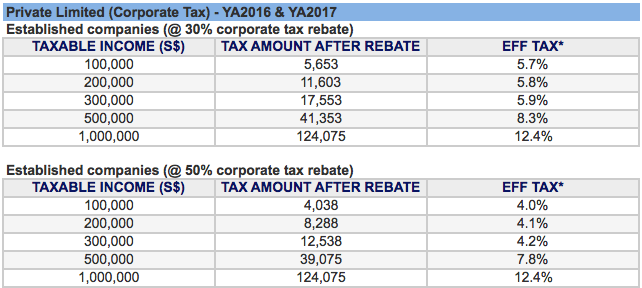

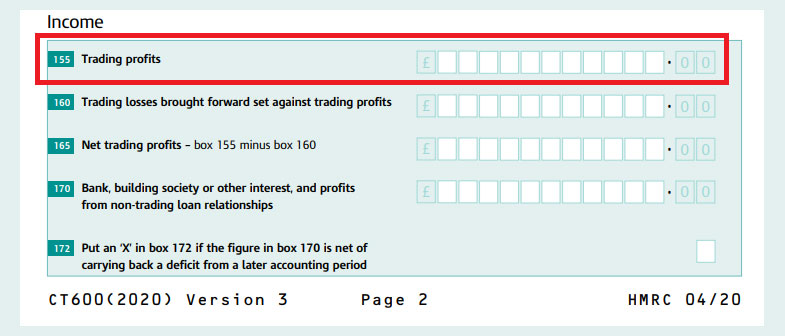

Corporation Tax Rebate Losses Web 4 avr 2022 nbsp 0183 32 The government introduced legislation in Finance Act 2021 that provides a temporary extension to the loss carry back rules for trading losses of both corporate

Web Tax benefits New businesses with innovative start up status are entitled to exemptions from Personal income tax or corporate income tax Total exemption for the first Web 19 janv 2018 nbsp 0183 32 Corporation Tax terminal capital and property income losses Guidance for companies to work out and claim relief from Corporation Tax on terminal losses

Corporation Tax Rebate Losses

Corporation Tax Rebate Losses

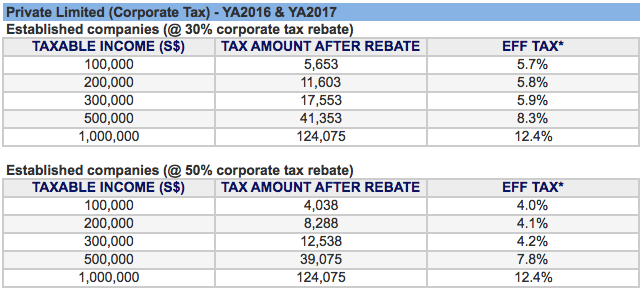

https://static1.squarespace.com/static/55b79c7fe4b0f338367f9329/t/56f7c11bac962c8475209b2d/1459077422156/50%25-corporate-tax-rebate-for-Singapore-companies

