Corporate Tax Return Deadline Electronic submission of Companies Return for accounting year ending in December 2024 with no tax liabilities or loss is declared Payment of Advertising Structure Fee for the third quarter of the year 2024 Payment of Environment Protection Fee for the month of June 2024

All companies deriving gross income and exempt income have the legal obligation to file annual returns and pay tax electronically Failure to file electronic returns carries a penalty of 20 of the tax payable maximum Rs 100 000 or Rs 5000 where no tax liability is declared in the return Every company both taxpayer and non taxpayer must file a return of its income on the basis of the income year preceding the year of assessment The return must be filed within six months of the financial year end Any tax due should be paid when the return is filed and within the six months deadline

Corporate Tax Return Deadline

Corporate Tax Return Deadline

https://www.fkgb.co.uk/wp-content/uploads/2020/01/Tax-return-deadline.jpg

Tax Return Deadline Extended By Two Days

https://www.steedman.co.uk/wp-content/uploads/2020/02/tax-return-deadline-extended-by-two-days.jpg

Tax Return Deadline ATO Issues New Warning

https://s.yimg.com/os/creatr-uploaded-images/2020-10/db5c83f0-197a-11eb-adef-e8044db9fca8

TAX PAID IN EXCESS REFUND Where the Income Tax form shows a TAX PAID IN EXCESS bank account should be provided for secured and fast track refund DUE DATE The return should be submitted at latest on 15 th October 2024 PENALTIES INTEREST Penalty for late submission of return PLS The Mauritian Revenue Authority May 10 issued a communique on the filing deadline for 2022 2023 corporate annual income tax returns The communique includes 1 the May 17 deadline for filing

If you re a C corporation or LLC electing to file your taxes as one for the 2024 tax year your corporate tax return is due on April 15th 2025 unless you use your own fiscal calendar in which case it s due on the 15th of the 4th month following the end of your tax year June 2020 will be granted an extended delay to pay any tax due in accordance with their annual Corporate tax return as follows a half of the tax shall be payable on or before 28 December 2020 and b the remainder shall be payable on or before 28 June 2021 Any tax payable by the above mentioned companies under the Advance Payment System

Download Corporate Tax Return Deadline

More picture related to Corporate Tax Return Deadline

Missed The Tax Return Deadline Do It By 30 April Before Further Charges

http://www.yourmoney.com/wp-content/uploads/sites/3/oldimg/2219557-caution-taxes-tax.jpg

