Council Tax Discount For Single Occupancy If you are a single person household you are eligible to a 25 reduction on your yearly council tax bill which can make a huge difference to your yearly living costs

Council tax bills assume that two adults occupy the property as their main home If only one resident lives there the bill can normally be reduced by 25 known as the single person discount Some people Apply to your local council for Council Tax Reduction sometimes called Council Tax Support You ll get a discount on your bill if you re eligible

Council Tax Discount For Single Occupancy

Council Tax Discount For Single Occupancy

https://www.income-tax.co.uk/wp-content/uploads/2023/01/What-is-the-Single-Person-Council-Tax-Discount.jpg

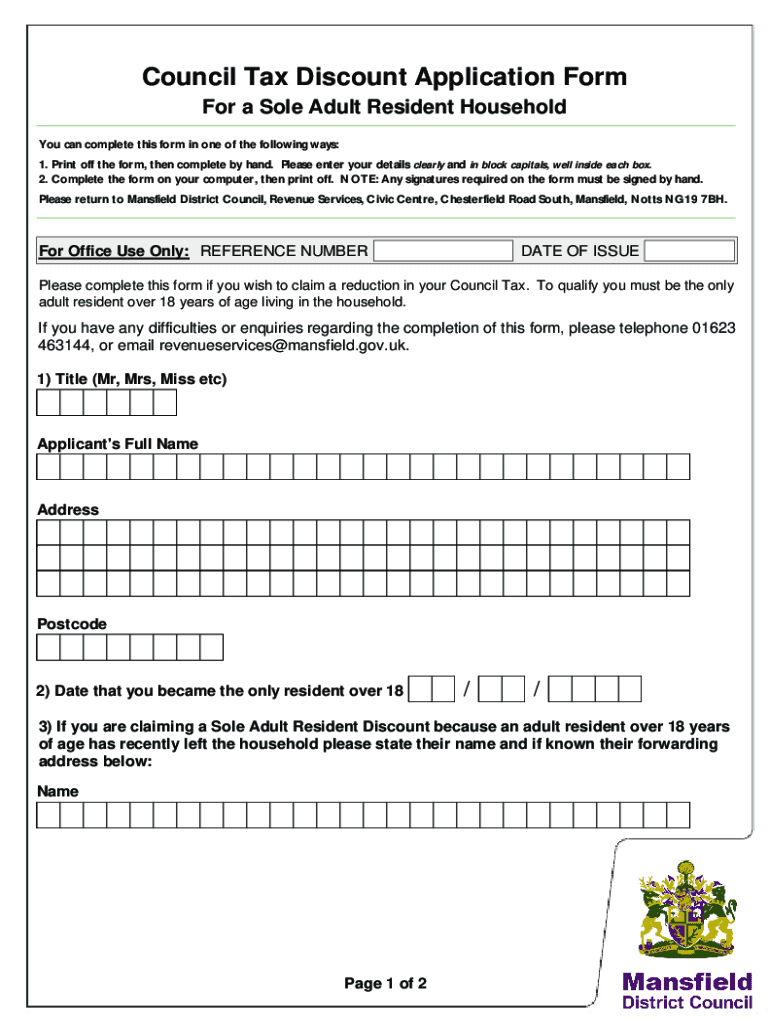

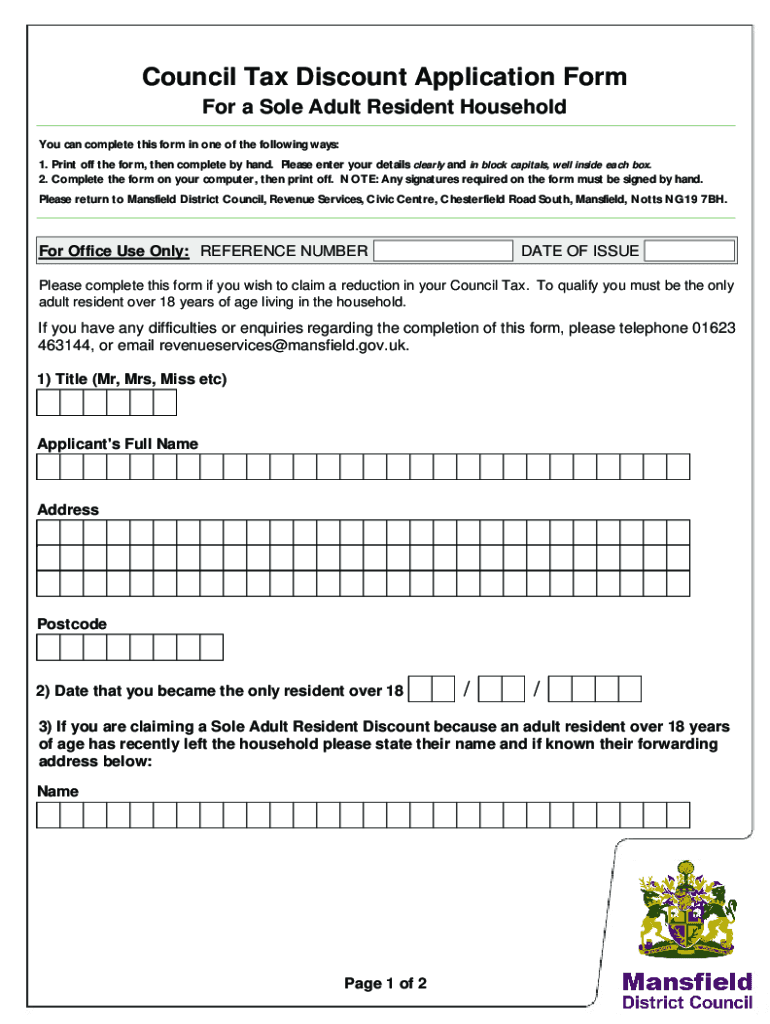

Council Tax Discount Application Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/556/694/556694551/large.png

Council Tax Discounts

https://www.moneysavingexpert.com/content/dam/hero-council-tax.jpg

ONE qualifying adult in a household means that a single person discount applies equivalent to 25 off the council tax bill NO qualifying adults in a household results in either a discount of 50 or a 100 exemption You might be able to pay less council tax or not pay it at all depending on your circumstances You might be able to get discounts for example for a single person or

