Corporations Federal Tax Rebates Web 1 f 233 vr 2022 nbsp 0183 32 The statutory federal tax rate for corporate profits is 21 according to ITEP and 55 corporations pulled in nearly 40 5 billion in U S pretax income in 2020

Web 5 avr 2021 nbsp 0183 32 Demetrius Freeman The Washington Post Fifty five of the nation s largest corporations paid no federal income tax on more than 40 billion in profits last year according to an analysis by Web The COVID related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for

Corporations Federal Tax Rebates

Corporations Federal Tax Rebates

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Federal-Tax-Rebate-2023.jpg?ssl=1

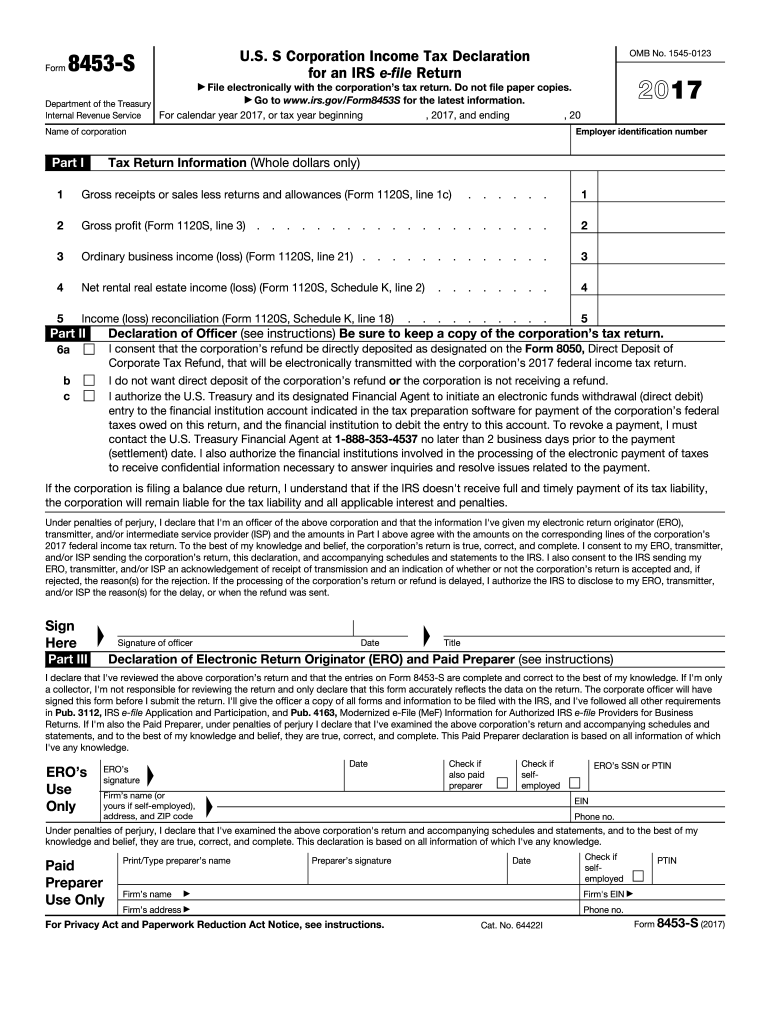

Corporate Tax Refund That Will Be Electronically Transmitted With The

https://www.pdffiller.com/preview/420/965/420965485/large.png

2016 Federal Tax Rebates HB McClure

http://hbmcclure.com/wp-content/uploads/Federal-Tax-Rebates-06-16.jpg

Web 27 avr 2022 nbsp 0183 32 The 15 others paid taxes at a tax rate below 10 well below the nominal rate of 21 finding that 55 corporations paid 0 in federal taxes on their 2020 profits Ben Werschkul is a writer Web 2 avr 2021 nbsp 0183 32 26 of the 55 companies including Nike which reported more than 2 8 billion of pretax income last year and FedEx which generated 1 2 billion avoided paying any

Web The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities Many Web 2 avr 2021 nbsp 0183 32 The statutory federal tax rate for corporate profits is 21 percent The 55 corporations would have paid a collective total of 8 5 billion for the year had they paid that rate on their 2020 income Instead

Download Corporations Federal Tax Rebates

More picture related to Corporations Federal Tax Rebates

Taxing Canadians Patience Corporations Need To Pay Their Fair Share

https://i.cbc.ca/1.5078161.1553905061!/fileImage/httpImage/image.jpg_gen/derivatives/original_780/carbon-tax-costs-returns-manitoba.jpg

