Corporate Tax Income Rebate Web Corporate Income Tax Rebates Corporate Income Tax rebates are given to companies to ease their business costs and to support their restructuring These rebates are

Web 3 lignes nbsp 0183 32 14 mars 2023 nbsp 0183 32 The corporate income tax rebate is designed to assist businesses that are liable to pay Web 12 sept 2023 nbsp 0183 32 Corporate income tax related compliance costs in the European Union could amount to as much as 54 billion a year Moreover 90 of this amount is incurred

Corporate Tax Income Rebate

Corporate Tax Income Rebate

https://www.rebate2022.com/wp-content/uploads/2023/05/latest-income-tax-slab-rates-for-fy-2022-23-ay-2023-24-budget-2022.jpg

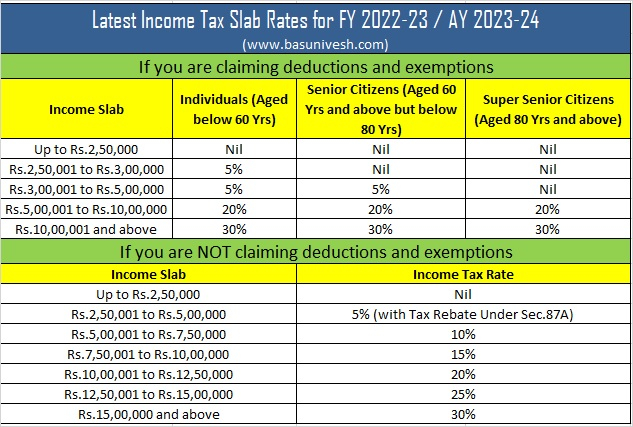

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Web 15 mars 2020 nbsp 0183 32 The table below summarizes the measures introduced in Budget 2020 with regards to the Corporate Income Tax Rebate its impact on businesses and the action Web Il y a 1 jour nbsp 0183 32 But that option received a lot of pushback from countries afraid of losing tax revenue Countries with comparatively low corporate tax like Ireland or Lithuania would

Web 16 f 233 vr 2021 nbsp 0183 32 No corporate income tax rebate is proposed for the year of assessment YA 2021 Extension of a number of Budget 2020 measures including Web 23 f 233 vr 2022 nbsp 0183 32 The corporate income tax rate would remain at 17 for year of assessment 2022 with no corporate income tax rebate proposed A minimum effective tax rate