Income Tax Return Deadline Extended Costas Tsielepis Co

https://tsielepis.com.cy/wp-content/uploads/2022/08/Deadline2.jpg

Tax Return Deadline Looms Here s What You Need To Know Flipboard

https://prod.static9.net.au/fs/c39f0dd4-9094-405b-b3d6-475d9097e7f9

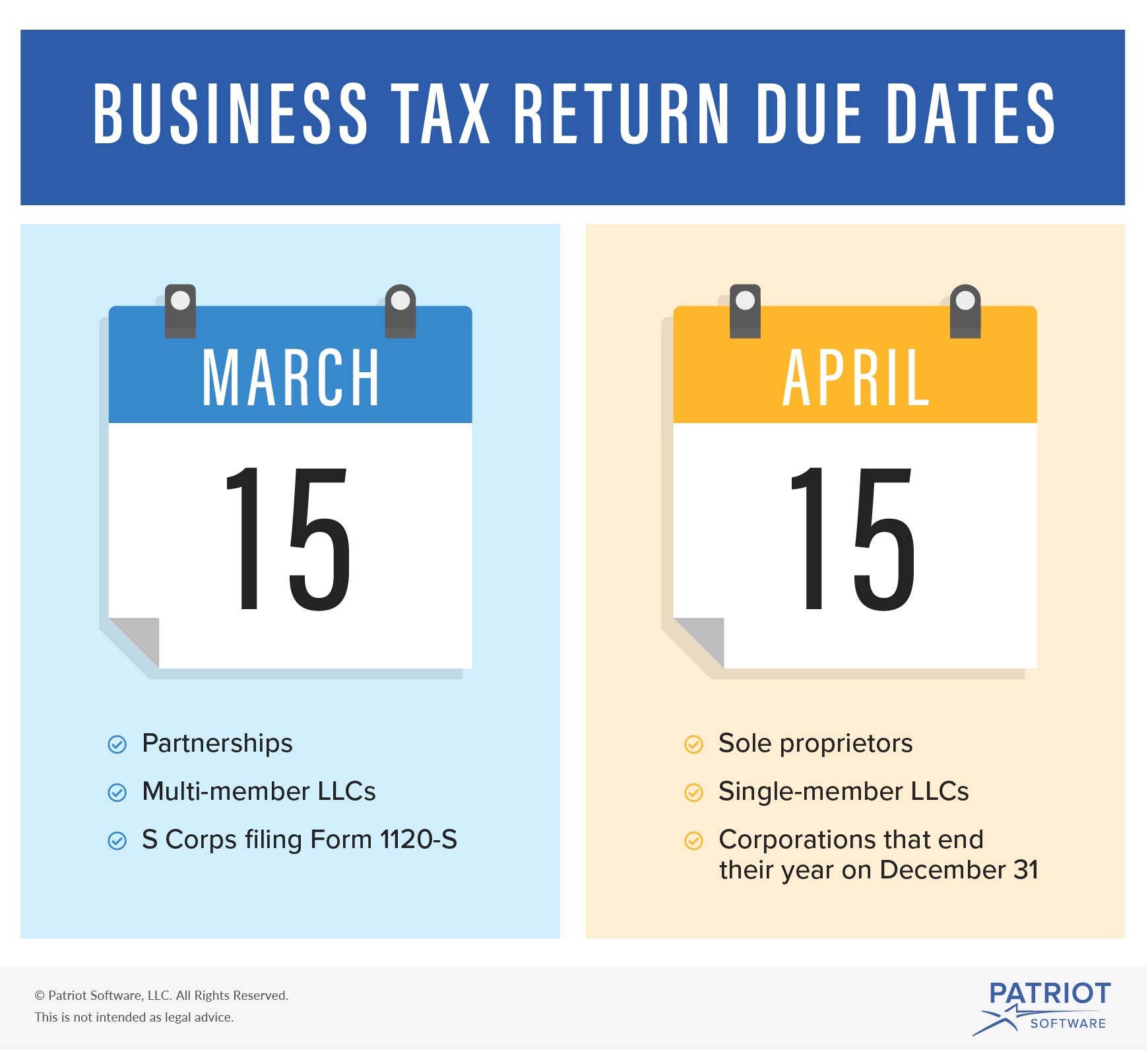

Form 1120 is the U S Corporation Income Tax Return that C corporations must file annually to report their income gains losses deductions and credits The filing deadline for Form 1120 is typically on the 15th day of the fourth month after the end of a corporation s fiscal tax year Corporate tax is paid before 20 May of each year Instalments are due on 20 March 20 June and 20 November equal each to 30 of the CIT of the previous year Last business day of April companies under the simplified regime and May companies under general regime

[desc-10] [desc-11]

Tax Return Deadlines When Are My Tax Returns Due One Click Life

https://oneclicklife.com.au/wp-content/uploads/2022/05/tax-deadline-01-1536x1024.jpg

Tax Deadlines For Q1 Of 2022 Holbrook Manter

https://www.holbrookmanter.com/wp-content/uploads/2021/10/tax-deadline--scaled.jpg

https://www.mra.mu › index.php › important-dates

Electronic submission of Companies Return for accounting year ending in December 2024 with no tax liabilities or loss is declared Payment of Advertising Structure Fee for the third quarter of the year 2024 Payment of Environment Protection Fee for the month of June 2024

https://www.mra.mu › index.php › business › corporate-tax

All companies deriving gross income and exempt income have the legal obligation to file annual returns and pay tax electronically Failure to file electronic returns carries a penalty of 20 of the tax payable maximum Rs 100 000 or Rs 5000 where no tax liability is declared in the return

State Corporate Income Tax Return Deadline Changes Wolters Kluwer

Tax Return Deadlines When Are My Tax Returns Due One Click Life

Tax Return Deadline Extended To July 15th The Accountants Tax

Tax Return Deadline Abstract Concept In 2022 Tax Return Tax Return

Tax Filing Deadline Extended 30 Days But Cook Co News

Penalty And Loss Of Benefits If You Miss Tax Return Deadline

Penalty And Loss Of Benefits If You Miss Tax Return Deadline

Tax Return Deadline How To Submit Your HMRC Self assessment Who Has

Business Tax Return Due Date By Company Structure

600 000 Miss The Self assessment Tax Return Deadline TaxAssist

Corporate Tax Return Deadline - TAX PAID IN EXCESS REFUND Where the Income Tax form shows a TAX PAID IN EXCESS bank account should be provided for secured and fast track refund DUE DATE The return should be submitted at latest on 15 th October 2024 PENALTIES INTEREST Penalty for late submission of return PLS