Corporate Income Tax Rebate Web Condition d attribution du cr 233 dit d imp 244 t pour la reprise d une entreprise par ses salari 233 s 1 La soci 233 t 233 rachet 233 e et la soci 233 t 233 nouvelle doivent 234 tre soumises au r 233 gime de droit

Web 15 mars 2020 nbsp 0183 32 The CIT rebate reduces the tax liability of tax paying companies in YA 2020 financial year ended 2019 As the CIT rebate will be capped at S 15 000 this measure Web 16 f 233 vr 2021 nbsp 0183 32 No corporate income tax rebate is proposed for the year of assessment YA 2021 Extension of a number of Budget 2020 measures including

Corporate Income Tax Rebate

Corporate Income Tax Rebate

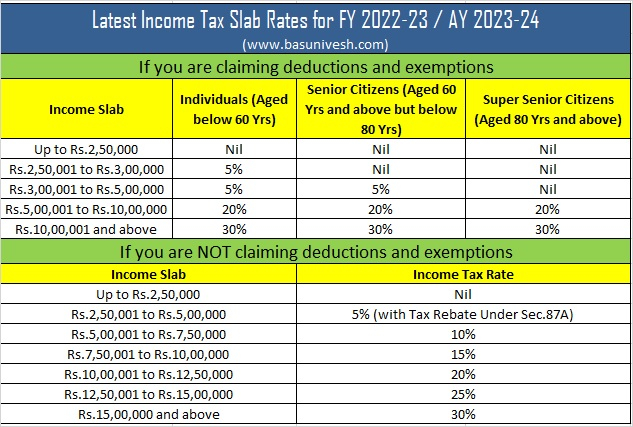

https://www.rebate2022.com/wp-content/uploads/2023/05/latest-income-tax-slab-rates-for-fy-2022-23-ay-2023-24-budget-2022.jpg

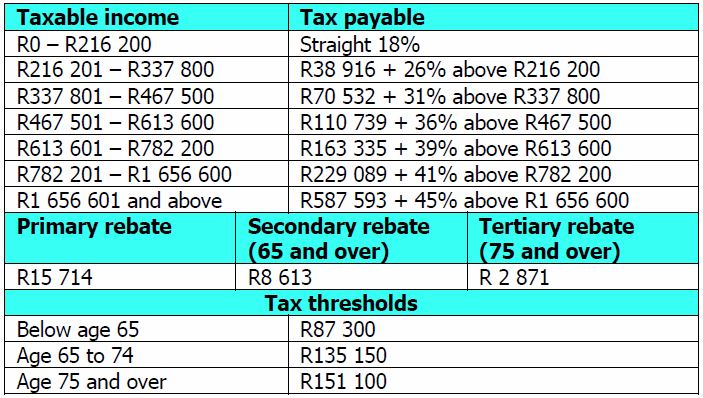

Budget Highlights For 2021 22 Nexia SAB T

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

https://www.firstpost.com/wp-content/uploads/large_file_plugin/2019/02/1549021404_Salarytable.jpg

Web 23 f 233 vr 2022 nbsp 0183 32 The corporate income tax rate would remain at 17 for year of assessment 2022 with no corporate income tax rebate proposed A minimum effective tax rate Web 7 sept 2023 nbsp 0183 32 The 15 percent minimum tax applies to corporations that report annual income of more than 1 billion to shareholders but reduced their effective tax rate well

Web Corporate income tax rate and rebate The corporate income tax rate would remain at 17 for year of assessment YA 2023 with no corporate income tax rebate proposed Web Il y a 4 heures nbsp 0183 32 The IRS and Treasury Department released interim guidance on the new book minimum tax on Tuesday The Inflation Reduction Act included a 15 alternative

