Corporate Income Tax Law Uk An Act to restate with minor changes certain enactments relating to corporation tax and certain enactments relating to company distributions and for connected purposes

You must pay Corporation Tax on profits from doing business as a limited company any foreign company with a UK branch or office a club co operative or other unincorporated Throughout this article the term pound and the symbol refer to the Pound sterling Corporation tax in the United Kingdom is a corporate tax levied in on the profits made by UK resident companies and on the profits of entities registered overseas with permanent establishments in the UK

Corporate Income Tax Law Uk

Corporate Income Tax Law Uk

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/cbbe7fc8e21955d2fe64524bb50f5edb/thumb_1200_1553.png

Income Tax 4 Eeeee Part B BCOC Income Tax Law And School Of

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/d668be106009083eec5d448264e9b60c/thumb_1200_1697.png

Corporate Income Tax And Profit Rates Short run Shifting In Selected

https://universalbooksellers.com/wp-content/uploads/2021/08/Income-Tax-scaled.jpg

An Act to restate with minor changes certain enactments relating to corporation tax and for connected purposes Companies with profits between 50 000 and 250 000 will pay tax at the main rate reduced by a marginal relief This provides a gradual increase in the effective

Ii Corporation Tax Act 2010 c 4 C HAPTER 4 C URRENCY Share loss relief against income 68 Share loss relief 69 Eligibility conditions 70 Entitlement to claim A Q A guide to tax on corporate transactions in the United Kingdom This Q A provides a high level overview of tax in the United Kingdom and looks at key

Download Corporate Income Tax Law Uk

More picture related to Corporate Income Tax Law Uk

Income TAX Accounting Article 22 INCOME TAX ACCOUNTING ARTICLE 22

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/76db0737fb1ecf641c6f4c6bc0f3d0ad/thumb_1200_1698.png

