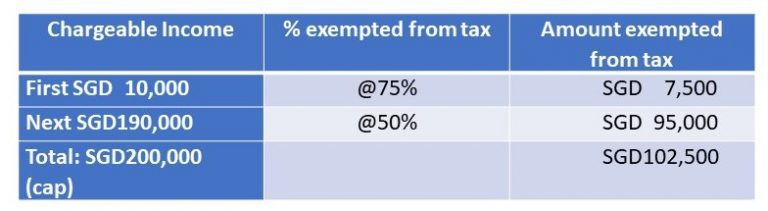

Corporate Tax Rebate Singapore Web 28 f 233 vr 2023 nbsp 0183 32 From YA2020 new start ups will be eligible for 75 tax exemption on the first 100 000 of normal chargeable income and 50

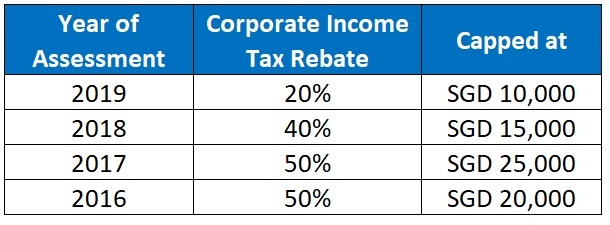

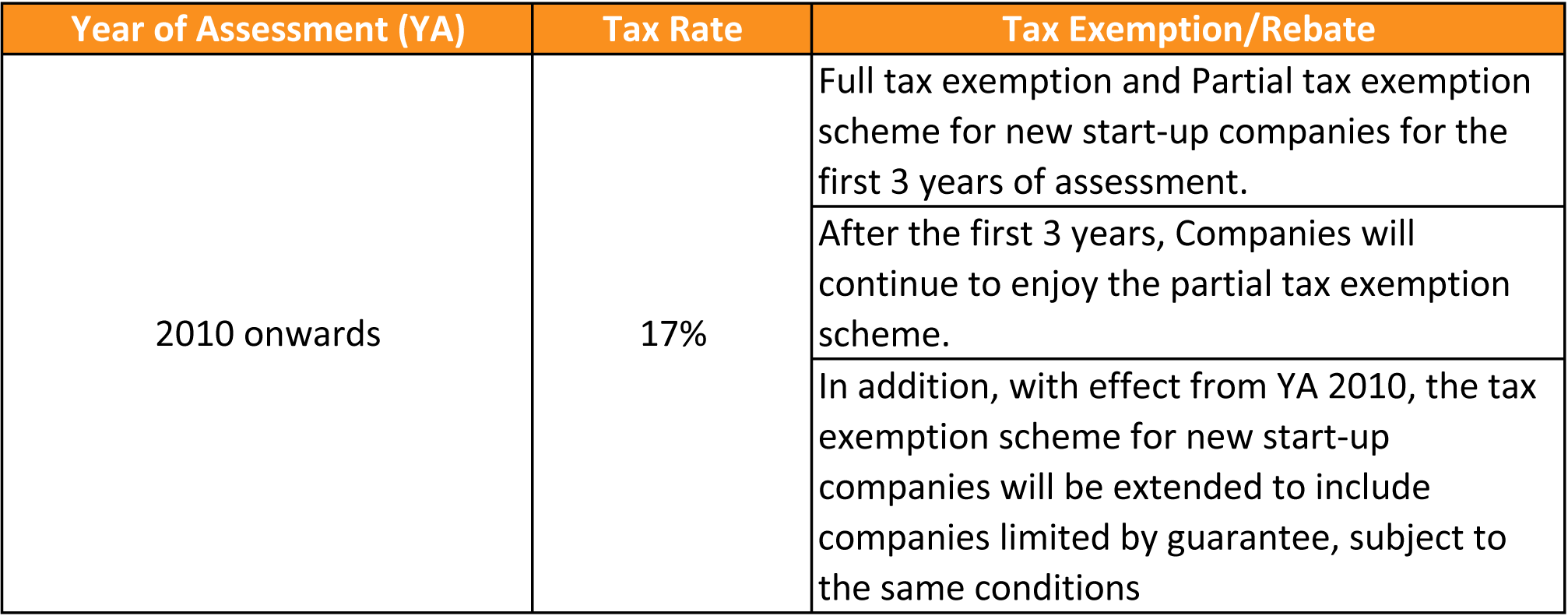

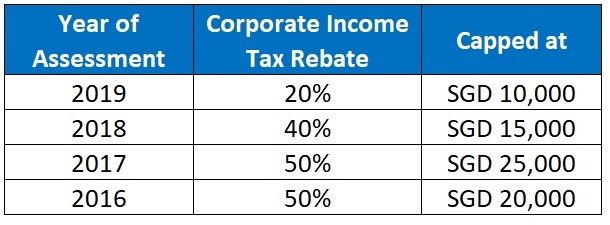

Web 18 f 233 vr 2020 nbsp 0183 32 All Singapore companies are eligible for corporate income tax rebate regardless of profit levels or paid up capital amount The following table lists the Web 16 janv 2023 nbsp 0183 32 Who is eligible for the corporate income tax rebate in Singapore As of the Singapore Budget 2023 the corporate income tax rebate is no longer available for YA