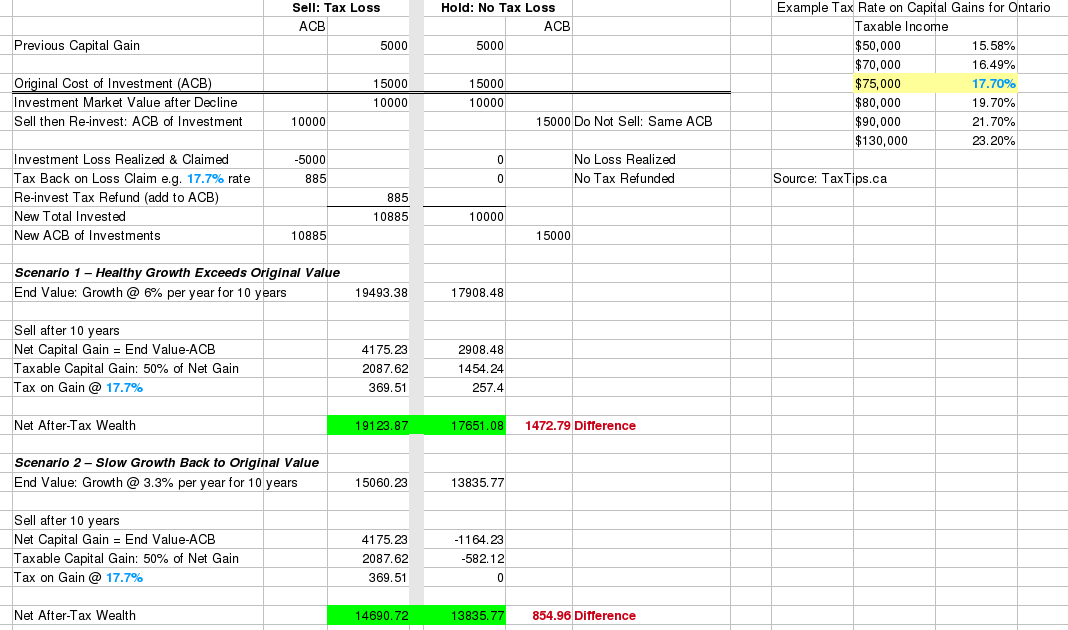

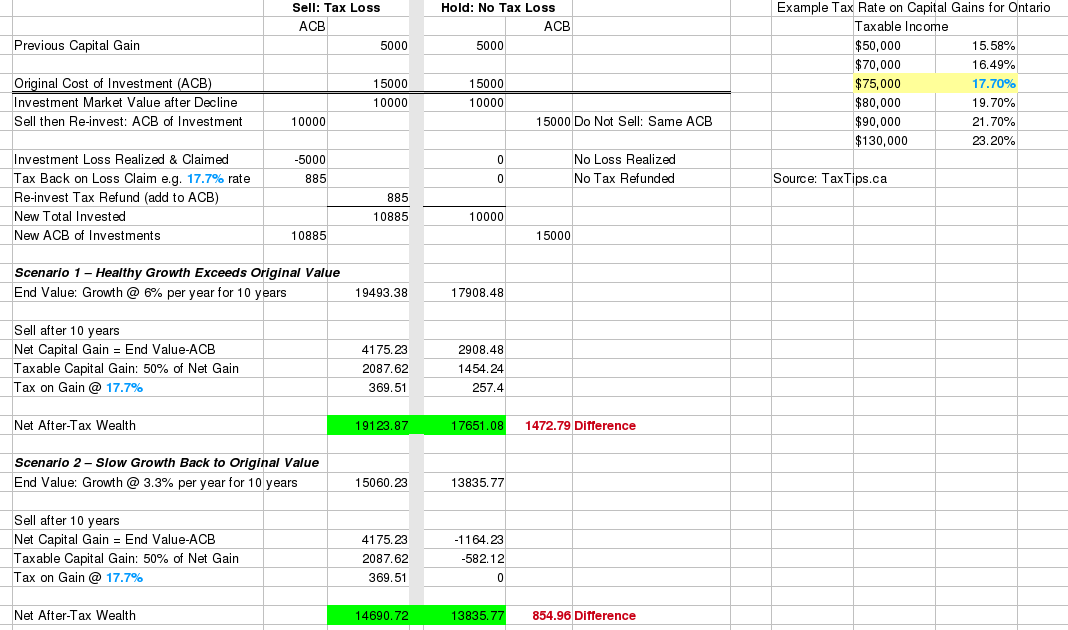

HowtoInvestOnline Tax Loss Selling Explained What Why And How

http://3.bp.blogspot.com/_hYeIYPkb8PY/SxziWUEjPXI/AAAAAAAAAr8/CPexHv69Hxk/w1200-h630-p-k-no-nu/tax-loss-table.png

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

https://www.relakhs.com/wp-content/uploads/2019/02/Revised-Section-87A-Tax-Rebate-impact-on-Income-tax-liability-calculation-FY-2019-20-AY-2020-21.jpg

