Ct Child Tax Rebate 2024 Check Status For Businesses For Individuals 2022 Child Tax Rebate PLEASE BE ADVISED The application deadline has ended The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children

Connecticut State Department of Revenue Services Department of Revenue Services Child Tax Credit Featured Items For Businesses For Individuals Practitioners Forms The House has overwhelmingly approved a bipartisan tax package that pairs a temporary expansion of the child tax credit with business tax breaks and credits to develop more low income housing The bill includes 33 billion to expand the widely used child tax credit for three years including the tax season currently underway provided the

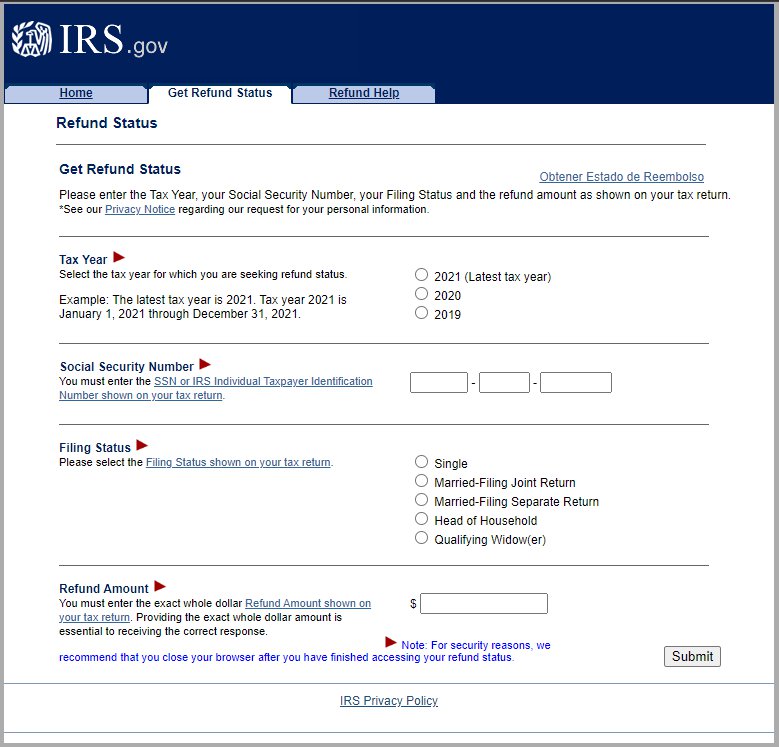

Ct Child Tax Rebate 2024 Check Status

Ct Child Tax Rebate 2024 Check Status

https://media.marketrealist.com/brand-img/mxVSc8gb7/1280x670/connecticut-ct-child-tax-rebate-check-1660116086071.jpg?position=top

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

CT Child Tax Rebate Claimed By More Than 70 Of Eligible Households

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA10eoKa.img?w=1568&h=1045&m=4&q=81