Download Corporate Tax Income Rebate

More picture related to Corporate Tax Income Rebate

Budget Highlights For 2021 22 Nexia SAB T

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

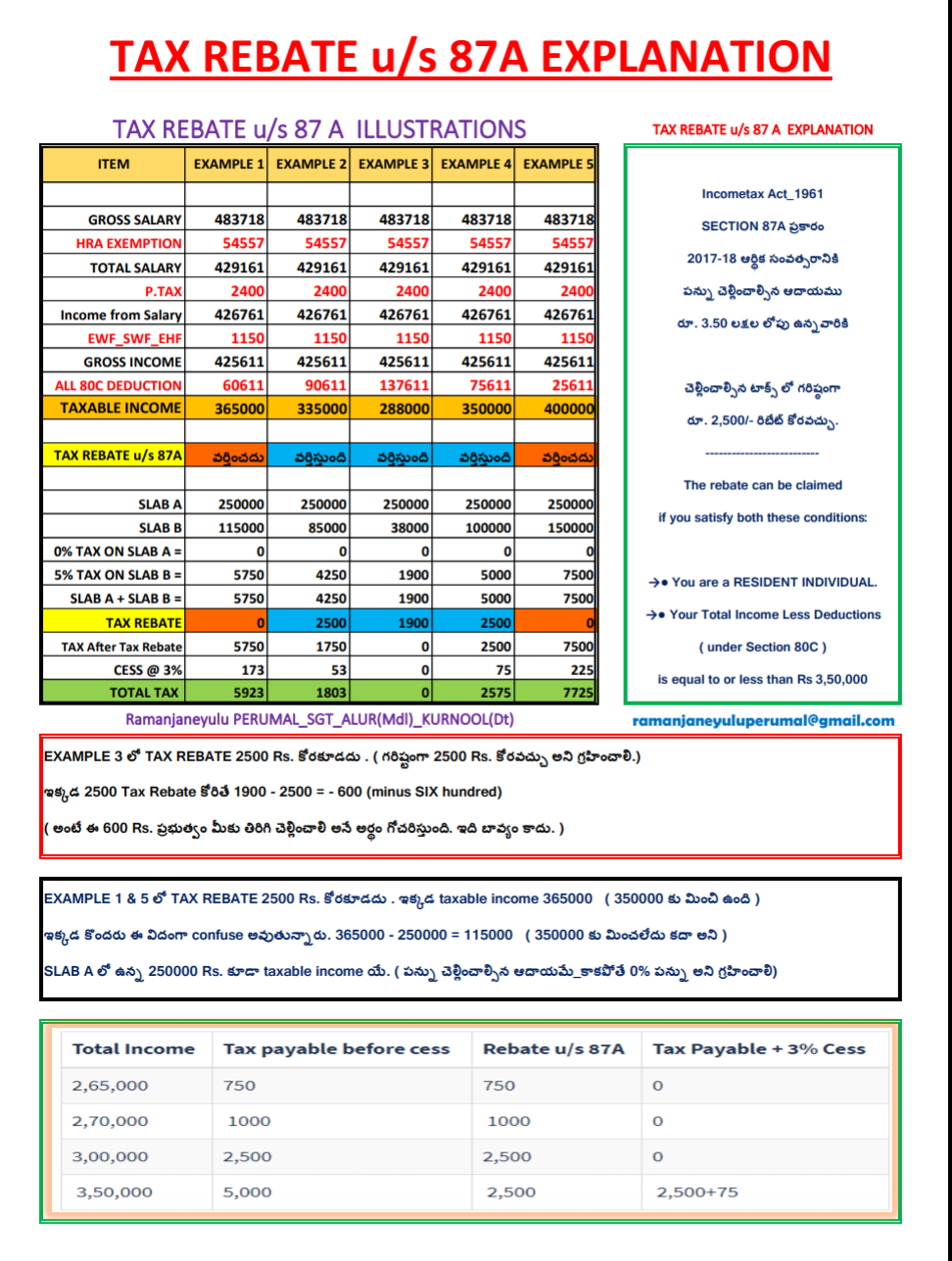

TAX REBATE 2017 18 Clarification Under Section 87 A MANNAMweb

https://1.bp.blogspot.com/-sDVKhBiYVPw/WjvLsbj_xKI/AAAAAAAAEqE/gBOxGyt0hCUPF9mjHp-v9CVvFwyYVySUwCLcBGAs/s1600/Screenshot_2017-12-21-10-36-55-705_com.google.android.apps.docs.png

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Web Il y a 13 heures nbsp 0183 32 The IRS and Treasury Department released interim guidance on the new book minimum tax on Tuesday The Inflation Reduction Act included a 15 alternative Web 7 sept 2023 nbsp 0183 32 The 15 percent minimum tax applies to corporations that report annual income of more than 1 billion to shareholders but reduced their effective tax rate well

Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Web YA 2020 onwards 75 exemption on the first 100 000 of normal chargeable income and a further 50 tax exemption on the next 100 000 of normal chargeable income YA

P55 Tax Rebate Form Business Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

https://www.iras.gov.sg/taxes/corporate-income-tax/basics-of-corporate...

Web Corporate Income Tax Rebates Corporate Income Tax rebates are given to companies to ease their business costs and to support their restructuring These rebates are

https://premiatnc.com/sg/blog/singapore-corp…

Web 3 lignes nbsp 0183 32 14 mars 2023 nbsp 0183 32 The corporate income tax rebate is designed to assist businesses that are liable to pay

