Ct Child Tax Rebate Income Criteria Web for the Child Tax Rebate if your income was less than or equal to 160 000 If the filing status from your 2021 federal income tax return was Married Filing Jointly or Qualifying

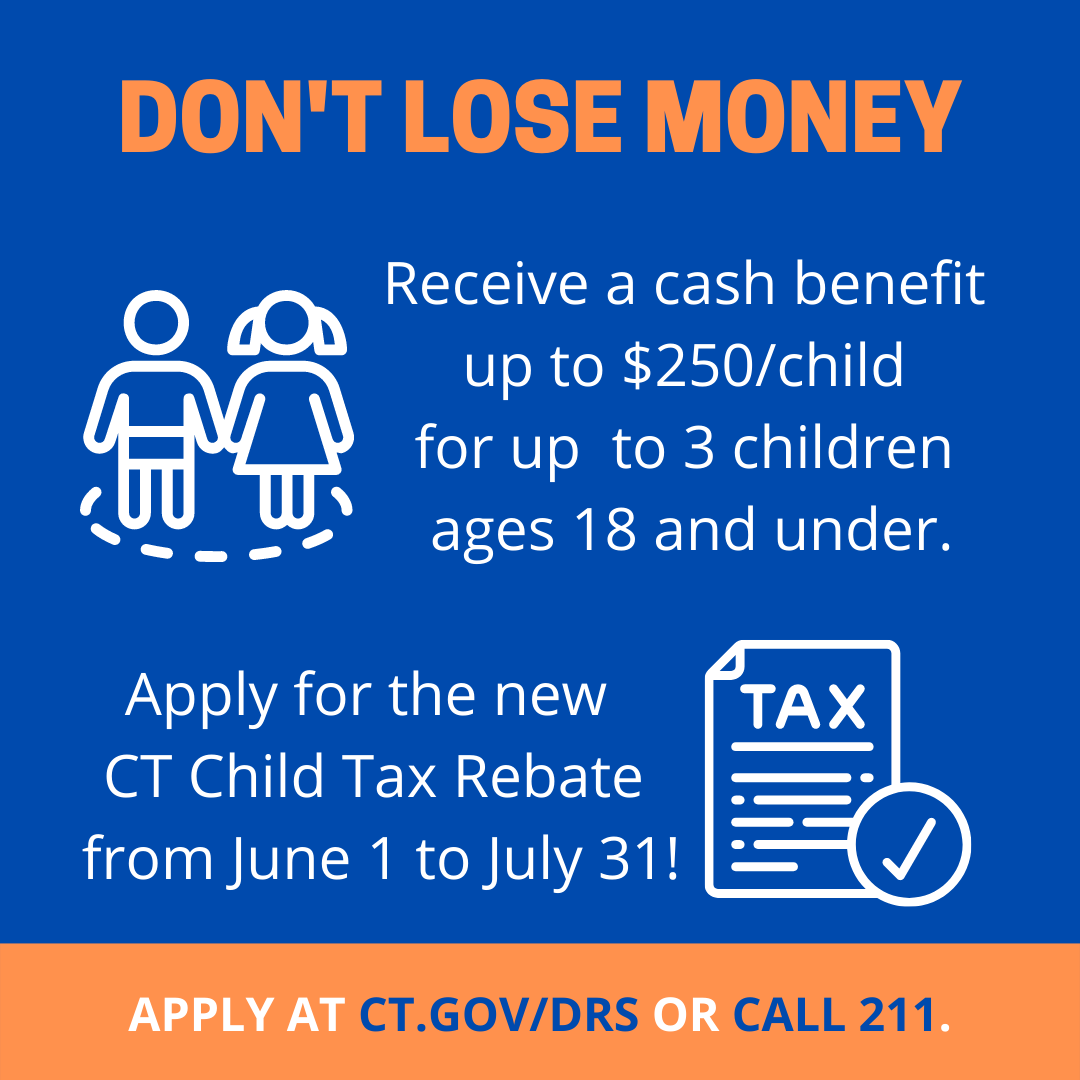

Web To be eligible for a rebate a taxpayer must 1 be domiciled in Connecticut when applying for the rebate 2 have validly claimed at least one dependent age 18 or under on his or Web 19 mai 2022 nbsp 0183 32 To receive the maximum rebate of 250 per child for up to three children the following income guidelines must be met Filer status Income threshold Single

Ct Child Tax Rebate Income Criteria

Ct Child Tax Rebate Income Criteria

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022-768x644.png

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

Gov Lamont Child Tax Rebate Checks Will Start Going Out Next Week

https://gray-wfsb-prod.cdn.arcpublishing.com/resizer/gKQ2psaELuOBCeaQ8VxbmEjmLAI=/800x450/smart/filters:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg

2022 Child Tax Rebate

https://portal.ct.gov/-/media/DCF/SPOTLIGHT/2022/June/Child-Tax-Rebate.png?sc_lang=en&h=1080&w=1080&la=en&hash=71DF1F1C6E19B1AE7C1DCCD9E598E4C5

Web To receive the maximum rebate of 250 per child for up to three children the following income guidelines must be met Those who have higher income rates may be eligible to Web 1 juin 2022 nbsp 0183 32 Any Connecticut resident who claimed at least one dependent child 18 years old or younger on their 2021 federal income tax return may be eligible Anyone

Web Created as part of the budget bill that Governor Lamont signed into law this spring the initiative is providing taxpayers with a state tax rebate of up to 250 per child for a Web The legislature authorized a one time rebate for qualifying taxpayers of up to 250 per child i e an individual who is age 18 or under as of December 31 2021 Taxpayers may

Download Ct Child Tax Rebate Income Criteria

More picture related to Ct Child Tax Rebate Income Criteria

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

https://thevillage.org/wp-content/uploads/2022/07/ChildTaxRebate-002_web.jpg

/cloudfront-us-east-1.images.arcpublishing.com/gray/WRJ3NSN3IVCB3PA3HYZNQ7CZNQ.jpg)

Group Pushes For Return Of CT s Child Tax Rebate

https://gray-wfsb-prod.cdn.arcpublishing.com/resizer/GUAHeWSoQPUtpogZ0KFkqGUl3jA=/1200x600/smart/filters:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/gray/WRJ3NSN3IVCB3PA3HYZNQ7CZNQ.jpg

CT s New Child Tax Rebate Connecticut Association For Community Action

https://www.cafca.org/wp-content/uploads/2022/06/CTCTR-English-1582x2048.jpg

Web 19 mai 2022 nbsp 0183 32 While any Connecticut resident who claimed at least one dependent child under the age of 18 on their 2021 federal income tax return may be eligible for the Web 12 d 233 c 2022 nbsp 0183 32 With the upcoming Congress sharply split between a Republican majority in the U S House of Representatives and Democrats holding the Senate social service advocates on Monday asked the

Web Any Connecticut resident who claimed at least one dependent child 18 years old or younger on their 2021 federal income tax return may have been eligible The Department of Web 29 juil 2022 nbsp 0183 32 Families have until this Sunday July 31 to apply for up to a 750 child tax rebate from the State of Connecticut Residents who claimed dependents 18 years old

CT Child Tax Rebate 2023 Eligibility Claim Process Important Dates

https://www.tax-rebate.net/wp-content/uploads/2023/04/Ct-Child-Tax-Rebate-2023.jpg

CT Is Offering 250 Child Tax Rebates Starting This Week

https://s.hdnux.com/photos/01/26/01/20/22549505/9/rawImage.jpg

https://portal.ct.gov/-/media/DRS/Publications/TSSB/2022/T…

Web for the Child Tax Rebate if your income was less than or equal to 160 000 If the filing status from your 2021 federal income tax return was Married Filing Jointly or Qualifying

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg?w=186)

https://cga.ct.gov/2022/rpt/pdf/2022-R-0110.pdf

Web To be eligible for a rebate a taxpayer must 1 be domiciled in Connecticut when applying for the rebate 2 have validly claimed at least one dependent age 18 or under on his or

CT Child Tax Rebate Claimed By More Than 70 Of Eligible Households

CT Child Tax Rebate 2023 Eligibility Claim Process Important Dates

WFSB Channel 3 Eyewitness News CT Child Tax Rebate Deadline

CT Families Should Begin Receiving Child Tax Rebates This Week

Ct Rebate Check 2023 RebateCheck

High Income Child Benefit Charge Tax Rebates

High Income Child Benefit Charge Tax Rebates

2022 Child Tax Rebate Ends July 31 Access Community Action Agency

Can I Claim My Child As A Dependent On My Tax Return Gardner Quad Squad

/do0bihdskp9dy.cloudfront.net/04-14-2023/t_835b4e177e654d3c88dc7eeb25c242fb_name_file_1280x720_2000_v3_1_.jpg)

VIDEO Group Pushes For Return Of CT s Child Tax Rebate

Ct Child Tax Rebate Income Criteria - Web 1 juin 2022 nbsp 0183 32 Any Connecticut resident who claimed at least one dependent child 18 years old or younger on their 2021 federal income tax return may be eligible Anyone