Corporate Tax Rebate Ya2019 Web 18 f 233 vr 2020 nbsp 0183 32 In YA2019 companies were granted 20 Corporate Income Tax rebate which is capped at a maximum of SGD10 000 If a Singapore company s tax payable for

Web Corporate Income Tax Exemption Schemes Since 2013 new startup companies in Singapore have enjoyed tax exemptions for various years of assessment YA as Web My company qualifies for the tax exemption scheme for start new up companies from YA 2019 to YA 2021 My normal chargeable income before tax exemption for the 3YAs are

Corporate Tax Rebate Ya2019

Corporate Tax Rebate Ya2019

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/tax-reliefs-rebates-income-tax.png

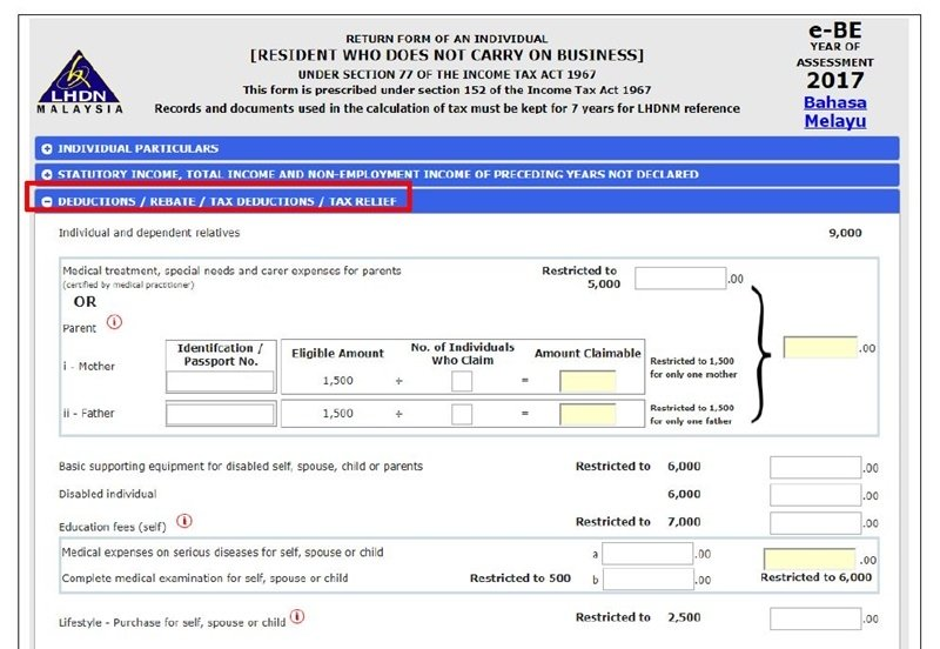

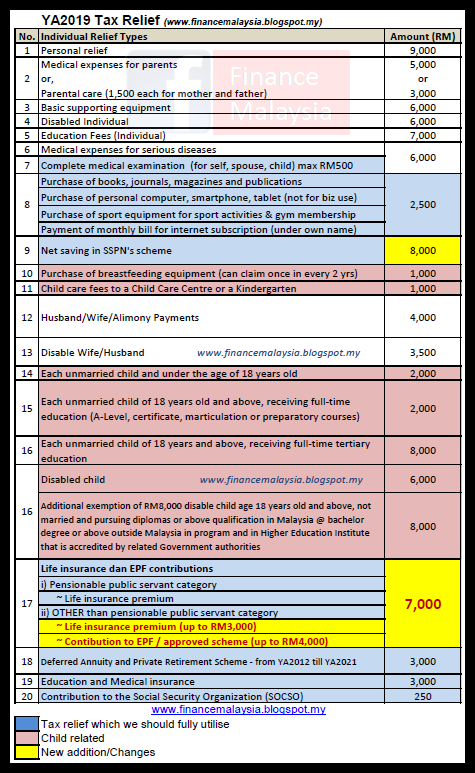

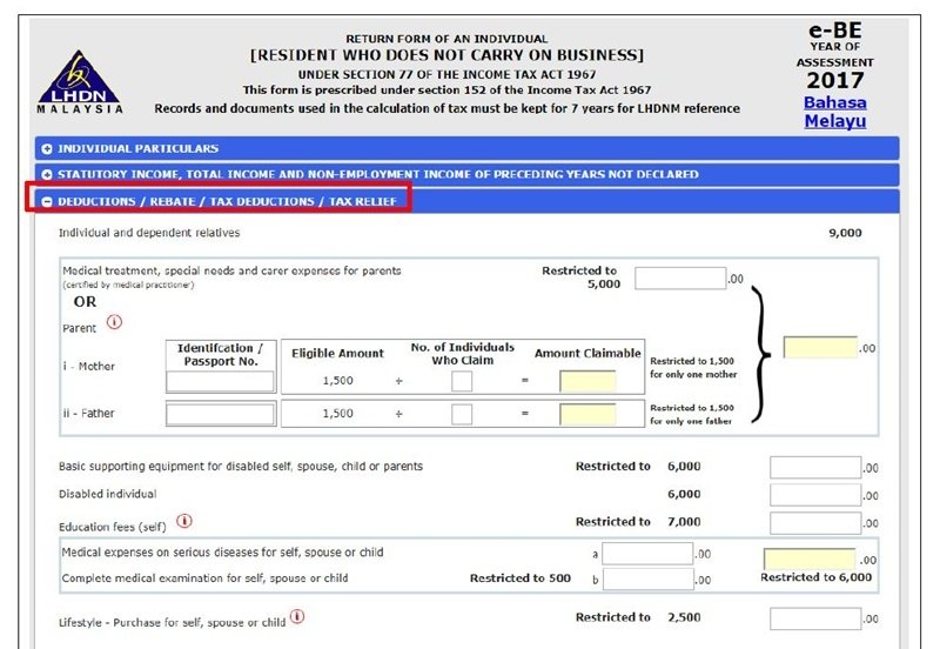

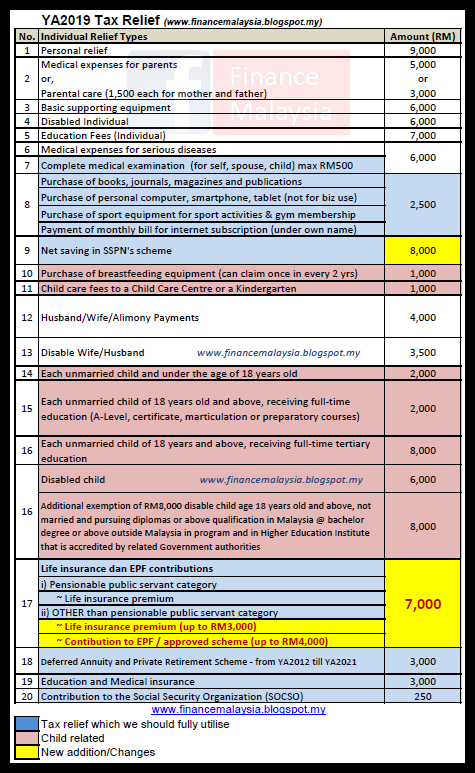

Finance Malaysia Blogspot Personal Income Tax For YA2019 What Life

