Corporation Tax Relief On Pension Contributions Over 75 Only tax relief on an excess contribution of 500 000 or more will be spread The length of time the tax relief will be spread over depends on the size of the excess Read the further guidance

Tax relief on employer contributions to a registered pension scheme is given by allowing contributions to be deducted as an expense in computing the profits of a trade profession or Tax relief Pensions Pension contributions Q A Last Updated 6 Apr 24 19 min read Contents 1 Individual contributions relevant earnings 2 Employer contributions corporation tax relief 3 Third party contributions 4 Tax relief and annual allowance 5 Carry forward

Corporation Tax Relief On Pension Contributions Over 75

Corporation Tax Relief On Pension Contributions Over 75

https://qaccountants.com/wp-content/uploads/2021/03/adobestock_378673700-scaled-1.jpeg

Tax Relief On Pension Contributions Gooding Accounts

https://www.goodingaccounts.co.uk/app/uploads/2022/07/bench-g836200001_1920.jpg

Claiming Tax Relief On Personal Contributions

https://s3.studylib.net/store/data/008863819_1-2f6094913014d745c3da18091a1e8c10-768x994.png

Only tax relief on an excess contribution of 500 000 or more will be spread The length of time the tax relief will be spread over depends on the size of the excess Read further guidance 1 Overview 2 Key Points 3 Corporation tax relief 4 Corporate tax relief for pension contributions 5 Wholly and exclusively 6 Tax relief meaning of paid and chargeable periods 7 Spreading of tax relief 8 Impact on individuals Discover how an employer can receive tax relief on pension contributions for an employee Key Points

Tax relief on contributions into a personal pension arrangement Tax relief on contributions into a retirement annuity contract General practitioners and dentists Compensation that There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which method is used If you re in a personal pension the

Download Corporation Tax Relief On Pension Contributions Over 75

More picture related to Corporation Tax Relief On Pension Contributions Over 75

Budget 2020 Pension Relief For Dentists SmallBiz Accounts

https://smallbizaccounts.co.uk/wp-content/uploads/2020/03/shutterstock_1387425773-scaled.jpg

Tax Relief On Home Help Comfort Keepers

https://comfortkeepers.ie/app/uploads/2022/08/BC_220302_1438_Final-resize.jpg

Self Employed Pension Tax Relief Explained Penfold Pension

https://images.prismic.io/penfold/d68abe56-2255-43f5-8412-5d0e13153a09_yearly-self-employed-pension-tax-relief.png?auto=compress

Tax relief for employer contributions to a UK registered pension scheme is governed by normal corporation tax deductibility principles subject to two main modifications First relief is available only for contributions actually paid Second there is no blanket restriction on deductibility for payments of a capital nature Establishing if tax relief on an employer contribution to a registered pension scheme needs to be spread is a 4 stage process Establish what contributions have been paid in the current and