Corporate Tax Rebate Singapore

Corporate Tax Rebate Singapore

https://www.rebate2022.com/wp-content/uploads/2023/05/singapore-corporate-tax-rate-singapore-taxation-guide-2021.jpg

Tax Services Singapore File Tax Returns On Time Company Taxation

https://www.accountingsolutionssingapore.com/wp-content/uploads/CIT-2018.jpg

Overview Of Singapore Corporate Taxation System JSE Office

https://jseoffices.com/wp-content/uploads/2018/06/no-11-768x211.jpg

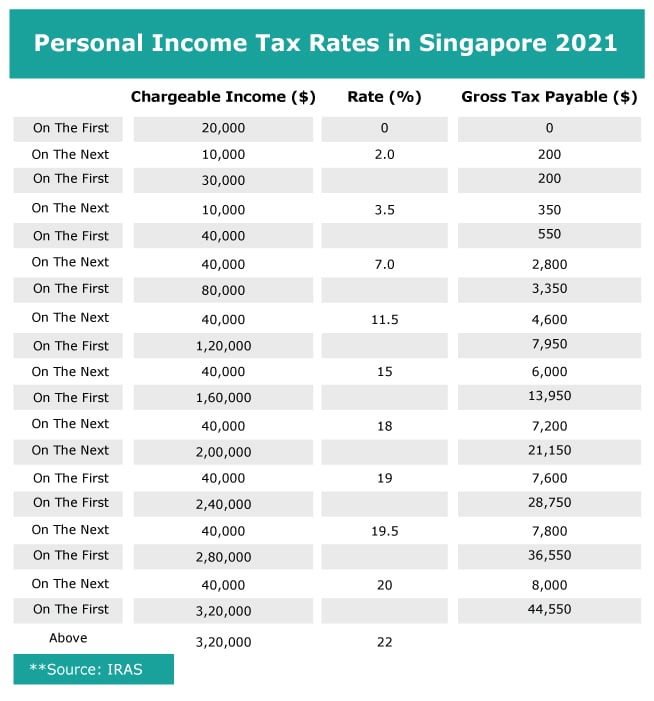

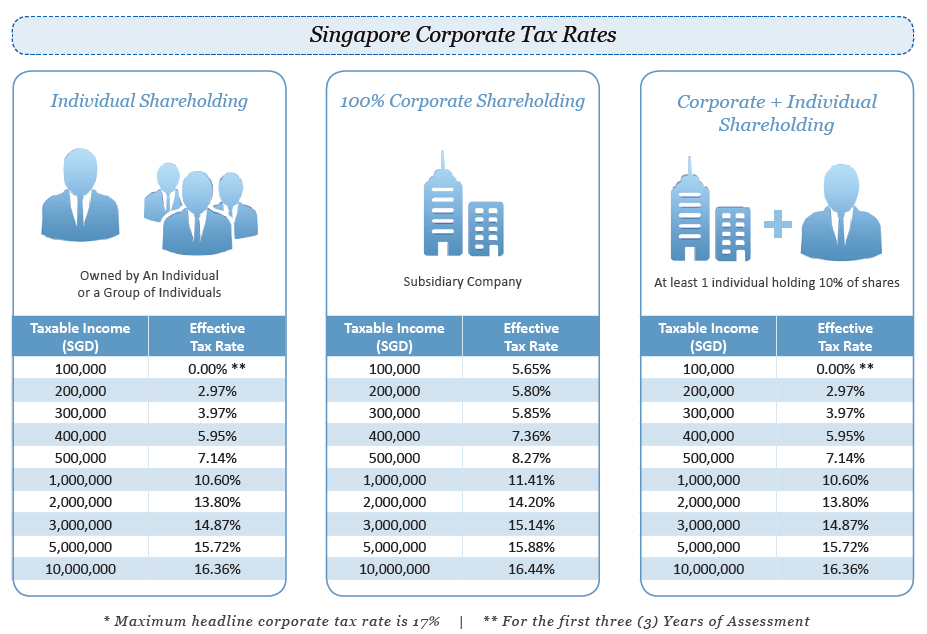

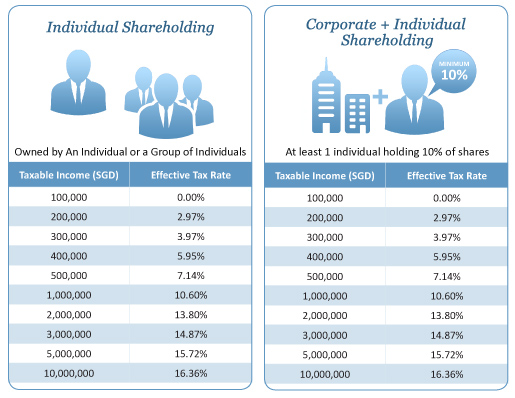

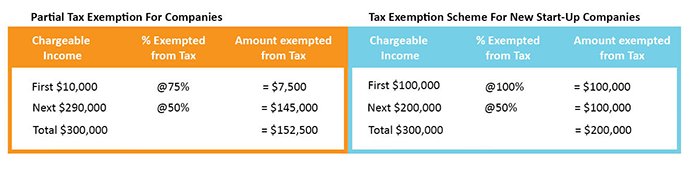

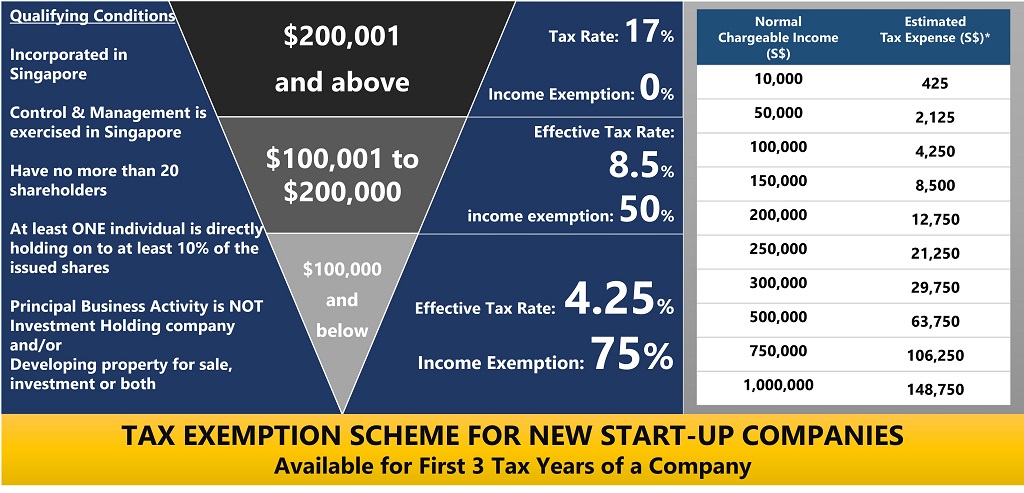

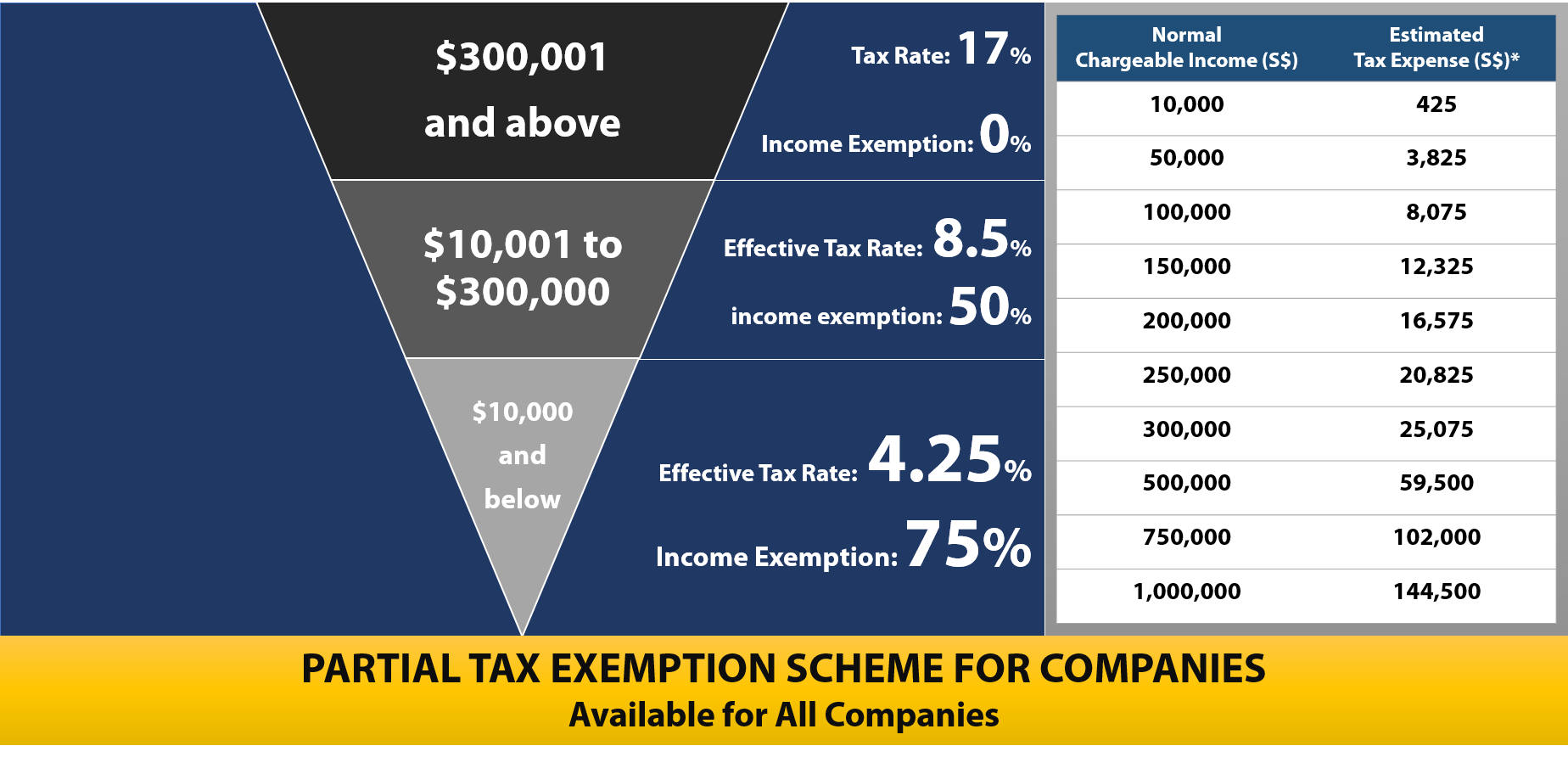

