Ct Child Tax Rebate Status 2023 Web 12 d 233 c 2022 nbsp 0183 32 With the upcoming Congress sharply split between a Republican majority in the U S House of Representatives and Democrats holding the Senate social service advocates on Monday asked the

Web 1 mai 2023 nbsp 0183 32 A Connecticut Child Tax Credit CTC in addition to the state s EITC could reduce child poverty by up to an estimated 50 These resources for children and families are needed now more than Web 9 sept 2023 nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have

Ct Child Tax Rebate Status 2023

Ct Child Tax Rebate Status 2023

https://www.cthousegop.com/ackert/wp-content/uploads/sites/3/2022/06/Child-Tax-Rebate-July-2022-768x644.png

Child Tax Rebate Now Accepting Applications CT News Junkie

https://i0.wp.com/ctnewsjunkie.com/wp-content/uploads/2022/06/child_tax_rates_1200.jpg?resize=768%2C218&ssl=1

CT Child Tax Rebate 2023 Eligibility Claim Process Important Dates

https://www.tax-rebate.net/wp-content/uploads/2023/04/Ct-Child-Tax-Rebate-2023.jpg

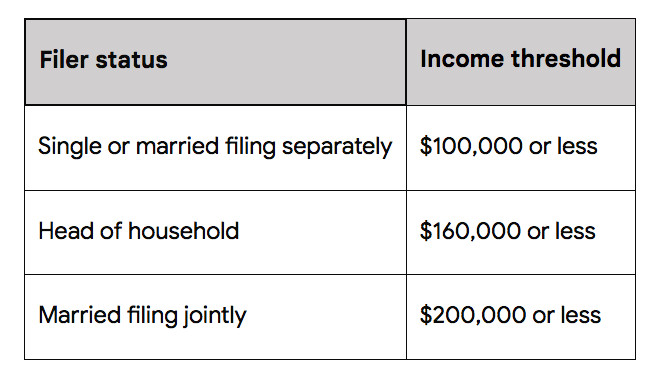

Web 19 mai 2022 nbsp 0183 32 HARTFORD CT Governor Ned Lamont today announced that Connecticut families can soon apply to receive a state tax rebate of up to 250 per child Web If your income is greater than 110 000 you are not eligible for the Child Tax Rebate If the filing status from your 2021 federal income tax return was Head of Household you

Web 23 mai 2022 nbsp 0183 32 The 2022 Connecticut Child Tax Rebate is part of the 2023 fiscal year budget adjustment recently signed into law by Gov Ned Lamont According to a press Web To receive the maximum rebate of 250 per child for up to three children the following income guidelines must be met Those who have higher income rates may be eligible to

Download Ct Child Tax Rebate Status 2023

More picture related to Ct Child Tax Rebate Status 2023

CT Families Should Begin Receiving Child Tax Rebates This Week

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

Opinion CT Must Enact A Permanent Refundable Child Tax Credit

https://ctmirror-images.s3.amazonaws.com/wp-content/uploads/2023/04/Child-Tax-Rebate-768x650.png

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate

https://thevillage.org/wp-content/uploads/2022/07/ChildTaxRebate-002_web.jpg

Web 12 ao 251 t 2023 nbsp 0183 32 If you are looking for Ct Child Tax Rebate 2023 Status you ve come to the right place We have 35 rebates about Ct Child Tax Rebate 2023 Status including Web 27 juin 2023 nbsp 0183 32 After submitting your claim you can track the status of your rebate check by visiting the manufacturer s or retailer s website and then enter your tracking number or

Web CT Child Tax Rebate has closed The 2022 Connecticut Child Tax Rebate is complete and applications are no longer being accepted Department of Revenue Services Web 6 avr 2023 nbsp 0183 32 The CT Child Tax Rebate 2023 provides eligible families with a rebate of up to 1 000 per child The exact amount of the rebate depends on a number of factors

CT Families Eligible For Child Tax Rebate CBS New York

https://assets3.cbsnewsstatic.com/hub/i/r/2022/05/19/01ffc22f-8a36-4d34-9152-75318c47bc2f/thumbnail/1200x630/23d2563385b7d25e46dbcbea21ed58d4/298ba60df5522f053f997d14d3053d88.jpg

Gov s Office Announces Final Tally Of Applications For Child Tax Rebate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AAZZRwK.img?w=1280&h=720&m=4&q=79

https://www.ctinsider.com/politics/article/CT-c…

Web 12 d 233 c 2022 nbsp 0183 32 With the upcoming Congress sharply split between a Republican majority in the U S House of Representatives and Democrats holding the Senate social service advocates on Monday asked the

https://ctmirror.org/2023/05/01/ct-lawmakers-…

Web 1 mai 2023 nbsp 0183 32 A Connecticut Child Tax Credit CTC in addition to the state s EITC could reduce child poverty by up to an estimated 50 These resources for children and families are needed now more than

Yale Pediatrics On Twitter RT 211CT It s Not Too Late To Apply For

CT Families Eligible For Child Tax Rebate CBS New York

Don t Forget To Apply Before 7 31 East Haddam Youth Family

200 000 CT Households Have Applied For The Child Tax Credit Rebate

2022 Child Tax Rebate

/do0bihdskp9dy.cloudfront.net/04-14-2023/t_835b4e177e654d3c88dc7eeb25c242fb_name_file_1280x720_2000_v3_1_.jpg)

VIDEO Group Pushes For Return Of CT s Child Tax Rebate

/do0bihdskp9dy.cloudfront.net/04-14-2023/t_835b4e177e654d3c88dc7eeb25c242fb_name_file_1280x720_2000_v3_1_.jpg)

VIDEO Group Pushes For Return Of CT s Child Tax Rebate

/do0bihdskp9dy.cloudfront.net/07-26-2022/t_2d46d54b24ab4fa0a689499c9a8de978_name_file_1280x720_2000_v3_1_.jpg)

VIDEO Deadline To Apply For CT s Child Tax Rebate Is Approaching

Child Tax Rebate 2023 How To Claim And Maximize Your Savings Tax

Ct Rebate Check 2023 RebateCheck

Ct Child Tax Rebate Status 2023 - Web 23 mai 2022 nbsp 0183 32 The 2022 Connecticut Child Tax Rebate is part of the 2023 fiscal year budget adjustment recently signed into law by Gov Ned Lamont According to a press