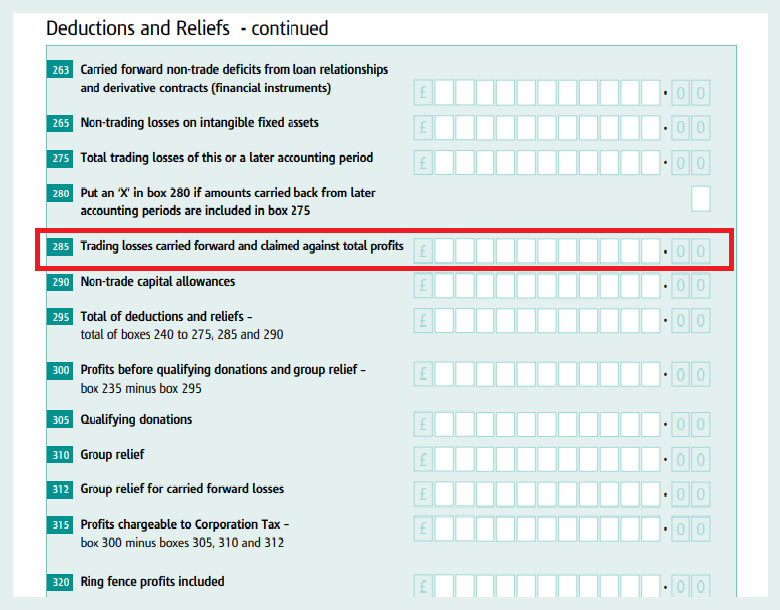

Web Marginal Relief Your company or organisation may be entitled to Marginal Relief if its taxable profits from 1 April 2023 are between 163 50 000 and 163 250 000 Previous Rates Web 1 f 233 vr 2021 nbsp 0183 32 Taxpayers can claim losses because of the operation of the rules of Subchapter S passing through income gains losses and deductions under Sec 1366 and exercise of the right to treat the S

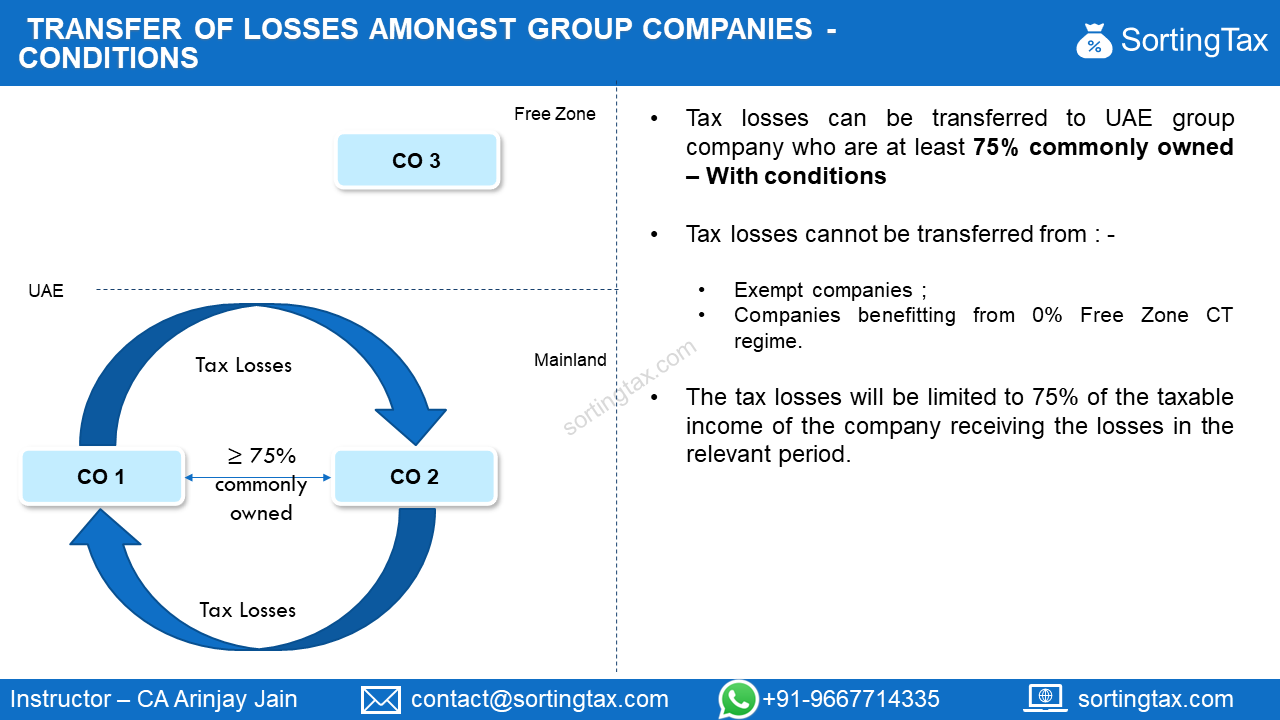

Web 3 mars 2021 nbsp 0183 32 This measure introduces a temporary extension to the period over which businesses may carry trading losses back for relief against profits of earlier years to get Web Part 5 of Corporation Tax Act 2010 CTA 2010 allows a company to surrender losses and other amounts and enables in certain cases involving groups or consortiums of