https://1.bp.blogspot.com/-0i_j5Ftj0lc/Xt3ueaRUcTI/AAAAAAAAEsY/4TD1vgvch_k9fiYltWVbhbmTKWmP6UlbgCK4BGAsYHg/s773/YA2019%2Btax%2Brelief.png

Tax Exemption Malaysia 2019

https://d3q48uqppez4lq.cloudfront.net/wp-content/uploads/2020/12/malaysia-tax-relief-2020-mypf.png

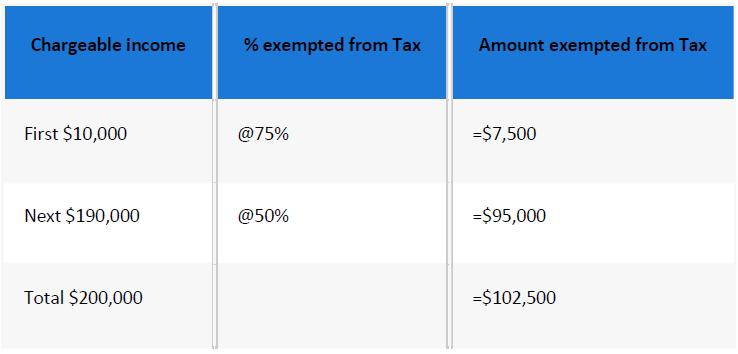

Web 28 f 233 vr 2023 nbsp 0183 32 From YA2020 all companies enjoy a 75 exemption on the first 10 000 of normal chargeable income and a further 50 exemption on the next 190 000 of normal chargeable income This Web YA 2020 onwards 75 exemption on the first 100 000 of normal chargeable income and a further 50 tax exemption on the next 100 000 of normal chargeable income YA

Web A newly incorporated Singapore tax resident company may for its first 3 YAs to YA2019 qualify for 100 tax exemption on its first S 100 000 of Chargeable Income CI and a Web For YA 2018 this rate is 40 of corporate tax payable capped at S 15 000 and for YA2019 it is at 20 of corporate tax payable capped at S 10 000 In addition to the low corporate tax rates there are

