Ct Off Road Fuel Tax Credit The per mile fee rate increases based on the carrier s gross weight ranging from 1 2 5 cents per mile for vehicles weighing 26 000 28 000 pounds lbs to 2 17 5 cents per mile for vehicles weighing more than 80 000 lbs Highway Use Fee Rates per mile Gross Weight in Pounds Rate in Dollars

Interest Interest for late payment is calculated at 1 01 of the tax per month or fraction of the month from the due date to the date of payment Penalties The penalty for an incomplete return or late filing is calculated at 10 10 of the amount of the tax due and unpaid or 50 whichever is greater 2023 Motor Vehicle Fuels Tax Refund Claim Off Highway Governmental School Bus Use 07 2023 AU 725 Form Inst 2023 Motor Vehicle Fuels Tax Refund Claim Farm Use 06 2023 AU 736 Form Inst 2023 Motor Vehicle Fuels Tax Refund Claim Motor Bus Taxicab and Livery 06 2023 AU 737 Form Inst

Ct Off Road Fuel Tax Credit

Ct Off Road Fuel Tax Credit

https://media.compliancesigns.com/media/catalog/product/o/s/osha-fuel-sign-odep-31164_1000_1.gif

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

Fuel Off Road Warp Alloy Wheels Photos And Prices TyresAddict

https://cdn.tyresaddict.com/wheels/fuel-off-road/warp-d733/fuel-off-road-warp-d733.10058.full.png

The suspension of the Connecticut motor vehicle fuels tax on gasoline and gasohol is extended for an additional month through December 31 2022 The Connecticut motor vehicle fuels tax is an excise tax imposed on distributors as that term is defined in Conn Gen Stat 12 455a a To claim a credit for the federal tax taxpayers file with their tax return Form 4136 Credit for Federal Tax Paid on Fuels If the expense for purchasing the fuel including the tax is deducted as a business expense the credit or refund must be included in

Form AU 724 Motor Vehicle Fuels Tax Refund Claim Off Highway Marine Governmental School Bus and Waste Hauling Use Form AU 725 Motor Vehicle Fuels Tax Refund Claim Farm Use Form AU 736 Motor Vehicle Fuels Tax Refund Claim Motor Bus Taxicab Livery Form AU 737 Motor Vehicle Fuels Tax Refund The state s diesel fuel tax will rise July 1 to 49 2 cents per gallon a nearly 23 increase from the current rate of 40 1 cents the Department of Revenue Services announced Wednesday in a letter to state lawmakers The increase follows a year in which retail diesel prices have nearly doubled

Download Ct Off Road Fuel Tax Credit

More picture related to Ct Off Road Fuel Tax Credit

Anvil Off Road 3011AOR Yellow Fuel Storage Can Walmart Walmart

https://i5.walmartimages.com/asr/093336a0-d9a9-43c8-8177-056925c8e52e_1.86e51abe7f0ca8ee3a638dd92a16607a.jpeg

Figure 2 1 From Identifying Excessive Vehicle Idling And Opportunities

https://ai2-s2-public.s3.amazonaws.com/figures/2017-08-08/2ad0eef4b6ef79e1d0b840a6fffb32255139d922/17-Figure2.1-1.png

Fuel Off Road

https://trafficjamsmotorsports.com/media/amasty/shopby/option_images/fuel-off-road.jpg

Motor fuels sold for use in motor vehicles are exempt from the sales and use tax CGS 12 412 15 The motor vehicle fuels tax is a per gallon excise tax that applies to sales of gasoline gasohol and diesel among other fuels The current fuel tax rate on gasoline and gasohol is 25 cents per gallon which has not been changed since 2000 The governor and legislature took a second step in early June freezing the diesel tax for one year at 49 2 cents per gallon and saving consumers 37 million Absent that action the diesel tax

Payments of fuel excise taxes are made by fuel vendors not by end consumers though the taxes will be passed on in the fuel s retail price Fuel tax is due on the 25th of each month and motor carrier road tax is due on April 30th July 31st October 31st and January 31th for the previous quarter Jurisdiction Connecticut Year of Report 2021 Fuel Exemptions Yes Comments Off Road Diesel Yes Effective Date mm dd yyyy 01 01 1996 Comments The reporting of motor vehicle fuels used in off road equipment is subject to the provisions of Conn Gen Stat 12 459 Consistent with the statute the tax paid on such fuel may be subject

Congestion Pricing Tax Bill And Traffic U2 How We Roll Dec 1 The

https://i0.wp.com/thesource.metro.net/wp-content/uploads/2017/12/RudeDudeShirt.png

