Cpf Tax Relief Iras Verkko The maximum CPF Cash Top up Relief per Year of Assessment is 16 000 maximum 8 000 for self and maximum 8 000 for family members From Year of Assessment

Verkko For YA 2023 your tax relief for your MediSave and voluntary CPF contributions will be capped at the lowest of 37 of your net trade income assessed or CPF relief cap Verkko Taxable Amount on CPF Contributions assuming employer contributed CPF based on the actual OW amp AW at the rate of 17 1 OW 5 500 per month from Jan Dec 2022

Cpf Tax Relief Iras

Cpf Tax Relief Iras

https://www.effisca.com/wp-content/uploads/2021/04/form-3520-RESP-tax-relief-effisca-tax-scaled.jpg

How CPF Tax Relief Are Computed Can You Save 1000 In Taxes From CPF

https://i.ytimg.com/vi/GRJH2BJwLdU/maxresdefault.jpg

What Is The Maximum Amount Of Tax Relief We Can Get From Our CPF

https://dollarsandsense.sg/wp-content/uploads/2022/03/kenneth-koh-8VwHpGtOyrg-unsplash.jpg

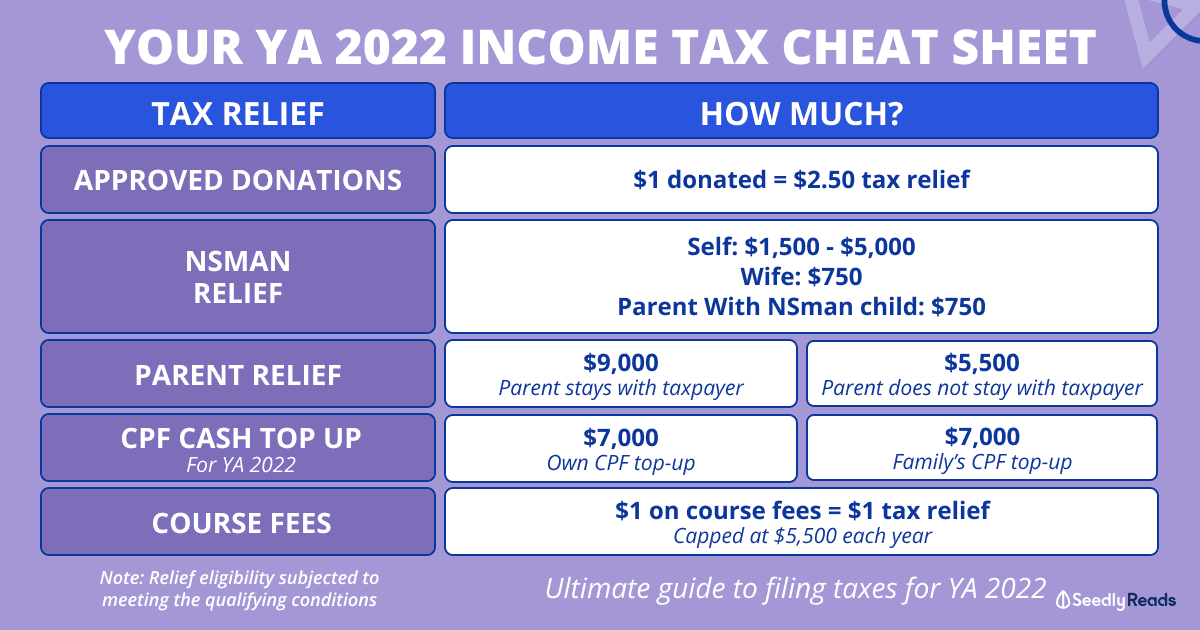

Verkko The Supplementary Retirement Scheme SRS is a voluntary scheme to encourage individuals to save for retirement over and above their CPF savings Contributions Verkko The cap on personal income tax relief applies to the total amount of all tax reliefs claimed including any relief on voluntary CPF contributions made 2 When does the

Verkko To be eligible for tax relief for any CPF SA RA top up for your spouse your spouse s income in the previous year should not exceed 4 000 The maximum tax relief you can get from topping up is now capped at Verkko 14 tammik 2022 nbsp 0183 32 You can use the tax calculator on Inland Revenue Authority of Singapore IRAS website to find out if you have reached your personal income tax

Download Cpf Tax Relief Iras

More picture related to Cpf Tax Relief Iras

IRAS Consent Form For PR Application Epica Immigration

https://www.epicaimmigration.com.sg/ei_images/iras-consent-form-pr.jpg

![]()

H nh nh L p Bi u T ng D ng T p Tin Cpf PNG Bi u T ng D ng T p Tin

https://png.pngtree.com/png-clipart/20190705/original/pngtree-cpf-file-format-icon-design-png-image_4306537.jpg

Common Tax Relief Programs The IRS Offers 914 Tax

https://www.914tax.com/wp-content/uploads/2022/01/Untitled-design-1200x675.png

Verkko Find out the conditions to qualify for tax relief If you are an employer making cash top ups on your employees behalf you will receive an equivalent amount of tax Verkko 16 marrask 2022 nbsp 0183 32 Policies What Is The Maximum Amount Of Tax Relief We Can Get From Our CPF Contributions Each Year From this year the tax relief for cash top ups

