Corporate Tax Return Due Date 2022 Extension 2022 C corp deadlines at a glance If you re a C corporation or LLC electing to file your taxes as one for 2023 your corporate tax return is due on April 15th 2024 unless you use your own fiscal calendar in which case it s due on the 15th of the 4th month following the end of your tax year

Extension is available for certain companies e g for companies with an accounting year end date of 31 December the filing due date is normally extended to 15 August of the year in which the return is issued and in certain circumstances e g e filing Use Form 7004 to request an automatic 6 month extension of time to file certain business income tax information and other returns Information on e filing Form 7004

Corporate Tax Return Due Date 2022 Extension

Corporate Tax Return Due Date 2022 Extension

https://blog.caonweb.com/wp-content/uploads/2022/05/INCOME-TAX-RETURN-FILING-FY-2021-22-AY-2022-23.png

INCOME TAX RETURN DUE DATE FY 2021 22 AY 2022 23 WILL ITR DUE DATE

https://i.ytimg.com/vi/_z-Z3hV2SmQ/maxresdefault.jpg

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259.jpeg

The corporation generally elects to deduct start up or organizational costs by claiming the deduction on its income tax return filed by the due date including extensions for the tax year in which the active trade or business begins For more details see C and F Corporate returns with fiscal tax year ends other than June 30 are due the 15th day of the 4th month after the end of its tax year Form 7004 extensions for C and F Corporate returns with fiscal tax year ends other than June 30 are due 6 months from the original due date

You must file your extension request no later than the regular due date of your return Taxpayers in certain disaster areas do not need to submit an extension electronically or on paper Check to see if you qualify and the due date of your return Extended Due Dates These dates apply for taxable years beginning after Dec 31 2015 2017 filing season for 2016 tax returns Forms 1040 1065 and 1120S shall be a six month period beginning on the due date for filing the return without regard to any extensions

Download Corporate Tax Return Due Date 2022 Extension

More picture related to Corporate Tax Return Due Date 2022 Extension

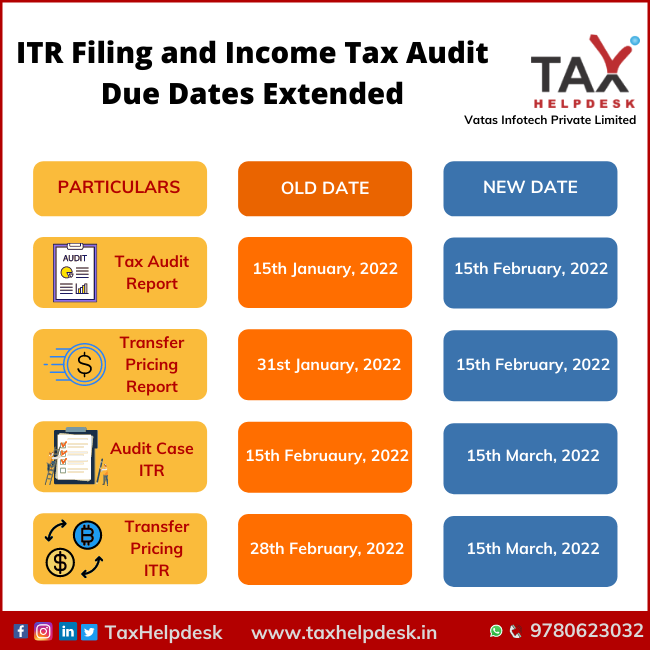

ITR Filing Income Tax Audit Due Dates Extended FY 2020 21 TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/01/ITR-Filing-and-Income-Tax-Audit-Due-Dates-Extended.png

Top 9 Tax Refund Schedule 2022 Chart 2022

https://assets-global.website-files.com/600089199ba28edd49ed9587/61e9dc516117a41cd6798851_2021 Tax Schedule%402x.png