The Federal Solar Tax Credit Extension Can We Win If We Lose

http://ilsr.org/wp-content/uploads/2015/09/value-of-federal-itc-over-time-ilsr.jpg

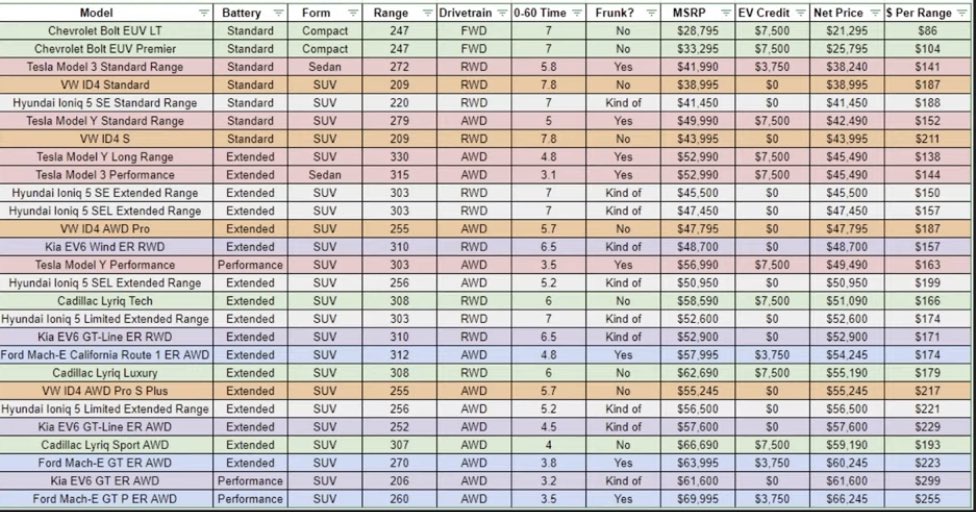

Dennis C On Twitter tesla Now Has The THIRD LEAST EXPENSIVE EV In

https://pbs.twimg.com/media/Ft8l7XHaYAE8WVO.jpg

Web 7 sept 2023 nbsp 0183 32 The 15 percent minimum tax applies to corporations that report annual income of more than 1 billion to shareholders but reduced their effective tax rate well Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue

Web 3 avr 2021 nbsp 0183 32 Altogether it received 109 million in federal tax rebates after reporting total pretax income of 2 9 billion for the year Officials at Nike which is based in Beaverton Web 7 avr 2021 nbsp 0183 32 quot A new independent study put out last week found that at least 55 of our largest corporations use the various loopholes to pay zero federal income tax in 2020 quot

