Cpf Tax Relief Cap CPF Relief is capped by the amount of compulsory employee CPF contributions made on Ordinary Wages and Additional Wages under the CPF Act The amount of CPF Relief is

For each Year of Assessment a personal income tax relief cap of 80 000 applies to the total amount of all tax reliefs claimed including any relief on cash top ups made There will be no refund for accepted cash top up The personal income tax relief cap sets a limit on the total amount of tax relief you can claim Even though each relief serves a good purpose some individuals

Cpf Tax Relief Cap

Cpf Tax Relief Cap

https://cdn-blog.seedly.sg/wp-content/uploads/2021/11/02144943/Changes-to-CPF-Rules-2021.png

How CPF Tax Relief Are Computed Can You Save 1000 In Taxes From CPF

https://i.ytimg.com/vi/GRJH2BJwLdU/maxresdefault.jpg

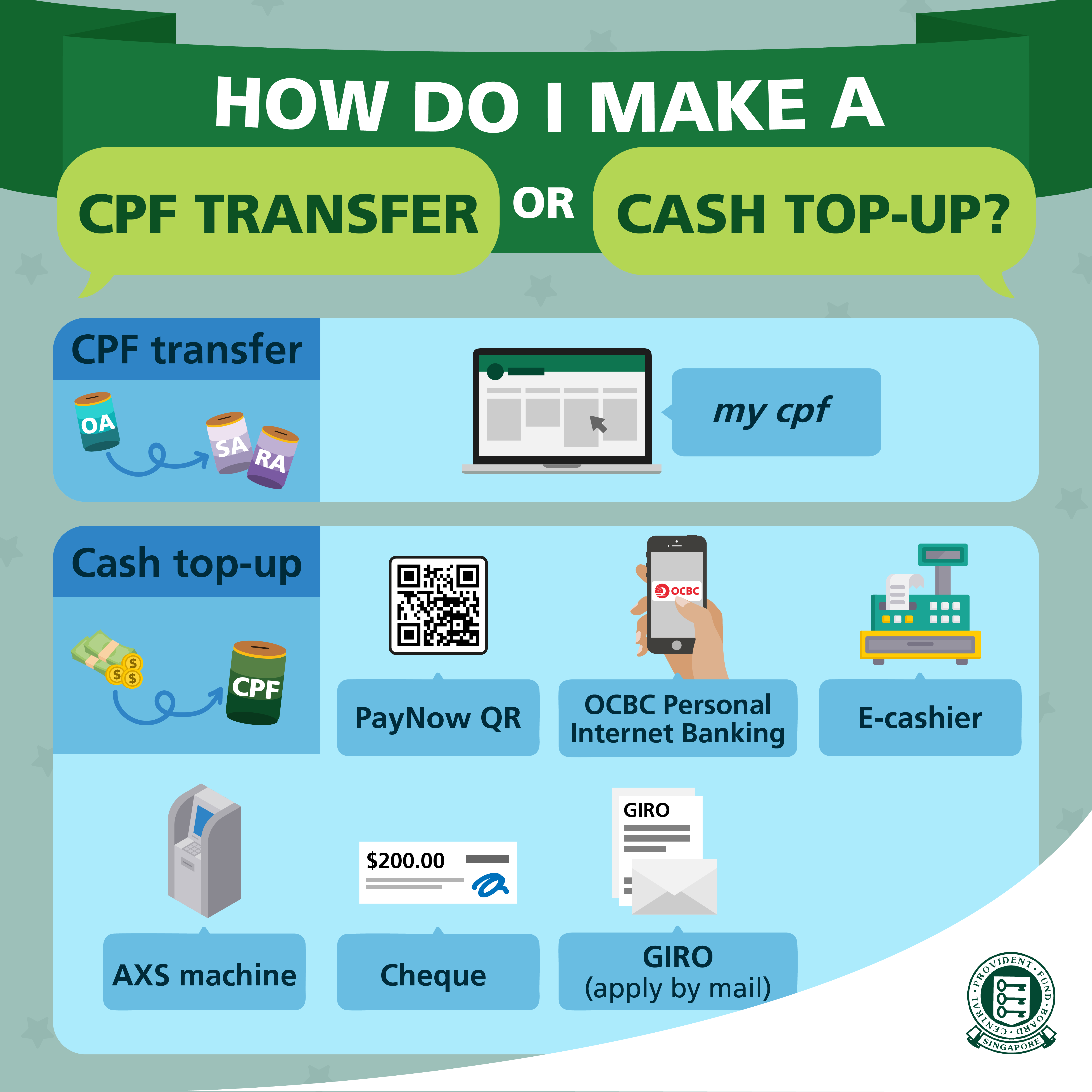

Tax Reduction Using CPF Our Journey Towards Financial Freedom

https://www.jcprojectfreedom.com/wp-content/uploads/2019/08/JC-Project-Freedom-How-Do-I-Make-a-CPF-Transfer-or-Cash-Top-Up.png

A personal income tax relief cap of 80 000 applies to the total amount of all tax reliefs claimed for each Year of Assessment You may be able to claim for the following reliefs The CPF relief for employees and the CPF cash top up relief are two types of CPF related tax reliefs that you can tap into The latter allows you to increase your CPF savings in your Special or

The combined tax relief for cash top ups to the Special Retirement Account and MediSave Account MA was introduced for greater consistency across CPF The personal income tax relief cap sets a limit on the total amount of tax relief you can claim Even though each relief serves a good purpose some individuals

Download Cpf Tax Relief Cap

More picture related to Cpf Tax Relief Cap

CPF Top Up Guide Should You Top Up Your CPF For Tax Relief Money

https://www.asiaone.com/sites/default/files/inline-images/Screenshot 2021-08-26 at 6.45.09 PM_0.png