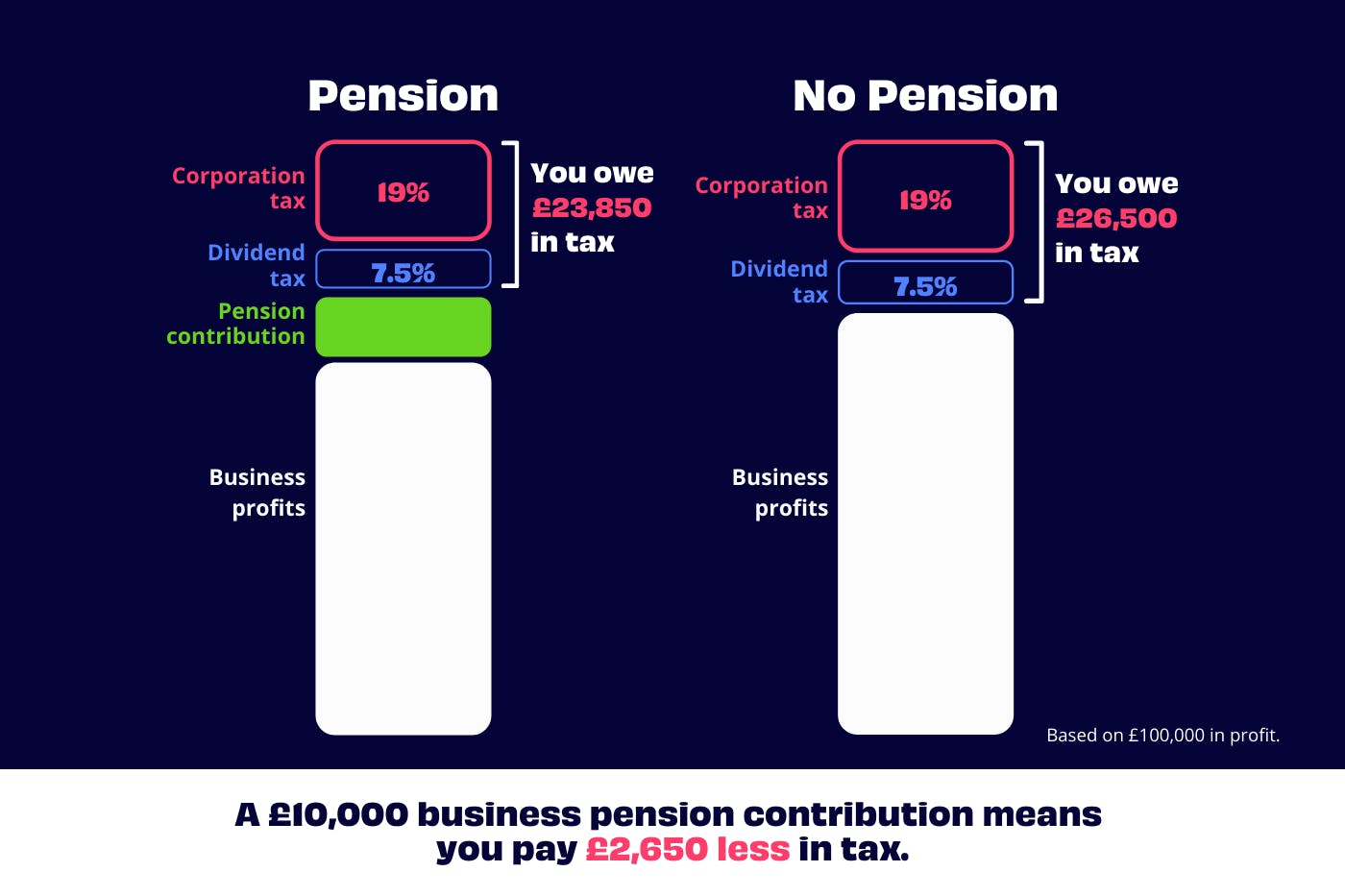

Both indirectly increase the effective rate of tax relief for saving into a pension Business owners The main rate of corporation tax is now 25 Alongside the NI savings the higher rate of relief on employer contributions will be more attractive to directors as a means of taking profits from their business 1 Contribution tax relief Once a person turns 75 personal and third party contributions no longer qualify for tax relief as they do not meet the definition of a relievable contribution This also means that such contributions are not tested against the person s annual allowance

Can I Get Tax Relief On Pension Contributions Financial Advisers

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

Claiming Tax Relief On Pension Contributions Thompson Taraz Rand

https://www.thompsontarazrand.co.uk/wp-content/uploads/2018/05/2015-12-17-223313-1.jpg

https://www. accaglobal.com /uk/en/technical...

Only tax relief on an excess contribution of 500 000 or more will be spread The length of time the tax relief will be spread over depends on the size of the excess Read the further guidance

https://www. gov.uk /.../pensions-tax-manual/ptm043100

Tax relief on employer contributions to a registered pension scheme is given by allowing contributions to be deducted as an expense in computing the profits of a trade profession or

Tax Relief On Employee Pension Contributions Dafferns

Can I Get Tax Relief On Pension Contributions Financial Advisers

Clive Owen LLP Claiming Higher Rate Tax Relief For Pension Contributions

A Consultation On Pensions Tax Relief Provisio Wealth

Maximise Tax Relief For 2020 Via Pension Contributions

Pension Tax Relief On Pension Contributions Freetrade

Pension Tax Relief On Pension Contributions Freetrade

Self Employed Pension Tax Relief Explained Penfold Pension

Pension Tax Relief In The United Kingdom UK Pension Help

SIPP Tax Relief Calculator Tax Relief On Pension Contributions

Corporation Tax Relief On Pension Contributions Over 75 - There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which method is used If you re in a personal pension the