Web 18 f 233 vr 2020 nbsp 0183 32 For example if a company or startup s earnings amount to SGD100 000 applying a 17 corporate tax rate to the chargeable income would result in SGD17 000 17 x SGD100 000 tax payable before any Web 15 mars 2020 nbsp 0183 32 All companies will receive a 25 CIT rebate for the Year of Assessment YA 2020 The rebate is capped at S 15 000 The CIT rebate is available to all

Web 14 mars 2023 nbsp 0183 32 The Singapore corporate income tax rebate is no longer available for YA 2023 This is based on the Singapore Budget 2023 which was delivered by Singapore s Deputy Prime Minister and Minister for Web To relieve business costs a 50 and 20 corporate income tax rebate of tax payable will be granted in YA 2017 and YA 2018 respectively The capped amounts for YA 2017 and

Download Corporate Tax Rebate Singapore

More picture related to Corporate Tax Rebate Singapore

Why Invest In India Through A Singapore Company Rikvin Pte Ltd

https://www.rikvin.com/wp-content/uploads/singapore-corporate-tax-rate-infographic.jpg

Corporate Tax In Singapore Company Incorporation In Singapore

http://www.paulhypepage.com/wp-content/uploads/2012/06/Corporate-Tax-Table-1.png

Corporate Tax Benefits For Singapore Companies Taxation Guide

https://www.singaporecompanyincorporation.sg/wp-content/uploads/effective-corporate-tax-rate-full-exemption.jpg

