Cook County Property Tax Discount For Seniors Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of 65 000 or less in the 2022 calendar year A Senior Freeze Exemption provides property tax savings by

The Senior Citizen Exemption provides tax relief by reducing the equalized assessed value EAV of an eligible residence by 8 000 The amount your tax bill is reduced depends on your Retirees and other older homeowners on fixed incomes may reduce their tax bill by taking advantage of Senior Freeze To qualify for the Senior Freeze exemption the applicant

Cook County Property Tax Discount For Seniors

Cook County Property Tax Discount For Seniors

https://news.wttw.com/sites/default/files/field/image/PropertyTaxPayments_0102.jpg

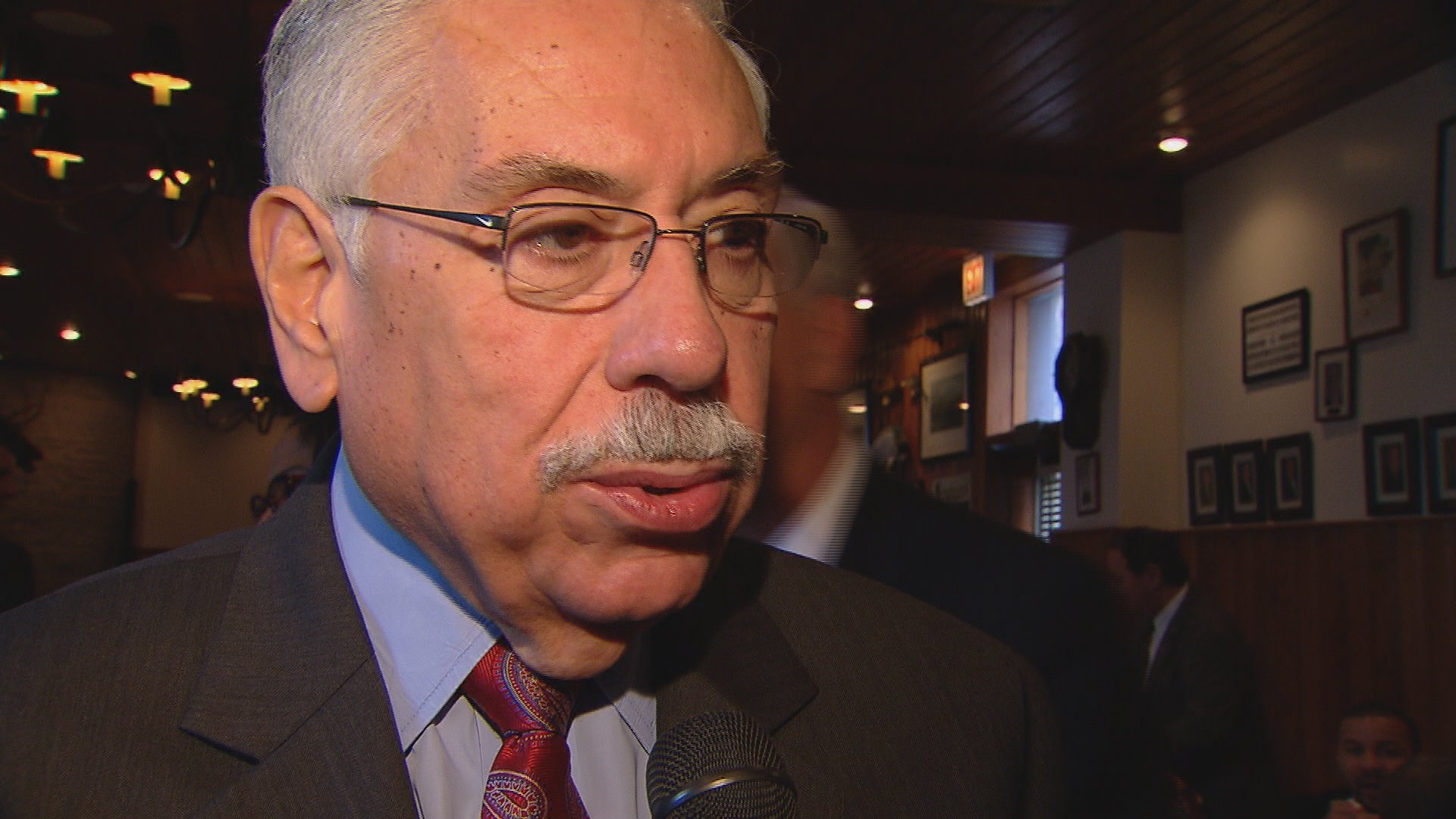

The Cook County Property Tax Assessor Wants Chicagoans To Appeal Law

https://garyhsmith.com/wp-content/uploads/2022/02/shutterstock_547890676-1024x683.jpg