Download Corporate Tax Rebate Ya2019

More picture related to Corporate Tax Rebate Ya2019

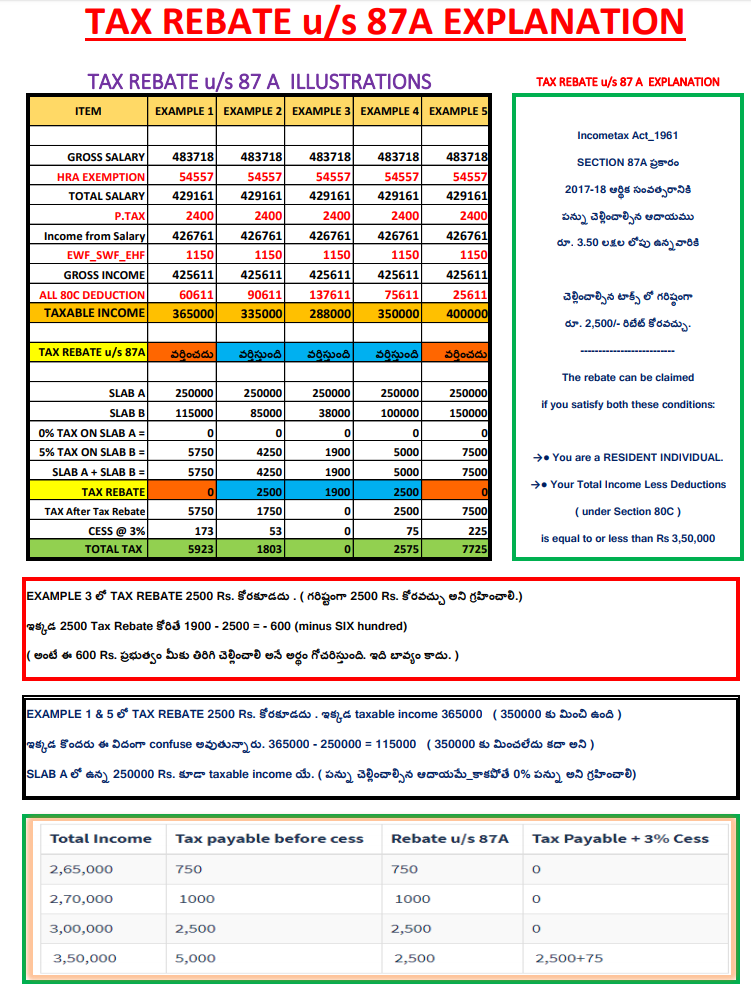

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

https://teachersbuzz.in/wp-content/uploads/2020/05/TAX2BRebate.png

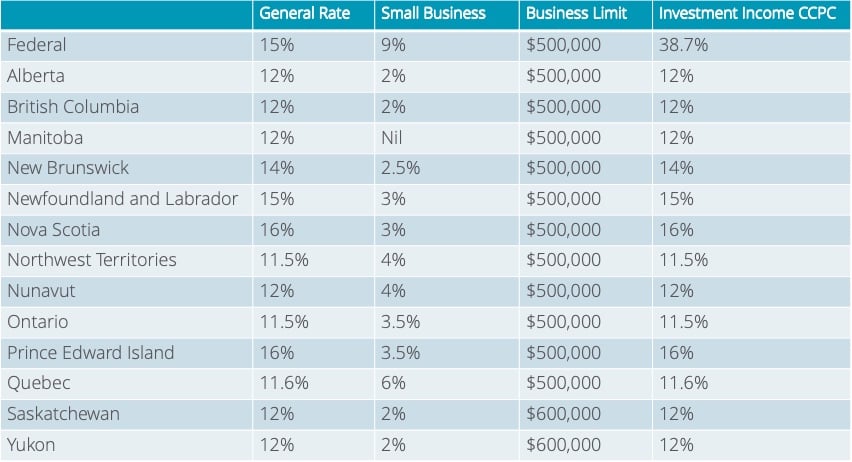

Financial Investing For A Small Business Owner In Canada

https://www.olympiabenefits.com/hs-fs/hubfs/corporateTaxRate.jpg?width=852&name=corporateTaxRate.jpg