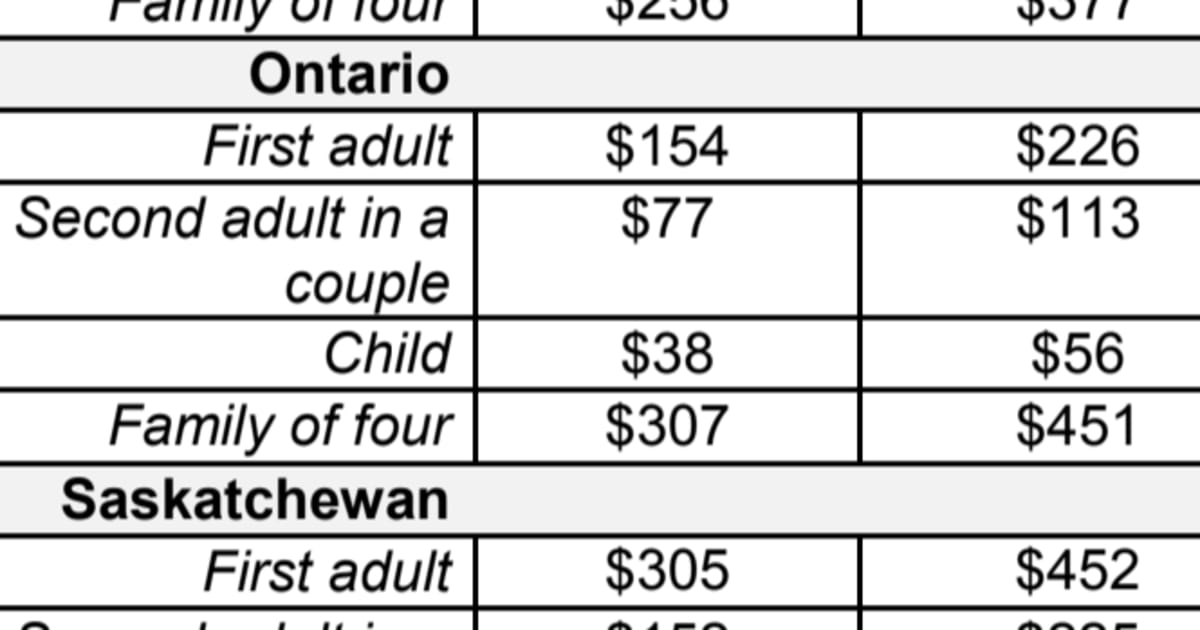

Carbon Tax Rebates Coming To Provinces That Rejected Federal Plan

https://o.aolcdn.com/images/dims3/GLOB/crop/665x349+104+593/resize/1200x630!/format/jpg/quality/85/https:%2F%2Fmedia-mbst-pub-ue1.s3.amazonaws.com%2Fcreatr-uploaded-images%2F2018-10%2Fed745550-d6e1-11e8-af77-61c4e81d1fdc

How To Find Federal Tax Credits Rebates For HVAC Upgrades

https://www.blueheatingandcooling.com/wp-content/uploads/2016/10/BHC-taxcredits.jpg

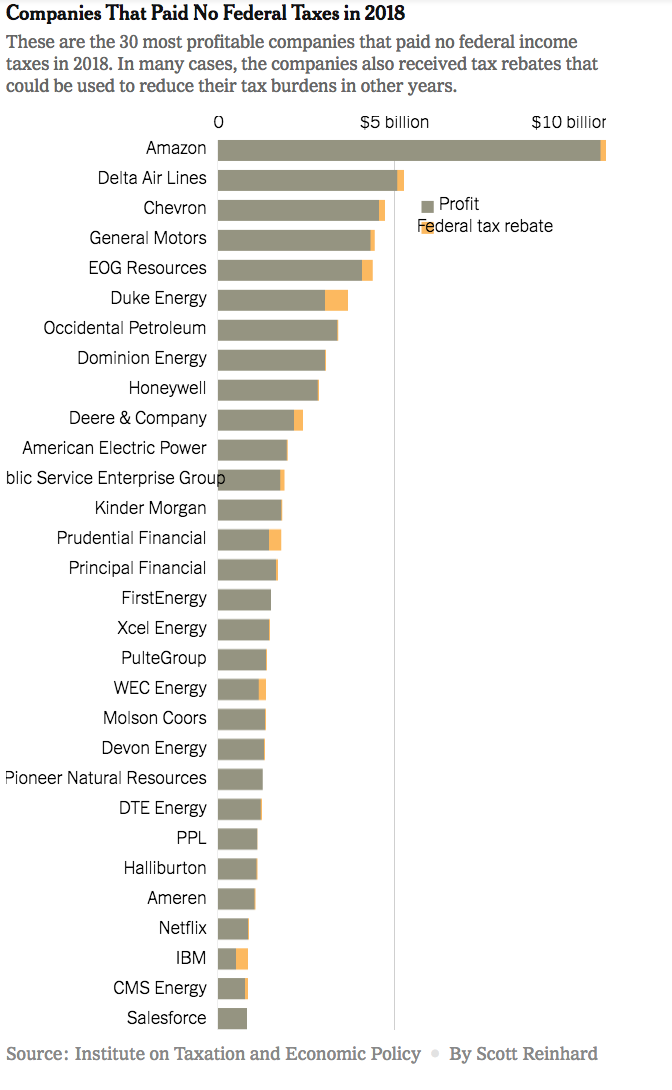

https://www.thestreet.com/investing/30-biggest-companies-that-paid...

Web 1 f 233 vr 2022 nbsp 0183 32 The statutory federal tax rate for corporate profits is 21 according to ITEP and 55 corporations pulled in nearly 40 5 billion in U S pretax income in 2020

https://www.washingtonpost.com/.../2021/04/0…

Web 5 avr 2021 nbsp 0183 32 Demetrius Freeman The Washington Post Fifty five of the nation s largest corporations paid no federal income tax on more than 40 billion in profits last year according to an analysis by

