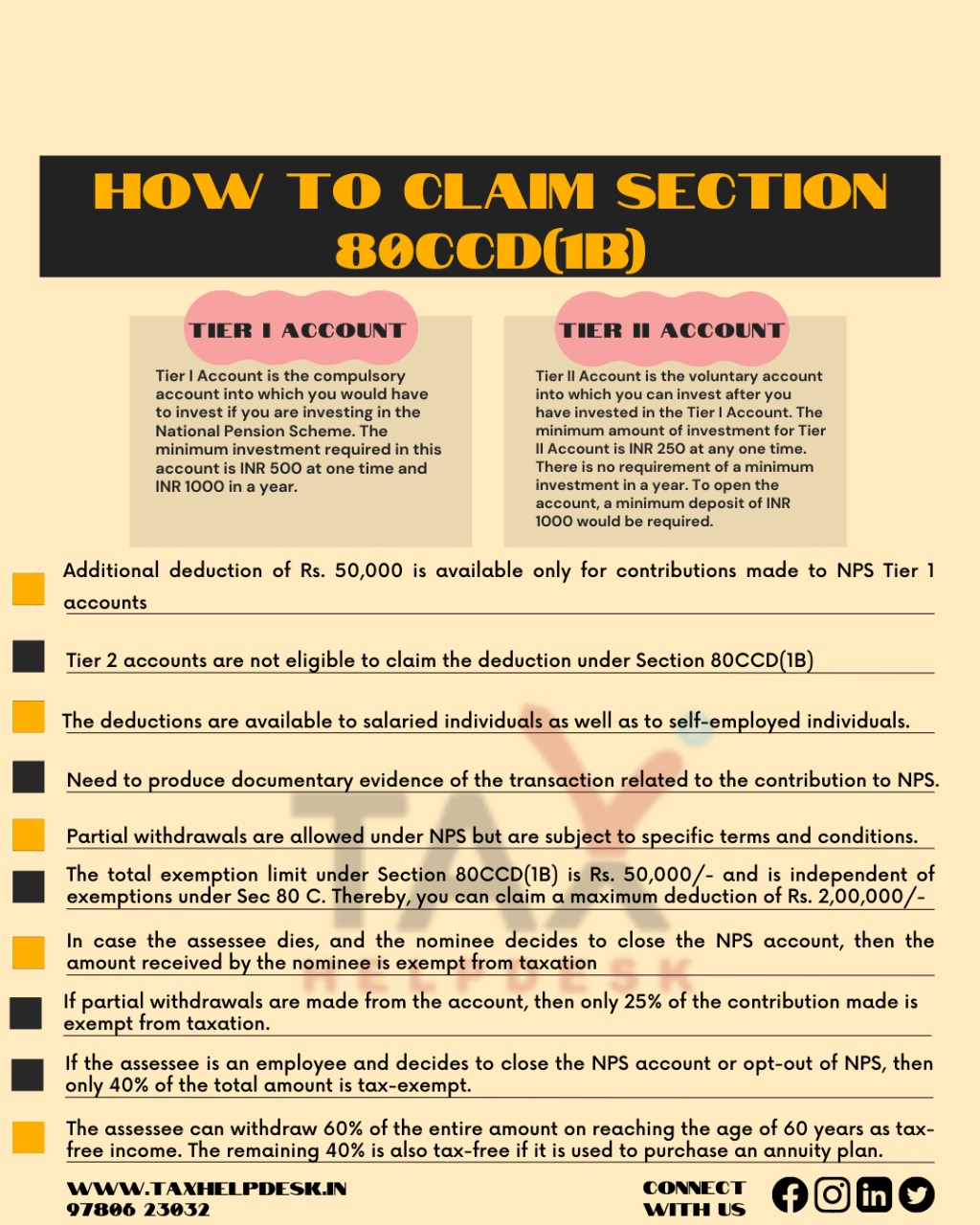

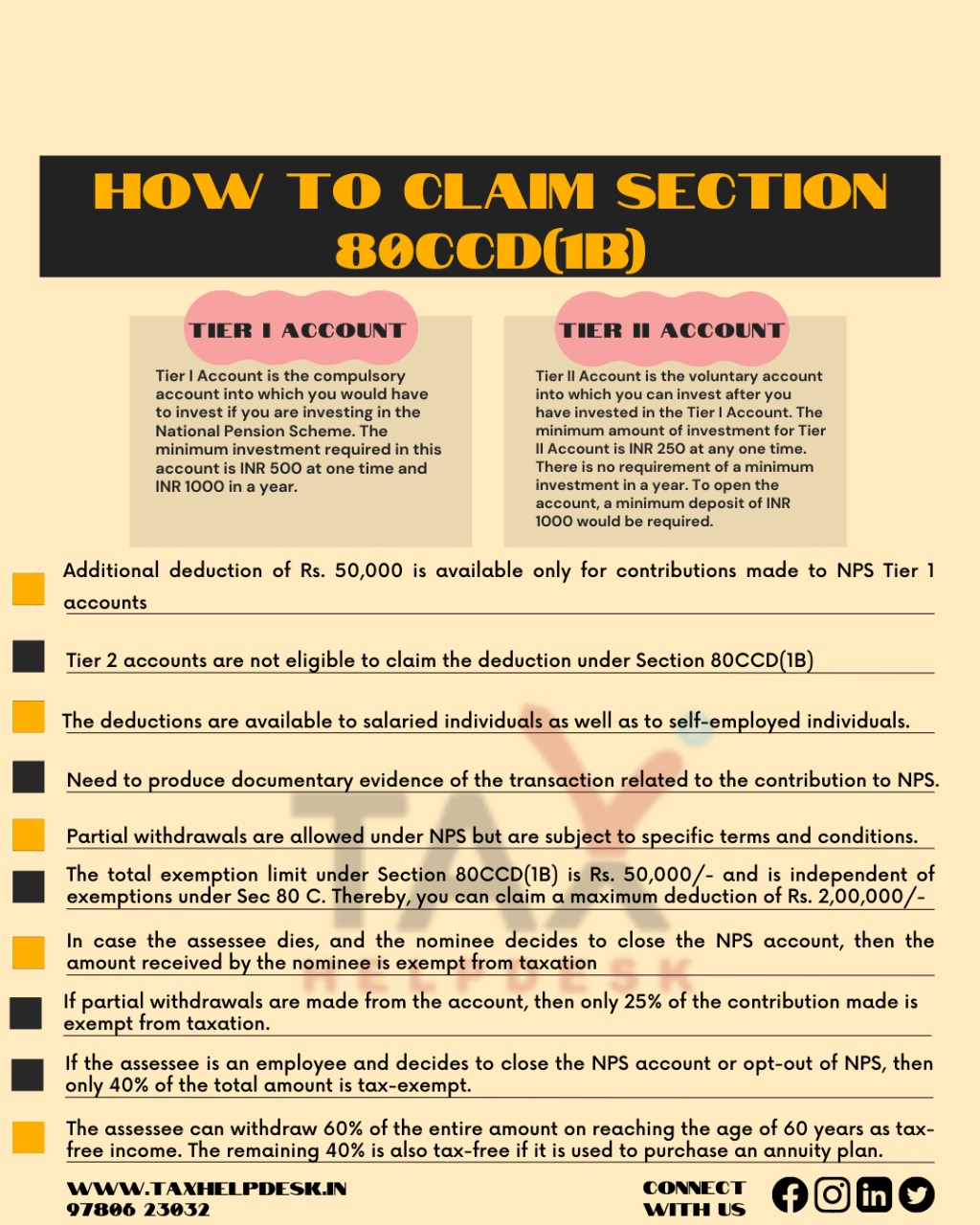

How To Claim Section 80CCD 1B TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/02/How-to-claim-Section-80CCD1B.jpeg

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2020/04/17122913/tax-benefits-of-nps.jpg

https://www.etmoney.com › learn › income-tax

Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section you can claim a deduction of up to 2 lakh in a financial

https://www.taxbuddy.com › blog

Understand Section 80CCD 1 and 80CCD 2 of the Income Tax Act covering tax deductions for contributions to the National Pension System NPS Learn about eligibility limits and benefits