The Labour Party has refused to rule out scrapping the 25 council tax discount for single occupiers piling pressure onto widows divorcees single parents and You may be able to get a 25 discount on your Council Tax bill if you are the only adult living on a property An adult is a person aged 18 or over To qualify for a discount you

Download Council Tax Discount For Single Occupancy

More picture related to Council Tax Discount For Single Occupancy

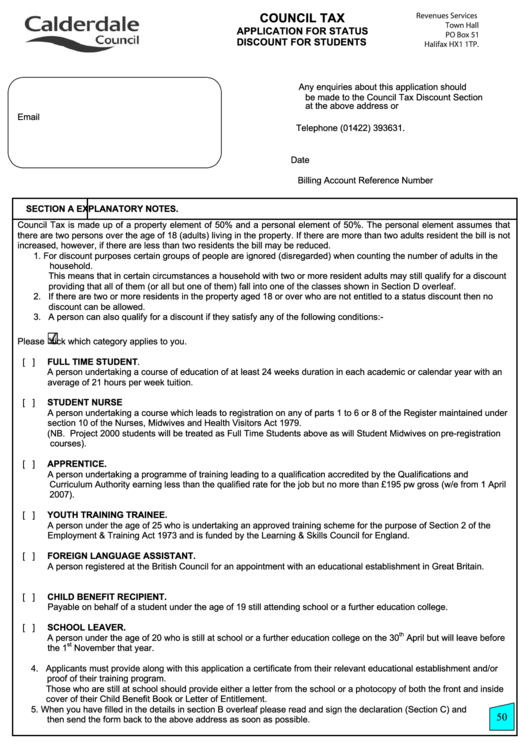

Council Tax Application For Status Discount For Students Printable

https://data.formsbank.com/pdf_docs_html/283/2835/283583/page_1_thumb_big.png

Council Tax Discount Scheme Grey Matters Consultancy

https://www.grey-matters-consultancy.com/wp-content/uploads/council-tax.jpg

Jeremy Corbyn Garden Tax How Labour Leader Will Scrap Single Person

https://cdn.images.express.co.uk/img/dynamic/139/590x/Jeremy-Corbyn-garden-tax-single-person-council-tax-discount-Labour-1136016.jpg?r=1559658718605

A 25 single occupancy discount also known as a single person discount is available if there is only one person aged 18 years or over living in the property Apply for a single occupancy A 25 per cent single person discount is available when you are the only person aged 18 or over who lives in your home To apply you need to register on our secure online Council Tax

Single Person Discount If you are the only adult who lives in your home you can get a 25 discount on your Council Tax bill You will need to tell your council that you are the only Discounts for single person households disabled people and students as well as some other groups exist which may allow people in those groups a discount on