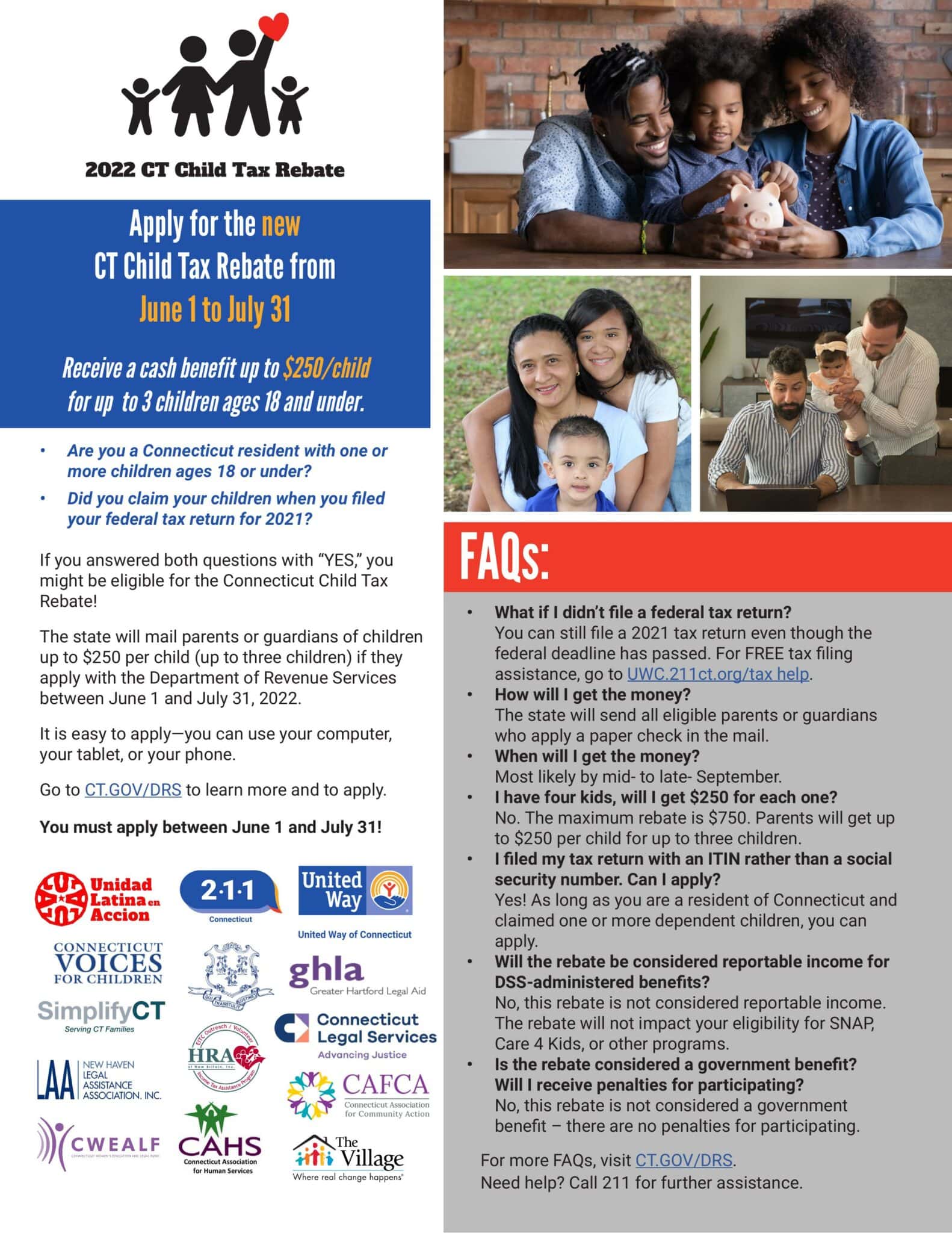

Connecticut was also one of a number of states that offered its own assistance to low and middle income families In 2022 the state provided a one time rebate of 250 per child More than 70 of CT Child Tax Rebate CT Child Tax Rebate has closed The 2022 Connecticut Child Tax Rebate is complete and applications are no longer being accepted

CT child tax rebate checks worth 78M are in the mail Gov Lamont says HARTFORD By early next week more than 189 000 checks worth 78 million will reach families with kids 18 years of age of younger under the state s election year child tax rebate program Eligible families with children 18 and under had to apply by July 31 to receive 250 per child up to 750 per family The state will start sending child tax rebate checks out next

Download Ct Child Tax Rebate 2024 Check Status

More picture related to Ct Child Tax Rebate 2024 Check Status

2022 Child Tax Rebate Stratford Crier

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

CT Child Tax Rebate Checks Are In The Mail Lamont Across Connecticut CT Patch

https://patch.com/img/cdn20/users/22994611/20220825/105526/styles/patch_image/public/money-bills___25105510368.jpg

West Hartford Residents Apply By July 31 For CT Child Tax Rebate We Ha West Hartford News

https://we-ha.com/wp-content/uploads/2022/06/Screen-Shot-2022-06-07-at-4.57.30-PM.png