Download Corporate Income Tax Rebate

More picture related to Corporate Income Tax Rebate

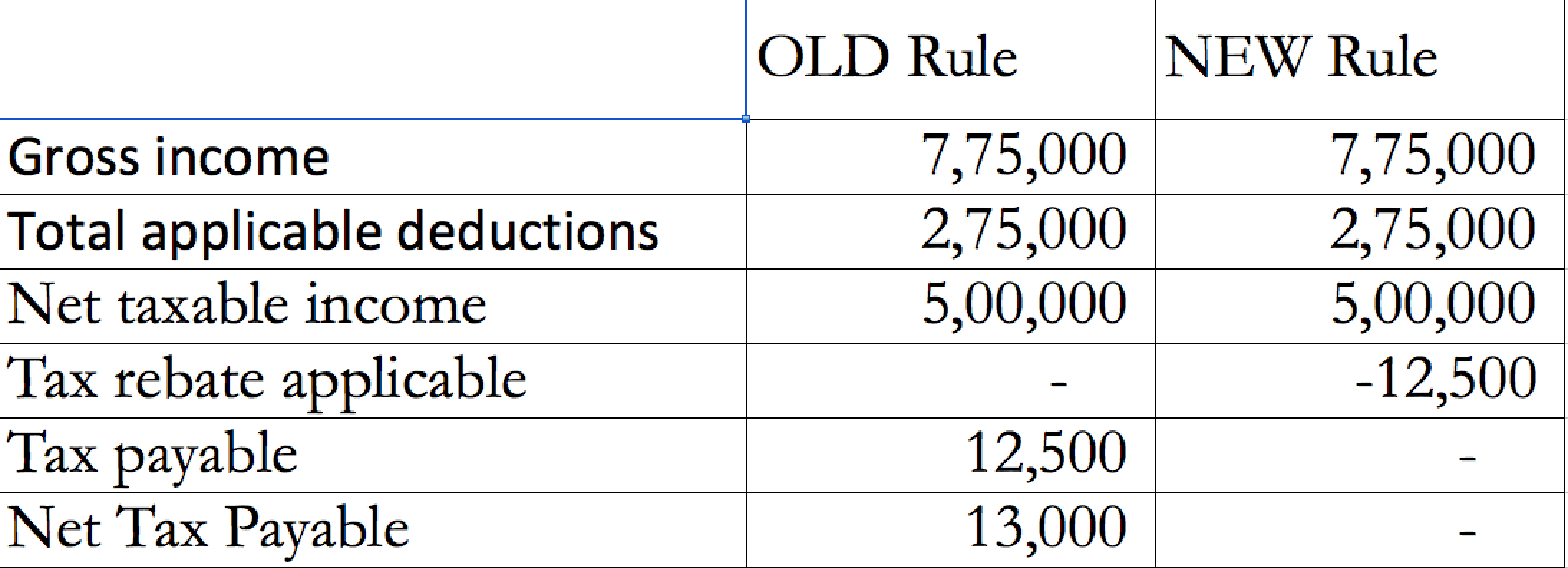

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.46.44-AM.png

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Web 16 ao 251 t 2022 nbsp 0183 32 Big U S companies fought the 15 corporate minimum tax in the Inflation Reduction Act but tax experts say it won t hurt their bottom line all that much

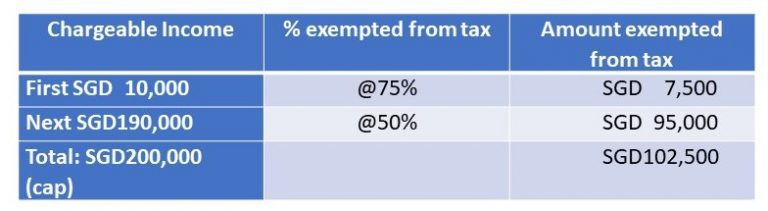

Web Corporate income tax The corporate income tax rate remains at 17 with a partial tax exemption on the first SGD 200 000 of a company s normal chargeable income No Web 14 mars 2023 nbsp 0183 32 Singapore Corporate Income Tax Rebate CIT Rebate Foreign Sourced Income Exemption Scheme FSIE Although foreign sourced income for Singaporean

Income Tax Deductions List FY 2019 20

https://www.relakhs.com/wp-content/uploads/2019/02/Revised-Section-87A-Tax-Rebate-impact-on-Income-tax-liability-calculation-FY-2019-20-AY-2020-21.jpg

Latvijas Balzams Secures Corporate Income Tax Rebate Amber Beverage Group

https://amberbev.com/wp-content/uploads/2017/10/LB_Ekas_uzraksts_debesis_1-768x1024.jpg

https://subventions.fr/guide-des-aides/credit-d-impot-pour-la-reprise...

Web Condition d attribution du cr 233 dit d imp 244 t pour la reprise d une entreprise par ses salari 233 s 1 La soci 233 t 233 rachet 233 e et la soci 233 t 233 nouvelle doivent 234 tre soumises au r 233 gime de droit

https://www.crowe.com/sg/blog/corporate-income-tax-rebate

Web 15 mars 2020 nbsp 0183 32 The CIT rebate reduces the tax liability of tax paying companies in YA 2020 financial year ended 2019 As the CIT rebate will be capped at S 15 000 this measure

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Income Tax Deductions List FY 2019 20

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Deferred Tax And Temporary Differences The Footnotes Analyst

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Overview Of Singapore Corporate Taxation System JSE Office

How Do I Find Out About Tax Rebate Tax Walls

Corporate Income Tax Rebate - Web 7 sept 2023 nbsp 0183 32 The 15 percent minimum tax applies to corporations that report annual income of more than 1 billion to shareholders but reduced their effective tax rate well