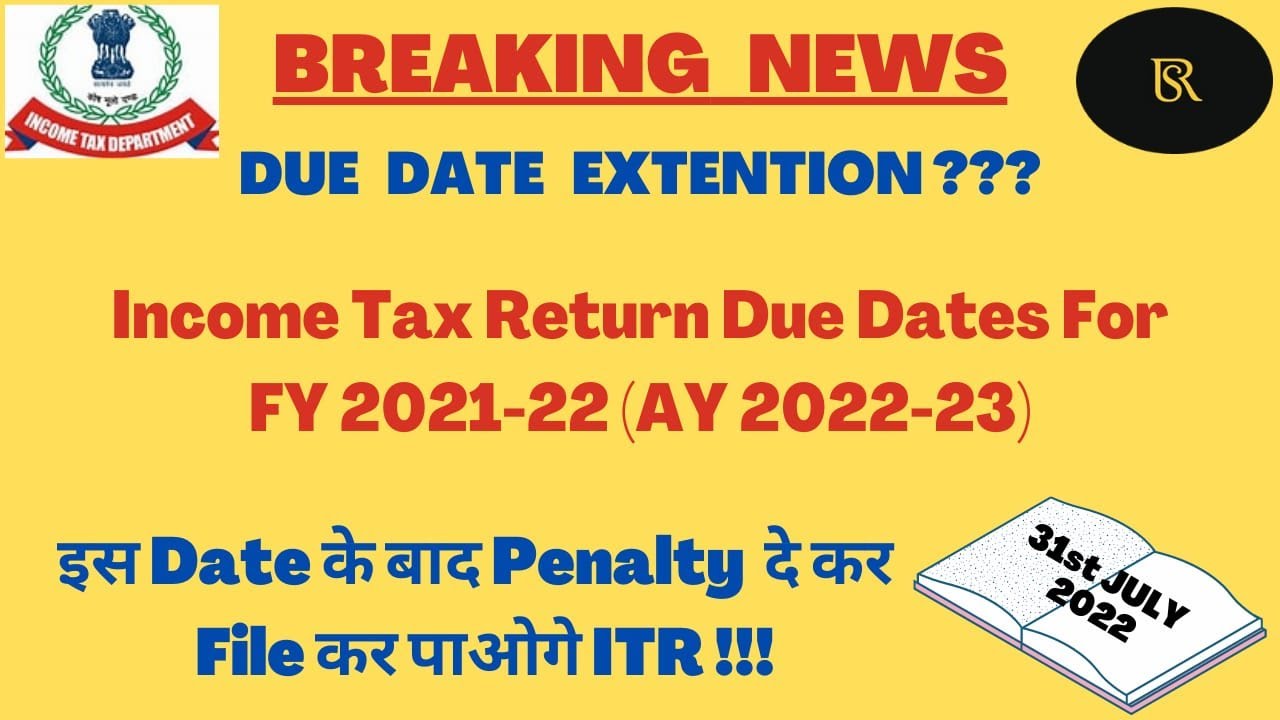

Extend Due Dates Of Income Tax Returns From 31 07 2022 To 31 08 2022

https://taxguru.in/wp-content/uploads/2022/07/Extend-due-dates-of-Income-tax-returns-from-31.07.2022-to-31.08.2022.jpg

2022 C corp deadlines at a glance If you re a C corporation or LLC electing to file your taxes as one for 2021 your corporate tax return is due on April 18 2022 unless you use your own fiscal calendar in which case it s due on the 15th of the 4th month following the end of your tax year If your tax year ends August 31st your filing due date is February 28th If your tax year ends September 23rd your filing due date is March 23rd If your tax year ends October 2nd your filing due date is April 2nd

You do however still have to file a tax return Form 1120 S the income tax return for S corporations and which is due on March 15 2024 if you re a calendar year corporation Here s what that means for your small business any other deadlines you should be aware of as an S corp and how deadlines for S corps differ from other business You can extend most business tax returns by filing Form 7004 You must file it by the original due date of the return Due dates for corporations If your business is an S corporation you must file the tax return or extension by the 15th day of the 3rd month after your tax year ends

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

https://academy.tax4wealth.com/public/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

Corporate Tax Return Due Date 2019 King Financial Services

https://kingfinancialsvcs.com/wp-content/uploads/2019/04/Corporate-Tax-Return-Due-Date-2019.jpg

https://www.bench.co/blog/tax-tips/corporate-tax-deadlines

2022 C corp deadlines at a glance If you re a C corporation or LLC electing to file your taxes as one for 2023 your corporate tax return is due on April 15th 2024 unless you use your own fiscal calendar in which case it s due on the 15th of the 4th month following the end of your tax year

https://taxsummaries.pwc.com/quick-charts/...

Extension is available for certain companies e g for companies with an accounting year end date of 31 December the filing due date is normally extended to 15 August of the year in which the return is issued and in certain circumstances e g e filing

Know The Last Date To File Income Tax Return For FY 2021 22 AY 2022 23

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

Tax Extension 2022 AislingTyler

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

When Are 2021 Taxes Due Southernapo

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

2022 Tax Deadlines And Extensions For Americans Abroad

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

Corporate Tax Return Due Date 2022 Extension - To request an extension the corporation must file the appropriate form with the IRS before the original tax return due date This typically grants an additional six months to file the tax return but remember that tax payments are still due by the original deadline