Conveyance Allowance Exemption Under Income Tax Act Any amount paid above the conveyance allowance limit is charged to tax under the head Income from Salaries The new tax regime allows an individual to claim the following

Exemption on conveyance allowance can be claimed under Section 10 14 ii of the Income Tax Act The maximum amount that can be claimed in a year is Rs 19 200 Rs 1 600 per month Is it possible to Subsection 14 of section 10 of the Income Tax Act 1961 read with rule 2BB of Income Tax rule deals with exemption of conveyance allowance The exemption

Conveyance Allowance Exemption Under Income Tax Act

Conveyance Allowance Exemption Under Income Tax Act

https://life.futuregenerali.in/media/ihsk1hd4/types-of-allowances.jpg

A Guide To Group Insurance Scheme Exemption Under Income Tax

https://www.plancover.com/insurance/wp-content/uploads/2021/12/A-guide-to-Group-Insurance-Scheme-Exemption-under-Income-Tax.png

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

As per the income tax act the conveyance allowance exemption is allowed to an employee to the extent of expenditure actually incurred for official purposes Conveyance allowance exemption from tax allows employees to claim a certain amount of their conveyance allowance as tax exempt income The exemption limit for conveyance allowance is Rs 1 600 per month or Rs

The current conveyance allowance exemption is Rs 1 600 each month or Rs 19 200 a year As is obvious it is double the previous limits set The revised rate of this allowance The exemption under section 10 sub section 14 ii of the Income Tax Act and Rule 2BB of Income Tax rule provides for conveyance allowance exemption The conveyance

Download Conveyance Allowance Exemption Under Income Tax Act

More picture related to Conveyance Allowance Exemption Under Income Tax Act

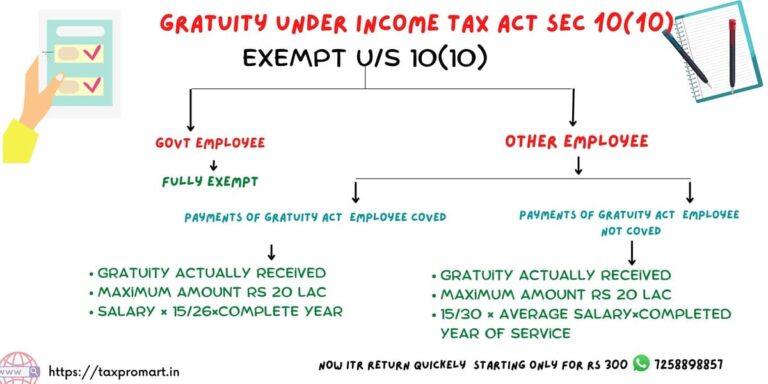

Gratuity Under Income Tax Act All You Need To Know

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/Gratuity-under-Income-Tax-Act-All-You-Need-To-Know-600x600.png

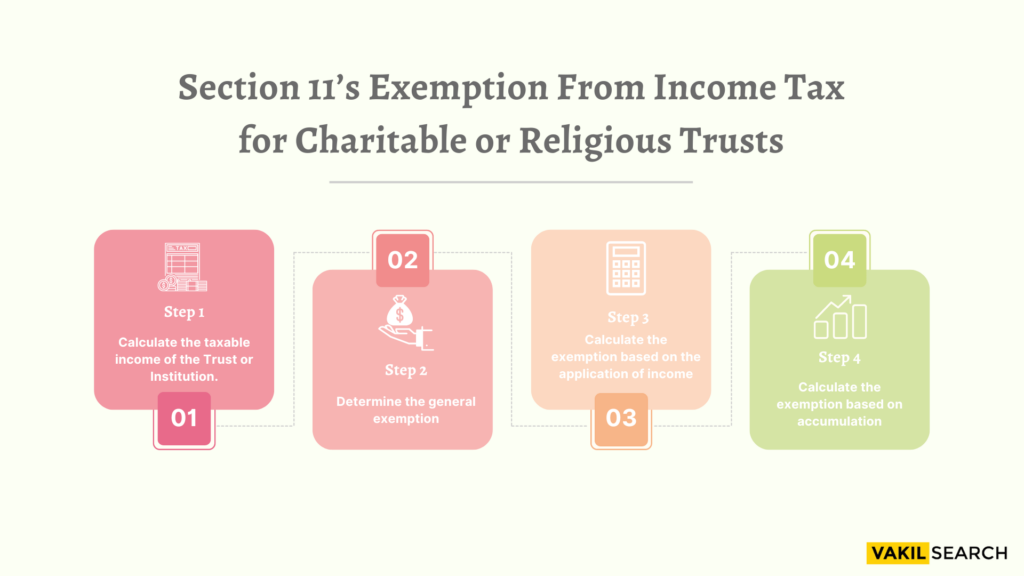

Section 11 Of Income Tax Act 1961 Exemption For Trusts

https://vakilsearch.com/blog/wp-content/uploads/2022/08/Section-11-Income-Tax-Act.png

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

https://i.pinimg.com/originals/cd/bf/52/cdbf5266dd5ee6d50226e5e607a73e23.png

It is possible to make a claim for exemption from the conveyance allowance under the provisions of Section 10 14 ii of the Income Tax Act The most that may be claimed in a single year is Under Section 10 14 of the Income Tax Act and Rule 2BB of Income Tax Rules the conveyance allowance exemption limit is Rs 1 600 per month or Rs 19 200 a year

Yes conveyance allowance in salary is taxable regardless of the tax regime However an exemption is available for the actual expenses incurred for official Section 10 14 i of the Income Tax Act This section provides exemptions for expenses incurred due to your employer s business It includes traveling

No Limitation Under Income Tax Act For Filing Application For

https://www.taxscan.in/wp-content/uploads/2022/11/Income-Tax-Act-application-condonation-Kerala-HC-TAXSCAN.jpg

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

https://cleartax.in/glossary/conveyance-allowance

Any amount paid above the conveyance allowance limit is charged to tax under the head Income from Salaries The new tax regime allows an individual to claim the following

https://www.bankbazaar.com/tax/conveyan…

Exemption on conveyance allowance can be claimed under Section 10 14 ii of the Income Tax Act The maximum amount that can be claimed in a year is Rs 19 200 Rs 1 600 per month Is it possible to

HRA Exemption Calculator In Excel House Rent Allowance Calculation

No Limitation Under Income Tax Act For Filing Application For

Section 27 Of The Income Tax Act Sorting Tax

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

Income Tax Act POCKET Edition Finance Act 2023 By Taxmann s

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

Section 11 Income Tax Act Exemptions For Charitable Trusts

Gratuity Under Income Tax Act Sec 10 10 All You Need To Know

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

Conveyance Allowance Exemption Under Income Tax Act - Find out the allowances available for different categories of taxpayers in India This webpage provides a list of exemptions and deductions that can reduce your taxable