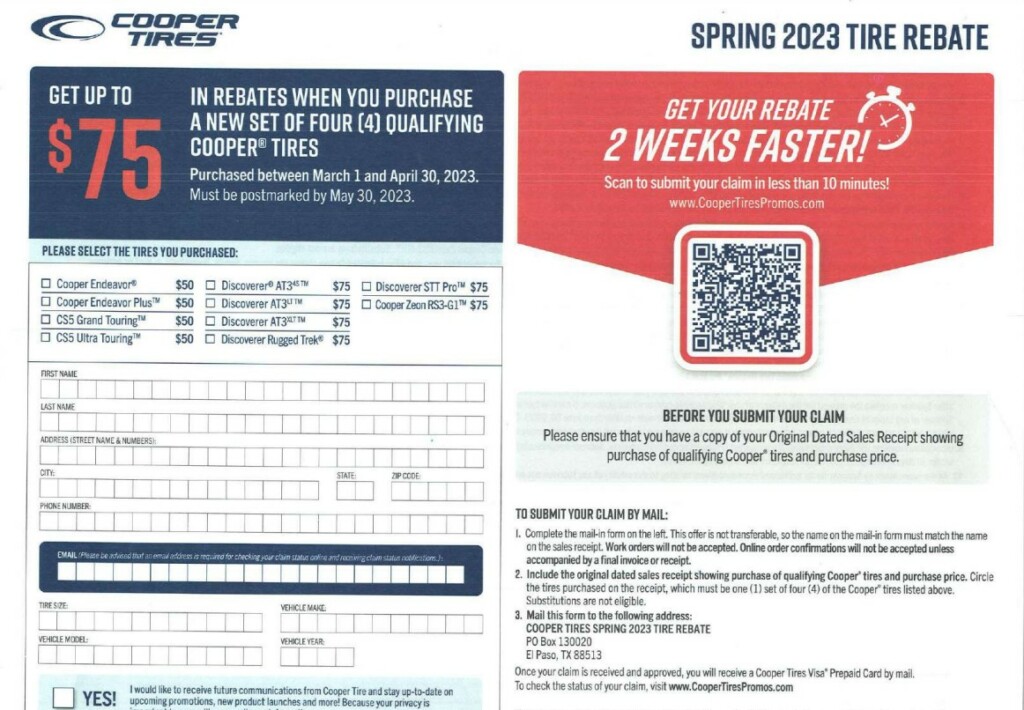

Ct Child Tax Rebate 2023 Tracking Number Web You will need the following information to properly complete Form CT Child Tax Rebate Your federal adjusted gross income from your 2021 federal income tax return Your

Web To receive the maximum rebate of 250 per child for up to three children the following income guidelines must be met Those who have higher income rates may be eligible to Web 8 juin 2022 nbsp 0183 32 Residents can apply online and will need to share their current address Social Security number and their adjusted gross income as listed on their 2021 tax form The

Ct Child Tax Rebate 2023 Tracking Number

Ct Child Tax Rebate 2023 Tracking Number

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/who-s-eligible-for-the-connecticut-child-tax-rebate.jpg

Rent Rebate CT 2023 Unlocking Financial Relief For Connecticut Tenants

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/05/Rent-Rebate-CT-2023.jpg?ssl=1

Child Tax Rebate 2023 How To Claim And Maximize Your Savings Tax

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Child-Tax-Rebate-2023.jpg

Web 12 d 233 c 2022 nbsp 0183 32 With the upcoming Congress sharply split between a Republican majority in the U S House of Representatives and Democrats holding the Senate social service advocates on Monday asked the Web CT Child Tax Rebate has closed The 2022 Connecticut Child Tax Rebate is complete and applications are no longer being accepted Department of Revenue Services

Web 19 mai 2022 nbsp 0183 32 Governor Ned Lamont today announced that Connecticut families can soon apply to receive a state tax rebate of up to 250 per child for a maximum of three Web 6 avr 2023 nbsp 0183 32 How much is the rebate The CT Child Tax Rebate 2023 provides eligible families with a rebate of up to 1 000 per child The exact amount of the rebate