2007 Tax Rebate Tax Deduction Rebates

P55 Tax Rebate Form Business Printable Rebate Form

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

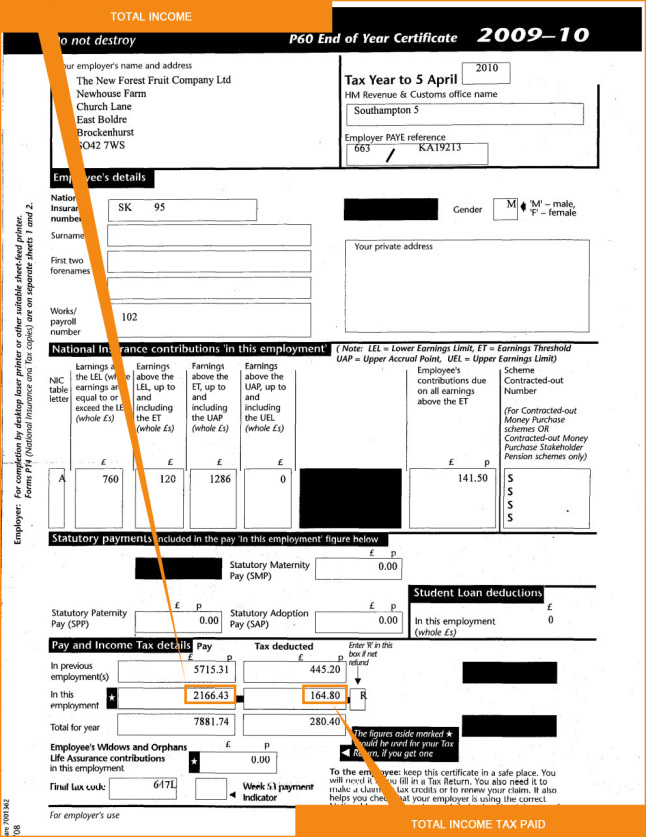

How To Check Your P60 Form Or Payslips For Tax Rebate Payslips

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

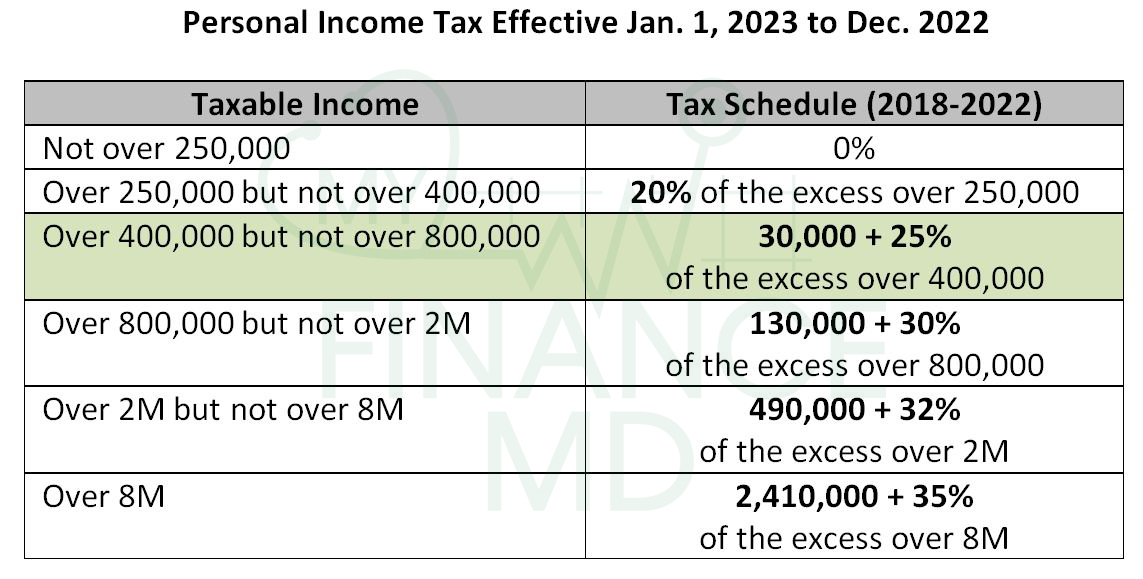

How To Compute And File The 2nd Quarter Income Tax Return TRAIN

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Corporate Tax Income Rebate - Web 23 f 233 vr 2022 nbsp 0183 32 The corporate income tax rate would remain at 17 for year of assessment 2022 with no corporate income tax rebate proposed A minimum effective tax rate