Verkko There is a personal income tax relief cap of 80 000 which applies to all tax reliefs including tax relief on cash top ups made to your CPF accounts The tax relief cap Verkko 13 maalisk 2023 nbsp 0183 32 How can I qualify for tax relief schemes Thankfully there are many tax relief schemes that you can qualify for By being a mother or signing up for a

CPF Top Up Guide Should You Top Up Your CPF For Tax Relief Money

https://www.asiaone.com/sites/default/files/inline-images/Screenshot 2021-08-26 at 6.45.09 PM_0.png

15 April 2010 IRAS

https://img.yumpu.com/23503105/1/500x640/15-april-2010-iras.jpg

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of...

Verkko The maximum CPF Cash Top up Relief per Year of Assessment is 16 000 maximum 8 000 for self and maximum 8 000 for family members From Year of Assessment

https://www.iras.gov.sg/taxes/individual-income-tax/basics-of...

Verkko For YA 2023 your tax relief for your MediSave and voluntary CPF contributions will be capped at the lowest of 37 of your net trade income assessed or CPF relief cap

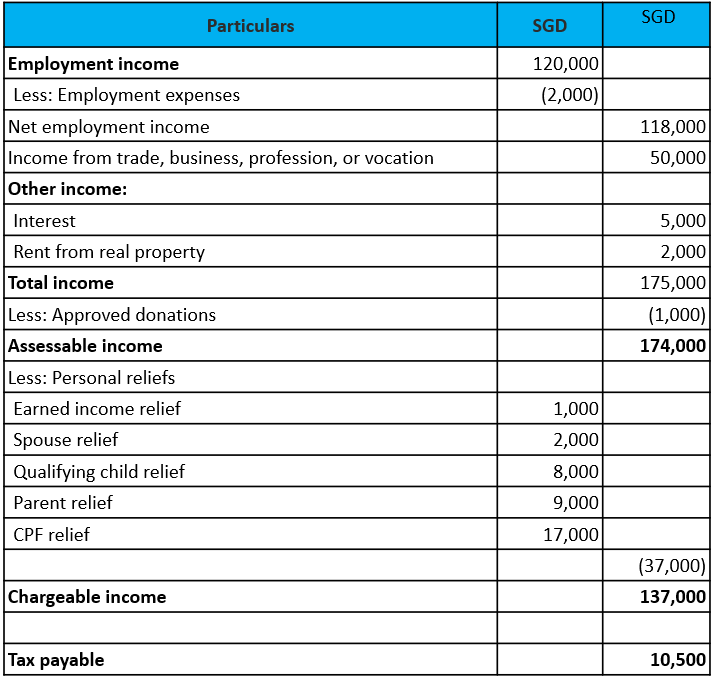

YA2023 Reducing Your Personal Income Tax In Six Ways SG Financial Advice

CPF Top Up Guide Should You Top Up Your CPF For Tax Relief Money

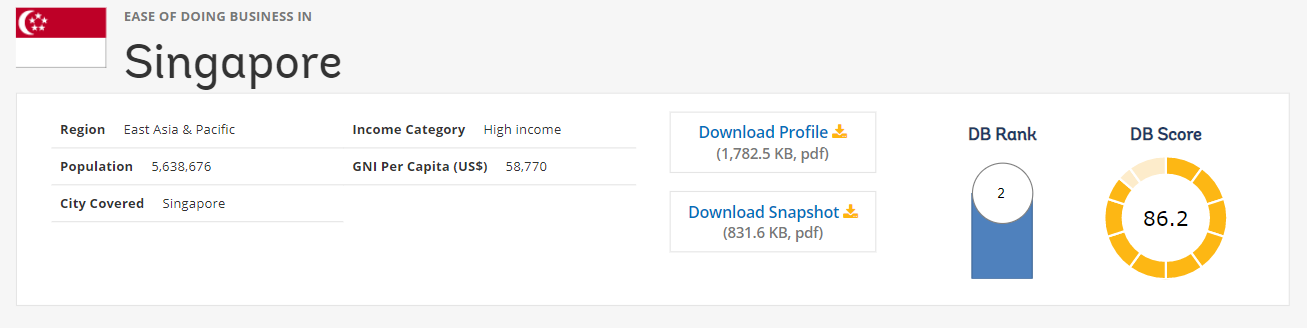

Complete Guide To Singapore Payroll Taxes IRAS CPF And Other

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

Significant Changes To CPF MediSave Cash Top Ups And Tax Relief

5 Ways To Make Your CPF Retirement Savings Work Harder CPF Top up Tax

5 Ways To Make Your CPF Retirement Savings Work Harder CPF Top up Tax

How To Pay Iras Tax With Credit Card TAX

Why You Should Set Up Your SRS Account Before 1st July 2022 Term sg

Singapore Income Tax 2022 Guide Singapore Income Tax Rates How To

Cpf Tax Relief Iras - Verkko The Supplementary Retirement Scheme SRS is a voluntary scheme to encourage individuals to save for retirement over and above their CPF savings Contributions