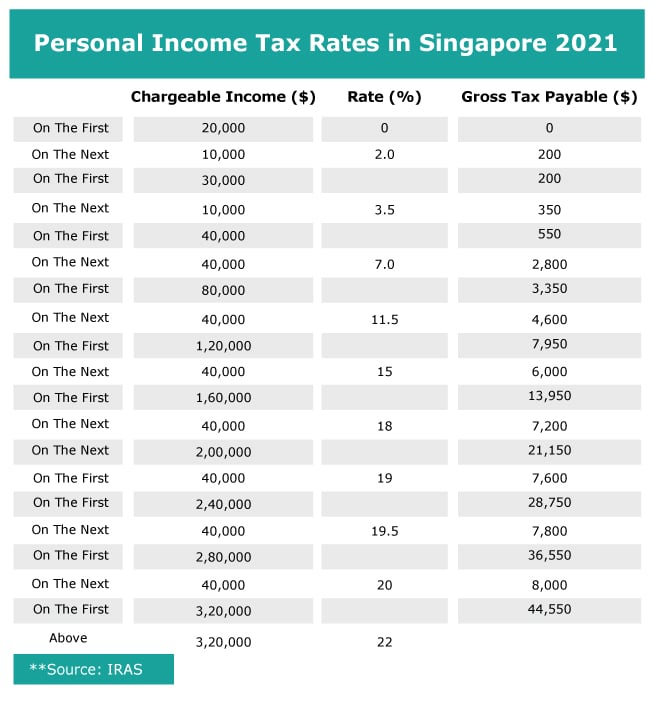

Corporate Tax Rebate 50 Web Tax benefits New businesses with innovative start up status are entitled to exemptions from Personal income tax or corporate income tax Total exemption for the first

Web 21 juil 2023 nbsp 0183 32 Corporate tax rates in France have been gradually reducing In 2021 the standard rate was 26 5 with companies with profits of more than 500 000 paying a Web 75 exemption on the first 10 000 of normal chargeable income and A further 50 exemption on the next 190 000 of normal chargeable income YA 2019 and before

Corporate Tax Rebate 50

Corporate Tax Rebate 50

https://www.rebate2022.com/wp-content/uploads/2023/05/singapore-corporate-tax-rate-singapore-taxation-guide-2021.jpg

How To Qualify For 50 SC Tax Rebate YouTube

https://i.ytimg.com/vi/LxLmX18DSPg/maxresdefault.jpg

Corporate Tax Rebate Budget 2022 Rebate2022

https://www.rebate2022.com/wp-content/uploads/2023/05/latest-income-tax-slab-rates-for-fy-2022-23-ay-2023-24-budget-2022.jpg

Web 5 juil 2021 nbsp 0183 32 amount that can be relieved using carried forward trading losses that arose before 1 April 2017 is restricted to broadly the amount of an allowance up to 163 5 Web 50 of next 290 000 145 000 Chargeable income after exempt income 407 500 Tax thereon 17 69 275 Less 50 corporate tax income rebate 50 of tax

Web HMRC s interest rate is 0 5 Refunds Use your Company Tax Return to tell HMRC if you think you re due a Corporation Tax refund known as a repayment and how you want Web The tax credit is 50 of the wages paid up to 10 000 per employee capped at 5 000 per employee If the amount of the tax credit for an employer is more than the amount of the

Download Corporate Tax Rebate 50

More picture related to Corporate Tax Rebate 50

Deferred Tax And Temporary Differences The Footnotes Analyst

https://www.footnotesanalyst.com/wp-content/uploads/2022/04/FAG-DT1.png

Which States Have Property Tax Rebates PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/north-central-illinois-economic-development-corporation-property-taxes-1.png?fit=1355%2C1149&ssl=1

Corporate Tax Overview Corporate Tax Rates Rebates Mudra Nidhi

https://www.mudranidhi.com/wp-content/uploads/2023/04/Corporate-Tax-Overview-Corporate-Tax-Rates-Rebates-1024x576.jpg