Download Corporation Tax Rebate Losses

More picture related to Corporation Tax Rebate Losses

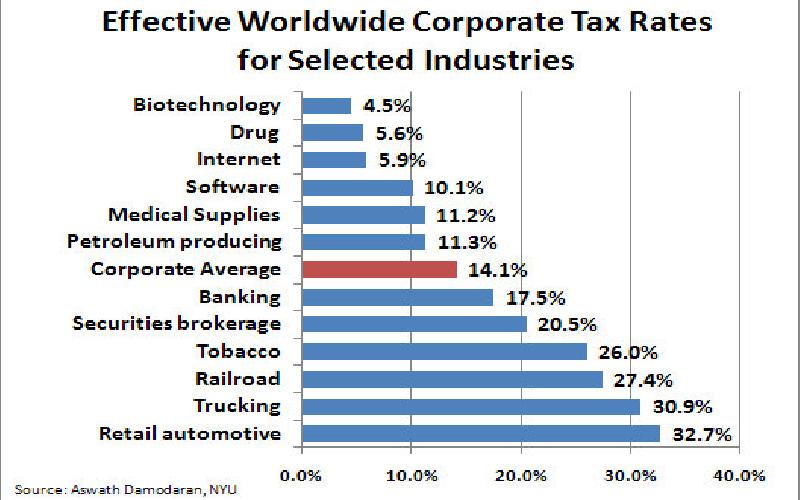

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

https://blogs-images.forbes.com/niallmccarthy/files/2017/03/20170323_Tax_Losses-1.jpg

Tax Rebates As Economic Stimulus Can They Work Businessandfinance Blog

https://expertscolumn.com/image_files/thumbmain/imag_820158520_2005542813.jpg

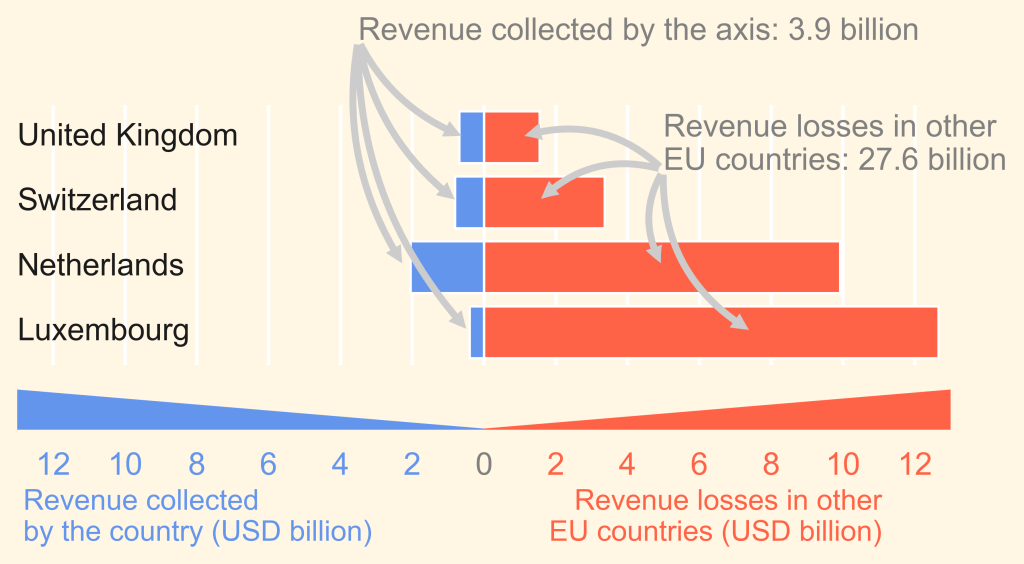

EU Loses Over 27 Billion In Corporate Tax A Year To UK Switzerland

https://taxjustice.net/wp-content/uploads/2020/07/Tax-gains-vs-revenue-losses-Axis-of-tax-avoidance-2.png