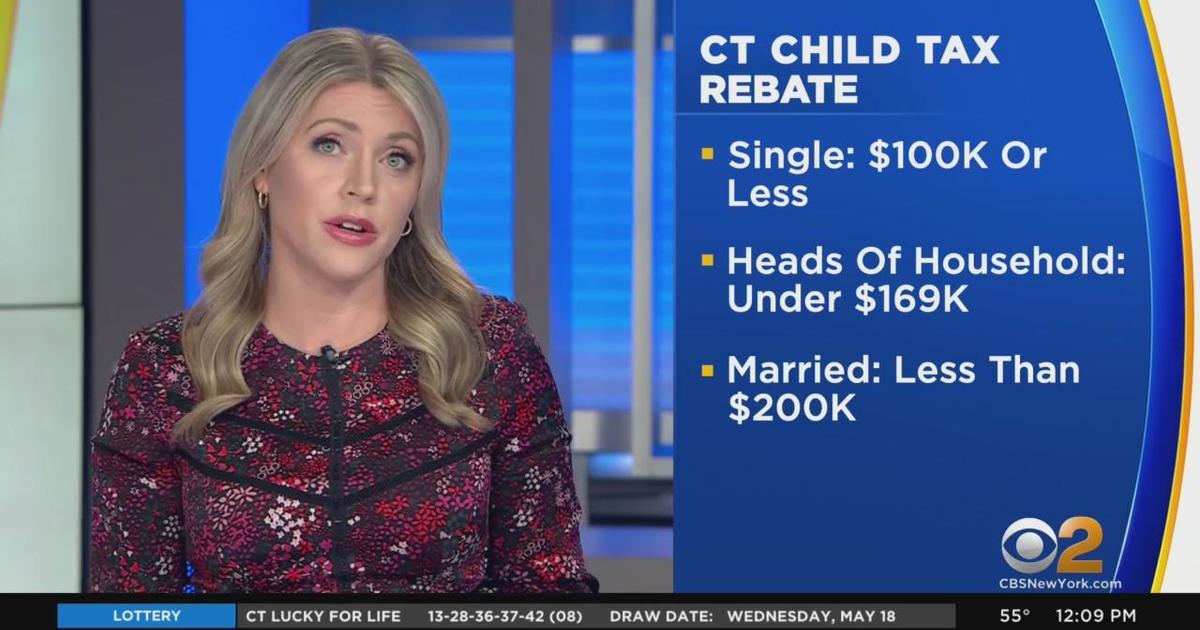

35 Advocates want 300 million from the state to provide families 600 per child for single parents making up to 100 000 and two parent households up to 200 000 HARTFORD CT Governor Ned Lamont today announced that three significant tax relief measures will take effect in Connecticut at the start of 2024 and among them are the largest income tax reduction ever enacted in state history an increase in a tax credit targeting the lowest income workers and an expansion of exemptions on

The bill would incrementally increase the maximum refundable child tax credit to 1 800 for 2023 tax returns 1 900 for the following year and 2 000 for 2025 tax returns These modifications are expected to apply to the 2023 2025 tax years with the maximum refundable credit increasing to 1 800 for 2023 1 900 for 2024 and 2 000 for 2025 The overall CTC maximum will also be adjusted for inflation in 2024 and 2025 For tax year 2023 filing the federal tax return Form 1040 or 1040 SR by April 15 2024 or

Advocates Push For CT Child Tax rebate Program To Return In 2023

https://s.hdnux.com/photos/01/30/22/71/23146052/3/rawImage.jpg

CT Parents 2022 CT Child Tax Rebate The River 105 9 Community Access

https://i.iheart.com/v3/re/new_assets/6297763d4c0753f62b32729f?ops=gravity("north"),fit(1200,675),quality(65)

https://portal.ct.gov/DRS/Credit-Programs/Child-Tax-Rebate/Overview

For Businesses For Individuals 2022 Child Tax Rebate PLEASE BE ADVISED The application deadline has ended The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children

https://portal.ct.gov/DRS/Credit-Programs/Child-Tax-Rebate

Connecticut State Department of Revenue Services Department of Revenue Services Child Tax Credit Featured Items For Businesses For Individuals Practitioners Forms

Group Pushes For Return Of CT s Child Tax Rebate

Advocates Push For CT Child Tax rebate Program To Return In 2023

CT s New Child Tax Rebate Connecticut Association For Community Action

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate Before July 31 Deadline

Connecticut Child Tax Rebate Beginning June 1 Connecticut Lamont Governor

Opinion CT Must Enact A Permanent Refundable Child Tax Credit

Opinion CT Must Enact A Permanent Refundable Child Tax Credit

CT Families Eligible For Child Tax Rebate CBS New York

2022 Connecticut Child Tax Rebate Bailey Scarano

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Ct Child Tax Rebate 2024 Check Status - CT Child Tax Rebate CT Child Tax Rebate has closed The 2022 Connecticut Child Tax Rebate is complete and applications are no longer being accepted