Download Ct Child Tax Rebate 2023 Tracking Number

More picture related to Ct Child Tax Rebate 2023 Tracking Number

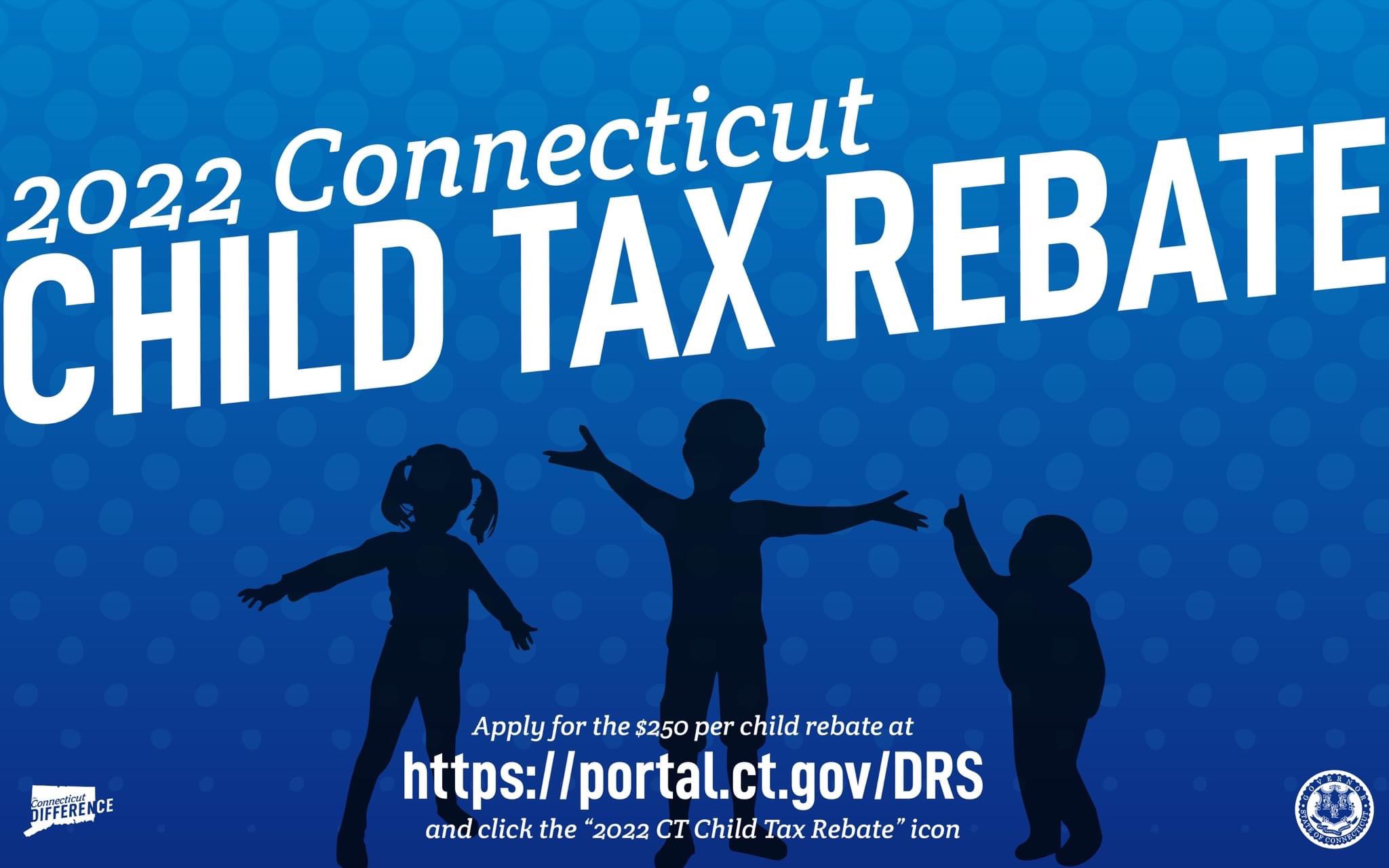

Cooper Tire Rebate 2023 TireRebate

https://www.tirerebate.org/wp-content/uploads/2023/03/Cooper-Tire-Rebate-2023-1024x710.jpg

Goodyear Rebate Form Guide October 2023 Steps To Apply And Track

https://i0.wp.com/www.goodyearrebates.net/wp-content/uploads/2023/06/Goodyear-Rebate-Form-October-2023.jpg?resize=840%2C641&ssl=1

Florida Tax Rebate 2023 Eligibility Application Deadline Tax

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Florida-Tax-Rebate-2023.jpg

Web 25 ao 251 t 2022 nbsp 0183 32 August 25 2022 7 41 PM CBS New York HARTFORD Conn Gov Ned Lamont announced Thursday checks for Connecticut s child tax rebate are starting to Web 27 juin 2023 nbsp 0183 32 After submitting your claim you can track the status of your rebate check by visiting the manufacturer s or retailer s website and then enter your tracking number or

Web Child Tax Rebate By Heather Poole Principal Analyst June 3 2022 2022 R 0110 Issue Provide an overview of the child tax rebate enacted in this year s budget act PA Web 3 juil 2022 nbsp 0183 32 Shutterstock CONNECTICUT Eligible Connecticut taxpayers with dependent children have until July 31 to apply for up to 750 in child tax rebates The