You Must Consider Making Cook County Property Tax Appeal With Saranow

https://image.isu.pub/151116053610-9e1ecbd5e3dfa868620cbe185cf0336b/jpg/page_1.jpg

A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property Most homeowners are eligible for this exemption if they meet the A Senior Freeze Exemption provides property tax savings by freezing the equalized assessed value EAV of an eligible property Most homeowners are eligible for this exemption if they

This exemption provides property tax savings and most homeowners who are 65 years and older qualify Automatic Renewal Yes this exemption automatically renews each year Newly Property tax savings for a Senior Exemption are calculated by multiplying the Senior Exemption amount of 8 000 by your local tax rate Your local tax rate is determined by the Cook County

Download Cook County Property Tax Discount For Seniors

More picture related to Cook County Property Tax Discount For Seniors

2020 Cook County And Chicago Property Tax Rates Explained

https://blog.lucidrealty.com/wp-content/uploads/Cook-County-property-tax-changes-for-single-family-homes-1.jpg

Get Cook County Property Tax Appeals Help Tickets Powered By Ticket

https://www.ticketfalcon.com/wp-content/uploads/2022/01/768_TaxAssessor_WCFlyer_Residents-1024x683.png

2019 Cook County And Chicago Property Tax Rates Explained

https://blog.lucidrealty.com/wp-content/uploads/Cook-County-property-tax-changes.jpg

Seniors can save on average up to 300 a year in property taxes and up to 750 when combined with the Homeowner Exemption The applicant must have owned and occupied the The Senior Citizen Real Estate Tax Deferral program is a tax relief program that works like a loan It allows qualified seniors to defer a maximum of 7 500 per tax year this

The Senior Citizen Homestead Exemption reduces the EAV of your home by 8 000 To receive the Senior Citizen Homestead Exemption the applicant must have owned and occupied the The Senior Freeze Exemption provides tax relief to eligible homeowners who meet age and income requirements see below and whose homes have drastically increased in value

Cook County Property Tax Portal Property Tax Property Cook County

https://i.pinimg.com/originals/ce/66/a3/ce66a31bc5ef26288ce557d846bd946e.jpg

Cook County Treasurer s Study Finds Property Tax Increases Outstrip

https://s29980.pcdn.co/wp-content/uploads/2020/11/Cook-county-property-taxes.jpg

https://www.cookcountyassessor.co…

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of 65 000 or less in the 2022 calendar year A Senior Freeze Exemption provides property tax savings by

https://www.cookcountyassessor.com › index.php › faq › ...

The Senior Citizen Exemption provides tax relief by reducing the equalized assessed value EAV of an eligible residence by 8 000 The amount your tax bill is reduced depends on your

25 4M In Cook County Property Tax Refunds To Be Issued Automatically

Cook County Property Tax Portal Property Tax Property Cook County

2016 Cook County And Chicago Property Tax Rates Released

Cook County Extends Property Tax Deadline To October 1 WBEZ Chicago

Cook County Property Taxes Keeping Up With The Changes The KSN Blog

Cook County Officials Warn Residents To Pay Property Tax Or Get

Cook County Officials Warn Residents To Pay Property Tax Or Get

Groups Seek Investigation Into Cook County Property Tax System

Cook County Property Tax Bills Now Online After Months long Delay CBS

Cook County Property Tax Reassessment Reda Ciprian Magnone LLC

Cook County Property Tax Discount For Seniors - Seniors in the counties bordering Cook County will see the maximum homestead exemption raised from 5 000 to 8 000 putting them on the same level as Cook County