Web Legislation will be introduced in Finance Bill 2021 to make technical changes to the loss relief rules The loss relief rules were significantly reformed with effect from 1 April 2017 Web Recent data on corporate tax losses present a puzzle this paper attempts to ex plain theratiooflossestopositiveincomewasmuchhigheraroundtherecession of 2001 than

Web 13 avr 2023 nbsp 0183 32 Under the carry back rules the company s 163 7 000 loss can be offset against the profits for the previous accounting year It reduces the previous year s profit from 163 19 000 to 163 12 000 Lower profit means less Web 1 sept 2021 nbsp 0183 32 You make a loss of 163 5 000 in your first year of trading and a profit of 163 10 000 in your second year of trading You incurred 163 3 000 of qualifying expenditure before you

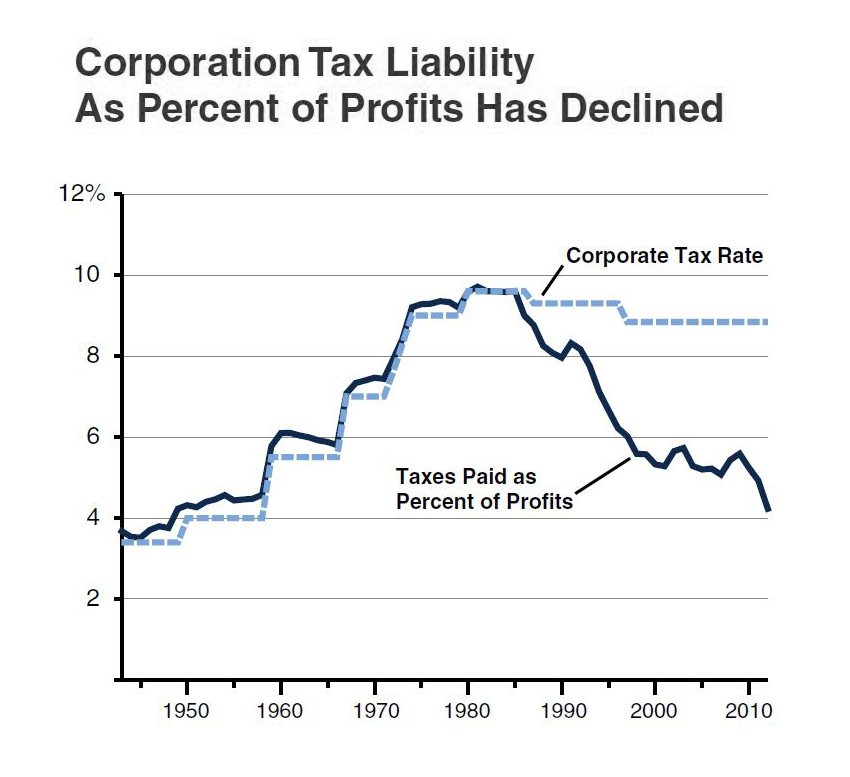

Corporation Tax Liability As Percent Of Profits Has Declined EconTax Blog

https://lao.ca.gov/Blog/Media/Image/38

Group Transfer Of Losses Under UAE Corporate Tax Sorting Tax

https://sortingtax.com/wp-content/uploads/2022/05/Slide12-2.png

https://www.gov.uk/government/publications/extended-loss-carry-back...

Web 4 avr 2022 nbsp 0183 32 The government introduced legislation in Finance Act 2021 that provides a temporary extension to the loss carry back rules for trading losses of both corporate

https://www.impots.gouv.fr/international-professionnel/tax-incentives

Web Tax benefits New businesses with innovative start up status are entitled to exemptions from Personal income tax or corporate income tax Total exemption for the first