/do0bihdskp9dy.cloudfront.net/04-14-2023/t_835b4e177e654d3c88dc7eeb25c242fb_name_file_1280x720_2000_v3_1_.jpg)

VIDEO Group Pushes For Return Of CT s Child Tax Rebate

https://gray-wfsb-prod.cdn.arcpublishing.com/resizer/smAo8VhERvdK4gNOQr-is5pdXfk=/1200x600/smart/filters:quality(85)/do0bihdskp9dy.cloudfront.net/04-14-2023/t_835b4e177e654d3c88dc7eeb25c242fb_name_file_1280x720_2000_v3_1_.jpg

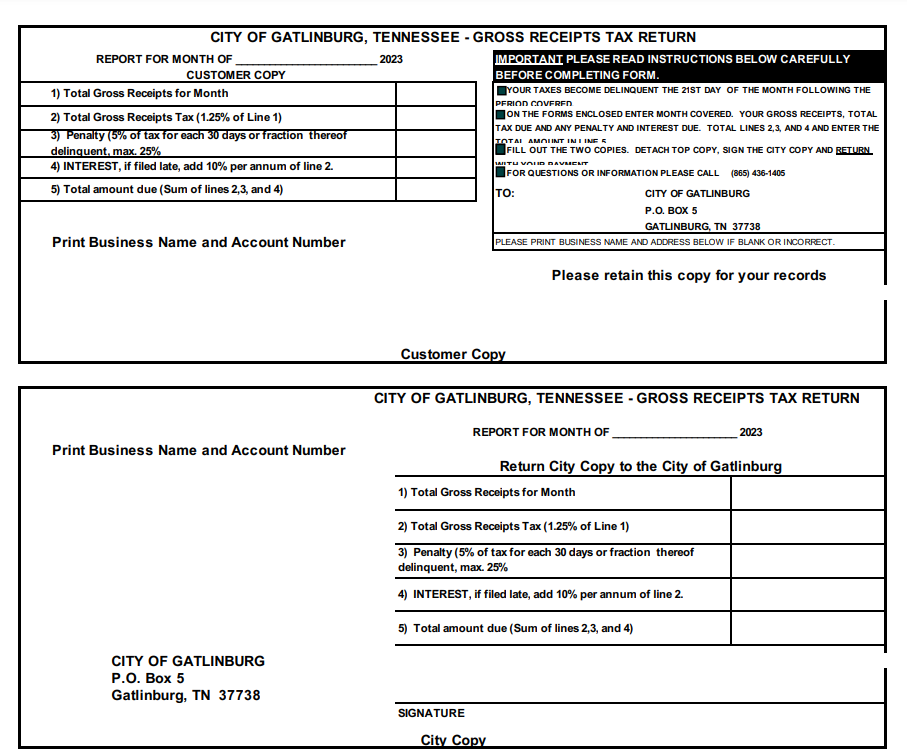

Tennessee Tax Rebate 2023 A Comprehensive Guide Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/05/Tennessee-Tax-Rebate-2023.png

https://portal.ct.gov/-/media/DRS/Publications/TSSB/2022/T…

Web You will need the following information to properly complete Form CT Child Tax Rebate Your federal adjusted gross income from your 2021 federal income tax return Your

https://portal.ct.gov/.../2022-Child-Tax-Rebate

Web To receive the maximum rebate of 250 per child for up to three children the following income guidelines must be met Those who have higher income rates may be eligible to

Minnesota Tax Rebate 2023 Your Comprehensive Guide Printable Rebate Form

/do0bihdskp9dy.cloudfront.net/04-14-2023/t_835b4e177e654d3c88dc7eeb25c242fb_name_file_1280x720_2000_v3_1_.jpg)

VIDEO Group Pushes For Return Of CT s Child Tax Rebate

Nebraska Tax Rebate 2023 Eligibility Application Deadline Status

Jimmy Tickey On Twitter Starting Today 250 Per Child Tax Rebates

/do0bihdskp9dy.cloudfront.net/07-28-2022/t_fcba6642edd54f0a9b86dbb43d5bc372_name_file_1280x720_2000_v3_1_.jpg)

INTERVIEW The CT Child Tax Rebate

Maximizing Your Benefits Illinois Income Tax Rebate 2023 Tax Rebate

Maximizing Your Benefits Illinois Income Tax Rebate 2023 Tax Rebate

Tax Rebate 2023 California Tax Rebate

Child Tax Credit 2022 1 050 In Direct Deposits Are Available To

Understanding Your Goodyear Rebate Invoice Number A Detailed Guide

Ct Child Tax Rebate 2023 Tracking Number - Web 25 ao 251 t 2022 nbsp 0183 32 About 200 000 checks have now been sent to residents who applied for the 2022 Connecticut Child Tax Rebate the state announced Thursday The program