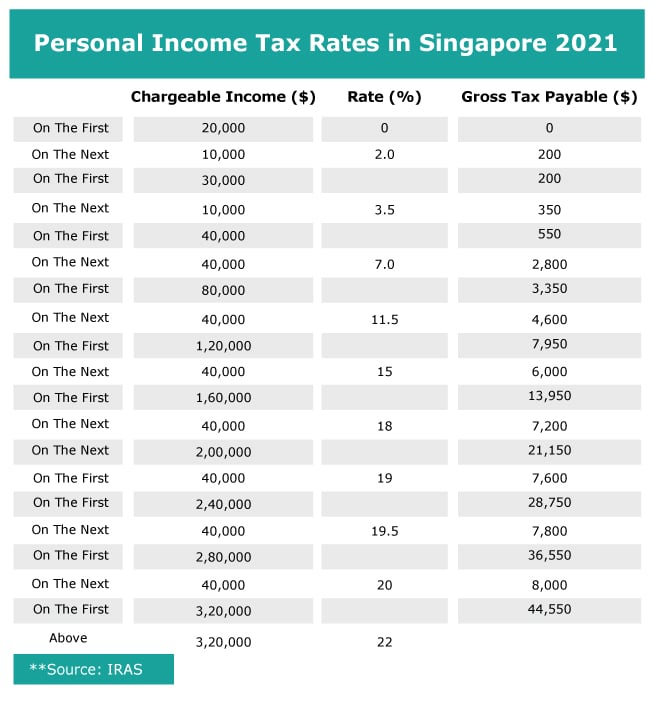

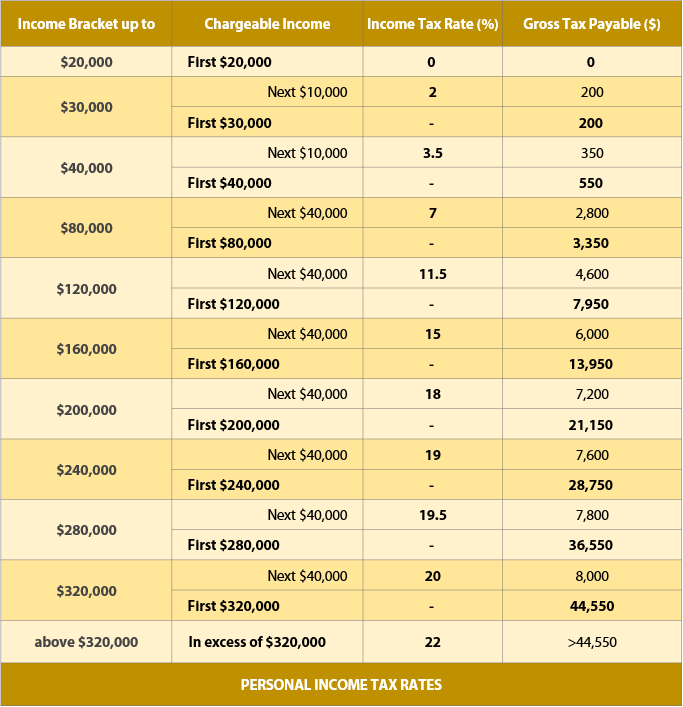

Web Singapore adopts the use of tax incentives as one of the tools to encourage new and high growth activities Tax incentives are granted only for qualifying activities and the Web February 2 2022 What s in the article Corporate Income Tax Exemption Schemes Corporate Income Tax CIT Rebate for YAs 2013 to 2020 There s no denying that

Web 75 exemption on the first SG 100 000 of normal chargeable income Newly incorporated companies will be exempted from 75 corporate income tax rate on the first Web 16 f 233 vr 2021 nbsp 0183 32 The corporate income tax rate remains at 17 with a partial tax exemption on the first SGD 200 000 of a company s normal chargeable income No corporate

All Income Earned In Singapore Is Subject To Tax However Singapore

https://i.pinimg.com/originals/02/cc/ee/02cceeb8209cfe3f959b1480f37a5c15.jpg

Corporate Tax Singapore Professional Tax Consultant

https://singaporeaccounting.com/wp-content/uploads/2016/01/SingaporeAccounting-Tax-Exemption-KR.png

https://dollarsandsense.sg/business/complete …

Web 28 f 233 vr 2023 nbsp 0183 32 From YA2020 new start ups will be eligible for 75 tax exemption on the first 100 000 of normal chargeable income and 50

https://pwco.com.sg/guides/corporate-tax-rebate

Web 18 f 233 vr 2020 nbsp 0183 32 All Singapore companies are eligible for corporate income tax rebate regardless of profit levels or paid up capital amount The following table lists the

Singapore Tax Rates

All Income Earned In Singapore Is Subject To Tax However Singapore

2020 Singapore Corporate Tax Update Singapore Taxation

Understanding Corporate Tax In Singapore ContactOne

Understanding Corporate Tax In Singapore ContactOne

Expanding Your Indian Startup In Singapore Business Blog

Expanding Your Indian Startup In Singapore Business Blog

Asiapedia Singapore s Corporate Income Tax Quick Facts Dezan

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Understanding Singapore Taxes In 5 Minutes

Corporate Tax Rebate Singapore - Web 15 mars 2020 nbsp 0183 32 All companies will receive a 25 CIT rebate for the Year of Assessment YA 2020 The rebate is capped at S 15 000 The CIT rebate is available to all