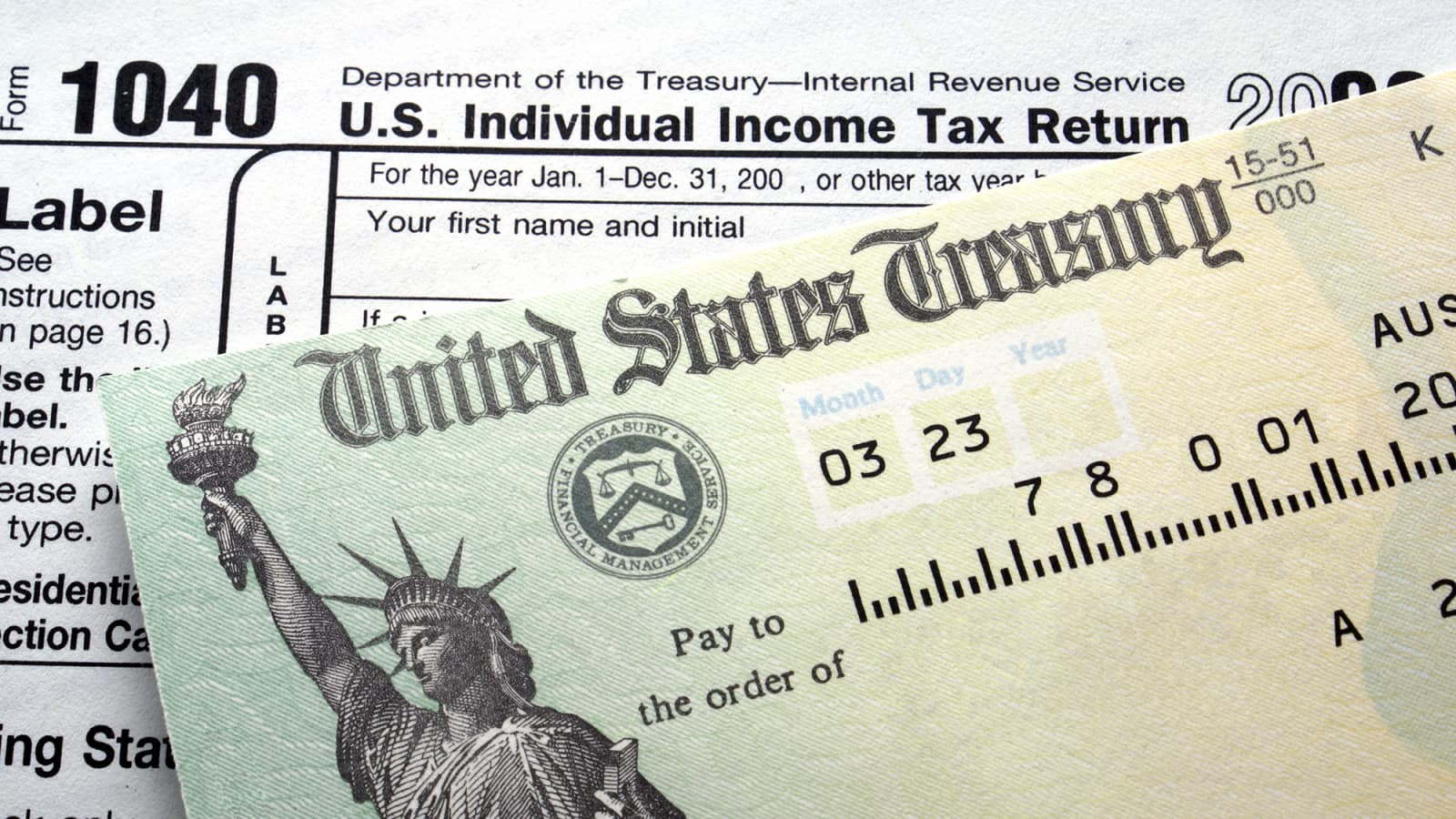

Why Is My Federal Tax Refund Taking More Than 21 Days TAXW

Carbon Tax Rebates Coming To Provinces That Rejected Federal Plan

Corps That Pay No Federal Taxes Diane Ravitch s Blog

Top Mass Save Rebate Form Templates Free To Download In PDF Format

Deferred Tax And Temporary Differences The Footnotes Analyst

Tax Rebate Checks Come Early This Year Yonkers Times

Tax Rebate Checks Come Early This Year Yonkers Times

60 US Mega corporations Not Only Paid Zero Taxes Last Year The

New Federal Tax Brackets For 2023

HMRC Give Tax Relief Pre approval Save The Thorold Arms

Corporations Federal Tax Rebates - Web Introduction This publication discusses the general tax laws that apply to ordinary domestic corporations It provides supplemental federal income tax information for