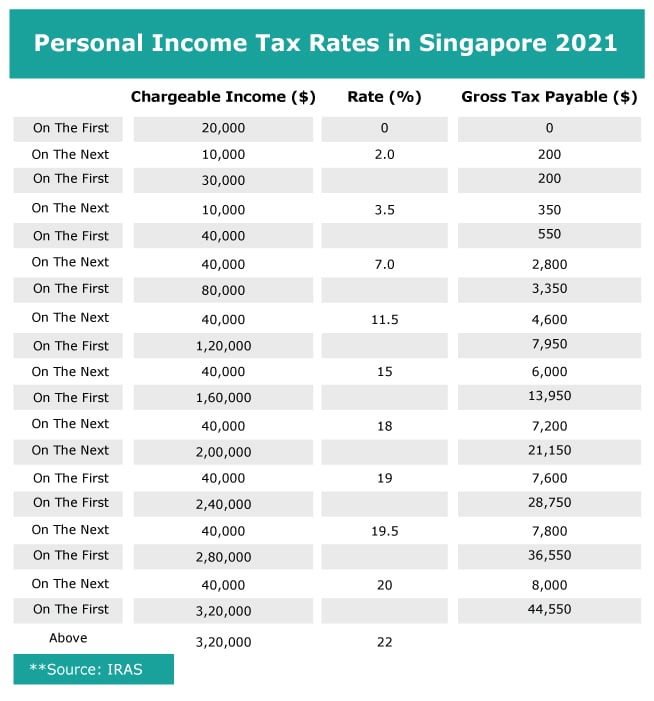

Web 4 mars 2022 nbsp 0183 32 Le budget de fonctionnement du CSE Dans les entreprises de moins de 50 salari 233 s l employeur n est pas tenu de participer au budget de fonctionnement Web 16 f 233 vr 2021 nbsp 0183 32 Corporate income tax The corporate income tax rate remains at 17 with a partial tax exemption on the first SGD 200 000 of a company s normal chargeable

Web 23 f 233 vr 2022 nbsp 0183 32 The corporate income tax rate would remain at 17 for year of assessment 2022 with no corporate income tax rebate proposed A minimum effective tax rate Web Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit

Happy Bright Day Quotes

https://i.ytimg.com/vi/YvJ_zpK4k30/maxresdefault.jpg

Illinois Tax Rebate Tracker Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/illinois-tax-rebate-2022-cray-kaiser-1.png

https://www.impots.gouv.fr/international-professionnel/tax-incentives

Web Tax benefits New businesses with innovative start up status are entitled to exemptions from Personal income tax or corporate income tax Total exemption for the first

https://www.expatica.com/fr/finance/taxes/france-corporate-tax-rate-445980

Web 21 juil 2023 nbsp 0183 32 Corporate tax rates in France have been gradually reducing In 2021 the standard rate was 26 5 with companies with profits of more than 500 000 paying a