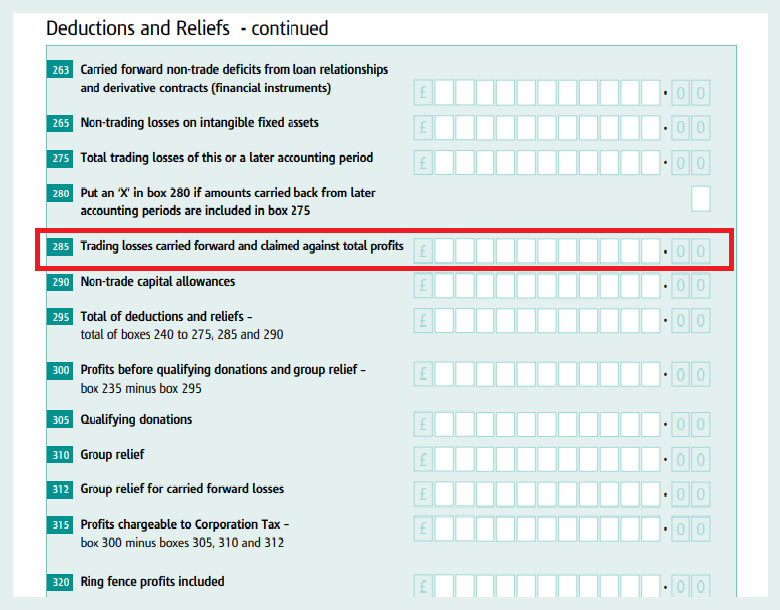

Corporation Tax And Trading Losses Debitam

Corporation Tax Liability As Percent Of Profits Has Declined EconTax Blog

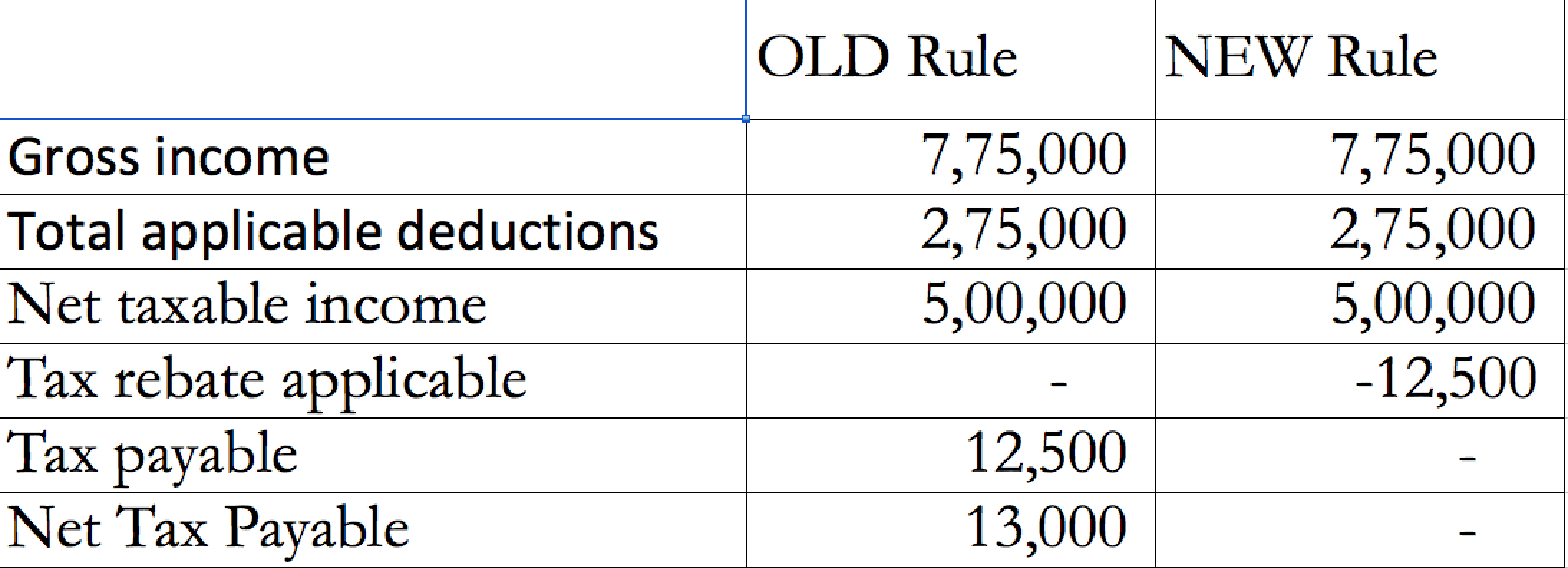

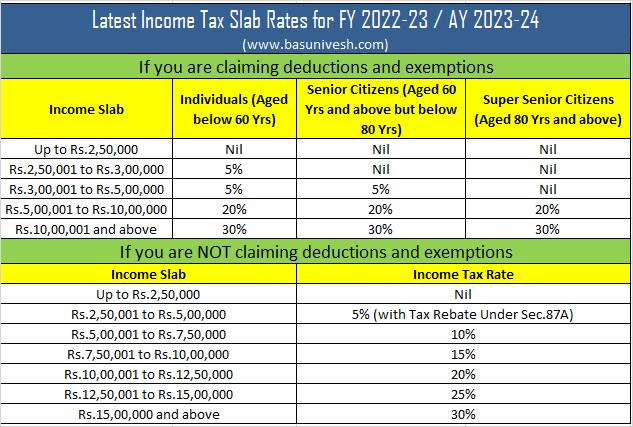

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Deferred Tax And Temporary Differences The Footnotes Analyst

