Cra Carbon Tax Rebate 2022 Ontario If you re entitled to receive the CCR you can expect to receive your payments on the 15th of April July October and January When the 15th falls on a Saturday Sunday or a federal statutory holiday the payment will be made on the last business day before the 15th

Check with the Nunavut government web site to learn about their carbon pricing and rebate policies Ontario The quarterly base amount for Ontario is 140 for an individual 70 for a spouse or common law partner 35 per eligible child under the age of 19 70 for the first eligible child in a single parent family The rural supplement is Ontario spouses common law partners and first children in single parent families can expect to receive 93 on Friday another payment of 46 50 in October 2022 then 46 50 in January next

Cra Carbon Tax Rebate 2022 Ontario

Cra Carbon Tax Rebate 2022 Ontario

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Carbon Tax Rebate Payment 2024 What Is Next CAIP Payment Deposit Date

https://www.wbhrb.in/wp-content/uploads/2024/01/Carbon-Tax-Rebate-Payment-Canada.jpg

Canadians Are Receiving The First Carbon Tax Rebate Of 2024 Today Here

https://nowtoronto.com/wp-content/uploads/2024/01/Carbon-tax.webp

SCARBOROUGH As part of the upcoming 2024 Ontario Economic Outlook and Fiscal Review the government is supporting Ontario families struggling with the high costs of the federal carbon tax and interest rates by proposing to provide a 200 taxpayer rebate to all eligible Ontario taxpayers To ensure families with children are not overlooked the government is also Here s how the payments will break down On Friday eligible individuals 19 or older in Ontario should receive 186 50 They ll receive another payment of 93 25 in October 2022 and again in January 2023 with a total annual rebate amount of 373

Here s how the payments will break down On Friday eligible individuals 19 or older in Ontario should receive 186 50 They ll receive another payment of 93 25 in October 2022 and again in January 2023 with a total annual rebate amount of 373 Most Ontarians will receive at least 140 per quarter from the carbon price rebate up from 122 last year thanks to a boost to the rebate in April The rebate is delivered every three months

Download Cra Carbon Tax Rebate 2022 Ontario

More picture related to Cra Carbon Tax Rebate 2022 Ontario

Attitude On Carbon Tax Rebate Defined By Politics Not Facts Survey

https://www.castanet.net/content/2022/1/20220124170148-61ef2ce393149cfe4fd5d6b7jpeg_p3572706.jpg

Carbon Tax Canada 2019

https://i.cbc.ca/1.4875360.1540329689!/fileImage/httpImage/federal-government-s-carbon-tax-and-rebate-plan.png

Tax Rebate For Individuals Swaper Investing Blog

https://swaper.com/blog/wp-content/uploads/SWAPER_blogpost_tax_1920x1080-1536x864.png

October 29 2024 at 12 53PM EDT That could mean that a family of five with three children under the age of 18 could receive 1 000 Premier Doug Ford has announced that his government will send Effective as of the 2021 tax year the Climate action incentive credit has become the Canada Carbon Rebate CCR The CCR will now be paid as a quarterly benefit If you are entitled you will receive your first CCR payment on or about July 15th 2022