HMRC Rebate Of Corporation Tax Accounting QuickFile

Happy Bright Day Quotes

Why Is Incorporating A Business Better Than Setting Up A LLP

Budget 2023 Expect Extension Of Corporate Tax Rebates For Green

Singapore Corporate Income Tax Rebate What Do You Need To Know

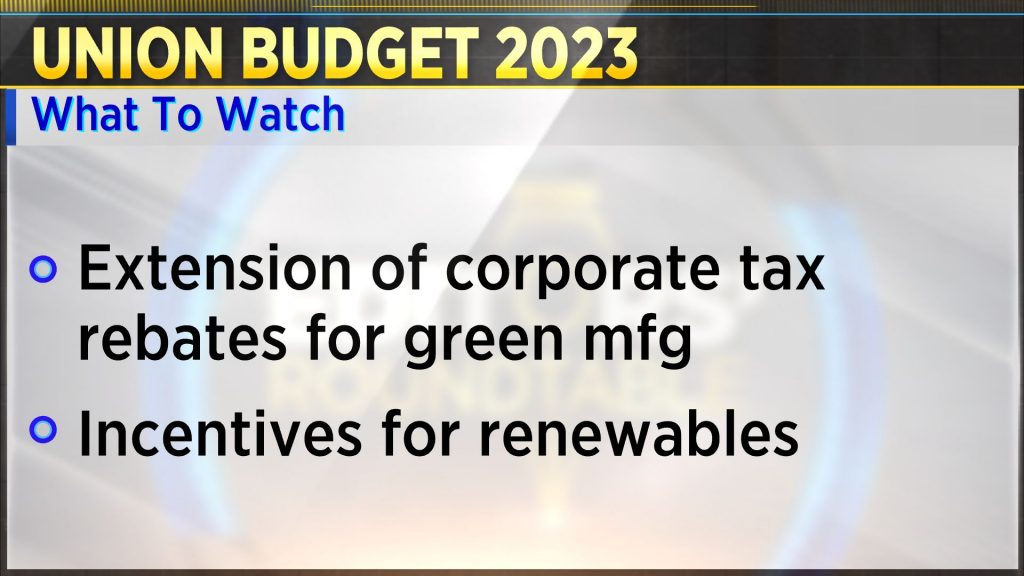

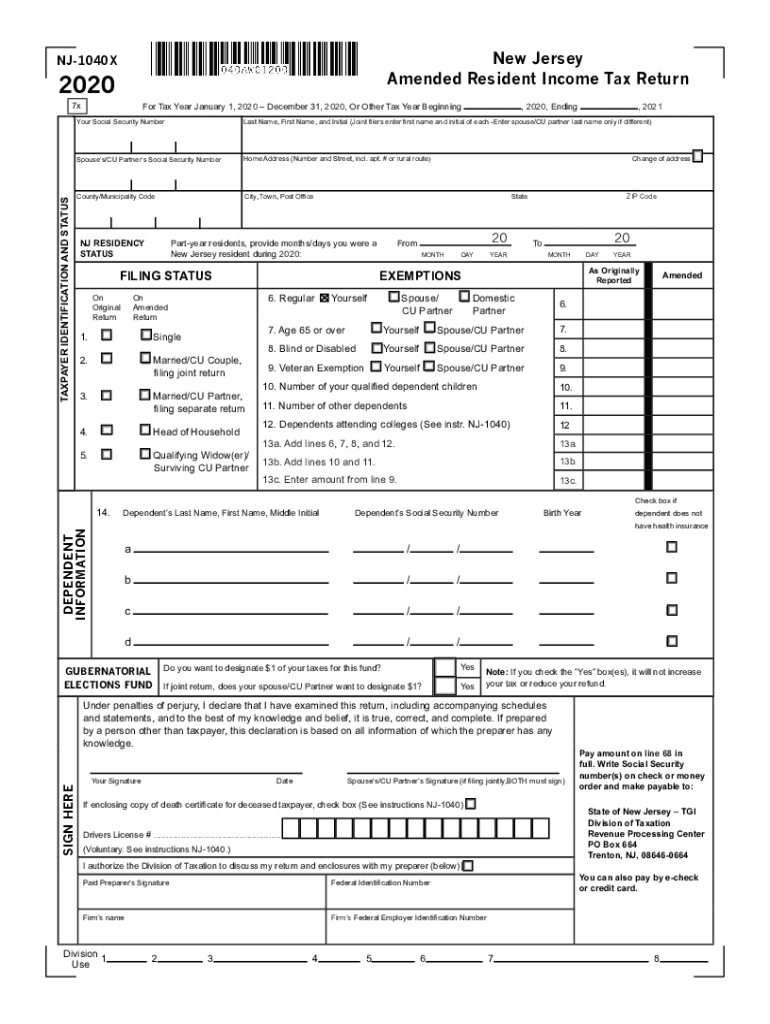

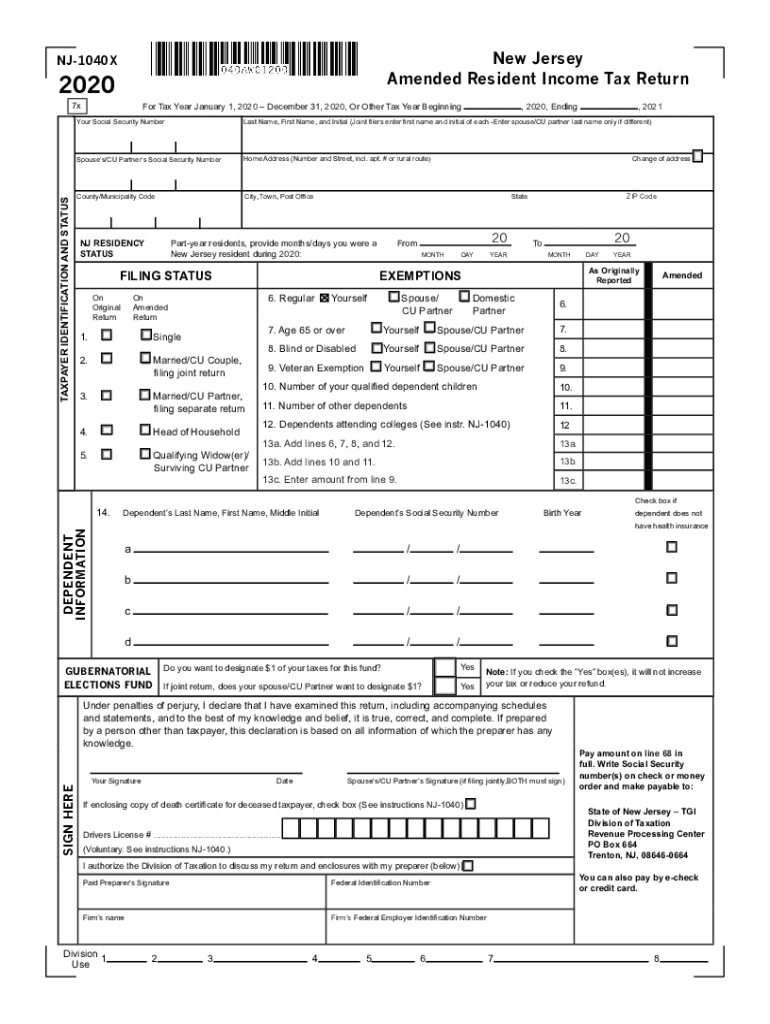

2020 Form NJ DoT NJ 1040x Fill Online Printable Fillable Blank

2020 Form NJ DoT NJ 1040x Fill Online Printable Fillable Blank

Corporate Tax Rebates Can Help Lengthen Runway For Startups Amid

Update On Montana Tax rebates Bill

Insights Corporation Tax Rebates

Corporate Tax Rebate 50 - Web De tr 232 s nombreux exemples de phrases traduites contenant quot corporate tax rebate quot Dictionnaire fran 231 ais anglais et moteur de recherche de traductions fran 231 aises