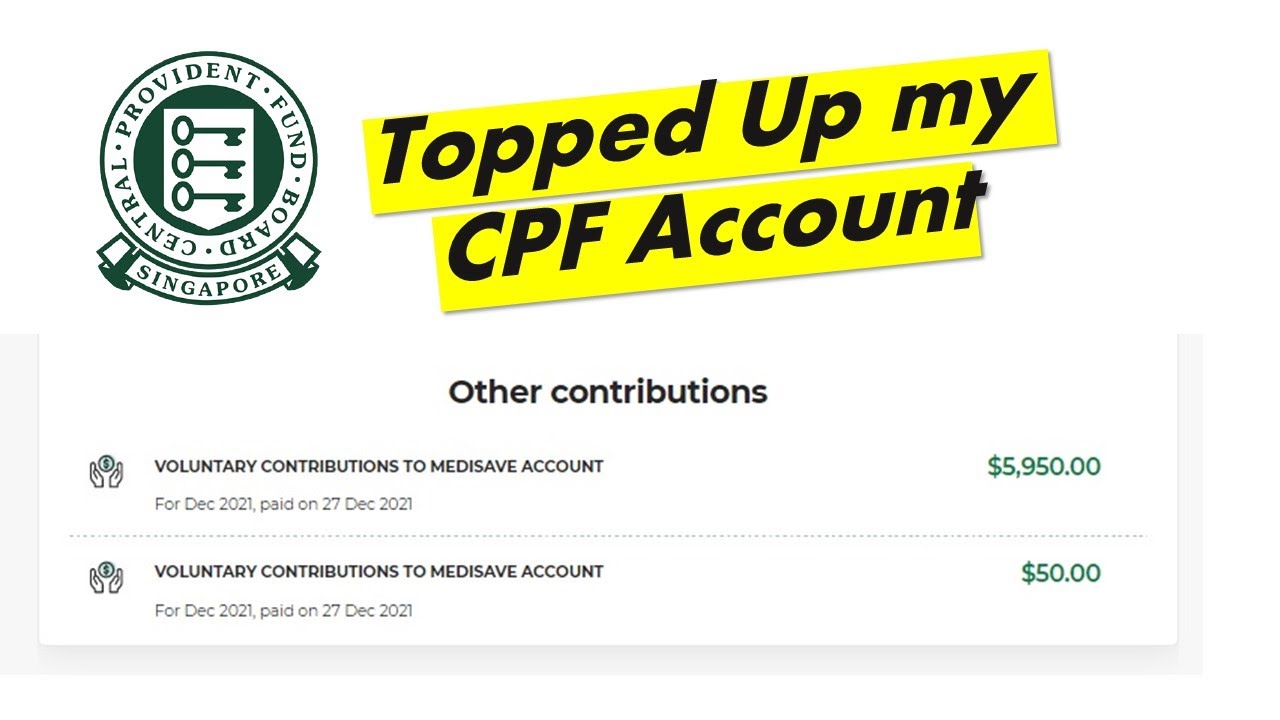

CPF Top Up I Just Topped Up My CPF Account For 2021 Tax Relief

https://i.ytimg.com/vi/H8x5_K3jxVM/maxresdefault.jpg

IRAS Central Provident Fund CPF Cash Top up Relief

https://www.iras.gov.sg/images/default-source/default-album/example-on-cpf-cash-top-up.png?sfvrsn=42c843a3_20

For YA 2024 your tax relief for your MediSave and voluntary CPF contributions will be capped at the lowest of 37 of your net trade income assessed or CPF relief cap of There is a personal income tax relief cap of 80 000 which applies to all tax reliefs including tax relief on cash top ups made to your CPF accounts The tax relief

There is no need to file or claim tax relief for your cash top up as CPF will inform the Inland Revenue Authority of Singapore IRAS if you meet all the eligibility criteria for tax For YA2023 meant for contributions done in 2022 the maximum tax relief for making cash top ups to our CPF accounts is 16 000 8 000 for either RSTU or MediSave top ups to self and

Learn All About The New CPF Changes From 2022

https://assets-global.website-files.com/60c843c7a86d865e99ca8b67/62621a23f6c7961a4af14735_Key CPF changes in 2022.png

CPF Moves To Make Before 2020 Ends Enjoy Tax Relief And Grow Your

https://cdn-blog.seedly.sg/wp-content/uploads/2020/12/11143442/121220-Things-to-do-with-CPF-1.png

https://www.iras.gov.sg/taxes/individual-income...

CPF Relief is capped by the amount of compulsory employee CPF contributions made on Ordinary Wages and Additional Wages under the CPF Act The amount of CPF Relief is

https://www.iras.gov.sg/taxes/individual-inc…

For each Year of Assessment a personal income tax relief cap of 80 000 applies to the total amount of all tax reliefs claimed including any relief on cash top ups made There will be no refund for accepted cash top up

How You Can Pay For Your Parents Medishield Life Premiums And Top Up

Learn All About The New CPF Changes From 2022

5 Ways To Make Your CPF Retirement Savings Work Harder CPF Top up Tax

Are The NEW CPF Rules Good For You 5 Ways On You Can Benefit With Tax

CPF Contribution Cap 2023 Guide What Singaporeans And Permanent

Changes To The CPF System And How It Affects My Retirement Retire By 50

Changes To The CPF System And How It Affects My Retirement Retire By 50

CPF Moves To Make Before 2021 Ends Enjoy Tax Relief And Grow Your

Comment Utilisez Son CPF

How To Reduce Your Income Tax In Singapore make Use Of These Tax

Cpf Tax Relief Cap - The personal income tax relief cap sets a limit on the total amount of tax relief you can claim Even though each relief serves a good purpose some individuals