Plans For Council Tax Discount For Vulnerable Residents Spotted Media

https://spottedmediaservices.co.uk/wp-content/uploads/SpottedCrawleyUpdate.png

Council Tax Discount For Unoccupied And Unfurnished Properties

https://surveymonkey-assets.s3.amazonaws.com/survey/85843437/72eb24a1-ccb1-4f3e-84dc-aa1591d6c794.jpg

https://www.idealhome.co.uk/property-a…

If you are a single person household you are eligible to a 25 reduction on your yearly council tax bill which can make a huge difference to your yearly living costs

https://www.which.co.uk/money/tax/counci…

Council tax bills assume that two adults occupy the property as their main home If only one resident lives there the bill can normally be reduced by 25 known as the single person discount Some people

Let s Talk About Council Tax Discounts Exemptions And Council Tax

Plans For Council Tax Discount For Vulnerable Residents Spotted Media

Council Tax Discount Over Unadopted Estate Refused Shropshire Star

How Council Tax Is Driving British Debt Fairer Share Campaign

Council Tax Britons Who Take In Ukrainian Refugees Could Get 1 000

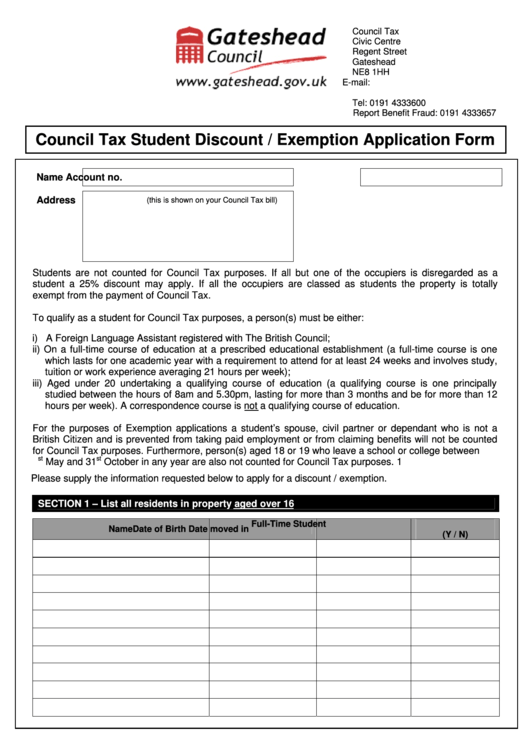

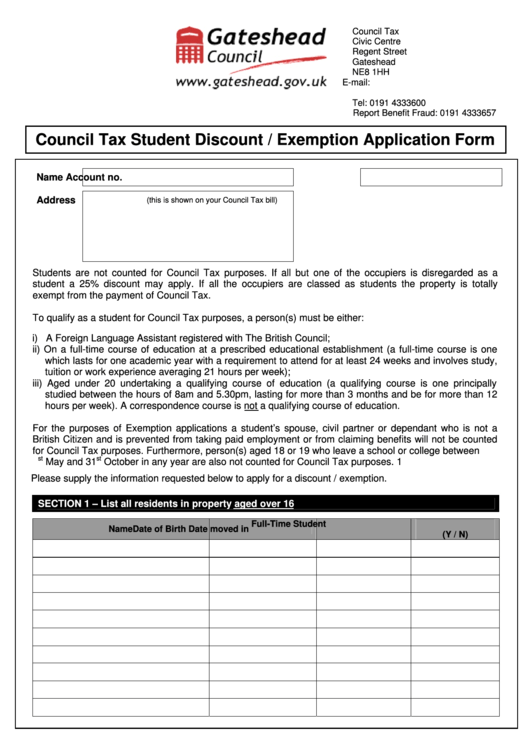

Council Tax Student Discount Exemption Application Form Gateshead

Council Tax Student Discount Exemption Application Form Gateshead

Plans For Council Tax Discount For Vulnerable Residents Spotted Media

COUNCIL IN SINGLE PERSON COUNCIL TAX DISCOUNT CRACKDOWN Island Echo

PDF Council Tax Discount Application Form Second Homes Discount

Council Tax Discount For Single Occupancy - You can get a 25 discount on your council tax bill if you live by yourself Claiming this rebate could save you hundreds of pounds each year so it really is worth doing Contact your local council to notify them that you live alone and ask them to arrange for the deduction to be applied to your bill