Wheels TheYotaGarage

https://cdn.shopify.com/s/files/1/0090/7608/0719/products/fuel-off-road-wheels-fuel-rebel-wheels-matte-bronze-w-black-lip-36662109602027_1000x.png?v=1664933757

https://portal.ct.gov/drs/businesses/highway-use-fee/huf

The per mile fee rate increases based on the carrier s gross weight ranging from 1 2 5 cents per mile for vehicles weighing 26 000 28 000 pounds lbs to 2 17 5 cents per mile for vehicles weighing more than 80 000 lbs Highway Use Fee Rates per mile Gross Weight in Pounds Rate in Dollars

https://portal.ct.gov/drs/taxes/motor-vehicle-tax/tax-information

Interest Interest for late payment is calculated at 1 01 of the tax per month or fraction of the month from the due date to the date of payment Penalties The penalty for an incomplete return or late filing is calculated at 10 10 of the amount of the tax due and unpaid or 50 whichever is greater

Fuel Filter Off Road DRD Motorcycles

Congestion Pricing Tax Bill And Traffic U2 How We Roll Dec 1 The

Fuel Tax Credit UPDATED JUNE 2022

REDUCTION IN FUEL TAX CREDITS

D232 Hostage 2 FUEL OFF ROAD JAPAN MHT

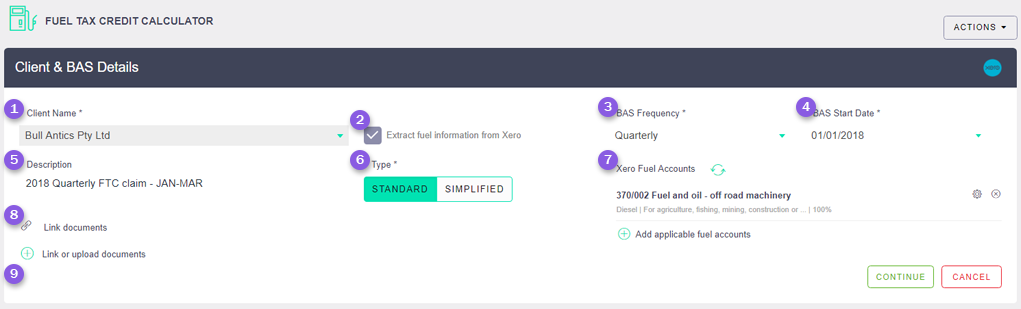

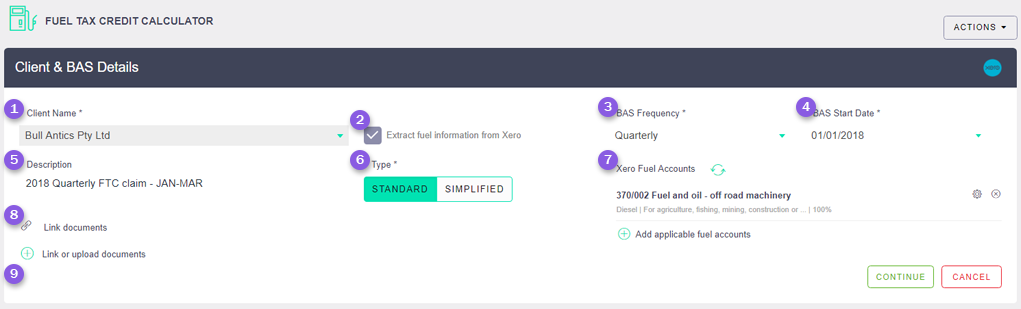

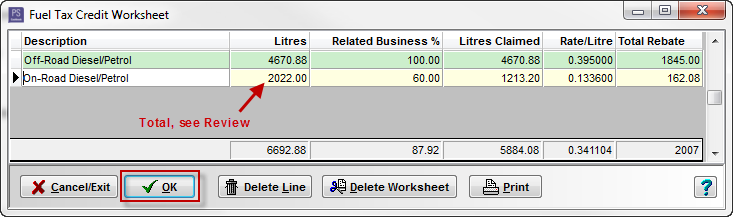

Fuel Tax Credit Calculator AccountKit Support Center

Fuel Tax Credit Calculator AccountKit Support Center

Calculating Fuel Tax Credit Manually PS Support

Off Road Fuel Tanks Stafross

Fuel Off Road Center Cap 1003 27B 1002 48B 8 Lug Dually GLOSS Black

Ct Off Road Fuel Tax Credit - The suspension of the Connecticut motor vehicle fuels tax on gasoline and gasohol is extended for an additional month through December 31 2022 The Connecticut motor vehicle fuels tax is an excise tax imposed on distributors as that term is defined in Conn Gen Stat 12 455a a