Tax Savings Deductions Under Chapter VI A Learn By Quicko

How To Claim Section 80CCD 1B TaxHelpdesk

Section 80CCC Tax Deductions On Pension Fund Contributions Tax2win

How To Claim Section 80CCD 1B TaxHelpdesk

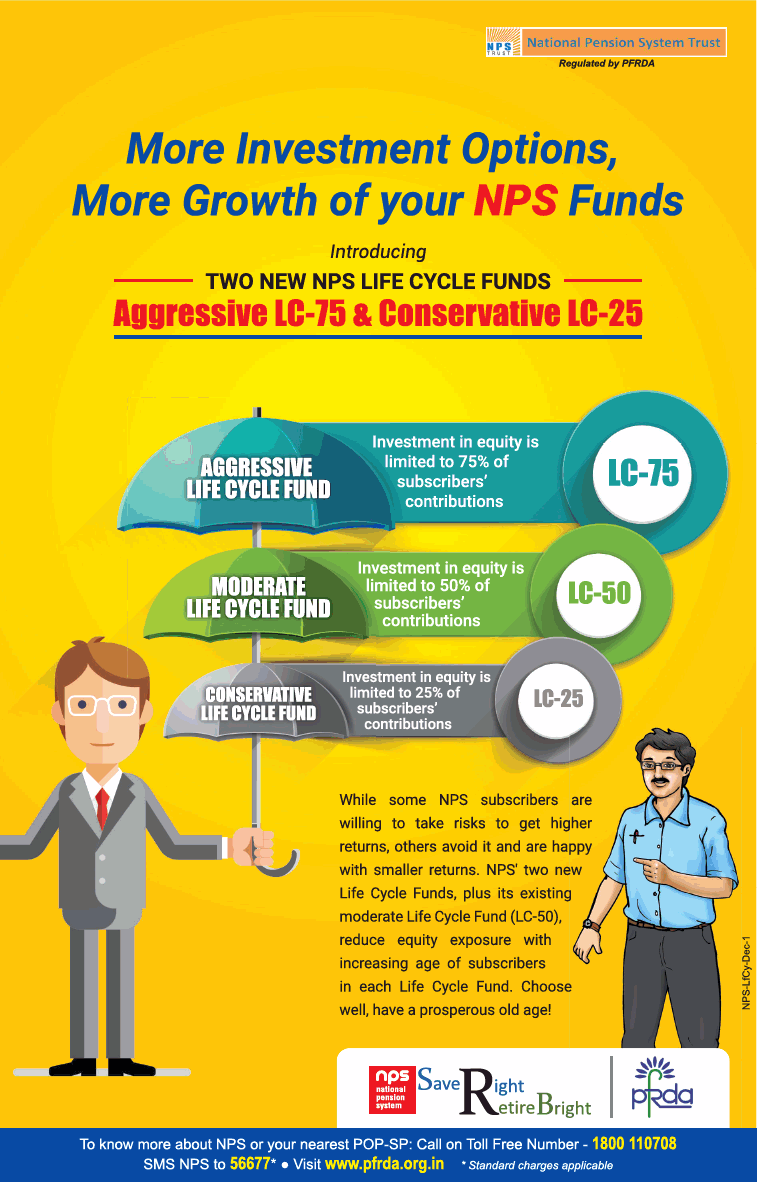

NPS Tax Benefit Under Section 80CCD 1 80CCD 2 And 80CCD 1B

Open ended Semi structure Interview Questions Download Scientific

Open ended Semi structure Interview Questions Download Scientific

Money Musingz Personal Finance Blog Section 80D 80CCD Explained

K Naresh On LinkedIn Finance Fridays Ep 3 Section 80CCD 2

Section 80CCD Dedution Contribution To Notified Pension Scheme NPS

Contribution To Nps Under Section 80ccd 2 - Learn how to claim tax deductions under Section 80CCD for NPS contributions Explore limits for employees self employed and employers plus additional benefits Enter your email Address