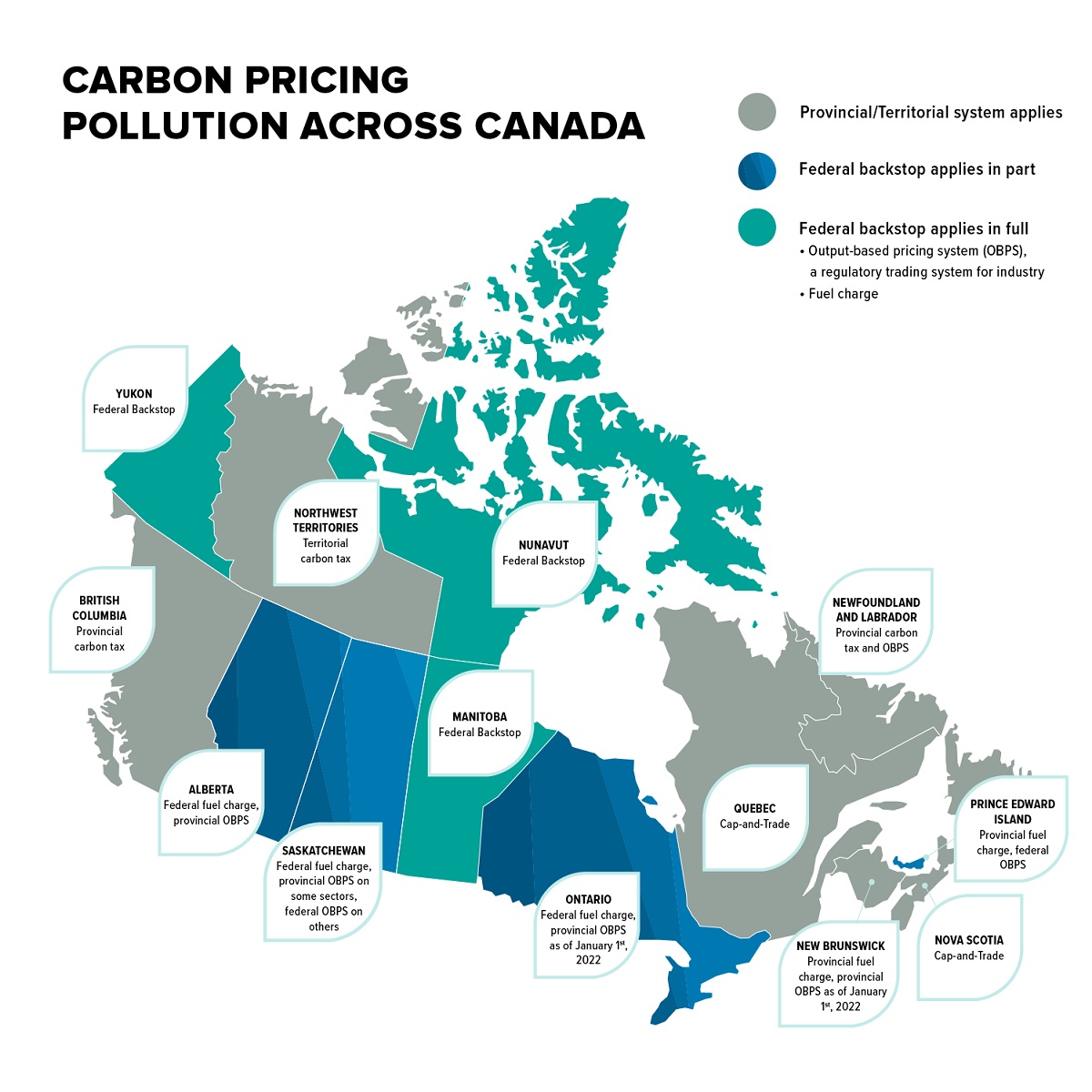

Residents of Alberta Saskatchewan Manitoba and Ontario are getting paid to help offset Ottawa s carbon tax The current carbon tax rate amounts to an extra cost of 2 21 cents per litre Provinces that participate in the federal carbon tax program Ontario Manitoba Alberta Saskatchewan New Brunswick Nova Scotia P E I and Newfoundland and Labrador qualify for the rebate

Here s How You Can Claim The 2022 Council Tax Rebate Holeys

https://holeys.co.uk/wp-content/uploads/2022/02/Blog-image-24.2.22.jpg

Council Tax Rebate 2022 Council Issues THIRD Date To Pay 150

https://cdn.images.express.co.uk/img/dynamic/23/1200x712/1610234_1.jpg

https://www.canada.ca/en/revenue-agency/services/...

If you re entitled to receive the CCR you can expect to receive your payments on the 15th of April July October and January When the 15th falls on a Saturday Sunday or a federal statutory holiday the payment will be made on the last business day before the 15th

https://www.canada.ca/en/revenue-agency/services/...

Check with the Nunavut government web site to learn about their carbon pricing and rebate policies Ontario The quarterly base amount for Ontario is 140 for an individual 70 for a spouse or common law partner 35 per eligible child under the age of 19 70 for the first eligible child in a single parent family The rural supplement is

2022 Tax Brackets Canada Cra

Here s How You Can Claim The 2022 Council Tax Rebate Holeys

2022 Child Tax Rebate Stratford Crier

2022 Income Tax Brackets Chart Printable Forms Free Online

Limited Impacts Of Carbon Tax Rebate Programmes On Public Support For

Your Cheat Sheet To Carbon Pricing In Canada Delphi

Your Cheat Sheet To Carbon Pricing In Canada Delphi

Canada s 2030 Emissions Reduction Plan Chapter 2 Canada ca

HST Rebate Forms Ontario PrintableRebateForm

2022 State Of Illinois Tax Rebates Scheffel Boyle

Cra Carbon Tax Rebate 2022 Ontario - The Canada Carbon Rebate CCR is a tax free amount paid to help individuals and families offset the cost of the federal carbon pollution pricing The quarterly CCR is available to eligible residents of Alberta Saskatchewan Manitoba Ontario New Brunswick Newfoundland and Labrador Nova Scotia and Prince Edward Island