B Com 5th Semester Income Tax Law And Accounts Previous Year Question

https://studynotes.in/wp-content/uploads/2023/01/BCom-Qp.png

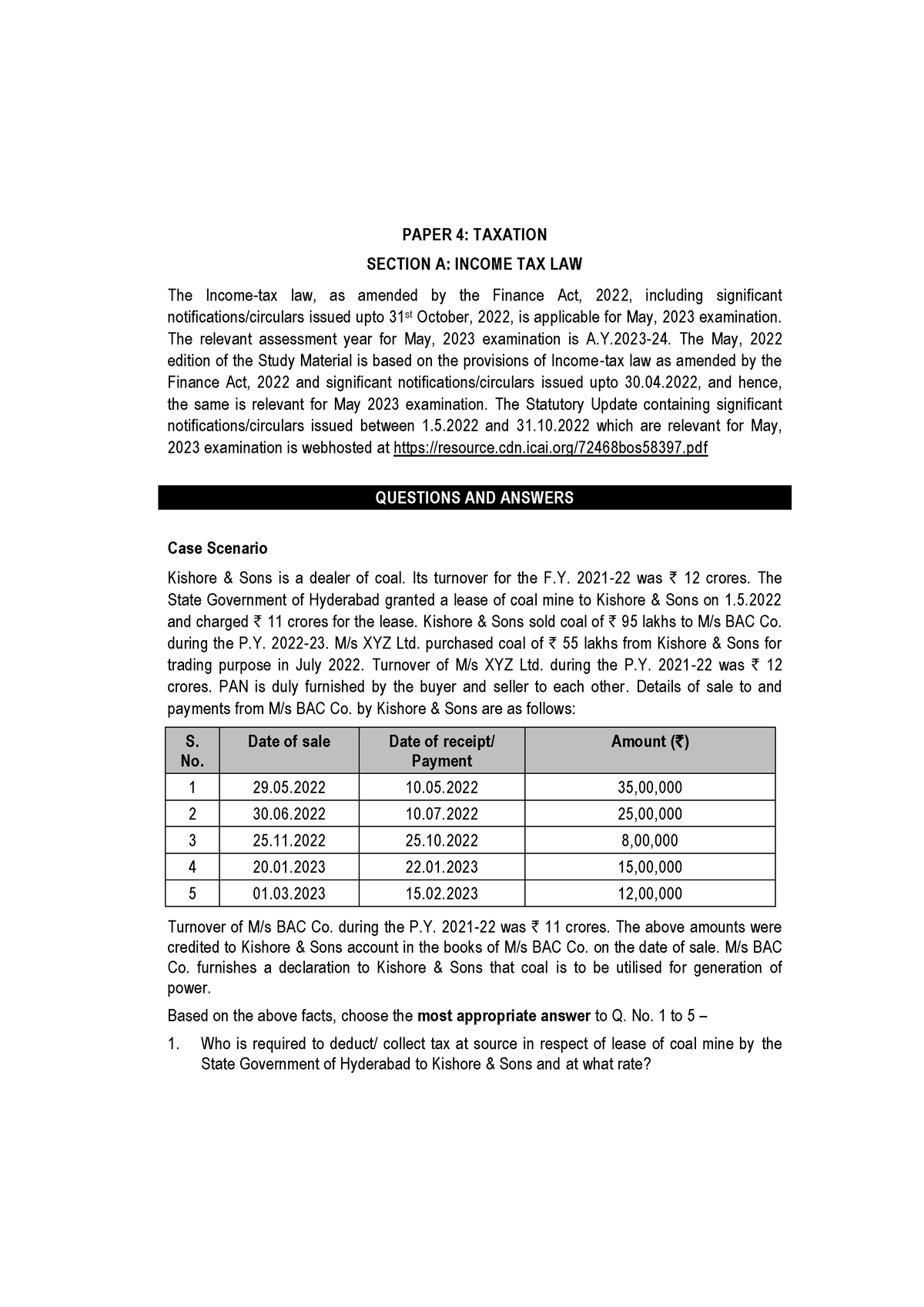

73149 Bos58999 p4 PAPER 4 TAXATION SECTION A INCOME TAX LAW The

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/d275a8a794672ab646a180c32422118c/thumb_1200_1697.png

For the financial year 2019 20 the main rate of UK corporation tax is set at 19 According to current legislation this rate should fall to 17 in 2020 21 This note is a general summary of the UK rules applying to the taxation of UK resident companies and UK permanent establishments It describes when corporation tax

Corporate Income determination A UK resident company is taxed on its worldwide total profits Total profits are the aggregate of i the company s net income Corporation tax rates In 2021 22 the main corporation tax rate is 19 A reduced rate of 10 applies to profits relating to patented technologies a policy known as the patent

The Main Features Of Tax Collection Litigation Elite Law Firm

https://cabelitelaw.com/wp-content/uploads/2021/05/taxes.jpg

Income Tax Law And Accounting By Virgilio D Reyes Hobbies Toys

https://media.karousell.com/media/photos/products/2021/8/14/income_tax_law_and_accounting__1628965650_401eef2d.jpg

https://www.legislation.gov.uk/ukpga/2010/4/contents

An Act to restate with minor changes certain enactments relating to corporation tax and certain enactments relating to company distributions and for connected purposes

https://www.gov.uk/corporation-tax

You must pay Corporation Tax on profits from doing business as a limited company any foreign company with a UK branch or office a club co operative or other unincorporated