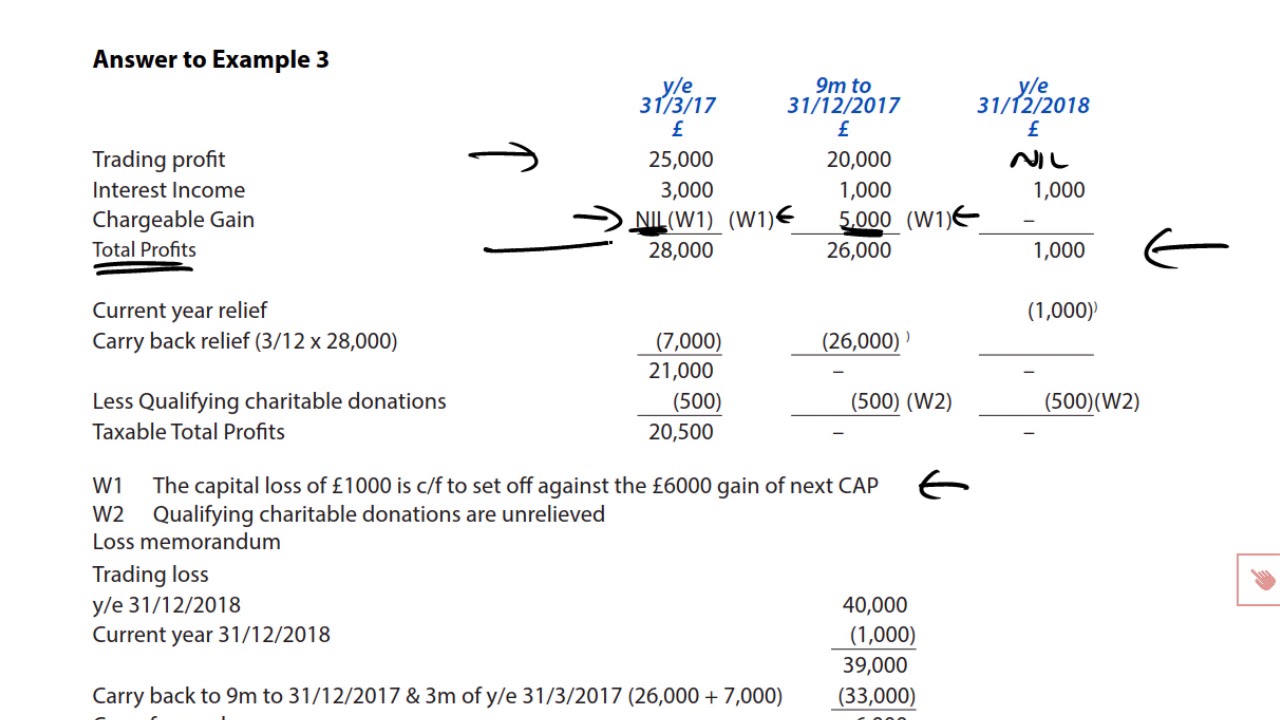

Tax Adjusted Trading Losses Carry Forward Relief ACCA Taxation TX

Corporation Tax And Trading Losses Debitam

Corporation Tax And Trading Losses Debitam

Happy Bright Day Quotes

Corporate Tax Rebate Budget 2022 Rebate2022