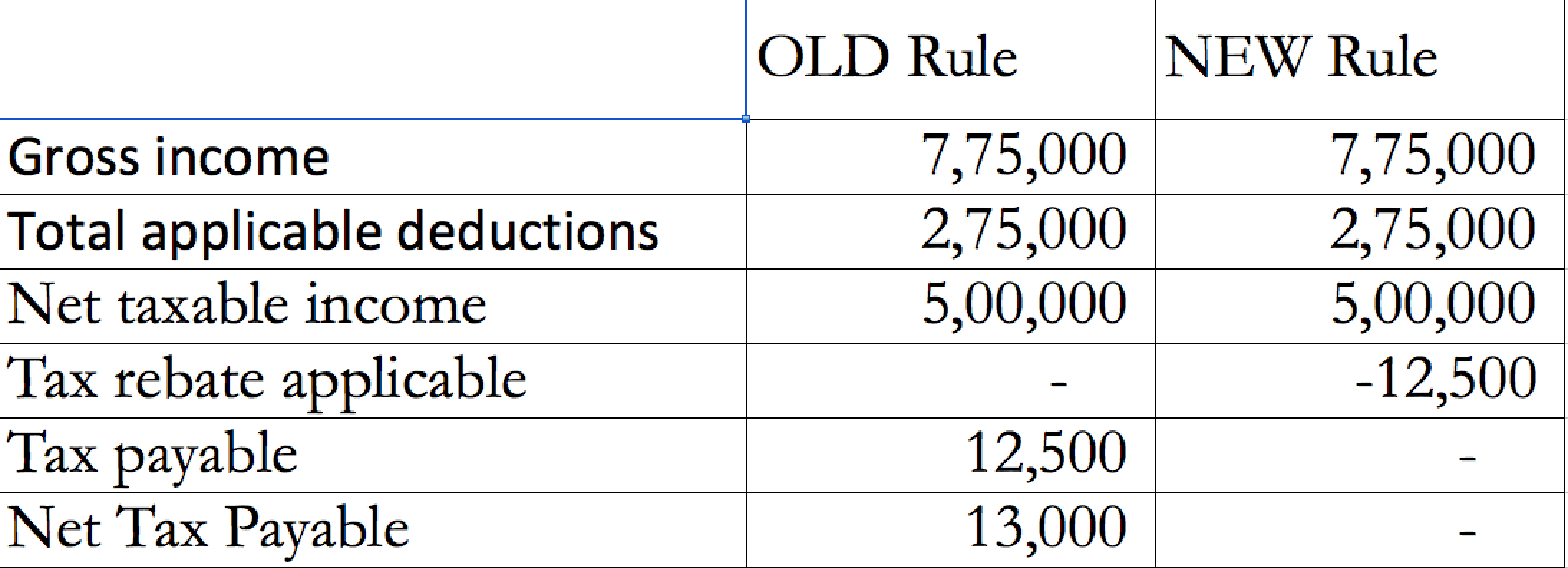

Web Companies are also given a 20 corporate tax rebate capped at S 10 000 for YA 2019 and 25 corporate tax rebate capped at S 15 000 for YA 2020 Web Corporate tax rates and reliefs No change to corporate tax rates Corporate income tax rate remains at 17 Corporate tax rebate reduced to 20 for YA 2019 capped at

Web 18 f 233 vr 2020 nbsp 0183 32 As a simple illustration if a company s chargeable income is SGD250 000 for YA2020 the total income exempted from tax would be SGD102 500 SGD7 500 SGD Web All companies will receive a corporate income tax rebate of the following 20 corporate income tax rebate capped at 10 000 for YA 2019 New 40 corporate income tax

Tax Planning For 2019 Malaysia Get It Done Now Be Better

https://www.bebetter.my/wp-content/uploads/2019/11/Tax-Saving-for-YA2019.png

Understanding Corporate Tax In Singapore ContactOne

https://i2.wp.com/www.contactone.com.sg/wp-content/uploads/2017/11/Illustration-Tax-Exemption-Scheme-Partial.png?resize=1024%2C494&ssl=1

https://pwco.com.sg/guides/corporate-tax-rebate

Web 18 f 233 vr 2020 nbsp 0183 32 In YA2019 companies were granted 20 Corporate Income Tax rebate which is capped at a maximum of SGD10 000 If a Singapore company s tax payable for

https://www.wealthbridgecs.com/sg-guide/singapore-corporate-tax...

Web Corporate Income Tax Exemption Schemes Since 2013 new startup companies in Singapore have enjoyed tax exemptions for various years of assessment YA as

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Tax Planning For 2019 Malaysia Get It Done Now Be Better

Corporate Tax Rate 2019 Phil Bower

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Section 87A Tax Rebate Under Section 87A

List Of LHDN s Income Tax Relief For E Filing 2021 YA 2020

List Of LHDN s Income Tax Relief For E Filing 2021 YA 2020

Budget 2019 Tax Changes And Other Tax Changes Affecting YA 2020

Malaysia Personal Tax Relief YA 2019 Cheng Co Group

One Stop Malaysia 2019 Malaysia Income Tax Rebate Ya 2019 Explained

Corporate Tax Rebate Ya2019 - Web For YA 2018 this rate is 40 of corporate tax payable capped at S 15 000 and for YA2019 it is at 20 of corporate tax payable capped at S 10 000 In addition to the low corporate tax rates there are