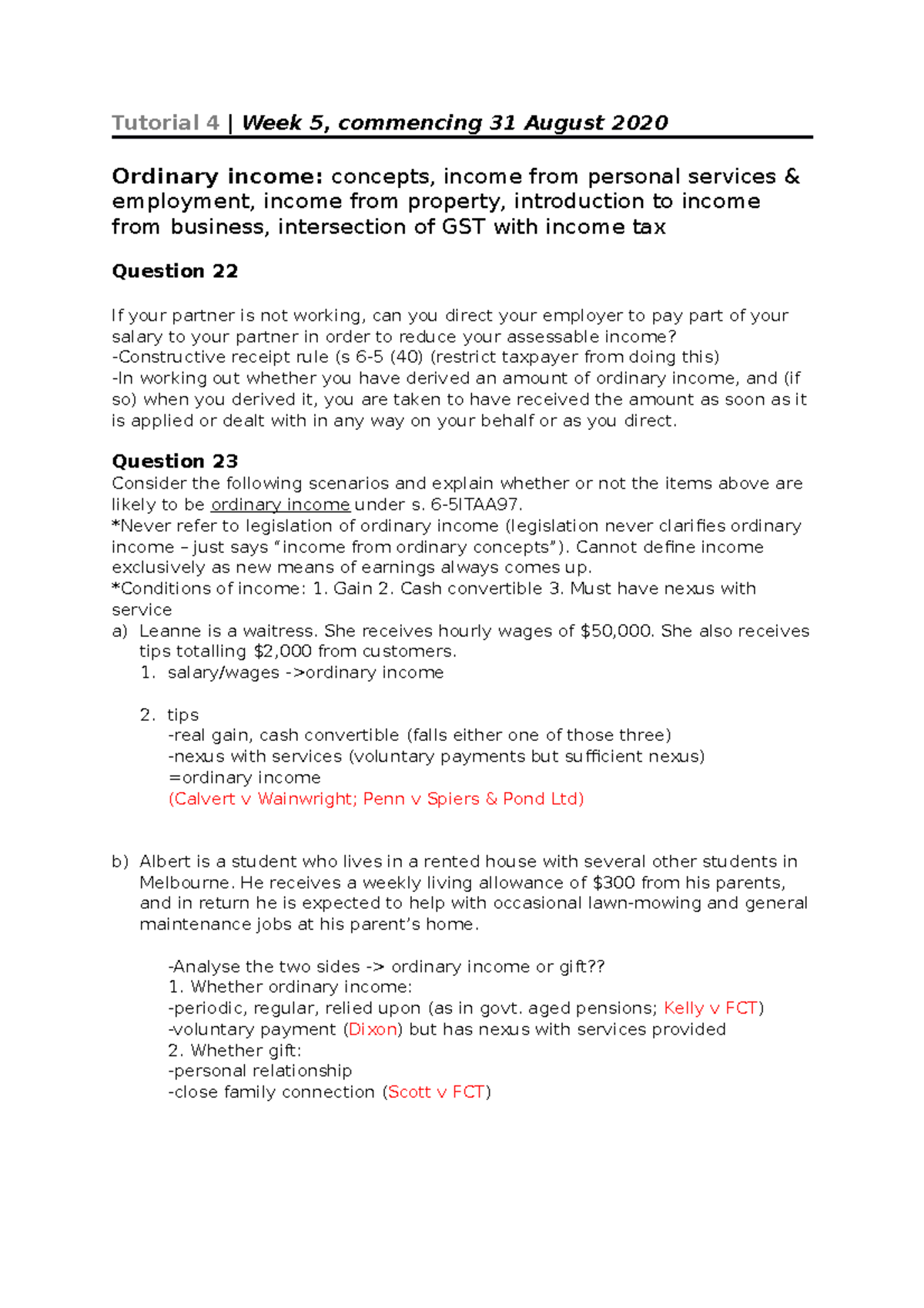

Tutorial 4 Income Tax Law Tutorial 4 Week 5 Commencing 31

The Main Features Of Tax Collection Litigation Elite Law Firm

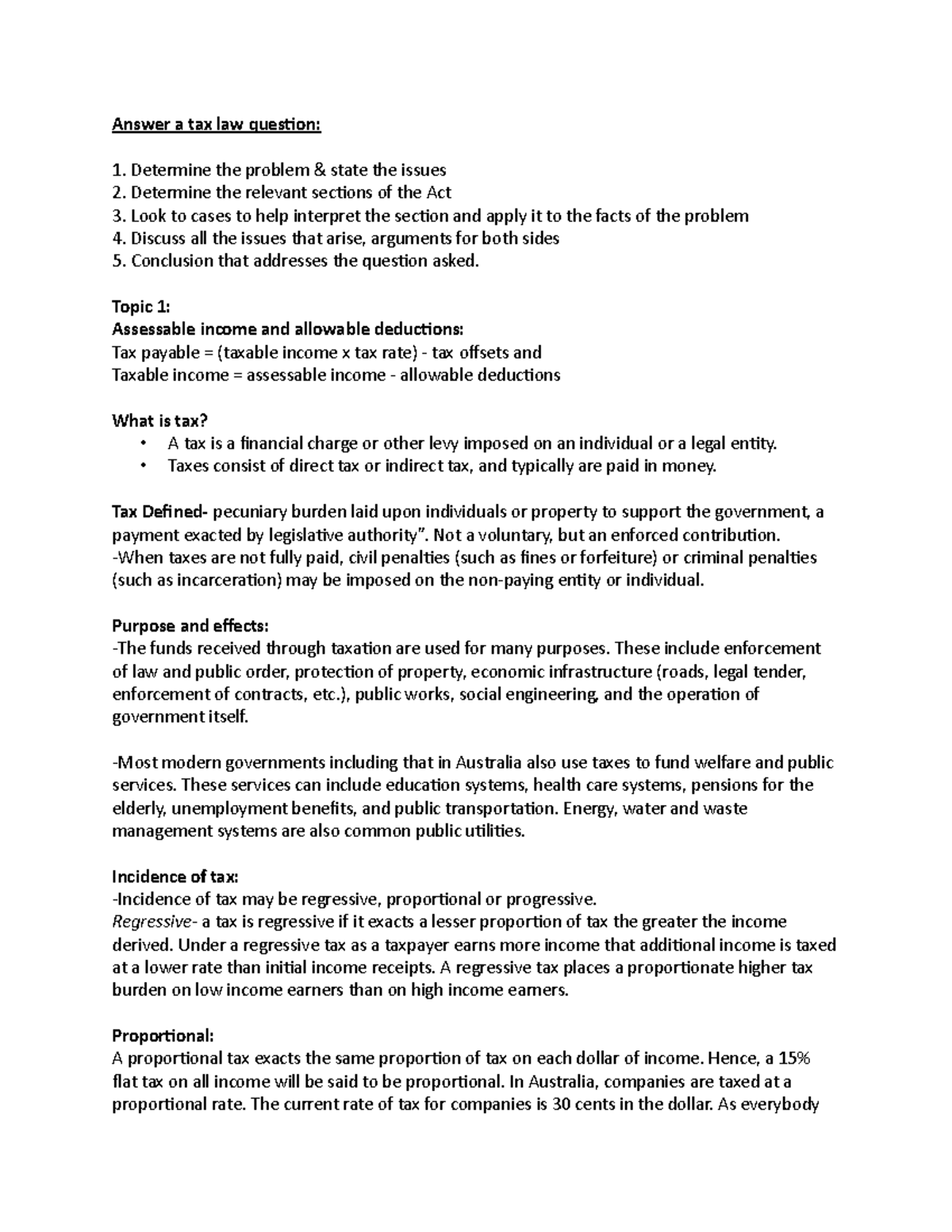

Basic Principles Of Income Tax Law Basic Principles Of Income Tax Law

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

1 Income Tax Law And Accounts own CHAPTER 1 BASIC CONCEPTS OF

Watch Income Tax Law Report Accidentally Reveals Demonetisation Impact

Watch Income Tax Law Report Accidentally Reveals Demonetisation Impact

Income Tax Law And Accounts Sahitya Bhawan

INCOME TAX NOV 2023 CA ANU SHREE AGRAWAL Bhagwati Education LLP

Income Tax Law And Accounts B Com Sem 4 Sahitya Bhawan

Corporate Income Tax Law Uk - Taxes clearances and concepts General contract and boilerplate Legal concepts Access now Practical Law Tax covers topics including Corporate transactions Employment