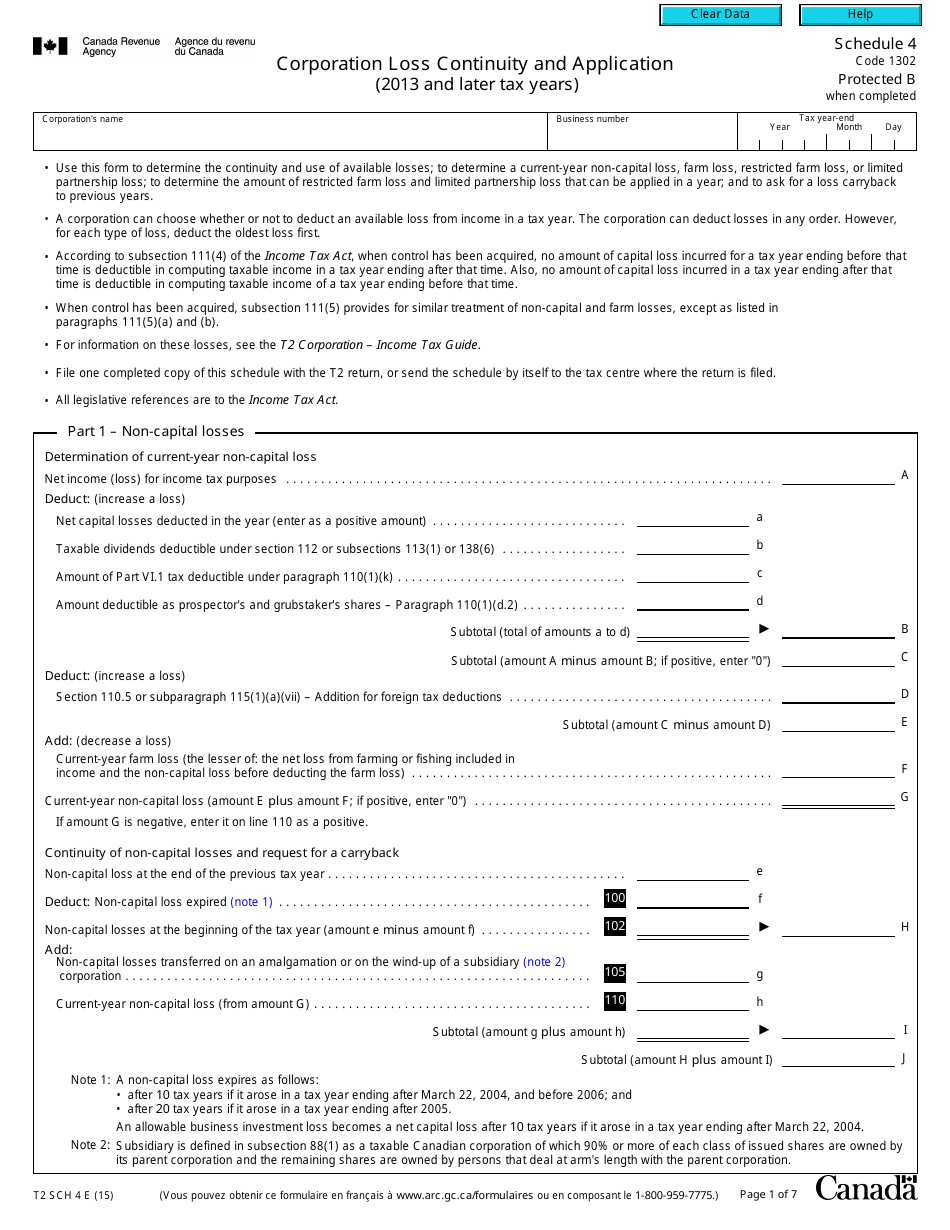

Form T2 Schedule 4 Download Fillable PDF Or Fill Online Corporation

Corporation Tax Rebate Losses - Web Get a refund or interest on your Corporation Tax If your company or organisation pays too much Corporation Tax HM Revenue and Customs HMRC will repay what you ve